Government Rebates For Furnaces 2024 For furnaces the tax credit amount was increased from 300 in 2022 to 30 of the cost up to 600 for 2023 through 2032 Eligibility for Furnace Tax Credits and Rebates ENERGY STAR certified gas and oil furnaces are eligible for the 30 or a maximum 600 in tax credits and rebates

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners SCEP Announces 8 5 Billion Home Energy Rebate Programs The U S Department of Energy s Karen Zelmar explains the Inflation Reduction Act s Home Energy Rebates programs and their top energy savings goals Video courtesy of the U S Department of Energy Latest News

Government Rebates For Furnaces 2024

Government Rebates For Furnaces 2024

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-for-Furnaces-2022.png

Government Rebate For Furnaces PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2022/04/Government-Rebate-For-Furnaces.png

P E I Government Ending Rebates For High efficiency Oil Furnaces

https://media.zenfs.com/en/cbc.ca/9f32314c4366c9ed555ec0497fca39be

Key Takeaways You can receive up to 3 200 in federal tax credits for installing qualifying HVAC equipment into an existing home split between ACs furnaces or boilers 1 200 and air source heat pumps and biomass stoves 2 000 Your HVAC system must fulfill high energy efficiency requirements to qualify for tax credits For Americans with a New Year s resolution to trade in their gas furnace or water heater for climate friendly heat pumps a word of caution Generous Inflation Reduction Act rebates for home

The Inflation Reduction Act is packed with provisions to incentivize homeowners to make energy efficiency upgrades to their home including installing high efficiency heating cooling and This breaks down to a total limit of 1 200 for any combination of home envelope improvements windows doors skylights insulation electrical plus furnaces boilers and central air conditioners Any combination of heat pumps heat pump water heaters and biomass stoves boilers are subject to an annual total limit of 2 000

Download Government Rebates For Furnaces 2024

More picture related to Government Rebates For Furnaces 2024

Are There Any Government Rebates For Furnaces Need To Know

https://lh4.googleusercontent.com/X3caEXhoCptrBlFwT7-ZOpXc9SPFiZDGo2VhsGW9niejQcZDlUY_3kXkGGEALmOaPR3fWR3xmhBz1EarHJZkywTS3Ah6Ikb8VYsCsDan79ONuT_GdOES1Wn2gcgl0HcGJUBKGNDzPM8JK3YpzwkxhXE

Government Rebates For Heat Pumps Furnaces And Water Heaters

https://content.app-sources.com/s/63109169048172133/uploads/Images/3-4620316.png

Mass Save PrintableRebateForm

https://printablerebateform.net/wp-content/uploads/2021/12/Residential-Mass-Save-Rebate-Form-2021-768x513.png

The Inflation Reduction Act of 2022 empowers Americans to make homes and buildings more energy efficient by providing federal tax credits and deductions that will help reduce energy costs and demand as we transition to cleaner energy sources Tax Credits for Home Builders Tax Deductions for Commercial Buildings In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy property expenditures paid or incurred by the taxpayer during the taxable year subject to the overall credit limit of 500

2024 Rebates for Heating and Cooling Equipment These rates apply to equipment installed January 1 2024 through May 31 2024 Applications must be submitted within 60 days of installation and no later than June 30 2024 Rebates are subject to change Check focusonenergy for current rebate amounts Under the law the HOMES rebate should be available to whole house energy saving retrofits that begin after the Inflation Reduction Act became law on August 16 2022 and completed before

Eliminate The Administrative Burden Of Rebates From Finance Enable

https://assets-global.website-files.com/61eee558e613794aa8a7f70c/6244596825b286767859375c_Blog banner 2400x1348px22.jpg

Save 500 With Heating And Cooling Tax Credits Biard Crockett

https://www.biardandcrockett.com/wp-content/uploads/2021/11/government-tax-rebates.jpg

https://www.furnacepriceguides.com/rebates-and-incentives/

For furnaces the tax credit amount was increased from 300 in 2022 to 30 of the cost up to 600 for 2023 through 2032 Eligibility for Furnace Tax Credits and Rebates ENERGY STAR certified gas and oil furnaces are eligible for the 30 or a maximum 600 in tax credits and rebates

https://todayshomeowner.com/hvac/guides/hvac-tax-credit/

The federal Inflation Reduction Act passed in 2022 expanded and extended federal income tax credits available for energy efficiency home improvements including HVAC system components An array of Energy Star certified equipment is eligible for the tax credits including Air source heat pumps Biomass fuel stoves Boilers Central air conditioners

DEC Savage Rascal Rebate Gun Rebates

Eliminate The Administrative Burden Of Rebates From Finance Enable

Top 5 Best Home Warranty Companies For Furnaces 2024 Today s Homeowner

CTV News On Twitter Most Canadians Got More From Carbon price Rebates Than They Spent In 2021

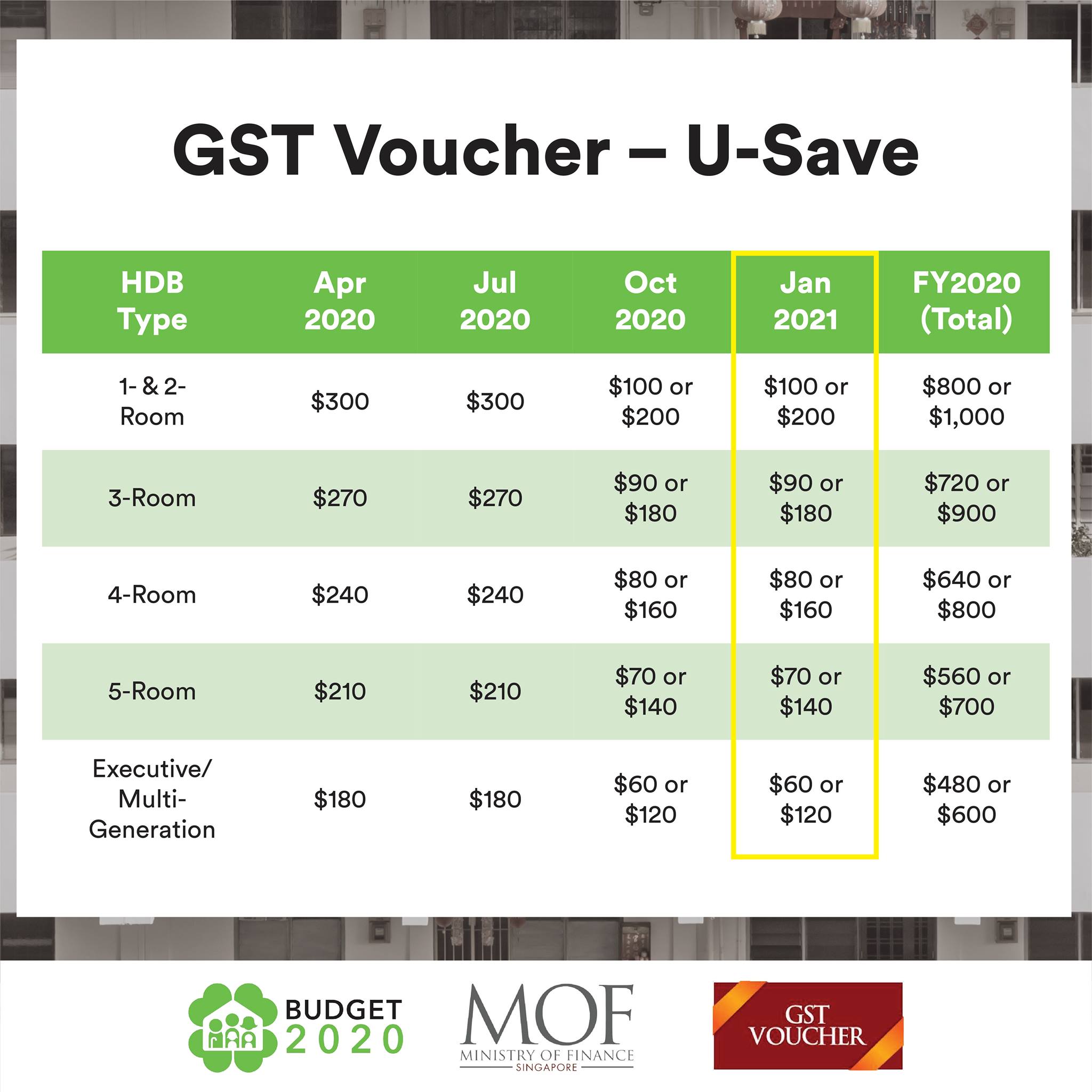

940 000 Households In S pore Will Receive Double Their Regular GST Voucher U Save Rebates For FY

How Do Home Rebates Work DC MD VA Home Rebates

How Do Home Rebates Work DC MD VA Home Rebates

NWC Tryouts 2023 2024 NWC Alliance

MRCOOL 96 AFUE 90000 BTU Multi Position Gas Furnace In The Forced Air Furnaces Department At

.png)

Why Are Rebates And Rebate Management Important For Manufacturers And Distributors Enable

Government Rebates For Furnaces 2024 - 2023 through 2032 30 up to a maximum of 1 200 heat pumps biomass stoves and boilers have a separate annual credit limit of 2 000 no lifetime limit Get details on the Energy Efficient Home Improvement Credit Residential Clean Energy Credit These expenses may qualify if they meet requirements detailed on energy gov