Government Tax Return I ask because the amount pre populated by HMRC on a friend s return is exactly 1 7 x weekly amount less than their actual new state pension entitlement for the last tax year and their pension started on day 7 of a pension week during the tax year meaning they were entitled to and received 1 day plus 3 weeks in the first 4 week payment

Hello I received my UTR last year and I filed my tax return for 2021 2022 through an accountant I am not sure if the accountant filed the paper return or online Until that point I did not create a personal tax account or had a government gateway ID I created both in June 2023 Posted Tue 06 Feb 2024 09 24 48 GMT by HMRC Admin 8 Response Hi To update the power of attorney details it needs to be the original document or a certified copy If you have submitted thias but not yet updated you will need to contact HMRC to review Self Assessment general enquiries Thankyou

Government Tax Return

Government Tax Return

https://previews.agefotostock.com/previewimage/medibigoff/b58f2e935315dce8794da09f72446133/esy-024813090.jpg

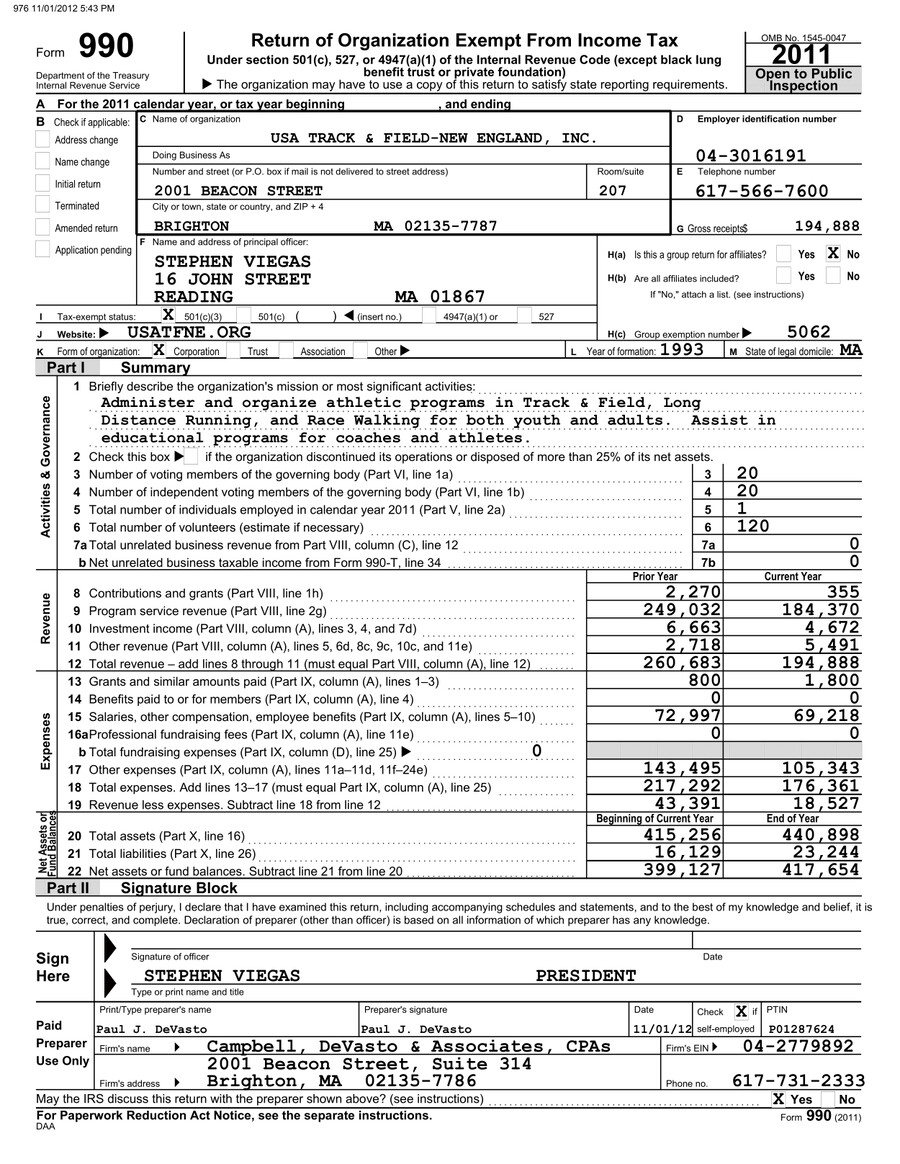

2011 Federal Tax Return By Sarah linehan Flipsnack

https://d1dhn91mufybwl.cloudfront.net/collections/items/56ba3bb9caa4c19ca08894i108758679/covers/page_1/medium

Shoot First Tax Questions Later Reason Foundation

https://reason.org/wp-content/uploads/2009/06/government_tax_return_1040.jpg

Hi You can only view the last 4 tax years returns online which is back to 2019 20 If you need copies of earlier tax returns you will need to contct our Self Assessment team Self Assessment general enquiries Thank you You must be signed in to post in this forum In tax year 2021 22 I paid the tax owed as well as had to pay a pay on account for 2022 23 in 2 installments For simplicity let s say I paid 2x5000 10000 as pay on account for 2022 23 Now I am completing my 2022 23 tax return where it says I owe 9500 in taxes BUT it doesn t look like the 10000 I already paid on account is taken into

Hi I believe non UK resident can t submit tax return via HMRC portal The other option is to use commercial software but you must already have government gateway ID password and have filed tax return on line before in order to use this option The last option is to file paper tax return by post The most common Income Tax and Self Assessment topics can be found here Income Tax You can get help with Self Assessment here Get help with Self Assessment Recording your expenses correctly could reduce your tax liability details can be found here Expenses if you re self employed Further support can also be found on

Download Government Tax Return

More picture related to Government Tax Return

Wood Grain Legal System 2K Communication Desk Tax Return

https://wallpapercrafter.com/desktop3/947384-tax-form-irs-tax-taxes-finance-accounting-paperwork.jpg

Financial Research Government Tax And Calculation Tax Return Concept

https://static.vecteezy.com/system/resources/previews/030/193/709/large_2x/financial-research-government-tax-and-calculation-tax-return-concept-businessman-showing-holographic-tax-on-hand-online-tax-return-form-filling-concept-for-payment-online-marketing-business-process-photo.JPG

https://c.pxhere.com/images/38/2b/139c5771ccf68374d3fc7581ece3-1444833.jpg!d

Welcome to the HMRC Community Forums The Community Forums will help you find answers to your questions about tax and benefits Use the search bar to find an answer to your query or use the forums to ask a question If you want to contribute to any of the forums you must Register or Sign in Check here for guidance on personal tax accounts and your taxes post any questions you have and share your experiences with others Most people can earn some interest on savings without paying tax You can find guidance regarding tax on

[desc-10] [desc-11]

Freelance Accounting Personal Tax Services

https://lookaside.fbsbx.com/lookaside/crawler/media/?media_id=100057362743633

Tax Return Deadline Extension

https://i0.wp.com/www.bachesamuels.com/wp-content/uploads/2022/01/Tax-return-red-1.png?fit=6912%2C3456&ssl=1

https://community.hmrc.gov.uk › customerforums › sa

I ask because the amount pre populated by HMRC on a friend s return is exactly 1 7 x weekly amount less than their actual new state pension entitlement for the last tax year and their pension started on day 7 of a pension week during the tax year meaning they were entitled to and received 1 day plus 3 weeks in the first 4 week payment

https://community.hmrc.gov.uk › customerforums › sa

Hello I received my UTR last year and I filed my tax return for 2021 2022 through an accountant I am not sure if the accountant filed the paper return or online Until that point I did not create a personal tax account or had a government gateway ID I created both in June 2023

Fixing Tax Returns The Qualified Amended Return

Freelance Accounting Personal Tax Services

Tax Return Employment Self Employment Dividend Rental Property

How To Read And Understand A Tax Return C2P Central

Democratic Plan Would Close Tax Break On Exchange traded Funds

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

When Should I File My UK Self Assessment Tax Return For 2022 23 Gold

Tax Law

Your Tax Guide

How To Use Aadhaar Card For Electronic Tax Return Verification

Government Tax Return - In tax year 2021 22 I paid the tax owed as well as had to pay a pay on account for 2022 23 in 2 installments For simplicity let s say I paid 2x5000 10000 as pay on account for 2022 23 Now I am completing my 2022 23 tax return where it says I owe 9500 in taxes BUT it doesn t look like the 10000 I already paid on account is taken into