Gov Rebates 2024 In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit January stimulus check 2024 update If you received one of those special state rebate payments sometimes called stimulus checks last year there s some news from the IRS that you need to

Gov Rebates 2024

Gov Rebates 2024

https://onecms-res.cloudinary.com/image/upload/s--9LmueFSU--/f_auto%2Cq_auto/v1/mediacorp/cna/image/2022/07/12/20220712_-_gstv_cash_and_cash_special.png?itok=B9GTdy88

Muth Encourages Eligible Residents To Apply For Extended Property Tax Rent Rebate Program

https://www.senatormuth.com/wp-content/uploads/2019/06/PropertyTaxRebate2018.jpg

What To Expect With Your Upcoming Tax Rebate Mass gov

https://www.mass.gov/files/2022-11/Tax Rebates-11.png

What s new for 2024 instant rebate Starting in January EV buyers won t have to wait until the following year s tax season to claim and pocket the clean vehicle tax credit Instead The law gives states until August 2024 to start handing out the rebates or lose the funding DOE has just taken the first step in a long process of getting these programs designed and those

Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings

Download Gov Rebates 2024

More picture related to Gov Rebates 2024

Who s Eligible For New Jersey Anchor Rebates In 2024 Check If You Are Qualify To Receive Up To

https://vegasonlyentertainment.com/wp-content/uploads/2023/07/rebate-scaled.jpg

Rebates For Seniors Mark Coure MP

https://markcoure.com.au/images/news/seniors-rebates-photo.png

CAT Rebates W L Inc

https://wl-parts.com/wp-content/uploads/2021/10/Cat-Rebates-WL-Flyer.png

Rebate from My State Government Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit 2024 Government Rebates for HVAC Replacements The terms and conditions of government rebates or grants can differ depending on the time of year location and other variables Modernize recommends checking with the Database of State Incentives for Renewables Efficiency to see if you re eligible before applying or hiring a contractor

IRA Rebates Washington expects to receive IRA funding for home energy improvement rebates in early 2024 and will begin to make these available no earlier than mid 2024 The Washington State Legislature also appropriated additional funding to support investments in high efficiency electric appliances for households and small businesses Oct 6 2023 If you buy a new or used clean energy vehicle you may qualify for a non refundable tax credit Visit FuelEconomy gov for a list of qualified vehicles Qualified two wheeled plug in electric vehicles may also be eligible for this credit

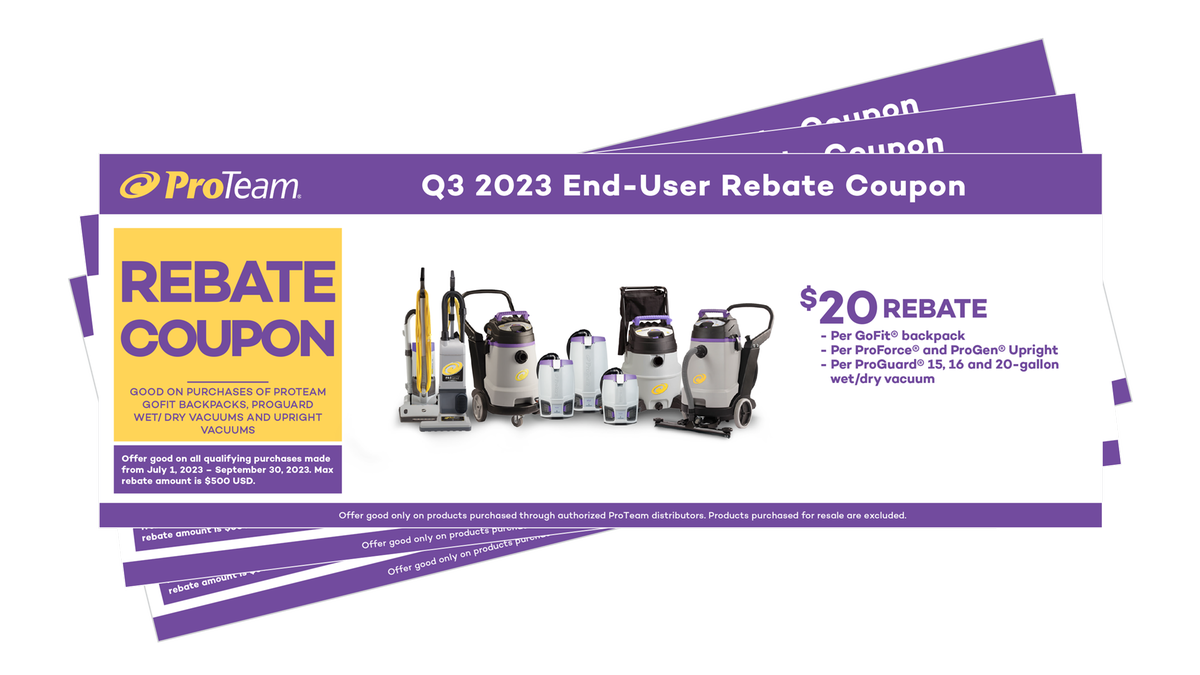

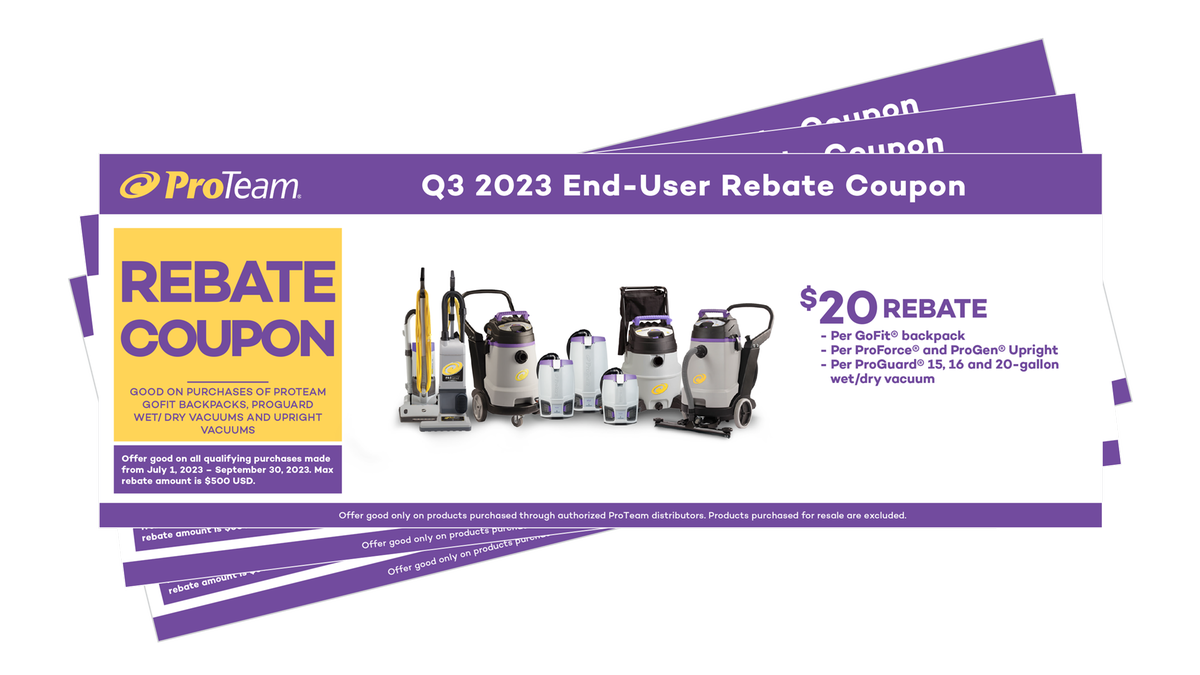

Manufacturer Rebates CleanFreak

https://cdn.shopify.com/s/files/1/0624/3270/6740/files/rebates-q3-full-line.png?v=1686831920

Smith Wesson Shield EZ Holiday Rebate H H Shooting Sports Oklahoma City

https://www.hhshootingsports.com/wp-content/uploads/2022/11/SmithWessonRebates-HalfPage-scaled.jpg

https://www.newsweek.com/will-there-new-stimulus-payment-2024-rebate-1856477

In 2024 Gov Josh Shapiro said that older residents would receive more financial help courtesy of his signed Act 7 of 2023 The law expanded the Property Tax Rent Rebate to provide a larger

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

How Do Home Rebates Work DC MD VA Home Rebates

Manufacturer Rebates CleanFreak

Eliminate The Administrative Burden Of Rebates From Finance Enable

Rebates Are Inherently Collaborative YouTube

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Milwaukee Tool Rebates Printable Rebate Form

Milwaukee Tool Rebates Printable Rebate Form

Tax Credits For Qualified Education Contributions Guide Montana Department Of Revenue

Primary Rebate South Africa Printable Rebate Form

Alconchoice Com Printable Rebate Form Printable Word Searches

Gov Rebates 2024 - In 2023 the U S Department of Energy released its program guidance for the Home Efficiency Rebates HER and Home Electrification and Appliance Rebates HEAR programs which together allocate over 208 million to North Carolina to provide energy efficiency rebates As of January 2024 DEQ is applying for the planning grant funding for the