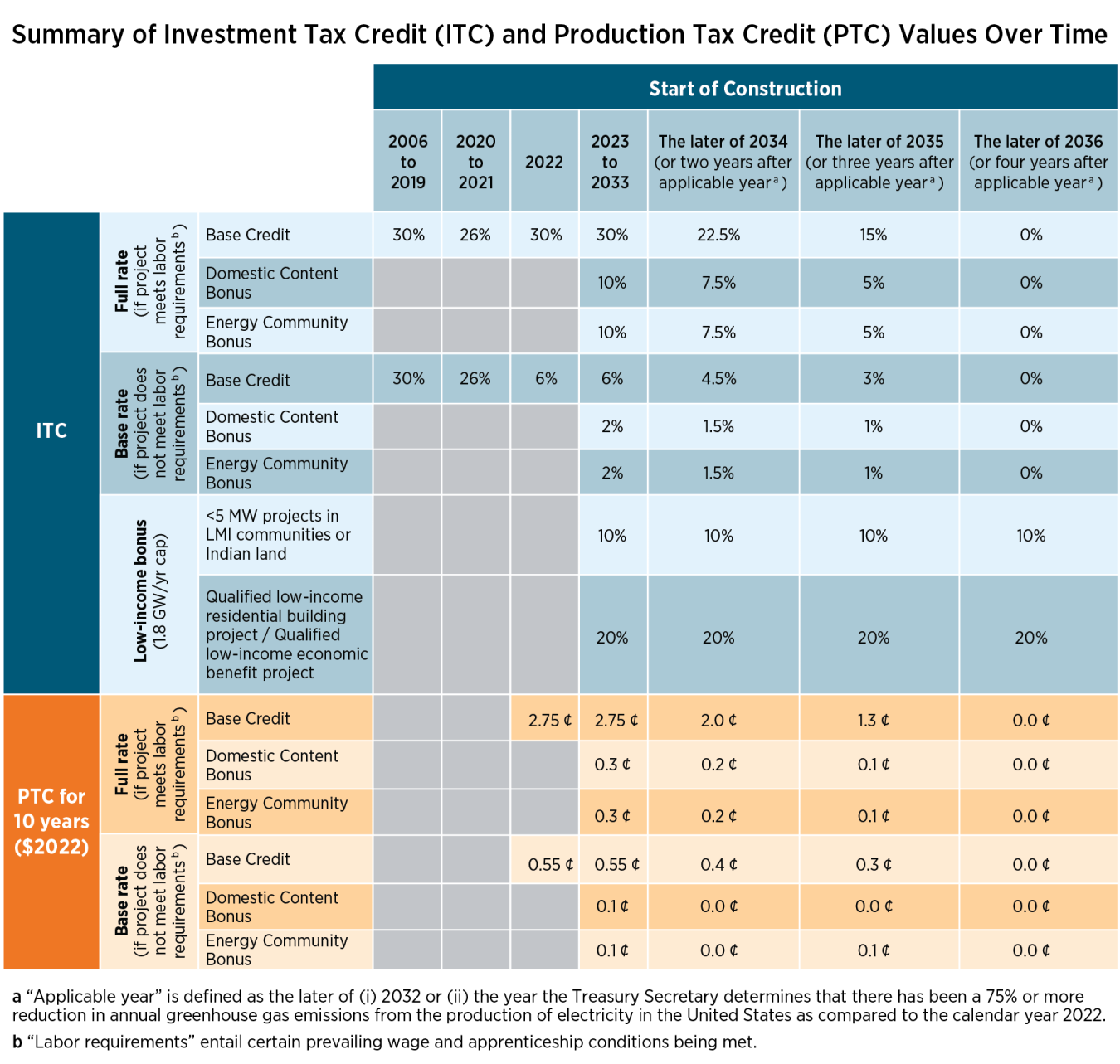

Government Solar Rebate 2024 Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit The U S government offers a solar tax credit that can reach up to 30 of the cost of installing a system that uses the sun to power your home Simple tax filing with a 50 flat fee for every

Government Solar Rebate 2024

Government Solar Rebate 2024

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

All About Australian Government Solar Rebate Qld 2021 2022

https://www.jarviselectrical.com.au/wp-content/uploads/2022/04/All-about-Australian-Government-Solar-Rebate-Qld-20212022.jpg

Our Guide To The Government Solar Rebate WA IBreeze

https://ibreeze.com.au/wp-content/uploads/2022/09/Solar-Panel-Government-Rebates.jpg

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the Home Energy Rebates are not yet available but DOE expects many states and territories to launch their programs in 2024 Our tracker shows which states and territories have applied for and received funding

Complete guide to the 2024 federal solar tax credit By Catherine Lane Updated 11 30 2023 Key takeaways The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000 The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating

Download Government Solar Rebate 2024

More picture related to Government Solar Rebate 2024

When Does The Government Solar Rebate End Update 2022 Solar Emporium

https://solaremporium.com.au/wp-content/uploads/2022/10/government-solar-rebate-2048x1152.jpg

Government Solar Rebate QLD Everything You Need To Know

https://solarunion.com.au/wp-content/uploads/2022/02/Rebate-Scheme--768x542.png

What Types Of Government Rebates Are Available For Solar Panels In VIC NSW Solar Emporium

https://solaremporium.com.au/wp-content/uploads/2022/07/solar-rebate-1-1.jpg

For example if your solar PV system was installed in 2022 installation costs totaled 18 000 and your state government gave you a one time rebate of 1 000 for installing the system your federal tax credit would be calculated as follows 18 000 0 30 5 400 State Tax Credit The tax credit is currently set at 30 of your total solar panel system installation cost Tax credits help to reduce the amount of money you owe in taxes So for example if you claim a tax credit of 4 000 the total amount you owe in income taxes will be reduced by 4 000 It s important to note that this is not a tax deduction which

WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households More than 1000 Projects Registered for New Direct Pay and Transferability Credit Monetization ProvisionsWASHINGTON Today the U S Department of the Treasury and Internal Revenue Service IRS announced reaching a major milestone in implementation of key provisions in the Inflation Reduction Act to expand the reach of the clean energy tax credits and help build projects more quickly and

Save Up To 1 850 With The Victorian Government Solar Rebate Venergy Australia

https://www.venergyaustralia.com.au/wp-content/uploads/2021/02/residential_solar7.jpg

Solar Victoria Government Rebate Sunbank Solar

https://mysunbank.com.au/wp-content/uploads/2018/08/blog-VicRebate-1030x690.jpg

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics

Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

Government Rebate Solar Panels Compare Solar Quotes

Save Up To 1 850 With The Victorian Government Solar Rebate Venergy Australia

How Much Is The Australian Government Solar Rebate Pure Home Improvement

Make The Most Of Your Solar System Canberra With Attractive Solar Panels Government Rebate

Victorian Government Rebate Available Up To 1 400 Solar Miner

The Complete Guide To The Victorian Government Solar Rebate Who Can Apply And How Solar Miner

The Complete Guide To The Victorian Government Solar Rebate Who Can Apply And How Solar Miner

When Does The Government Solar Rebate End Update 2022 Solar Emporium

Solar Rebate NSW 2021 Your Guide To The NSW Solar Rebate Scheme

Understanding NSW Solar Rebate

Government Solar Rebate 2024 - Complete guide to the 2024 federal solar tax credit By Catherine Lane Updated 11 30 2023 Key takeaways The Residential Clean Energy Credit is a dollar for dollar income tax credit equal to 30 of solar installation costs An average 20 000 solar system is eligible for a solar tax credit of 6 000