Government Rebate For Hybrid Cars Web 2 juil 2022 nbsp 0183 32 Le gouvernement a donc d 233 cid 233 de maintenir le bonus 233 cologique au niveau actuel jusqu au 31 d 233 cembre 2022 soit 6 000 pour l achat d un mod 232 le 233 lectrique et 1 000 pour un hybride rechargeable Ce dispositif concerne les v 233 hicules command 233 s avant le 31 d 233 cembre 2022 et devant 234 tre livr 233 s avant le 30 juin 2023 L autre

Web V 233 hicule hybride rechargeable taux de CO2 entre 21 et 50 g km de 50 000 au maximum et autonomie gt 224 50 km 1 000 0 Les v 233 hicules d occasion ont aussi le droit 224 leur bonus Le montant Web 25 juil 2023 nbsp 0183 32 Consumer Reports details the list of 2022 2023 and 2024 model year electric vehicles and plug in hybrids that qualify for federal tax credits of up to 7 500 under the Inflation Reduction Act

Government Rebate For Hybrid Cars

Government Rebate For Hybrid Cars

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/federal-rebates-for-hybrid-cars-2022-2022-carrebate-7.jpg?w=467&h=554&ssl=1

Federal Rebates For Hybrid Cars 2022 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/federal-rebate-for-electric-cars-2022-carrebate-7.jpg?resize=840%2C473&ssl=1

Government Rebate For Hybrid Cars Ontario 2022 Carrebate FordRebates

https://i0.wp.com/www.fordrebates.net/wp-content/uploads/2023/05/government-rebate-for-hybrid-cars-ontario-2022-carrebate.jpg?w=2100&ssl=1

Web Overview Some types of low emission vehicles are eligible for a grant from the government so that you can buy them more cheaply You do not apply for the grant The seller includes it as a Web 16 mai 2022 nbsp 0183 32 If you purchased a new all electric vehicle EV or plug in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7 500 according to the U S Department of Energy The total federal incentive amount depends on the capacity of the battery used to power your car and state and or local

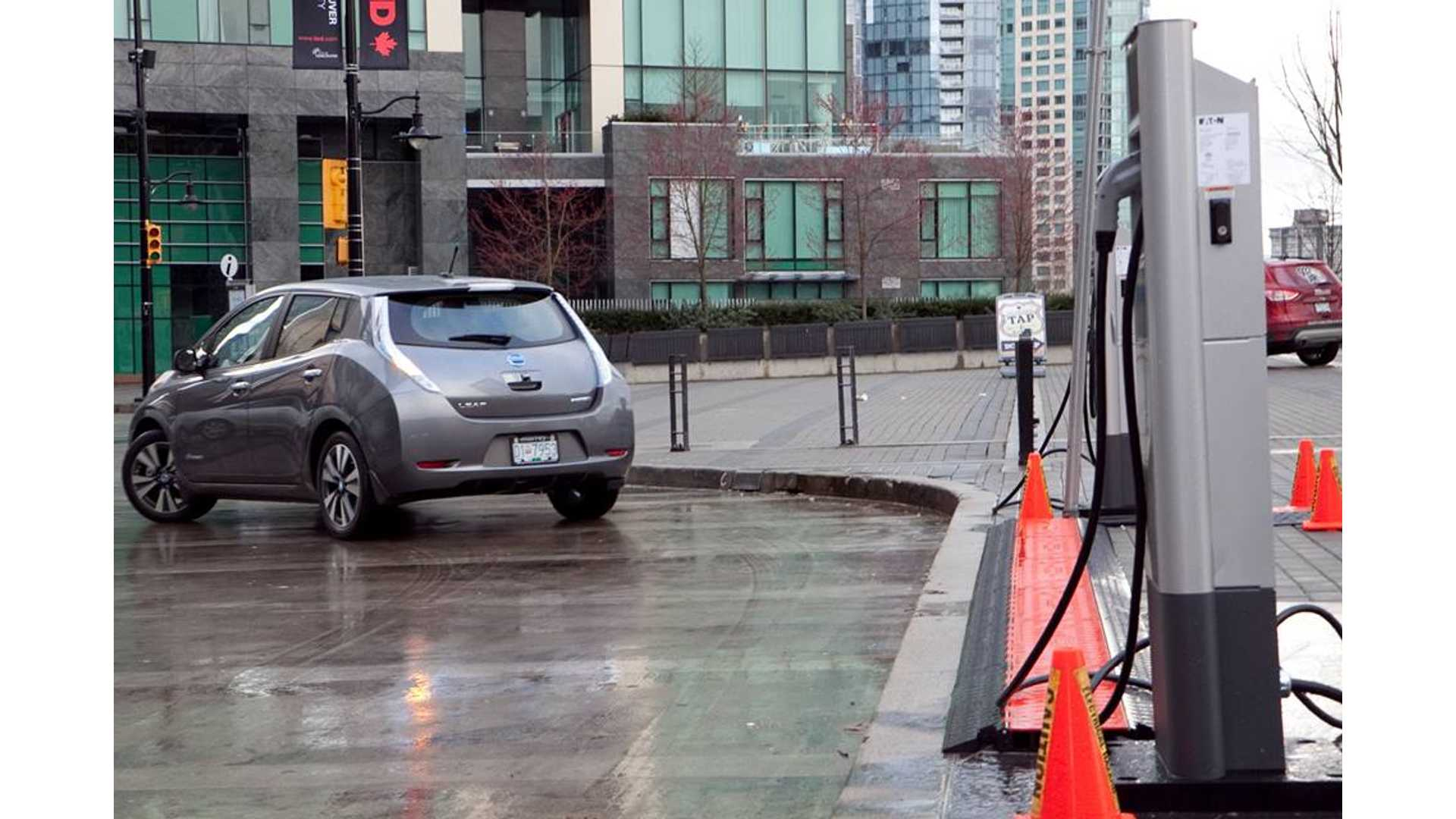

Web You may qualify for a credit up to 7 500 under Internal Revenue Code Section 30D if you buy a new qualified plug in EV or fuel cell electric vehicle FCV The Inflation Reduction Act of 2022 changed the rules for this credit for vehicles purchased from 2023 to 2032 The credit is available to individuals and their businesses Web 22 avr 2022 nbsp 0183 32 The program launched in 2019 offers a 5 000 rebate for fully electric vehicles and 2 500 for hybrid vehicles Starting next week the rebate will be extended to cars with a base model

Download Government Rebate For Hybrid Cars

More picture related to Government Rebate For Hybrid Cars

Government Rebate For Hybrid Cars Ontario 2022 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/hybrid-car-government-rebate-2022-carrebate-3.jpg

Government Tax Rebates For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/are-the-tax-rebates-for-electric-and-hybrid-cars-worth-it-lionsgate-7.png?w=567&h=378&ssl=1

Virginia Rebates Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/nj-electric-car-rebate-reddit-virginia-made-progress-on-clean-3.jpg

Web 6 juin 2023 nbsp 0183 32 If you ve been shopping for or researching an electric vehicle you ve probably heard that the federal tax credit for EVs and plug in hybrids was significantly overhauled by the Inflation Web 25 janv 2022 nbsp 0183 32 Several states and even some eco minded cities offer their own incentives for EV and plug in hybrid buyers that typically take the form of either a tax credit or a rebate Provisions and

Web Get a tax credit of up to 7 500 for new vehicles purchased in or after 2023 Pre Owned Plug in and Fuel Cell Electric Vehicles Purchased in or after 2023 Get a credit of up to 4 000 for used vehicles purchased from a dealer for 25 000 or less The amount equals 30 of purchased price with a maximum credit of 4 000 Other requirements apply Web A federal hybrid car tax credit is available to consumers who buy plug in electric vehicles EVs in the United States According to the U S Department of Energy you can receive a tax credit of

Hybrid Car Rebate British Columbia 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2022/08/british-columbia-ev-rebate-fund-nearly-out-of-money-drive-tesla-canada-3.jpg?w=836&h=359&ssl=1

Government Rebats For Hybrid Cars 2023 Carrebate

https://i0.wp.com/www.carrebate.net/wp-content/uploads/2023/05/trending-news-hybrid-cars-will-cost-less-government-is-working-on-a.jpg?resize=840%2C441&ssl=1

https://www.quechoisir.org/actualite-bonus-ecologique-2022...

Web 2 juil 2022 nbsp 0183 32 Le gouvernement a donc d 233 cid 233 de maintenir le bonus 233 cologique au niveau actuel jusqu au 31 d 233 cembre 2022 soit 6 000 pour l achat d un mod 232 le 233 lectrique et 1 000 pour un hybride rechargeable Ce dispositif concerne les v 233 hicules command 233 s avant le 31 d 233 cembre 2022 et devant 234 tre livr 233 s avant le 30 juin 2023 L autre

https://www.autoplus.fr/environnement/voitures-electriques-hybride...

Web V 233 hicule hybride rechargeable taux de CO2 entre 21 et 50 g km de 50 000 au maximum et autonomie gt 224 50 km 1 000 0 Les v 233 hicules d occasion ont aussi le droit 224 leur bonus Le montant

Colorado Rebate For Hybrid Cars 2023 Carrebate

Hybrid Car Rebate British Columbia 2023 Carrebate

Government Hybrid Car Rebates 2022 2023 Carrebate

Government Rebats For Hybrid Cars 2023 Carrebate

Hybrid Electric Car Rebates 2023 Carrebate

Rebate For Hybrid Car 2023 Carrebate

Rebate For Hybrid Car 2023 Carrebate

Hybrid Car Rebate British Columbia 2023 Carrebate

Ontario Government Rebates For Hybrid Cars 2023 Carrebate

Ontario Government Rebates For Hybrid Cars 2023 Carrebate

Government Rebate For Hybrid Cars - Web 28 nov 2022 nbsp 0183 32 The scheme was altered again in October 2018 when the discount was cut to 163 3 500 for electric cars and was axed entirely for plug in hybrid vehicles The grant was reduced annually since to the point where most private car sales are now no longer eligible