Government Tax Rebate Student Loans Web The student loan isn t tax free educational assistance so the qualified expenses don t need to be reduced by any part of the loan proceeds Joan is treated as having paid 1 000 in

Web You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 163 22 015 a year for Plan 1 163 27 295 a Web 24 ao 251 t 2022 nbsp 0183 32 The short answer is It won t at least on your federal tax return Biden on Wednesday announced that he will forgive 10 000 in federal student debt for most

Government Tax Rebate Student Loans

Government Tax Rebate Student Loans

https://studentloanhero.com/wp-content/uploads/f21d66bc-bb4b-4eb4-8ba2-066e3aa6040a_pasted20image200.png

Student Loans And Tax Refund 2023

https://cdn.neamb.com/-/media/images/neamb/articles-pages/student_loan_debt/student_loan_debt_repayment_calculator_helps_educators_find_relief/student_loan_debt_repayment_calculator_helps_educators_find_relief_842x474.jpg

How Can You Find Out If You Paid Taxes On Student Loans

https://blog.turbotax.intuit.com/wp-content/uploads/2020/05/You-can-deduct-student-loan-interest-if-you-meet-the-following-qualifications.jpg?resize=150

Web 11 oct 2022 nbsp 0183 32 You can deduct either 2 500 in student loan interest or the actual amount of loan interest you paid during the year whichever is less If you paid at least 600 in Web 31 ao 251 t 2023 nbsp 0183 32 Here are three drawbacks of the SAVE plan 1 Borrowers with mid level balances don t stand to benefit as much Your monthly payment on the SAVE plan is

Web 29 d 233 c 2016 nbsp 0183 32 Your student loan Plan 1 2 or 4 deduction will be calculated based on 9 of your total income above the threshold of your plan type Your PGL deduction will be Web 5 nov 2020 nbsp 0183 32 IR 2020 250 November 5 2020 WASHINGTON The Internal Revenue Service IRS today urged any eligible self supporting college student who doesn t need

Download Government Tax Rebate Student Loans

More picture related to Government Tax Rebate Student Loans

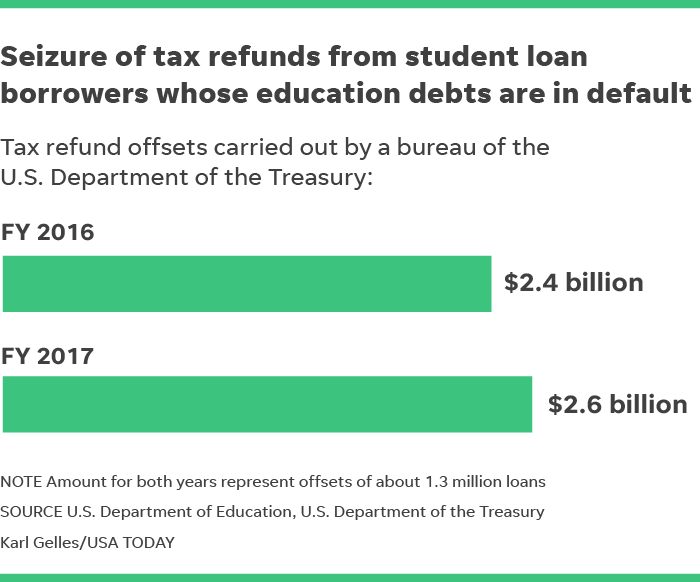

Tax Refunds Of 2 6B Were Seized During 17 To Repay Student Loans In

https://www.gannett-cdn.com/media/2018/04/17/USATODAY/USATODAY/636595805484628789-041718-TAX-SEIZURES-Online.png

Parent Plus Loan Repayment Calculator TaurabMaies

https://lendedu.com/wp-content/uploads/2016/03/federal-student-loan-repayment-options-1.png

Online Essay Help Amazonia fiocruz br

https://assets.rbl.ms/9870831/980x.png

Web 20 sept 2022 nbsp 0183 32 You can get a refund without applying if your payments brought your loan balance below the maximum debt relief amount 10 000 for all borrowers and 20 000 for Pell Grant recipients Borrowers Web 15 sept 2022 nbsp 0183 32 So in this you will receive 3 000 However your overall student loan balance will go back up to 8 000 After that you would apply for student loan

Web 22 juil 2022 nbsp 0183 32 But thanks to the latest student loan relief rules your tax refund won t be taken in 2022 for past due student loan payments Federal student loan payments Web 21 mars 2023 nbsp 0183 32 Before the Covid pandemic nearly 13 million taxpayers took advantage of the student loan interest deduction which allows borrowers to deduct up to 2 500 a

What Does Rebate Lost Mean On Student Loans

https://i.pinimg.com/originals/0d/76/b4/0d76b4b553d8485f92958197f1fd023c.jpg

Paying Off Student Loans Don t Forget This 2500 Deduction Frugaling

https://i1.wp.com/frugaling.org/wp-content/uploads/2014/01/StudentLoan1098-E.jpg

https://www.irs.gov/publications/p970

Web The student loan isn t tax free educational assistance so the qualified expenses don t need to be reduced by any part of the loan proceeds Joan is treated as having paid 1 000 in

https://www.gov.uk/repaying-your-student-loan/getting-a-refund

Web You can ask for a refund if you made repayments but your income over the whole tax year 6 April to 5 April the following year was less than 163 22 015 a year for Plan 1 163 27 295 a

Cool Student Loans Extension Date Ideas Rivergambiaexpedition

What Does Rebate Lost Mean On Student Loans

Est mulos Econ micos EN VIVO SSI Payment Direct Payments Tax Rebates

Student Loans Deduction Nitisara Omran

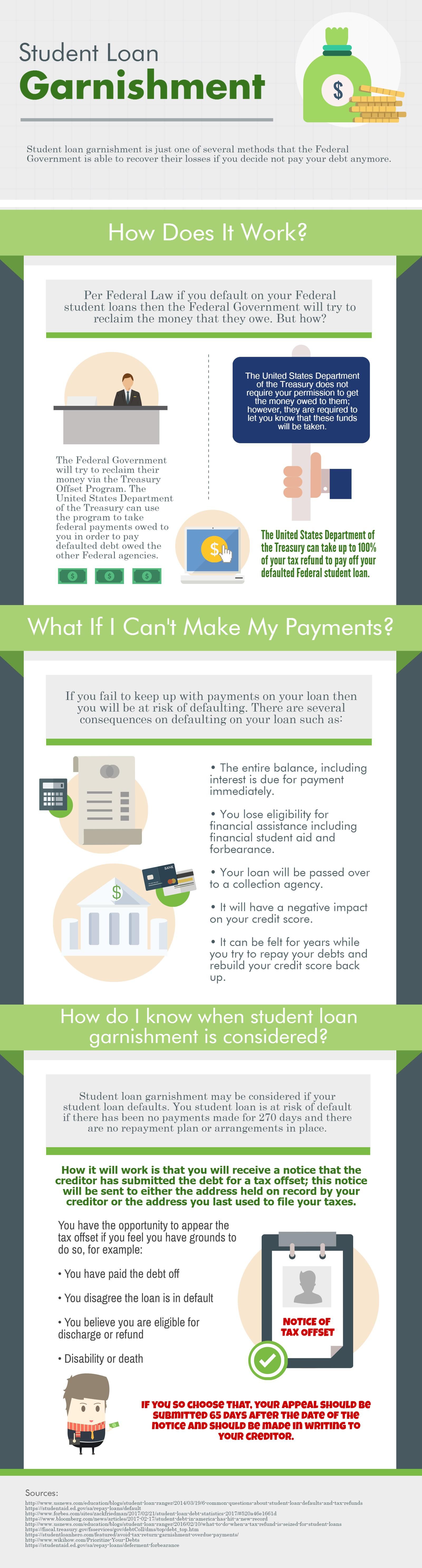

How To Stop Student Loans From Taking Your Taxes

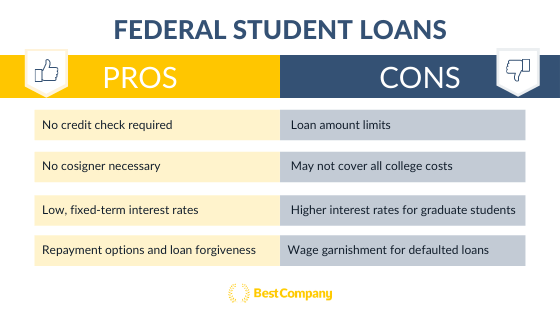

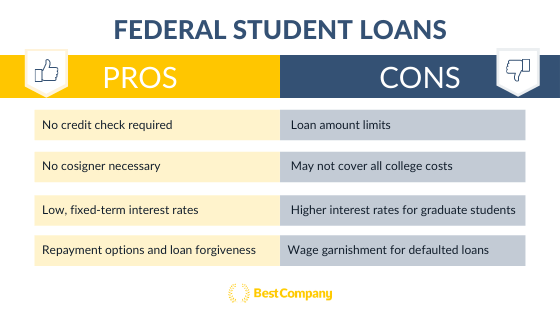

Private Vs Federal Student Loans Getting Out Of Student Debt

Private Vs Federal Student Loans Getting Out Of Student Debt

They ll Get You Either Coming Or Going Imgflip

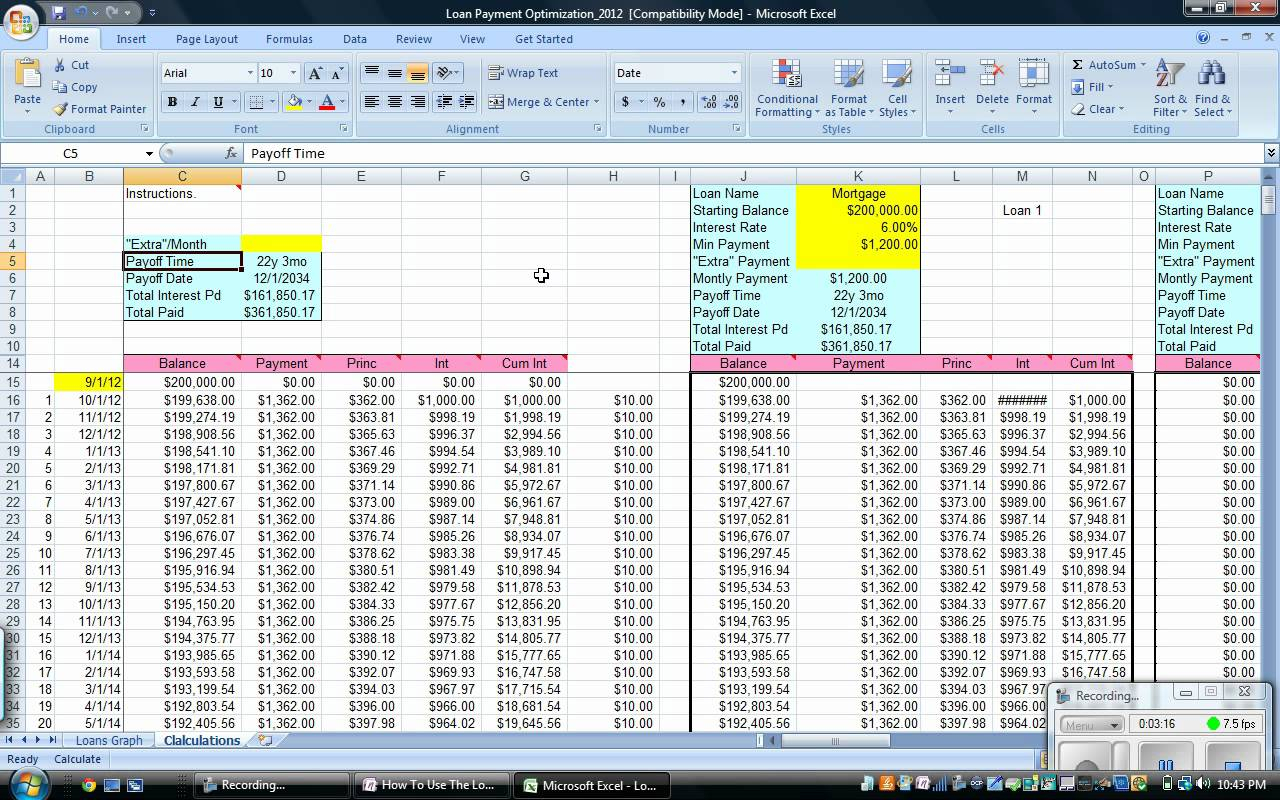

Student Loan Excel Sheet Studentqw

How To Get A Rebate On Consolidated Student Loans 11 Steps

Government Tax Rebate Student Loans - Web 30 mars 2022 nbsp 0183 32 Once the federal student loan forbearance ends and the IRS has the green light to start collection activities again any tax refund you receive can be garnished and