Government Rebates Energy Efficient Hvac Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat pumps heat pump water heaters insulation doors

Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects These home energy rebates will help American households save money on energy Web 13 avr 2023 nbsp 0183 32 The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for

Government Rebates Energy Efficient Hvac

Government Rebates Energy Efficient Hvac

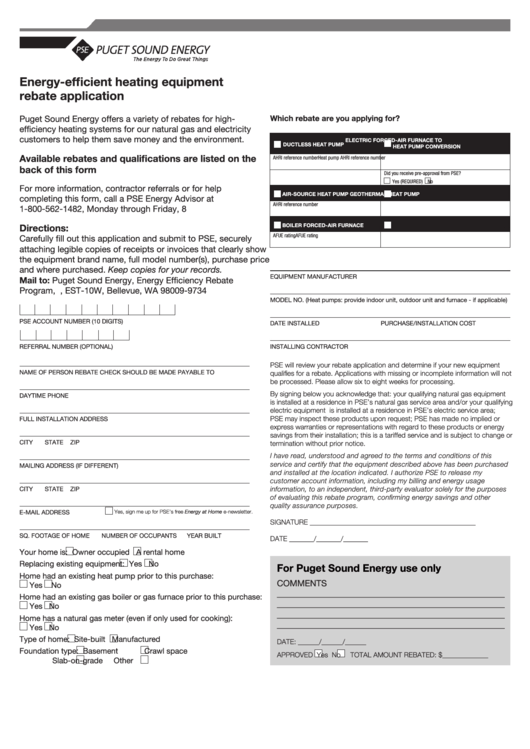

https://149354076.v2.pressablecdn.com/wp-content/uploads/2020/10/Taking-Advantage-of-HVAC-Rebates-and-Federal-Tax-Credits-with-An-HVAC-System.png

Guide To HVAC Rebates In 2023

https://www.azaircond.com/corporate/images/HVACRebates-19-LNX_UCS_FAM_THERM_IAQ_AC_FURN-945x532-12333.jpeg

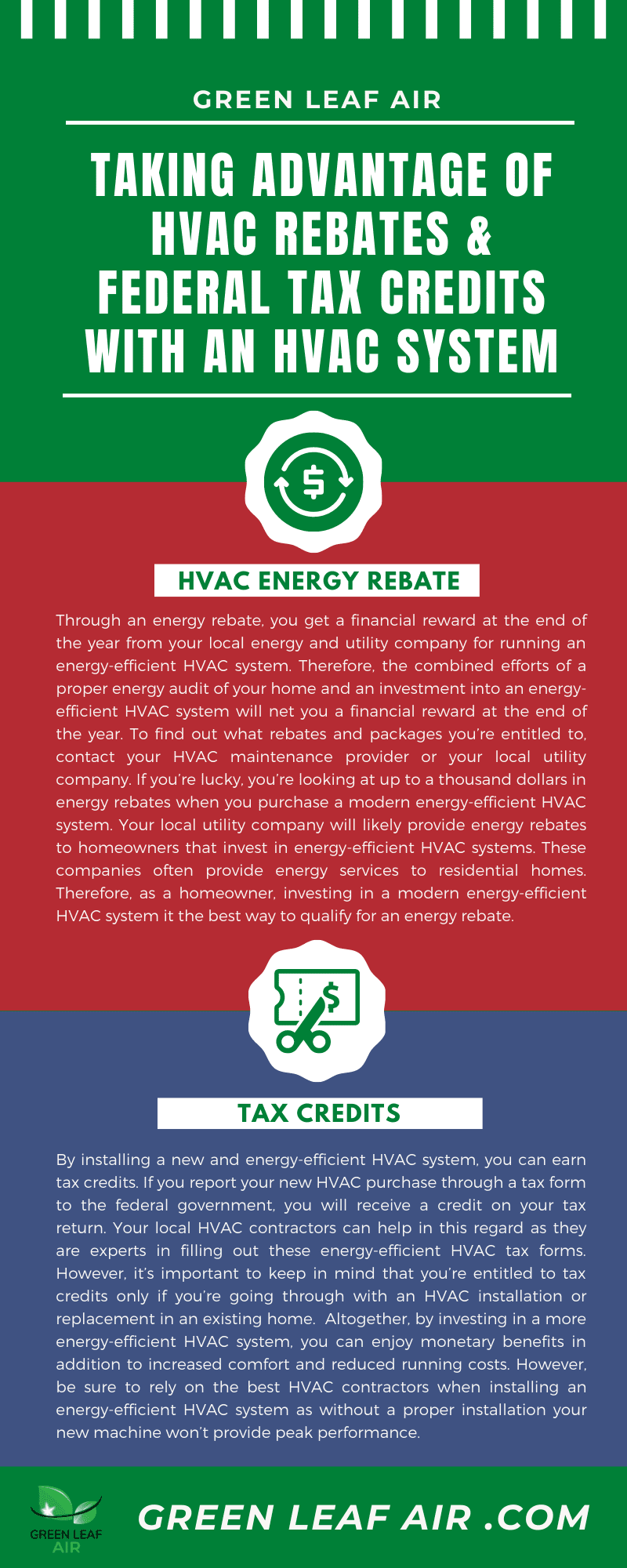

Energy Efficient Heating Equipment Rebate Application Pse Printable

https://data.formsbank.com/pdf_docs_html/298/2982/298270/page_1_thumb_big.png

Web Cependant si les aides de l 201 tat ne suffisent pas 224 subventionner 224 100 votre pompe 224 chaleur et que vous avez encore un reste 224 charge rien n est perdu Aussi vous pouvez pr 233 tendre au pr 234 t 224 taux Z 233 ro Vous pouvez aussi b 233 n 233 ficier des aides de CITE de Ma Web 1 janv 2023 nbsp 0183 32 If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 or earlier Use

Web 9 sept 2022 nbsp 0183 32 High Efficiency Electric Home Rebate Act HEEHRA This provides rebates for low and middle income families to electrify their homes such as by installing heat pumps or electric clothes Web 15 ao 251 t 2023 nbsp 0183 32 Explore new federal energy guidelines for 2023 and learn about HVAC rebates and energy efficient incentive program aimed toward homeowners Are you doing an HVAC project Modernize can pair you with three to four pros in your area so you

Download Government Rebates Energy Efficient Hvac

More picture related to Government Rebates Energy Efficient Hvac

Pin On Places To Visit

https://i.pinimg.com/originals/04/c7/11/04c7116c80dc21d522b99e70b8320517.png

Save Upto 2000 With New HVAC System Instant Cash Rebates

https://extremecomfortac.com/wp-content/uploads/2020/12/2000-HVAC-Rebates-Michael-web.jpg

Energy Star Air Conditioner Rebates 4 Star Energy Rated Air

https://www.barriersciences.com/user_files/upload/ontario-energy-rebates-2019.jpg

Web 30 d 233 c 2022 nbsp 0183 32 The overall total limit for an efficiency tax credit in one year is 3 200 This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air Web 27 avr 2021 nbsp 0183 32 In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year

Web 1 ao 251 t 2023 nbsp 0183 32 The Nonbusiness Energy Property Tax Credit now called the Energy Efficient Home Improvement Credit may apply to central air conditioning units installed through the end of 2022 The maximum tax credit amount is 300 for qualifying units Web 22 d 233 c 2022 nbsp 0183 32 The inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements and residential energy property These FAQs provide details on the IRA s changes to these tax credits information on eligible expenditures and

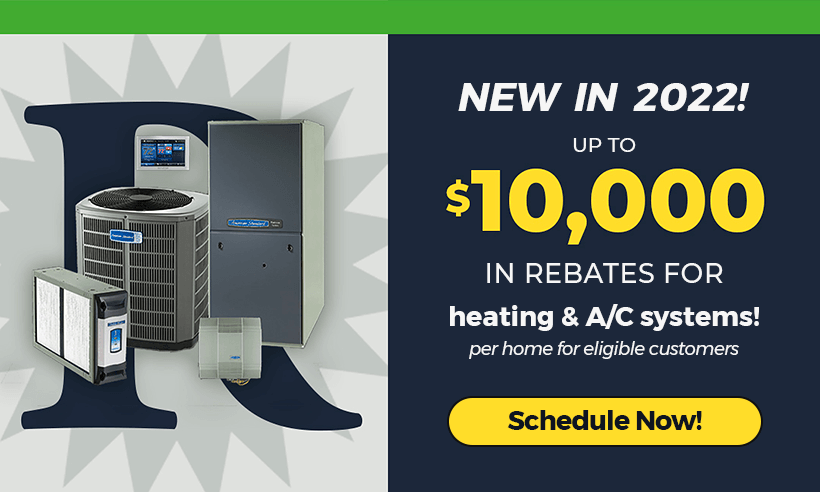

2022 HVAC Rebates Rodenhiser Plumbing Heating AC And Electric

https://norfolk.rodenhiser.com/images/2022/now-is-the-time3.png

Potomac Edison HVAC Rebate Program Air Doctor Heating And Air

https://airdoctorhvac.com/wp-content/uploads/2019/03/Potomac-Edison-HVAC-Rebates.jpg

https://www.energystar.gov/about/federal_tax_credits

Web 30 d 233 c 2022 nbsp 0183 32 New federal income tax credits are available through 2032 providing up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent Improvements such as installing heat pumps heat pump water heaters insulation doors

https://www.energy.gov/scep/home-energy-rebate-program

Web The law includes 391 billion to support clean energy and address climate change including 8 8 billion in rebates for home energy efficiency and electrification projects These home energy rebates will help American households save money on energy

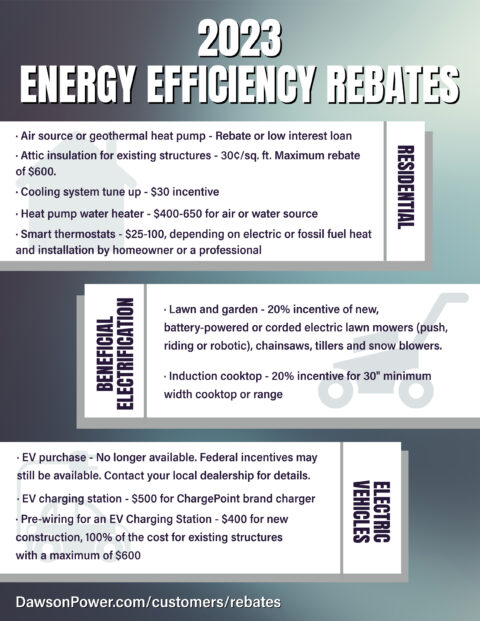

2023 Energy Efficiency Rebates Dawson Public Power District

2022 HVAC Rebates Rodenhiser Plumbing Heating AC And Electric

New LADWP Program Offers 225 Rebate On Energy efficient AC Units For

Energy Efficient Hvac PPT

Energy Efficiency Blog M E Flow

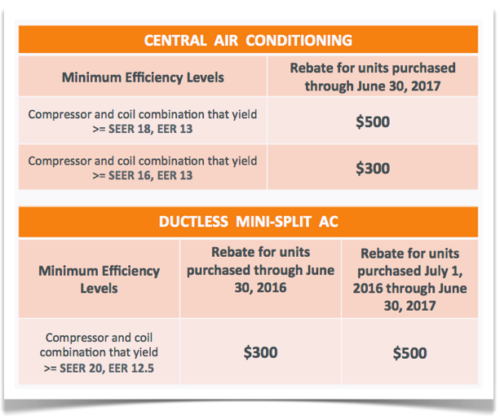

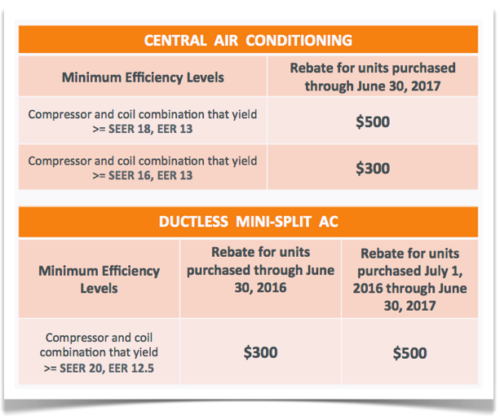

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

High Efficiency Air Conditioning New Jersey Rebates Skylands Energy

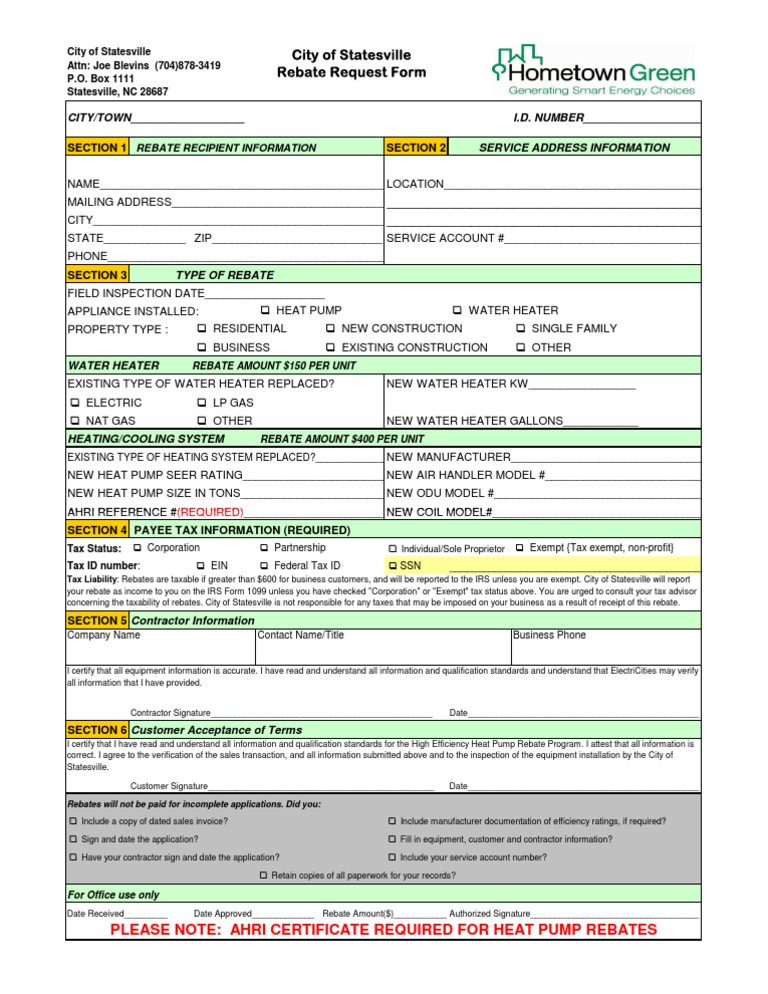

Rebate Form CityofStatesville Revised 8 28 09 Rebate Marketing

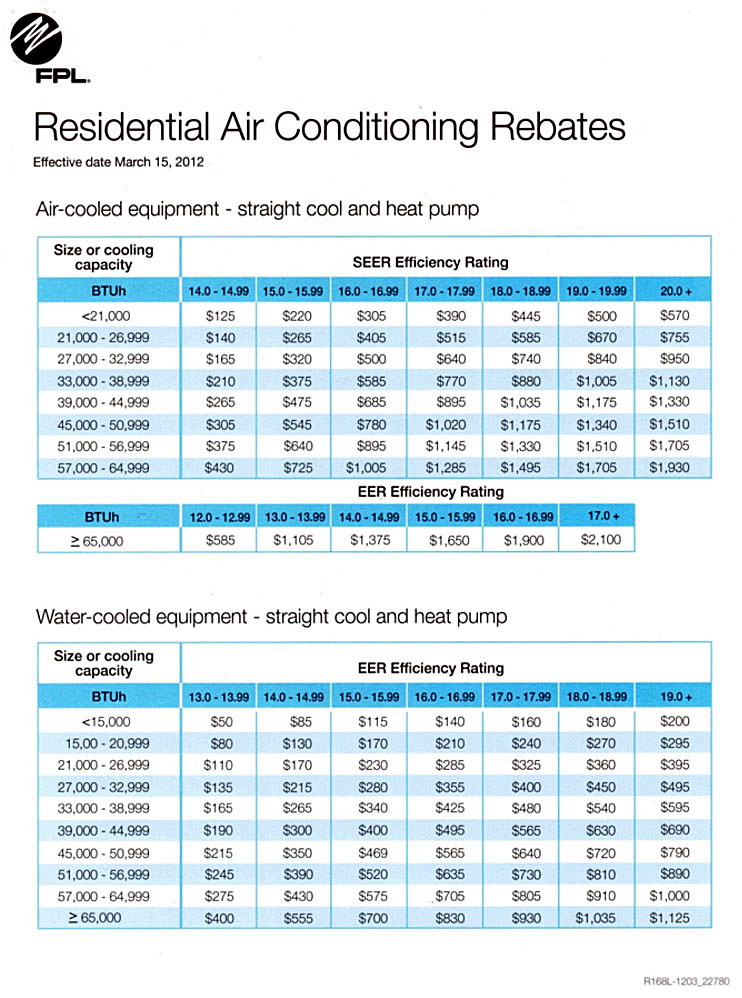

How Much Money Can A New Air Conditioning System Save You Advanced

HVAC Rebates And Specials For Your Next Purchase Brody Pennell

Government Rebates Energy Efficient Hvac - Web 15 ao 251 t 2023 nbsp 0183 32 Explore new federal energy guidelines for 2023 and learn about HVAC rebates and energy efficient incentive program aimed toward homeowners Are you doing an HVAC project Modernize can pair you with three to four pros in your area so you