Government Car Mileage Reimbursement Rate Using a limited type company car for the trip you are entitled to a kilometre allowance of 13 cents in 2024 which in this case would be the base amount For

IR 2023 239 Dec 14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an 17 rowsThe standard mileage rates for 2023 are Self employed and business 65 5

Government Car Mileage Reimbursement Rate

Government Car Mileage Reimbursement Rate

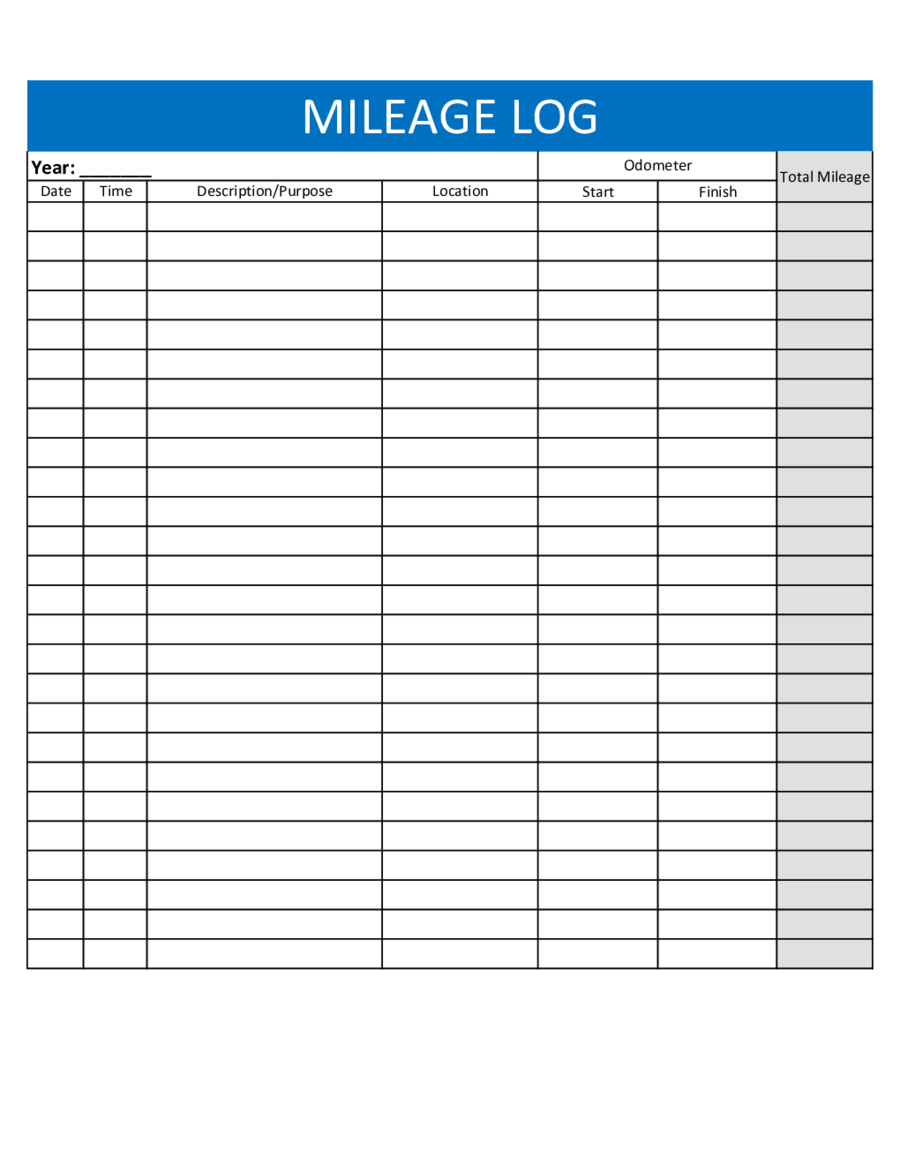

https://www.printableform.net/wp-content/uploads/2021/03/2020-mileage-log-fillable-printable-pdf-forms-handypdf.png

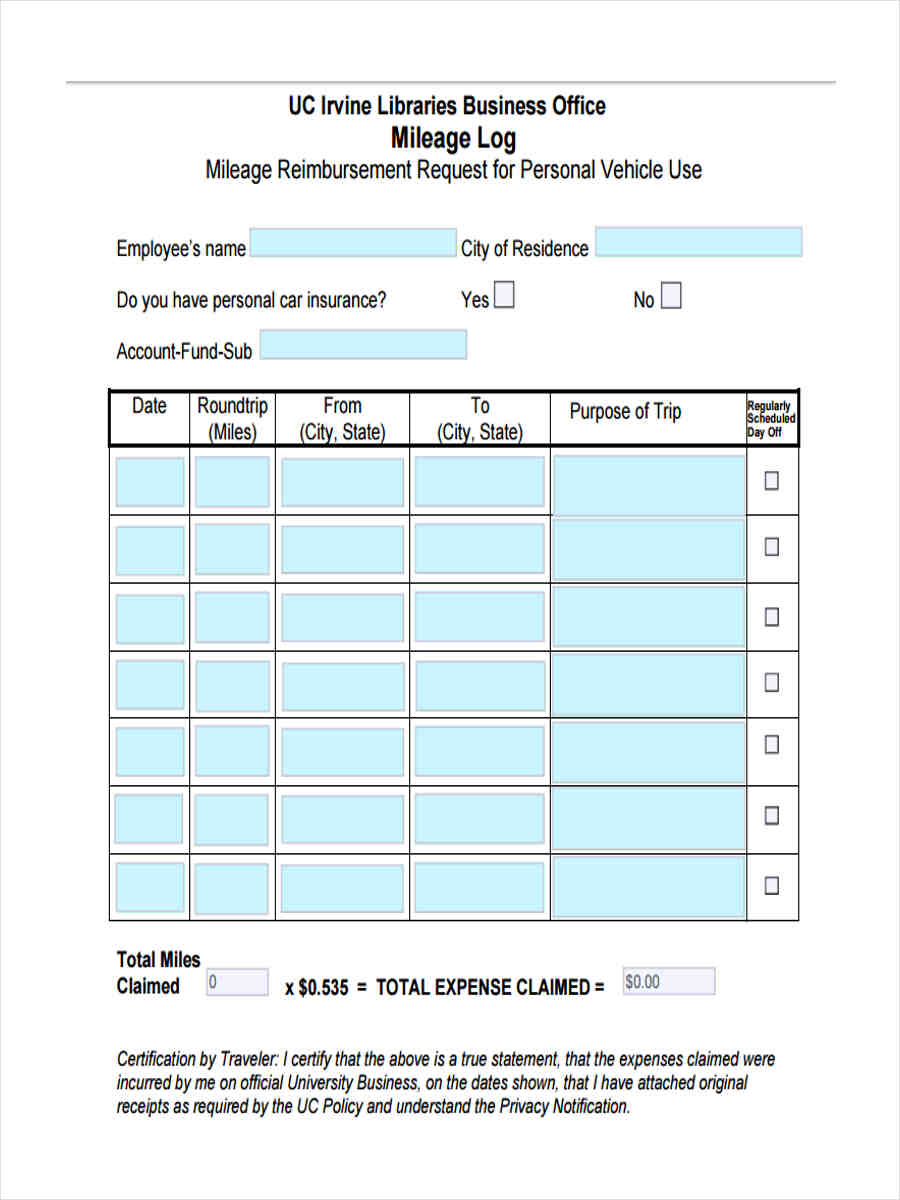

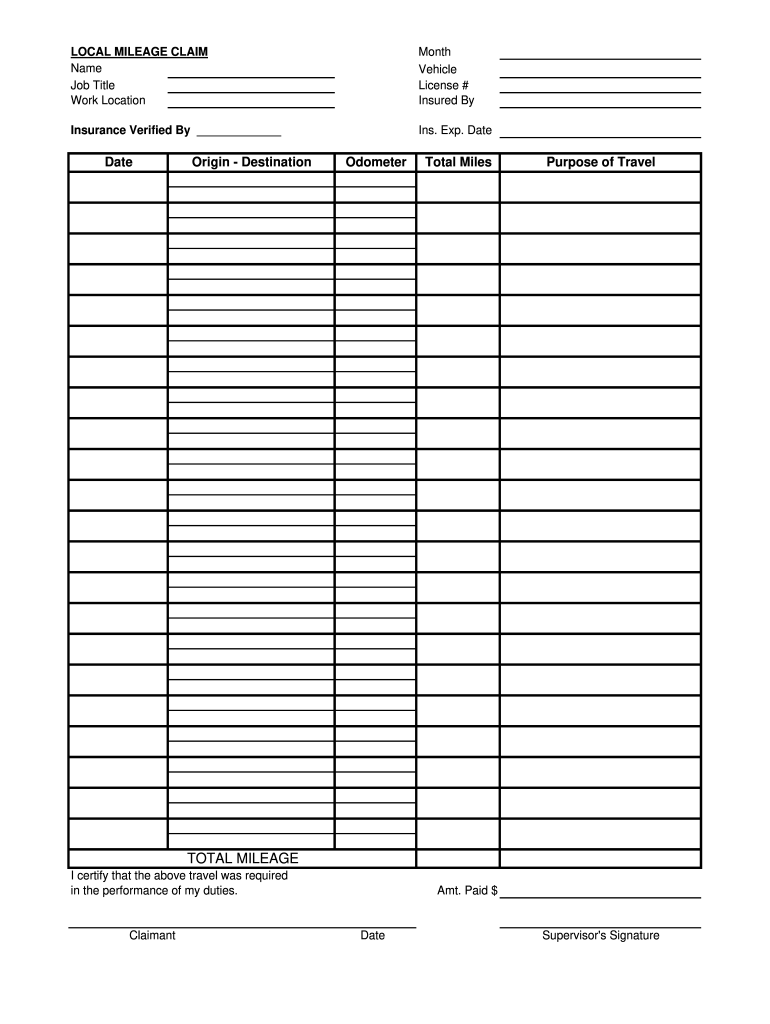

FREE 12 Mileage Reimbursement Forms In PDF Ms Word Excel

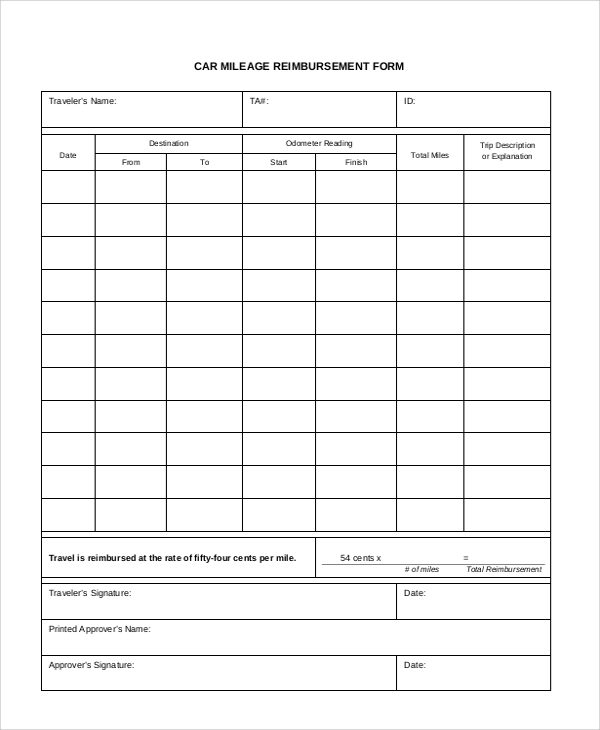

https://images.sampleforms.com/wp-content/uploads/2017/05/Auto-Mileage-Reimbursement.jpg

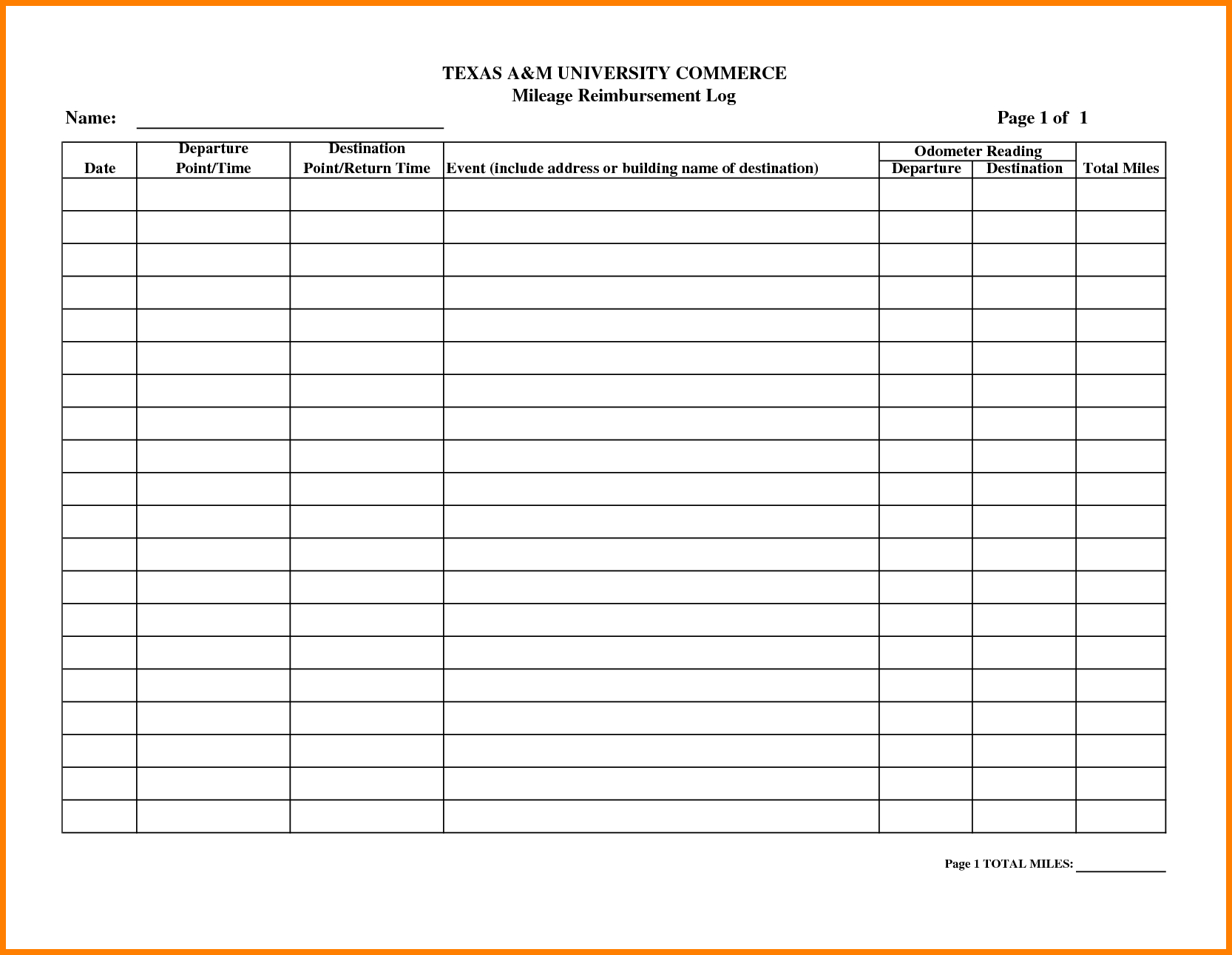

Free Mileage Log Templates Smartsheet 2022

https://www.smartsheet.com/sites/default/files/IC-Standard-Milage-Rates.jpg

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual Mileage Rates If you are authorized to travel by a privately owned vehicle POV for local Temporary Duty TDY or Permanent Change of Station PCS travel

As required by statute GSA sets the POA mileage reimbursement rate as the single standard mileage rate established by the Internal Revenue Service IRS GSA sets the Per diem rates look up Allowances for lodging meal and incidental costs while on official government travel Mileage reimbursement rates Reimbursement rates

Download Government Car Mileage Reimbursement Rate

More picture related to Government Car Mileage Reimbursement Rate

Car Mileage Reimbursement Form IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/free-11-sample-mileage-reimbursement-forms-in-ms-word-1.jpg

Mileage Reimbursement Form Free IRS Mileage Rate 2021

https://irs-mileage-rate.com/wp-content/uploads/2021/08/mileage-reimbursement-forms-charlotte-clergy-coalition-1.jpg

2024 Irs Mileage Reimbursement Rate Coral Karola

https://uploads-ssl.webflow.com/60882c80d0ef9737f2ee0911/63af21f1de517056bf96579c_Screenshot 2022-12-30 at 18.18.35.png

You will be reimbursed an applicable mileage rate based on the type of POV you actually use privately owned airplane privately owned automobile privately owned motorcycle Beginning on Jan 1 2022 the standard mileage rates for the use of a car also vans pickups or panel trucks will be 58 5 cents per mile driven for business use

What is the 2024 federal mileage reimbursement rate According to the IRS the mileage rate is set yearly based on an annual study of the fixed and variable costs Standard mileage rates are values the IRS sets for calculating reimbursable or deductible costs for driving a personal car for work related reasons There are three categories of

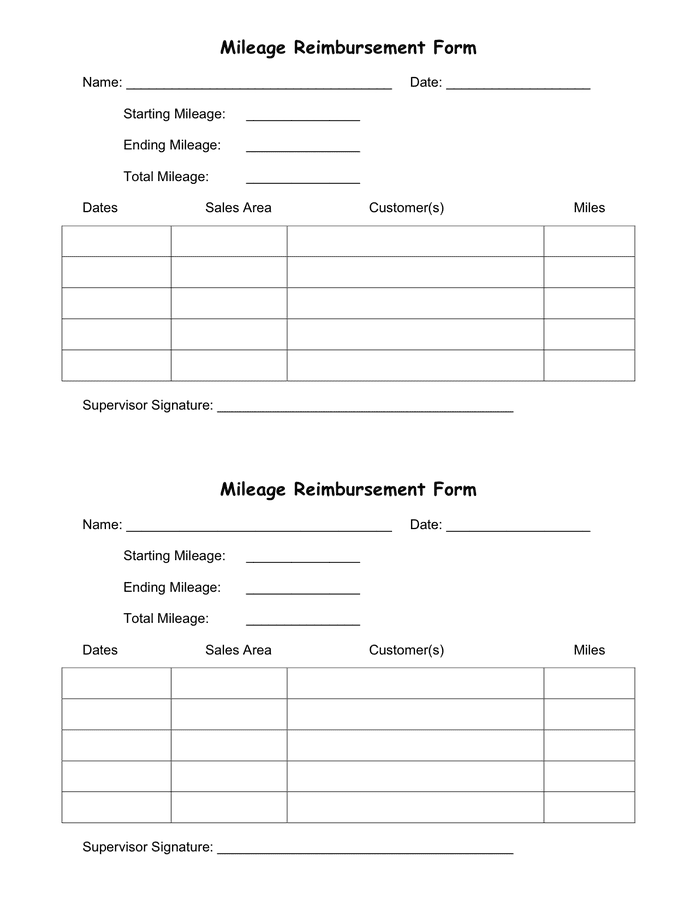

Free Mileage Reimbursement Form 2023 IRS Rates PDF Word EForms

https://eforms.com/images/2020/01/IRS-Mileage-Reimbursement-Form.png

Car Mileage Reimbursement 2024 Giana Babbette

http://static.dexform.com/media/docs/8682/mileage-reimbursement-form-6_1.png

https://www.vero.fi/en/individuals/deductions/...

Using a limited type company car for the trip you are entitled to a kilometre allowance of 13 cents in 2024 which in this case would be the base amount For

https://www.irs.gov/newsroom/irs-issues-standard...

IR 2023 239 Dec 14 2023 The Internal Revenue Service today issued the 2024 optional standard mileage rates used to calculate the deductible costs of operating an

2023 Standard Mileage Rates

Free Mileage Reimbursement Form 2023 IRS Rates PDF Word EForms

2023 Standard Mileage Rates Released By IRS

Mileage Form Template Complete With Ease AirSlate SignNow

2024 Mileage Log Fillable Printable PDF Forms Handypdf

Fuel Tracker Excel Template Excel Templates

Fuel Tracker Excel Template Excel Templates

How To Calculate Mileage Claim In Malaysia Karen Rutherford

Mileage Form PDF IRS Mileage Rate 2021

Free Mileage Reimbursement Form 2022 IRS Rates Word PDF EForms

Government Car Mileage Reimbursement Rate - Federal government employees are reimbursed at the Privately Owned Vehicle POV mileage reimbursement rate set each year by the General Services