Gst Hst Rebate Dates Payment dates How much you can expect to receive Your GST HST credit payments are based on the following your adjusted family net income If you re single the amount from line

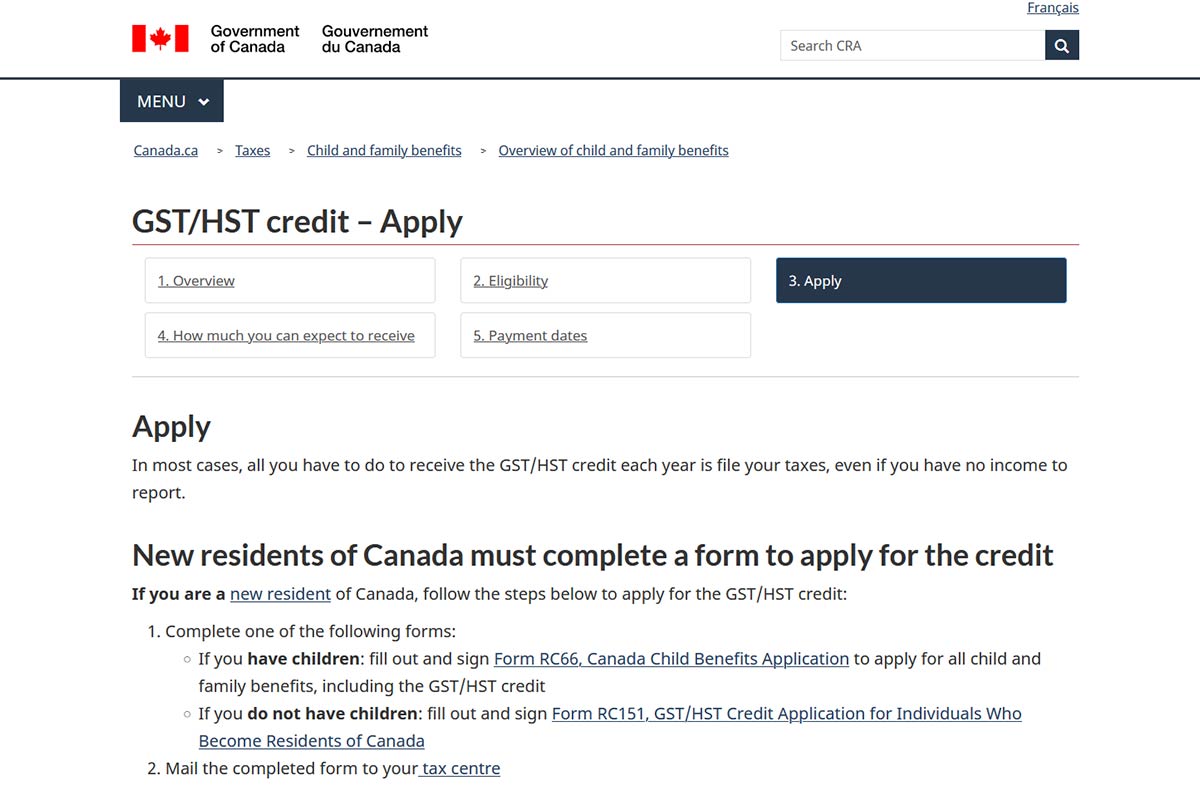

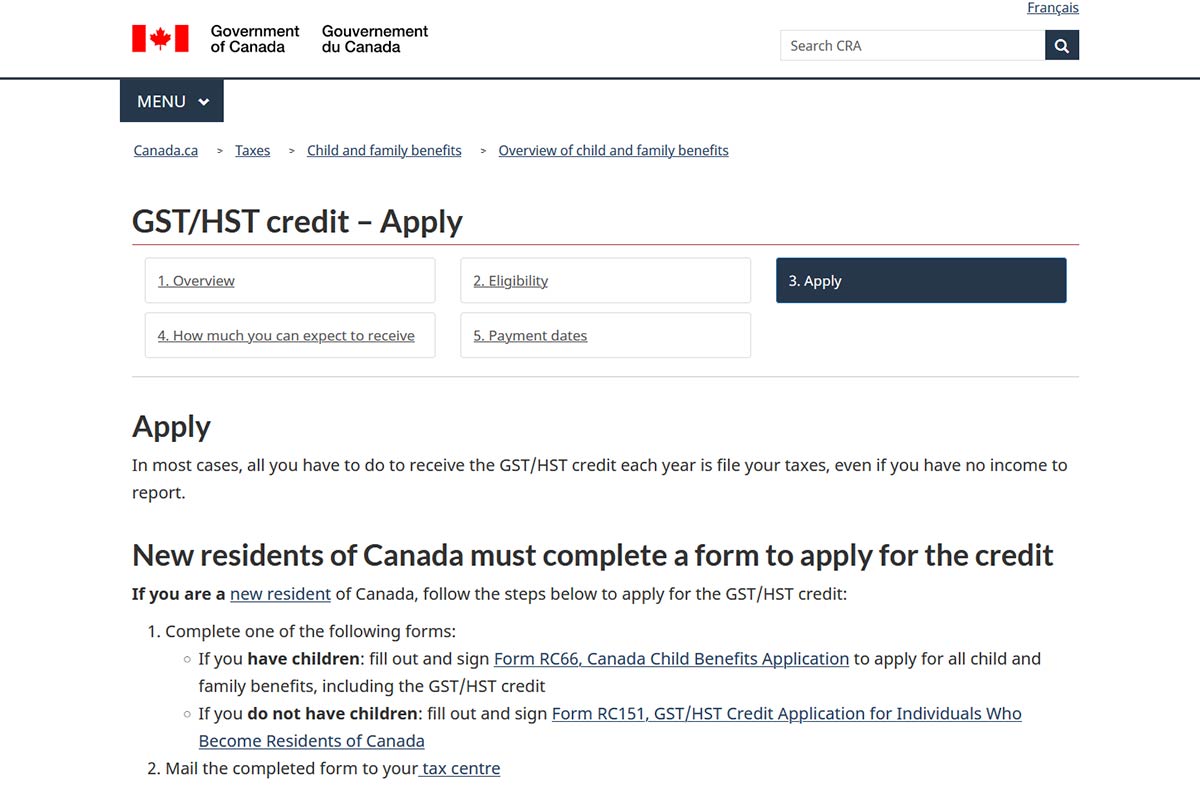

The GST HST credit payment dates for the 2022 tax year are July 5 2023 October 5 2023 January 5 2024 and April 5 2024 As long as you file your tax return you ll automatically be considered for the GST HST credit GST HST Payment Dates for 2024 The GST payment dates in 2024 for GST HST credits are January 5 2024 April 5 2024 July 5 2024 October 4 2024 You can receive your payments via direct deposit to your

Gst Hst Rebate Dates

Gst Hst Rebate Dates

https://www.apumone.com/wp-content/uploads/2023/01/GST-payments-2023-696x394.jpg

GST HST Payment Dates 2022 2023 All You Need To Know Insurdinary

https://www.insurdinary.ca/wp-content/uploads/2021/11/gst-hst-credit-application.jpg

Types Of GST Return And Their Due Dates Enterslice

https://enterslice.com/learning/wp-content/uploads/2017/06/GST-Returns-enterslice.png

The next payment date is January 3 2025 The GST HST payment is a government benefit program that alleviates the tax burden for low and middle income households in Canada In this guide we ll cover GST Between July 2024 and June 2025 single Canadians without any children could get up to 519 in GST HST credit

The tax rebates are sent out quarterly in January April July and October After the Oct 4 payment the next one is scheduled for Jan 3 2025 Here are the exact GST payment dates for 2024 January 5 2024 April 5 2024 July 5 2024 October 4 2024 GST HST Payment Amounts If you qualify for the GST HST

Download Gst Hst Rebate Dates

More picture related to Gst Hst Rebate Dates

GST HST Rebate For Owner Built Homes Sproule Associates

https://my-rebate.ca/wp-content/uploads/2020/08/Image-14.jpg

![]()

GST Payment Dates And Everything You Need To Know About The GST HST

https://cdn.shortpixel.ai/spai5/q_lossy+ret_img+to_webp/https://piggybank.ca/wp-content/uploads/GST-Payment-Dates.png

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

https://i.ytimg.com/vi/4YjatL1BTQE/maxresdefault.jpg

The CRA allows you to retroactively claim GST HST credit and receive payments for up to three years prior to the date of filing When will your GST HST be recalculated Life changes can have an impact on your GST List of payment dates for Canada Child Tax Benefit CCTB GST HST credit Universal Child Care Benefit UCCB and Working Income Tax Benefit WITB

GST Payment Dates in 2024 The payment dates for GST and HST this year are January 5 2024 April 5 2024 July 5 2024 October 5 2024 Payments can be received GST payments are generally paid out on the 5th day of January April July and October This may vary slightly if the 5th falls on a weekend or statutory holiday GST

GST Payment Dates 2023 GST HST Credit Explained

https://www.savvynewcanadians.com/wp-content/uploads/2020/01/GST-Payment-Dates.jpg

GST HST Refundable Tax Credit What Are The Payment Dates For 2021

https://learningbull.ca/wp-content/uploads/2021/06/tax-468440_1920-1536x1024.jpg

https://www.canada.ca/en/revenue-agency/services/...

Payment dates How much you can expect to receive Your GST HST credit payments are based on the following your adjusted family net income If you re single the amount from line

https://turbotax.intuit.ca/tips/gst-hst-pay…

The GST HST credit payment dates for the 2022 tax year are July 5 2023 October 5 2023 January 5 2024 and April 5 2024 As long as you file your tax return you ll automatically be considered for the GST HST credit

GST And HST Payment Dates 2021 Do You Qualify

GST Payment Dates 2023 GST HST Credit Explained

GST HST New Housing Rebate

GST HST New Housing Rebate And New Residential Rental Property Rebate

GST HST Rebate Q A 2 8W YouTube

GST Payment Dates 2023 Explaining The GST HST Credit Yore Oyster

GST Payment Dates 2023 Explaining The GST HST Credit Yore Oyster

Applicability Of The GST HST New Housing Rebate

GST HST Public Service Bodies Rebate

HST Rebate Calculator GST HST Rebate Experts Sproule Associates

Gst Hst Rebate Dates - GST HST payment dates for 2024 are January 5th April 5th July 5th and October 4th Pay your GST on these due dates to avoid interest charges