Government Tax Rebates 2024 April 15 tax filing deadline for most taxpayers For most taxpayers the deadline to file their personal federal tax return pay any tax owed or request an extension to file is Monday April 15 2024 Taxpayers living in Maine or Massachusetts have until April 17 2024 due to the Patriot s Day and Emancipation Day holidays

The law requires the IRS to hold the entire refund not just the portion associated with the EITC or ACTC The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return Through 2032 federal income tax credits are available to homeowners that will allow up to 3 200 annually to lower the cost of energy efficient home upgrades by up to 30 percent In addition to the energy efficiency credits homeowners can also take advantage of the modified and extended Residential Clean Energy credit which provides a 30

Government Tax Rebates 2024

Government Tax Rebates 2024

https://www.northjersey.com/gcdn/-mm-/e12712590430b2876b51073aa0fd9d0df788d233/c=0-357-3866-2541/local/-/media/2017/05/08/Bergen/NorthJersey/636298617519756307-20170508-173344.jpg?width=3200&height=1808&fit=crop&format=pjpg&auto=webp

Save 500 With Heating And Cooling Tax Credits Biard Crockett

https://www.biardandcrockett.com/wp-content/uploads/2021/11/government-tax-rebates.jpg

How To Get Energy Efficiency Improvement Rebates Air Assurance

https://images.squarespace-cdn.com/content/v1/58adb3f25016e12237d1f5e2/1572291829160-3JUC7RPM78BK9MUJKJ4A/ke17ZwdGBToddI8pDm48kBNRt0cg4WAanfWojlHLplx7gQa3H78H3Y0txjaiv_0fDoOvxcdMmMKkDsyUqMSsMWxHk725yiiHCCLfrh8O1z5QPOohDIaIeljMHgDF5CVlOqpeNLcJ80NK65_fV7S1US6IfA3z_hZ3gTROHXzj40oiauNtBL88ZRQhKg2xy4MQPt_AAiqPvsV6TvkS6kIncw/Tax+Rebates_iStock-1055975774.jpg

The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S jobs Program Updates The Residential Clean Energy Credit equals 30 of the costs of new qualified clean energy property for your home installed anytime from 2022 through 2032 The credit percentage rate phases down to 26 percent for property placed in service in 2033 and 22 percent for property placed in service in 2034

It s generally Line 11 on your 1040 form but if you have foreign income or income from Guam or Puerto Rico you ll need to add those back in The income caps for new vehicles are 300 000 for In that scenario the 2 000 credit for the heat pump could be combined with tax credits up to 600 total for the windows skylights plus 500 for two or more doors If you replace your water heater the following year you would be eligible for another 30 tax credit up to 2 000 plus up to 600 if you need an electric panel upgrade to

Download Government Tax Rebates 2024

More picture related to Government Tax Rebates 2024

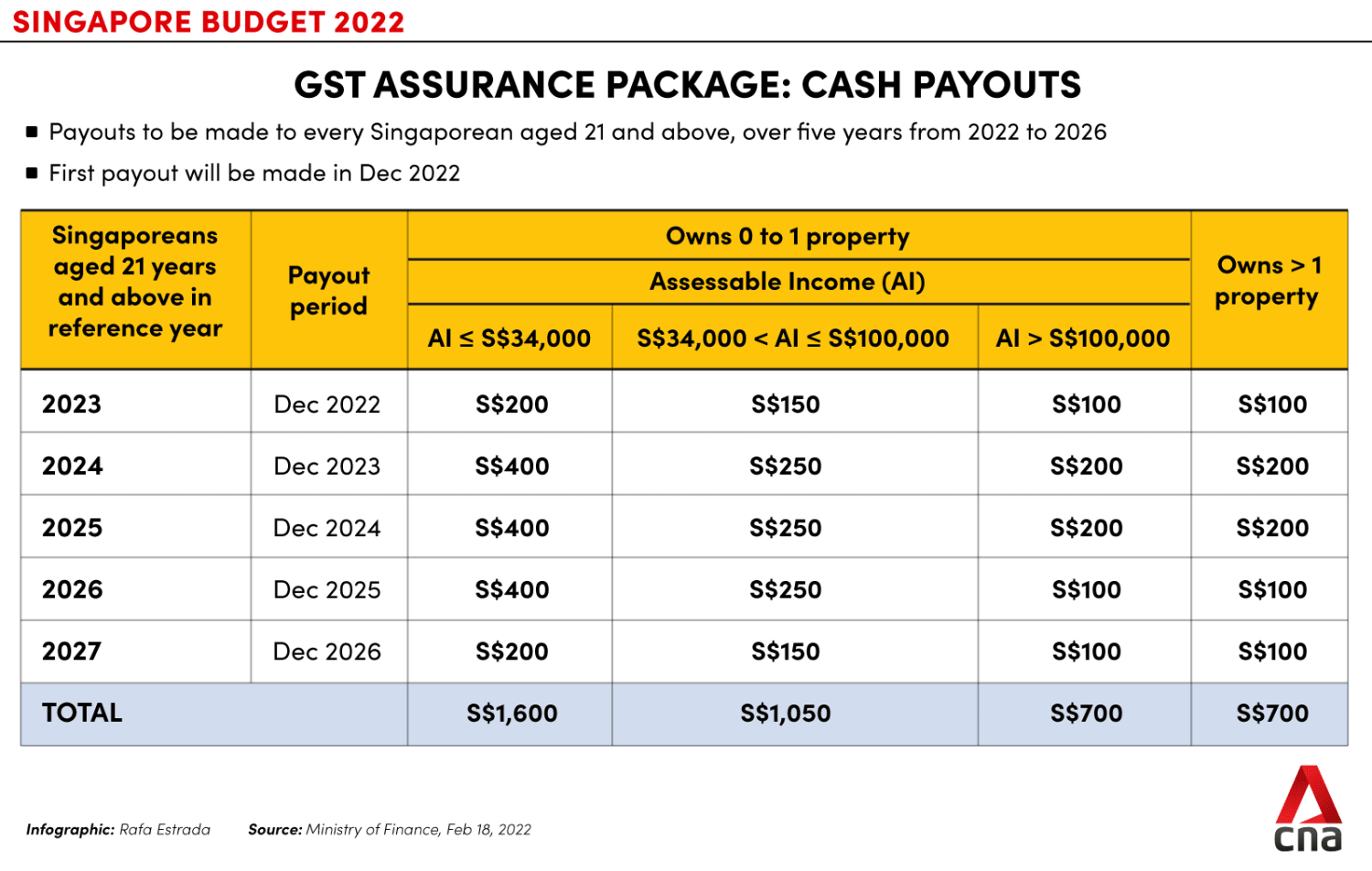

Budget 2022 GST Will Go Up To 8 Next Year Then 9 From 2024 Extra S 640 Million To Cushion

https://onecms-res.cloudinary.com/image/upload/s--bQEl11z1--/f_auto,q_auto/v1/mediacorp/cna/image/2022/02/18/20220217-gst-assurance-cash-payouts.png?itok=kk9CRjh1

PDF A CRITIQUE ON LEASE VERSUS BUY ANALYSIS AND GOVERNMENT TAX REVENUE

https://i1.rgstatic.net/publication/368017915_A_CRITIQUE_ON_LEASE_VERSUS_BUY_ANALYSIS_AND_GOVERNMENT_TAX_REVENUE/links/63dbddb364fc8606380b32a1/largepreview.png

Understanding Income Tax Reliefs Rebates Deductions And Exemptions In Malaysia

https://ringgitplus.com/en/blog/wp-content/uploads/2020/02/Tax-Rebates-800x534.jpg

The refundable portion would rise by 200 to 1 800 per child for the 2023 tax year 1 900 in 2024 and 2 000 in 2025 The bill would expand the Low Income Housing Tax Credit the government The 2024 program opening next year will unlock additional capacity for this robust demand tax exempt entities including non profits local or tribal governments consumer or worker cooperatives and emerging renewable energy companies including housing supported by the Low Income Housing Tax Credit and Section 8 of the Housing Act

The federal tax credit is sometimes referred to as an Investment Tax Credit or ITC though is different from the ITC offered to businesses that own solar systems What is the federal solar tax credit An expanded child tax credit In 2021 in the midst of the coronavirus pandemic President Biden and Democrats in Congress temporarily beefed up the child tax credit allowing most families to

LHDN IRB Personal Income Tax Rebate 2022

https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEi4EoUCYcQMowVkFCssu_CdI43zIKHrVC46Kba3BHcmZh3oeO18l7EDF2MRUyAcTAsJGJ4xoe-Ekdnfv4_Pv7Vwf9uH3fIfSDaX5l9O3cEd7zdy7J1TPcGn75nLB59_9Nl_SqNTLkJeFhMTJtIwlgtqjSOzqw1iz42LdAJ22TGq8dO7vpInhBCvgVt7/s1600-e60/Tax rebates 2021.jpg

Tax Rebates Worth At Least 75 To Start Going Out To 25 000 People This Week All You Need To

https://www.the-sun.com/wp-content/uploads/sites/6/2022/02/CW-COMP-MONEY-TIME-TO-ACT-US.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://www.irs.gov/newsroom/2024-tax-filing-season-set-for-january-29-irs-continues-to-make-improvements-to-help-taxpayers

April 15 tax filing deadline for most taxpayers For most taxpayers the deadline to file their personal federal tax return pay any tax owed or request an extension to file is Monday April 15 2024 Taxpayers living in Maine or Massachusetts have until April 17 2024 due to the Patriot s Day and Emancipation Day holidays

https://www.irs.gov/newsroom/get-ready-to-file-in-2024-whats-new-and-what-to-consider

The law requires the IRS to hold the entire refund not just the portion associated with the EITC or ACTC The IRS expects most EITC and ACTC related refunds to be available in taxpayer bank accounts or on debit cards by Feb 27 2024 if the taxpayer chose direct deposit and there are no other issues with the tax return

1 000 Tax Rebate Residents In This State May Receive Extra Money This Summer Here s How To Be

LHDN IRB Personal Income Tax Rebate 2022

Tax Rebates Who Will Start Receiving Checks Of Up To 1 000 From Today Marca

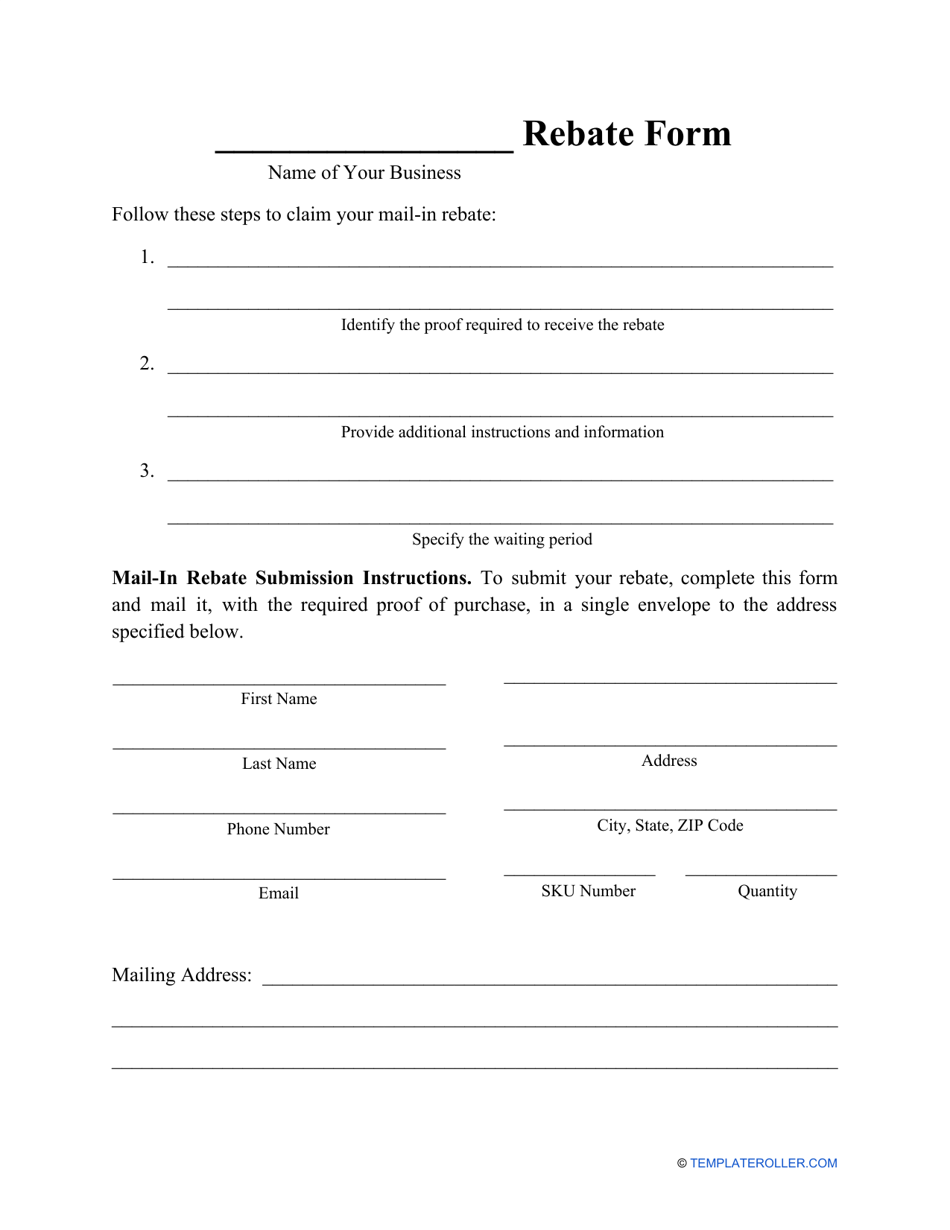

Conquista Midollo Coro Rebate Program Template Omettere Additivo Bobina

Primary Rebate South Africa Printable Rebate Form

Tax Rebates How To Get And Who Is Eligible For A 700 Rebate Marca

Tax Rebates How To Get And Who Is Eligible For A 700 Rebate Marca

All Rebate Forms Available 2023 Printable Rebate Form

IRS Most Virginia 2022 Tax Rebates Aren t Taxable Kiplinger

Tax Rebates Are On The Way

Government Tax Rebates 2024 - The rebates can help you save money on select home improvement projects that can lower your energy bills DOE estimates these rebates will save households up to 1 billion annually on energy bills and support over 50 000 U S jobs Program Updates