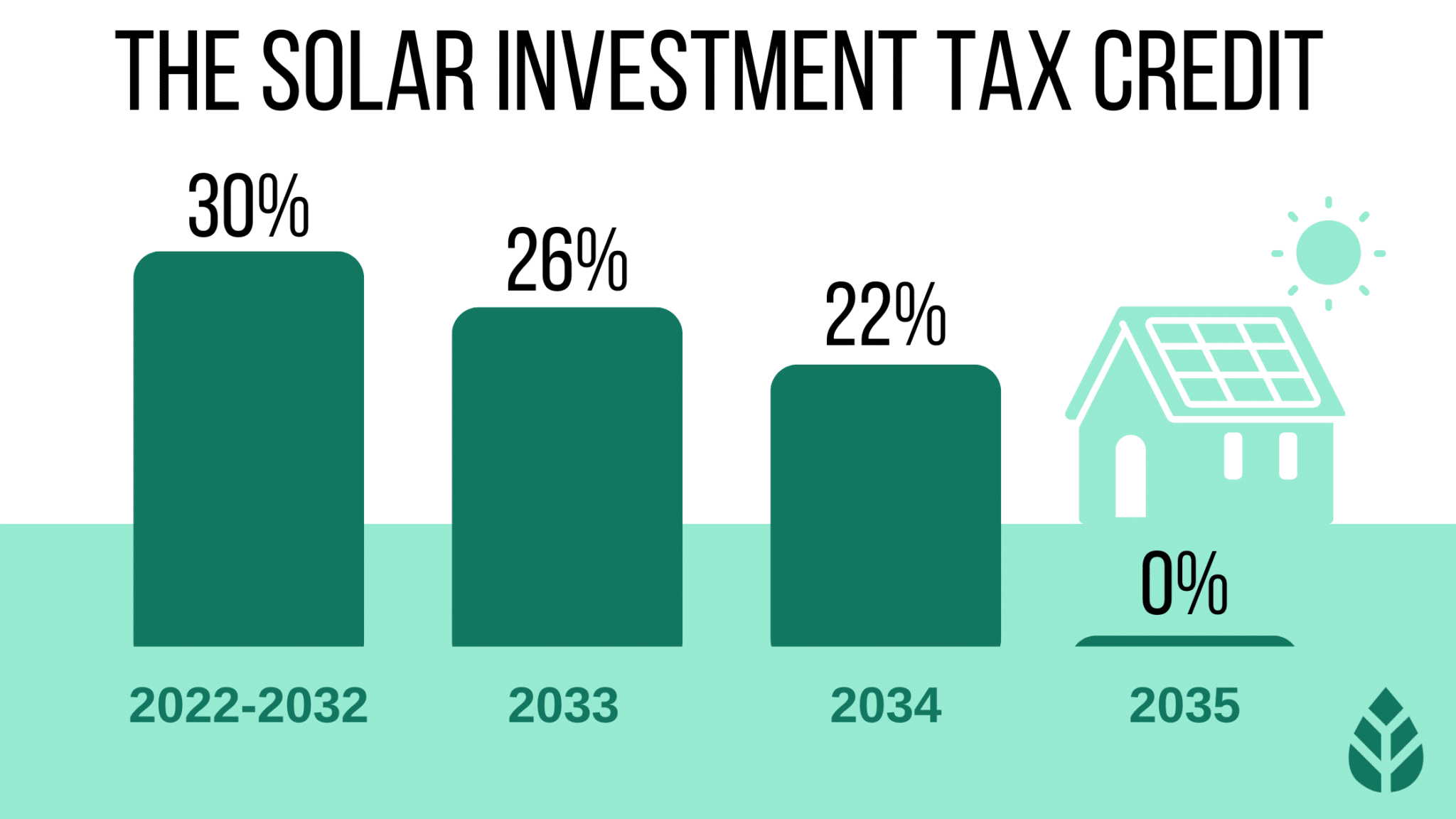

Government Solar Rebates 2024 The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the

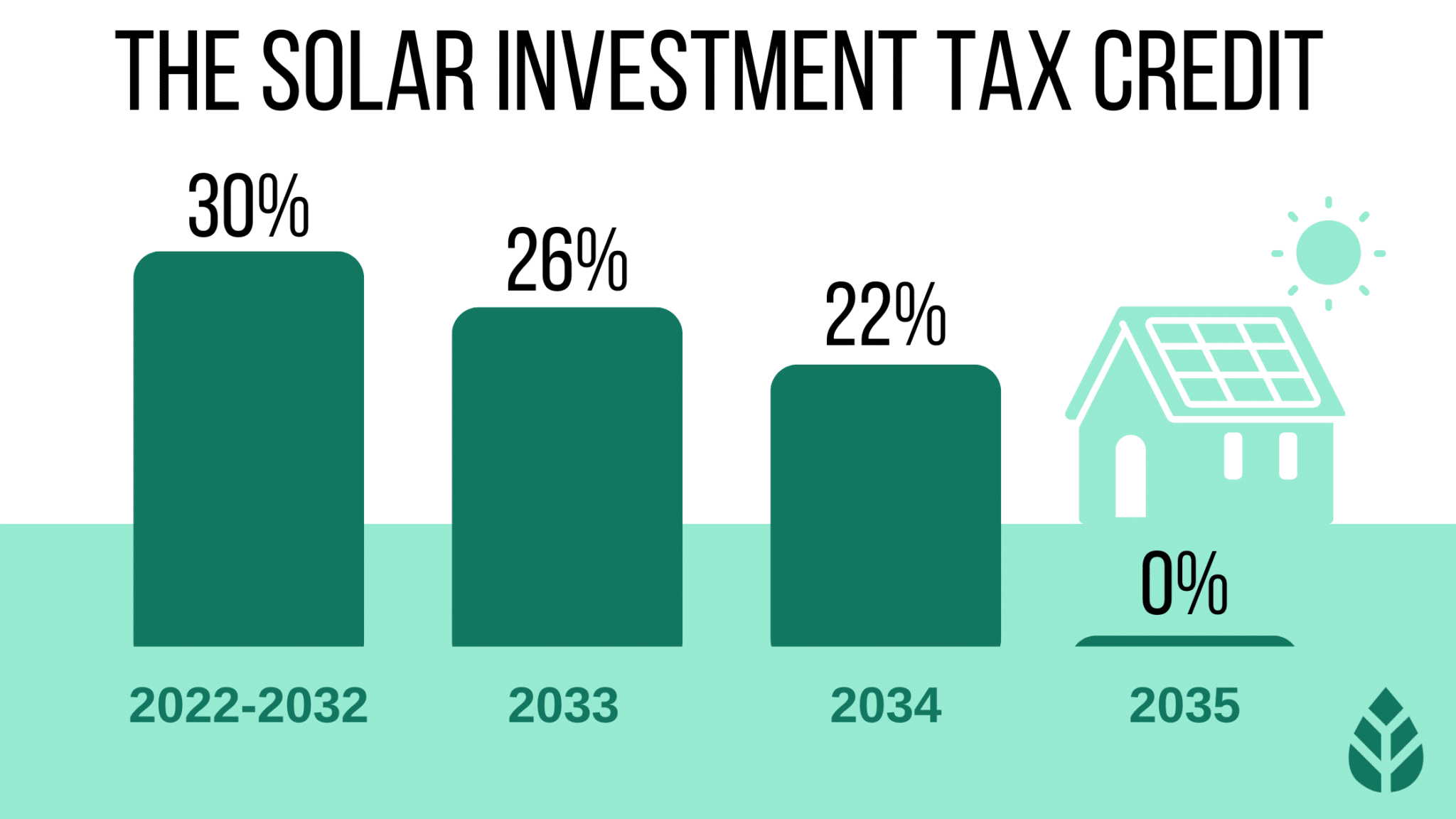

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit The U S government offers a solar tax credit that can help you recoup up to 30 of the cost of installing a solar power system 2024 Solar tax credit which extended solar tax credits

Government Solar Rebates 2024

Government Solar Rebates 2024

https://www.easysolar.com.au/wp-content/uploads/2023/01/Save-Money-Now-With-Government-Solar-Rebate-WA-770x513.jpg

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2023-05/Summary-ITC-and-PTC-Values-Chart-2023.png?itok=_P0koCpu

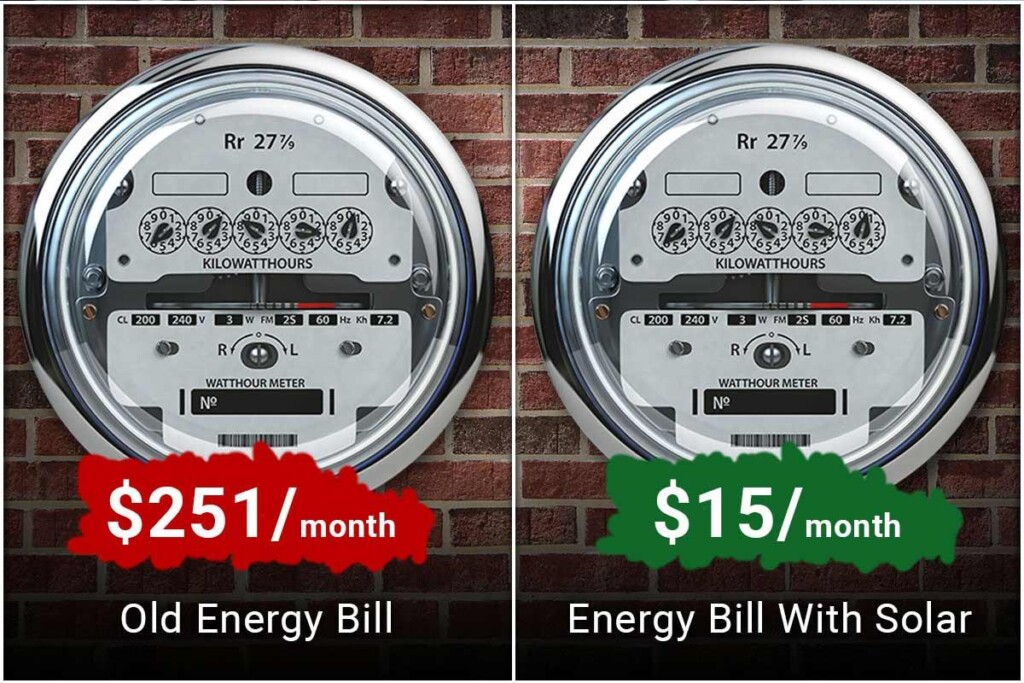

Government Solar Tax Rebates V2 The Price Chopper

https://www.thepricechopper.com/wp-content/uploads/2022/01/electricity_meter-1024x683.jpg

On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates Solar PV systems installed in 2020 and 2021 are eligible for a 26 tax credit In August 2022 Congress passed an extension of the ITC raising it to 30 for the installation of which was between 2022 2032 Systems installed on or before December 31 2019 were also eligible for a 30 tax credit

December 29 2023 Energy gov Renewable You for 2024 Clean Energy Upgrades for Your New Year s Resolutions As the confetti from New Year s Eve celebrations settles it is only fitting that we prepare our 2024 New Year s Resolutions An average 20 000 solar system is eligible for a solar tax credit of 6 000 The Inflation Reduction Act extended the federal solar tax credit until 2035 To qualify for the federal solar tax credit you must own the solar panels have taxable income and it must be installed at your primary or secondary residence

Download Government Solar Rebates 2024

More picture related to Government Solar Rebates 2024

Government Rebates SV Solar

https://www.svsolar.com.au/wp-content/uploads/2023/04/rebates_2.png

Solar Rebates ACT Canberra Government Solar Scheme PowerRebate

https://i0.wp.com/www.powerrebate.net/wp-content/uploads/2023/05/solar-rebates-act-canberra-government-solar-scheme.jpeg

All About Australian Government Solar Rebate Qld 2021 2022

https://www.jarviselectrical.com.au/wp-content/uploads/2022/04/All-about-Australian-Government-Solar-Rebate-Qld-20212022-1.jpg

The solar tax credit which is among several federal Residential Clean Energy Credits available through 2032 allows homeowners to subtract 30 percent of the cost of installing solar heating WASHINGTON June 28 2023 Today the U S Environmental Protection Agency EPA launched a 7 billion grant competition through President Biden s Investing in America agenda to increase access to affordable resilient and clean solar energy for millions of low income households

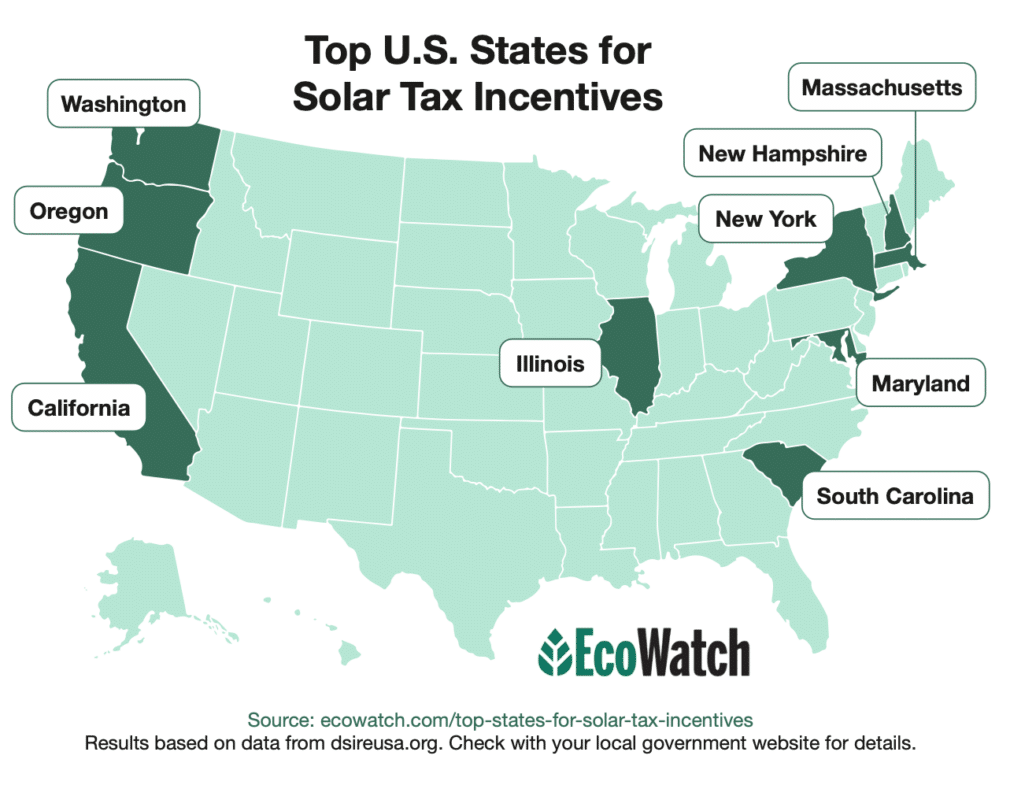

2024 Guide to solar incentives by state All state solar tax credits can be claimed in addition to the federal government s investment tax credit They vary in amount but are usually a percentage of the total cost of the system Almost all state tax credits have a maximum with current amounts between 500 and 5 000 depending on the state However starting in 2022 those who installed new solar panels or invested in an off site community solar project could get a tax credit of up to 30 percent through the Residential Clean Energy

Solar Rebate Perth WA Government Solar Rebate 2021

https://regenpower.com/wp-content/uploads/2023/04/government-rebates.jpg

What Types Of Government Rebates Are Available For Solar Panels In VIC NSW Solar Emporium

https://solaremporium.com.au/wp-content/uploads/2022/07/What-Types-of-Government-Rebates-are-Available-for-Solar-Panels-in-VIC-NSW.jpg

https://www.forbes.com/home-improvement/solar/solar-tax-credit-by-state/

The Federal Solar Tax Credit for 2024 is 30 this is an increase from 26 in recent years and extends through to 2032 Tax credits and incentives can help bring the price down such as the

https://www.irs.gov/credits-deductions/home-energy-tax-credits

Solar wind and geothermal power generation Solar water heaters Fuel cells Battery storage beginning in 2023 The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation 2022 to 2032 30 no annual maximum or lifetime limit 2033 26 no annual maximum or lifetime limit

2024 Solar Incentives And Rebates By States Ranked Top 9

Solar Rebate Perth WA Government Solar Rebate 2021

Our Guide To The Government Solar Rebate WA IBreeze

Through Government Rebates And Tax Incentives This Solar Program Is Making Solar Energy More

Solar Rebate NSW 2021 Your Guide To The NSW Solar Rebate Scheme

Texas Solar Incentives Tax Credits Rebates More In 2023

Texas Solar Incentives Tax Credits Rebates More In 2023

Government Home Solar Panel Incentives Rebates In Australia 2022 Guide JFK Electrical

Solar Rebate NSW 2021 Your Guide To The NSW Solar Rebate Scheme

Solar Rebate Qld 2021 Your Guide Captain Green Solar

Government Solar Rebates 2024 - On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates