Gst Annual Return 2020 21 Due Date The due date for furnishing annual return in form GSTR 9 self certified reconciliation statement in form GSTR 9C for the financial year 2020 21 has been

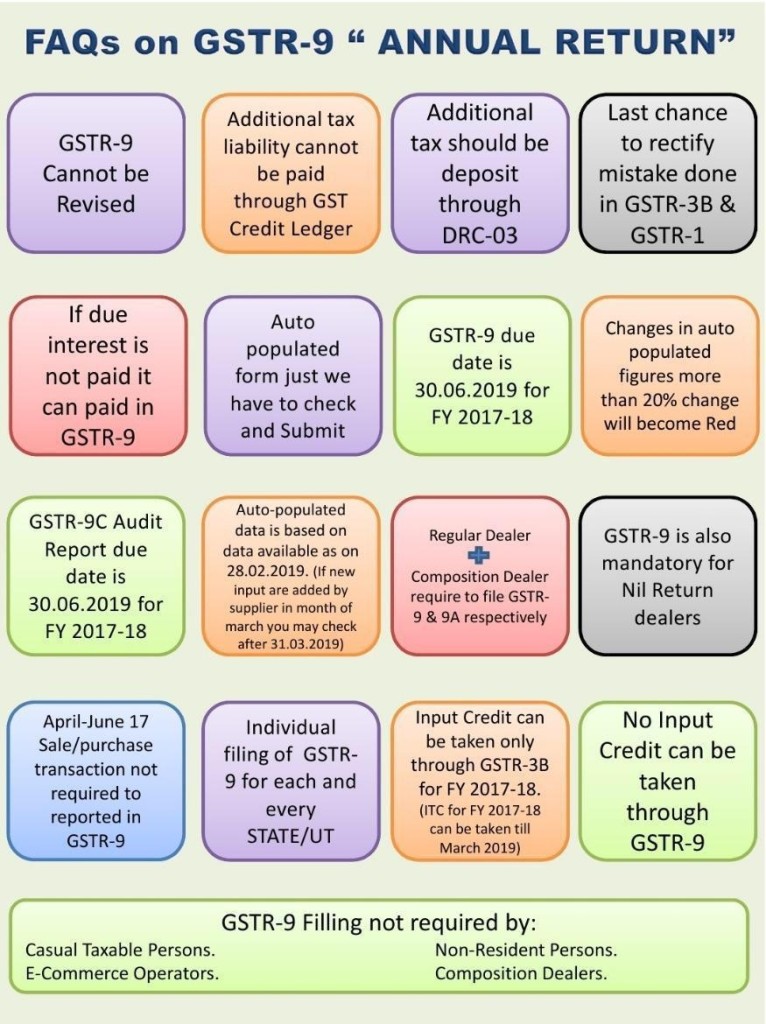

GSTR 9 Annual Return Filing Know due date applicability turnover limit eligibility rules and filing format Every taxable person under GST law will be required to Stay updated with the important dates under GST from FY 2017 18 to 2021 22 Learn about due dates last dates for filing returns and more

Gst Annual Return 2020 21 Due Date

Gst Annual Return 2020 21 Due Date

https://carajput.com/blog/wp-content/uploads/2019/03/ANNUAL-RETURN.jpeg

GST Annual Return Due Dates FinancePost

https://financepost.in/wp-content/uploads/2021/12/dd.jpg

GST Annual Returns

https://taxguru.in/wp-content/uploads/2022/11/GST-Annual-Returns.jpg

The government has extended by two months till February 28 the deadline for businesses to file GST annual returns for 2020 21 fiscal ended March 2021 ITC for the year 2020 21 availed in GSTR 3B for the period between April 2021 to September 2021 is to be filled here ITC reversed in 2020 21 as per provisions of

Due to COVID 19 pandemic and challenges faced by taxpayers Government has extended dates for GST filings These are notified in Central Tax Notifications 30 The due date to file GST Annual Return for F Y 2020 21 is 31 12 2021 The requirement of filing annual return is given u s 44 of CGST Act 2017 read with rule 80 of

Download Gst Annual Return 2020 21 Due Date

More picture related to Gst Annual Return 2020 21 Due Date

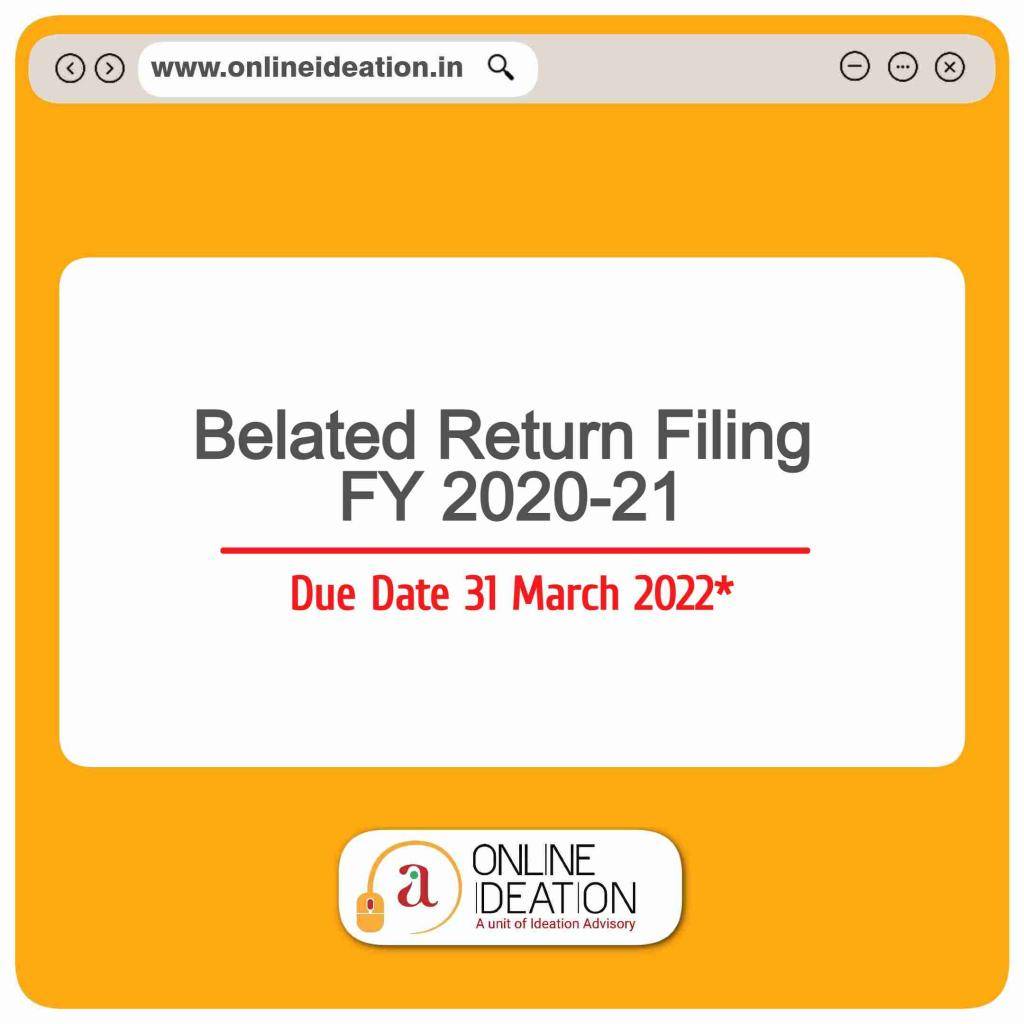

Belated Return Filing For FY 2020 21 Due Date 31 March 2022

https://www.onlineideation.in/files/Belated-return-FY-2020-21-onlineideation-1024x1024.jpg

How To File Gst Annual Return GSTR 9 Gst Annual

https://i.ytimg.com/vi/eGg6x0JVk4U/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGGUgZShlMA8=&rs=AOn4CLClOVD-BD9mSHWYTiW2DmsN5dYoYA

GSTR 9 Filing For FY 2022 23 Clause Wise Analysis GST Annual Return

https://i.ytimg.com/vi/3RgOSHc2BFA/maxresdefault.jpg

Below is a summary of all the notifications released for extensions of due dates in May and June 21 Extended for 15 days GST Amnesty Scheme notified via Due date for filing GSTR 1 for monthly filers is 11th of the next month and for quarterly filers is 13th of next month of quarter Due date is not different for different

The government has extended the deadline for businesses to file the goods and services tax GST annual returns for the financial year 2020 21 by two more The due date for furnishing GST Annual Return in FORM GSTR 9 self certified reconciliation statement in FORM GSTR 9C for the financial year 2020 21 has

GST Return Due Date For FY 2022 23

http://www.taxmani.in/wp-content/uploads/2022/04/GST-Return-Due-Date-for-FY-2022-23.png

GST Annual Return FY 2021 22 Gstr 9 Gstr 9C Latest Update Big

https://i.ytimg.com/vi/y8foqg8veq4/maxresdefault.jpg

https://www.newindianexpress.com/business/2021/dec/...

The due date for furnishing annual return in form GSTR 9 self certified reconciliation statement in form GSTR 9C for the financial year 2020 21 has been

https://cleartax.in/s/gstr-9-annual-return

GSTR 9 Annual Return Filing Know due date applicability turnover limit eligibility rules and filing format Every taxable person under GST law will be required to

How To File GSTR 9 Online Mode FY 2022 23 GST Annual Return Filing

GST Return Due Date For FY 2022 23

31st Dec 2022 ITR GST ANNUAL Return GSTR 9 GST Audit

GST Annual Return Concept GSTR9 GSTR9C GST Document Record And

GSTR 9 FY 2022 23 GST Annual Return Big Change YouTube

ALL ABOUT GST ANNUAL RETURN GSTR 9 GSTR 9C LEGAL PROVISIONS CA

ALL ABOUT GST ANNUAL RETURN GSTR 9 GSTR 9C LEGAL PROVISIONS CA

Belated Return Filing For FY 2020 21 Due Date 31 March 2022

ITR FILING 2020 21 DUE DATE EXTENDED TAX AUDIT 2020 21 DUE DATE

CBDT Relaxes Requirement Of E Filing Of Form No 3CF IndiaFilings

Gst Annual Return 2020 21 Due Date - The due date to file GSTR 9 self certified GSTR 9C for the FY 2020 21 was extended up to 28th February 2022 The due date to file GSTR 9 GSTR 9C for the FY 2019 20