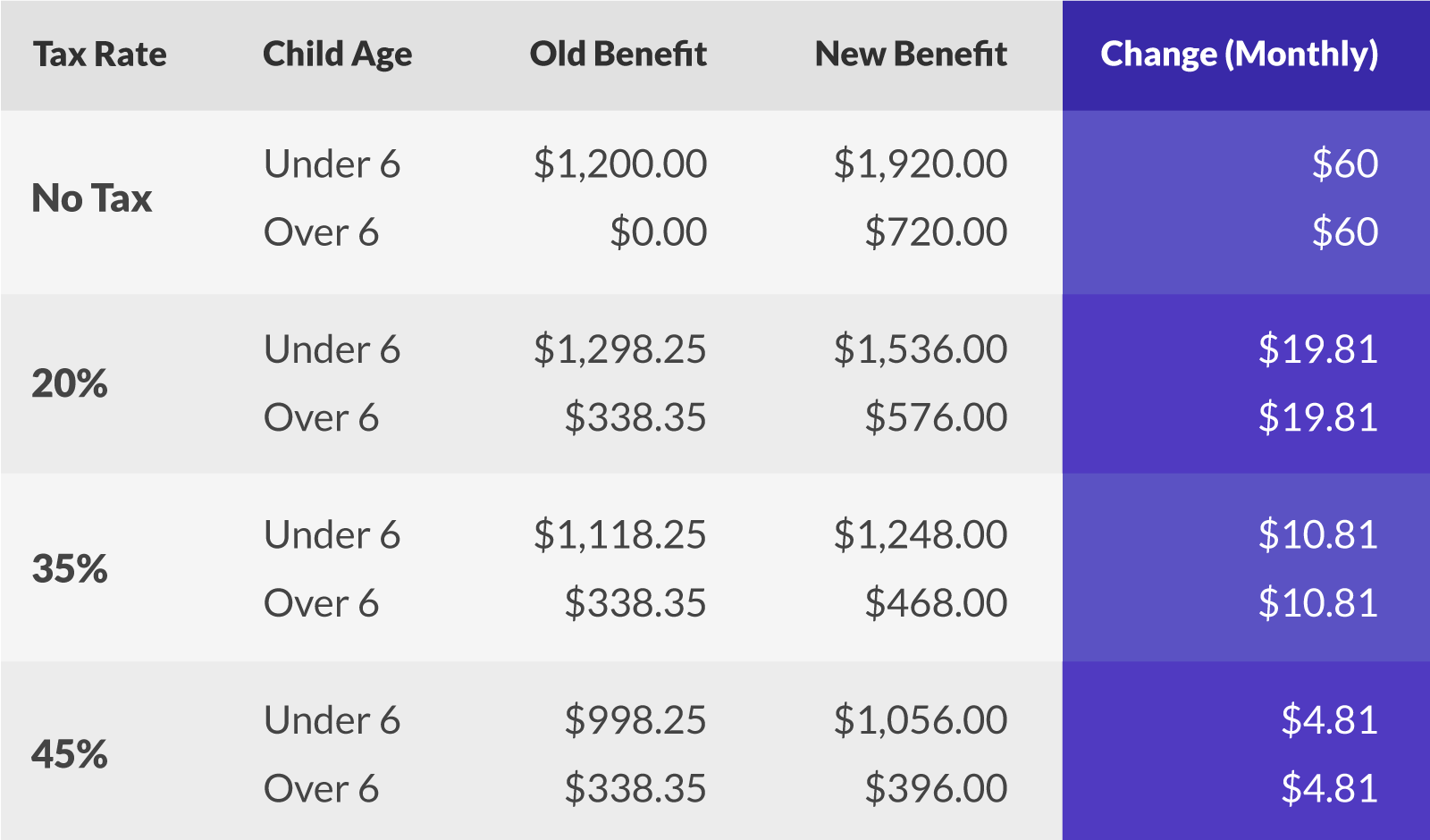

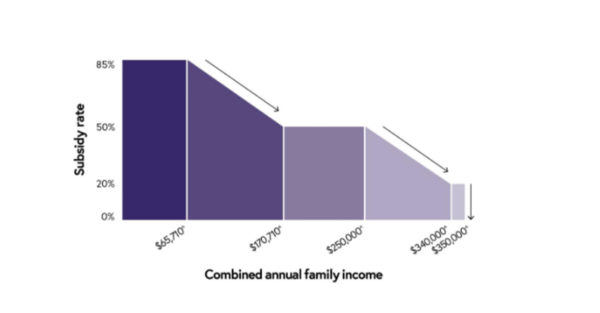

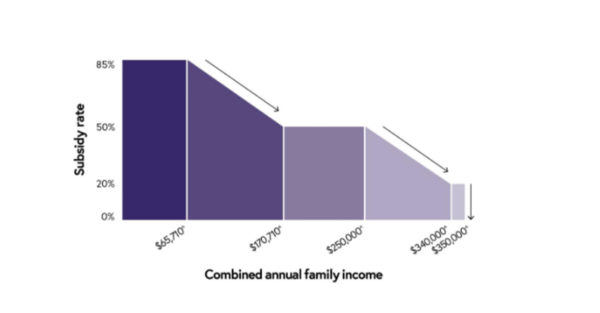

Government Child Care Rebate Changes Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting

Web 7 mars 2022 nbsp 0183 32 The annual cap used to mean families earning more than about 190 000 would stop getting a subsidy when the total received reached 10 655 per child each Web 27 sept 2022 nbsp 0183 32 The changes would see families earning up to 80 000 refunded 90 per cent of their first child s fees That proportion would decrease by one per cent for every extra 5 000 earned Depending on

Government Child Care Rebate Changes

Government Child Care Rebate Changes

https://www.carrebate.net/wp-content/uploads/2022/08/how-canada-s-revamped-universal-child-care-benefit-affects-you.png

How To Keep Receiving Childcare Rebates Under The Government s New System

https://cdn.babyology.com.au/wp-content/uploads/2019/03/childcare-rebate-update.jpg

Child Care Rebate

https://s2.studylib.es/store/data/005176746_1-5f58414245153e95907f2f11a65b3252-768x994.png

Web 10 oct 2021 nbsp 0183 32 If you pocket between about 189 390 and 353 680 the amount of money you can claim back stops at 10 560 per child What s changing Under the changes Web 10 oct 2021 nbsp 0183 32 From 10 December 2021 we re removing the annual cap for all families who get CCS From 7 March 2022 families with more than one child in care will get a higher

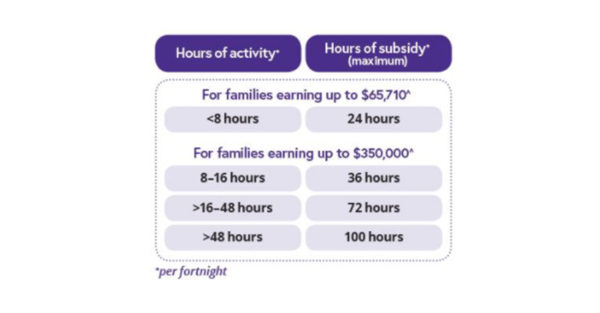

Web 27 mars 2017 nbsp 0183 32 The main changes include Replacing the Child Care Benefit and Child Care Rebate with a new Child Care Subsidy The new subsidy will have eligibility rules and be subject to means testing Total Web Current Child Care Subsidy arrangements The CCS is the Australian Government s main program to assist families with the costs of child care It commenced on 2 July 2018 and replaced two previous payments Child

Download Government Child Care Rebate Changes

More picture related to Government Child Care Rebate Changes

New Child Care Rebate Calculator 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/06/if-only-singaporeans-stopped-to-think-higher-subsidies-for-child.jpg

Five Things You Need To Know About The New Child Care Subsidy

https://cdn.babyology.com.au/wp-content/uploads/2017/11/childcarerebate2-600x313.jpg

Changes To Child Care Fee Assistance July 2018

http://www.playgroupnsw.org.au/site/DefaultSite/filesystem/images/Parent Resources/childcarerebate-landing.jpg

Web 10 juil 2023 nbsp 0183 32 Changes to Child Care Subsidy CCS changed on 10 July 2023 Most families using child care can now get more subsidy Read more about what you need to know Web Child Care Subsidy Income Test 2023 Updates From July 2023 The maximum CCS rate will be lifted to 90 for families earning 80 000 or less CCS rates will be increased for

Web 3 juil 2023 nbsp 0183 32 What are the childcare changes From July 10 the new Child Care Subsidy CCS regime will kick in The government will cover a larger percentage of most families childcare fees and more families will also Web 10 oct 2021 nbsp 0183 32 The changes build on the Morrison Government s Child Care Package introduced in 2018 which is still keeping out of pocket costs low for families using child

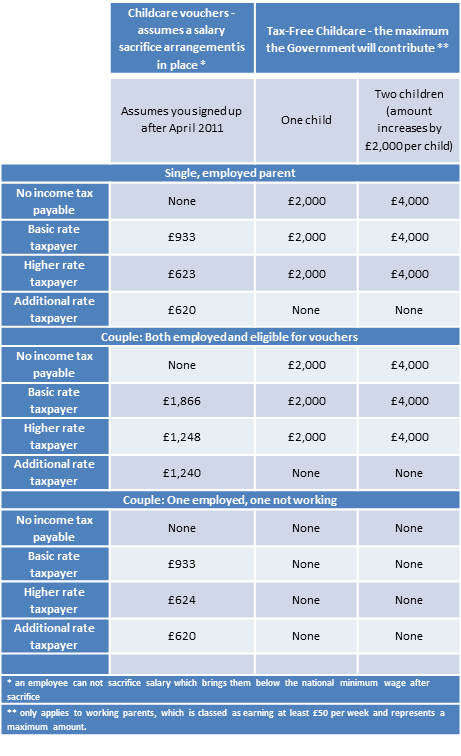

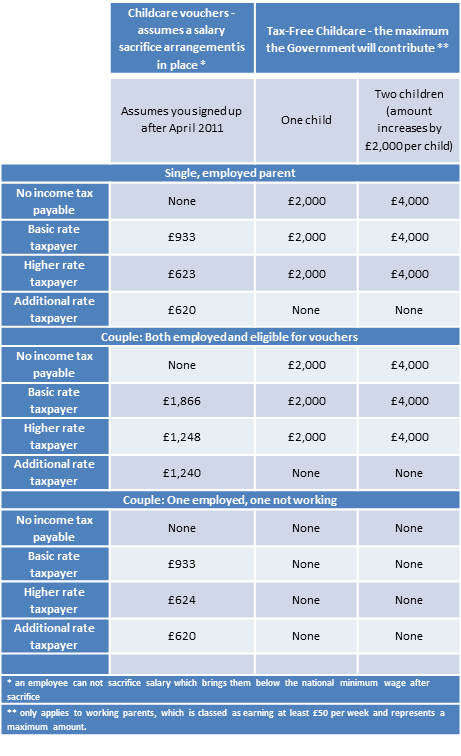

New Tax free Childcare Is It The End Of Salary Sacrifice For

https://blogs.mazars.com/letstalktax/files/2015/04/Childcare-table.png

Childcare Changes Help Some Not All The Courier Mail

https://content.api.news/v3/images/bin/3a21a4c2b29a215e7fb2600fc48787d0

https://www.servicesaustralia.gov.au/changes-if-you-get-family...

Web 10 juil 2023 nbsp 0183 32 Families earning up to 80 000 can get an increased maximum CCS amount from 85 to 90 If you earn over 80 000 you may get a subsidy starting

https://www.abc.net.au/news/2022-03-08/childcare-subsidy-changes-wh…

Web 7 mars 2022 nbsp 0183 32 The annual cap used to mean families earning more than about 190 000 would stop getting a subsidy when the total received reached 10 655 per child each

Scott Morrison Government Childcare Reform Will Be Implemented Slowly

New Tax free Childcare Is It The End Of Salary Sacrifice For

What The Changes To Child Care Rebates Mean For YOUR Family Keep Calm

Childcare Rebate Change Simon Birmingham Writes To Senate

New Budget Child Care Rebate 2022 Carrebate

Five Things You Need To Know About The New Child Care Subsidy

Five Things You Need To Know About The New Child Care Subsidy

The Changes After The Child Care Rebate Ended In Australia By

Child Care Rebate Application Form Edit Fill Sign Online Handypdf

Child Care Rebate Application Form Free Download

Government Child Care Rebate Changes - Web The changes only apply to families with more than one child aged five and under in care It is still means tested so to be eligible your family s combined income has to be under