Government Energy Rebates 2024 The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year 30 of the product cost up to 250 per door 500 maximum in one taxable year 30 of the project costs up to 2 000 for Home energy audits The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 30 up to a lifetime maximum of 500 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit

Government Energy Rebates 2024

Government Energy Rebates 2024

https://energyaction.com.au/wp-content/uploads/2023/08/government-energy-assistance.jpg

Government Rebates For Heat Pumps PumpRebate

https://www.pumprebate.com/wp-content/uploads/2022/09/heat-pumps-rebates-2019-coastal-energy-106.png

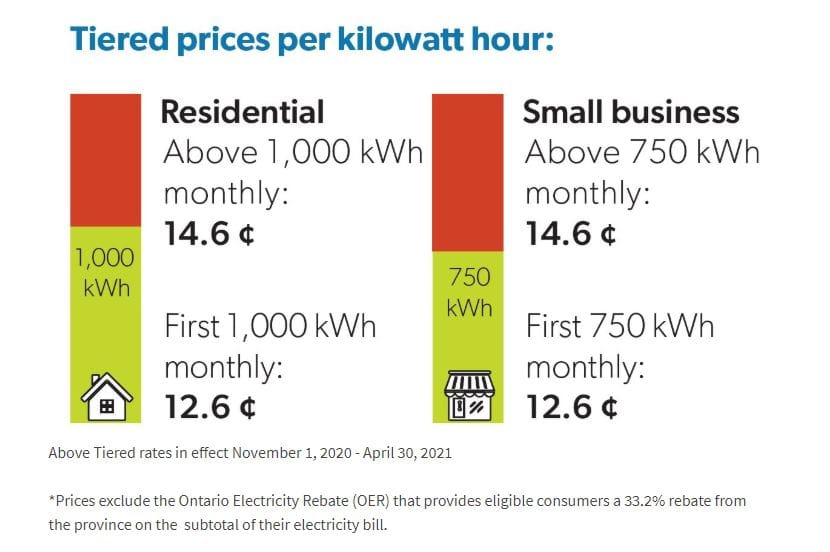

Ontario Energy Rebates 2023 Rebate2022

https://www.rebate2022.com/wp-content/uploads/2022/08/ontario-government-energy-rebates-2021-6-benefits-announced-in-the-1.jpg

About Home Energy Rebates On Aug 16 2022 President Biden signed the landmark Inflation Reduction Act The law includes nearly 400 billion to support clean energy and address climate change including 8 8 billion in Home Energy Rebates which will provide two separate rebates to consumers The Home Efficiency Rebates will provide 4 3 billion to discount the price of energy saving Energy gov scep Background The 8 8 billion Home Energy Rebates HER program provides an unprecedented opportunity for states territories and Tribes to make American homes more comfortable while reducing energy costs and greenhouse gas emissions Given the complexity and expertise required to plan design and execute these programs

The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 You may be able to take the credit if you IRA Home Electrification and Appliance Rebates collectively the Home Energy Rebates The Home Energy Rebates together authorize 8 8 billion in funds for the benefit of U S households and home upgrades to be distributed to households by State Energy Offices and Indian Tribes 1 Table 1 Home Energy Rebate Programs IRA Provision Number Home

Download Government Energy Rebates 2024

More picture related to Government Energy Rebates 2024

Energy Savings Rebate Program Enbridge Rebate

https://cozycomfortplus.com/wp-content/uploads/2020/02/Banner-1-Final-Feb-12-1080x500.jpg

Government Of Canada Energy Rebates 2023

https://allseasoninspection.ca/wp-content/uploads/2021/09/Enbridge-Home-Efficiency-Rebate-all-season-inspection.jpg

NJ Clean Energy Rebates Incentives In 2024

https://www.electricrate.com/wp-content/uploads/2023/01/nj-rebates-for-energy-efficient-appliances.jpg

Rebate from My State Government Unlike utility rebates rebates from state governments generally do not reduce your federal tax credit For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit DOE announced selections for the following voucher opportunities in January 2024 Voucher Opportunity 1 VO1 Pre Demonstration Commercialization Support OCED EERE addresses key adoption risk areas faced by companies already funded by DOE that are moving on from the research and development stage This support includes bankability studies manufacturing or supply chain assessments

More than 1000 Projects Registered for New Direct Pay and Transferability Credit Monetization ProvisionsWASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS announced reaching a major milestone in implementation of key provisions in the Inflation Reduction Act to expand the reach of the clean energy tax credits and help build projects more quickly and Maximum Allowed Rebate Amount Per Household Above 80 Area Median Income AMI Home Efficiency Project with at least 20 predicted energy savings 80 of project costs up to 4 000 50 of project costs up to 2 000 maximum of 200 000 for a multifamily building Home Efficiency Project with at least 35 predicted energy savings

Government Of Canada Energy Rebates 2022

https://allseasoninspection.ca/wp-content/uploads/2021/09/Canada-Greener-Homes-Grant-all-season-insepection.jpg

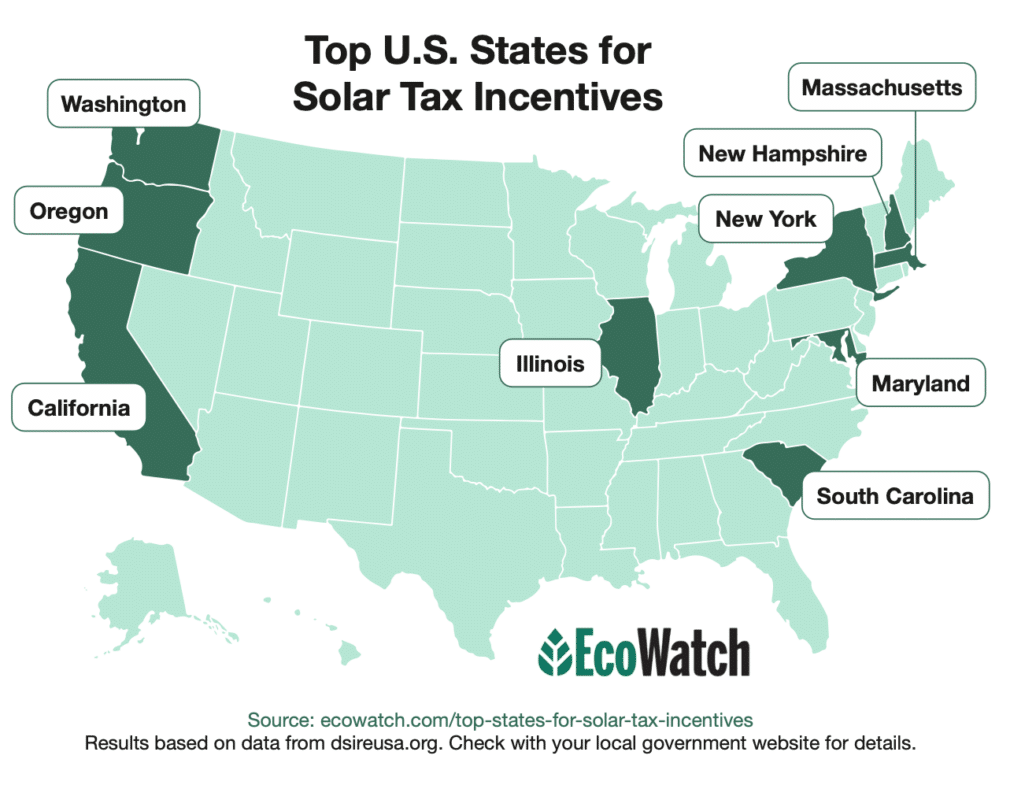

2024 Solar Incentives And Rebates By States Ranked Top 9

https://www.ecowatch.com/wp-content/uploads/2023/03/Top-States-Solar-Incentives-2023-1036x800.png

https://www.irs.gov/credits-deductions/energy-efficient-home-improvement-credit

The maximum credit you can claim each year is 1 200 for energy property costs and certain energy efficient home improvements with limits on doors 250 per door and 500 total windows 600 and home energy audits 150 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit

https://www.energystar.gov/about/federal_tax_credits

By further improving your home s envelope with new ENERGY STAR certified exterior doors and a heat pump water heater you can claim up to 600 or 30 of the product cost for upgrading your windows in one taxable year 30 of the product cost up to 250 per door 500 maximum in one taxable year 30 of the project costs up to 2 000 for

Through Government Rebates And Tax Incentives This Solar Program Is Making Solar Energy More

Government Of Canada Energy Rebates 2022

Government Of Canada Energy Rebates 2022

Government Of Canada Energy Rebates 2022

Budget 2022 GST Will Go Up To 8 Next Year Then 9 From 2024 Extra S 640 Million To Cushion

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Energy Rebates Don t Leave Money On The Table Schmidt Associates

Victorian Government Energy Rebates

How To Look For Energy Rebates In Your Location YouTube

Government Of Canada Energy Rebates 2022

Government Energy Rebates 2024 - The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034 You may be able to take the credit if you