Gov Tax Rebate Working From Home To claim for tax relief for working from home employees can apply directly via GOV UK for free Once their application has been approved the online portal will adjust their tax code for the

You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such as working To claim for the working from home tax relief Head to the government s microservice portal and answer the eligibility questions During this process you also be asked about other work related expenses that you could claim for too

Gov Tax Rebate Working From Home

Gov Tax Rebate Working From Home

https://www.irishtaxrebates.ie/img/xworking-from-home.jpg.pagespeed.ic.M-kXjUrBxF.jpg

Tax Implications Of Working From Home And Collecting Unemployment

https://www.seilersingleton.com/wp-content/uploads/2020/09/20208-09-28-Work-from-home-1080x675.jpg

Industry Updates Coronavirus SSP Rebate Scheme Set To Close On 17

https://blog.accountancymanager.co.uk/wp-content/uploads/2022/03/man-working-from-home-during-the-coronavirus-pande-2021-08-29-13-12-09-utc-scaled.jpg

The good news is that the government is offering up to 125 in tax relief for all employees who have worked from home so far in the 2021 22 tax year even if only for 1 day Almost 800 000 Brits have already claimed the rebate for working from home since April 2021 according to figures from HMRC How do you claim working from home tax relief The government s microsite makes claiming tax relief pretty easy but there are some eligibility criteria To claim you must Only be claiming expenses for working from home Not pay tax by self assessment Not have had your expenses paid by your employer

If you re one of the millions who have spent the best part of that time homeworking then the good news is that you could be entitled to a 125 tax rebate part of relaxed tax measures Claiming working from home tax relief could knock up to 125 off your tax bill Here s how to claim it for working at home during the pandemic

Download Gov Tax Rebate Working From Home

More picture related to Gov Tax Rebate Working From Home

Claiming Tax Relief On Employment Expenses With A P87 Form

https://goselfemployed.co/wp-content/uploads/2018/01/p87.jpg

Just Ranchin With Can Am Defender Pro Can Am Off Road

https://can-am.brp.com/content/dam/global/en/can-am-off-road/my20/vehicle-line-up/ssv/defender/defender-pro/CAN-AM-DALE-BRISBY-DEFENDER-PRO60.jpg

Working From Home Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/Work-from-Home-Tax-Rebate-Form-2021-717x1024.jpg

You ll receive a rebate for the full tax year even if you don t know what date you ll be going back to the office and even if you ve only worked from home for one day If your claim is successful your PAYE tax code will be changed so you ll be able to take home more of your income before tax The process for claiming tax relief for working from home is fairly straightforward You can easily apply for the rebate yourself Claims for working from home tax relief can be made online using the dedicated HMRC Portal You sneed to set up a

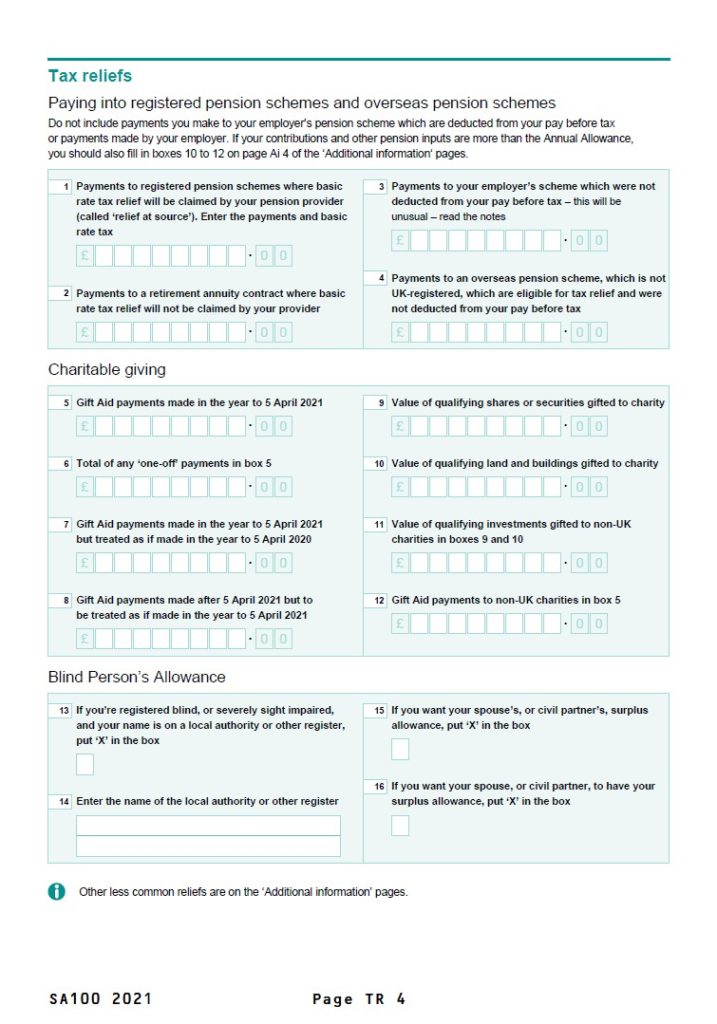

There are two ways to claim expenses either on your annual tax return if you file one or on a special form called a P87 which is available electronically via Government Gateway external or To apply for working from home tax relief you need to follow the steps on the government s website There are two different times to claim at the end of the tax year or during the tax year Here s how to claim working from home tax relief 2023 24 Check you are eligible by answering the questions on the government portal

Claiming Tax Relief For Working From Home Backhouse Solicitors

https://www.backhouse-solicitors.co.uk/wp-content/uploads/2020/11/work_from_home.jpg

Council Tax Rebate Epping Forest District Council

https://www.eppingforestdc.gov.uk/wp-content/uploads/2022/02/energy-bills-rebate-600x315.jpg

https://www.gov.uk/government/news/working-from...

To claim for tax relief for working from home employees can apply directly via GOV UK for free Once their application has been approved the online portal will adjust their tax code for the

https://www.gov.uk/claim-tax-refund

You may be able to get a tax refund rebate if you ve paid too much tax Use this tool to find out what you need to do if you paid too much on pay from a job job expenses such as working

4 TAX REBATE U s 87A New TAX REBATE EXAMPLES Income Tax

Claiming Tax Relief For Working From Home Backhouse Solicitors

HMRC Tax Rebate Working From Home Money Back Helpdesk

Earn A Rebate When You Recycle Your Old Working Appliances

What To Expect With Your Upcoming Tax Rebate Mass gov

P55 Tax Rebate Form By State Printable Rebate Form

P55 Tax Rebate Form By State Printable Rebate Form

Montana Tax Rebates Montana Department Of Revenue

Governor Lamont Announces Families Can Apply For The 2022 Connecticut

HMRC Tax Rebate Working From Home Money Back Helpdesk

Gov Tax Rebate Working From Home - If you re self employed If you work from home rather than from a business premises you can either add work related expenses when you file your 2022 23 tax return or you may be able to claim by using the government s online service beforehand For 2021 22