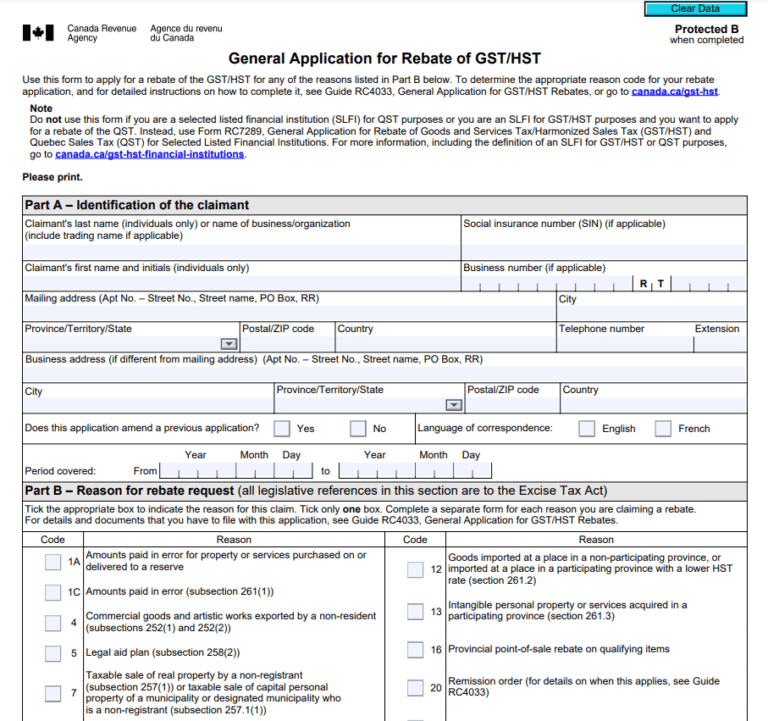

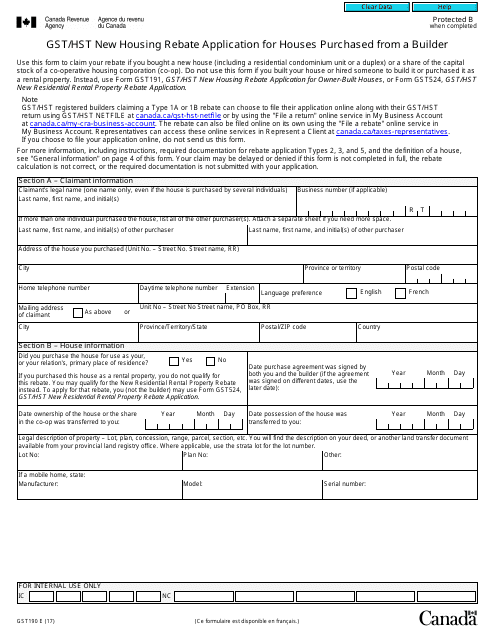

Gst Hst Rebate New Home Fill out this form to claim your GST HST new housing rebate if you bought a new house including a residential condominium unit or a duplex or a share of the capital stock of a co operative housing corporation co op

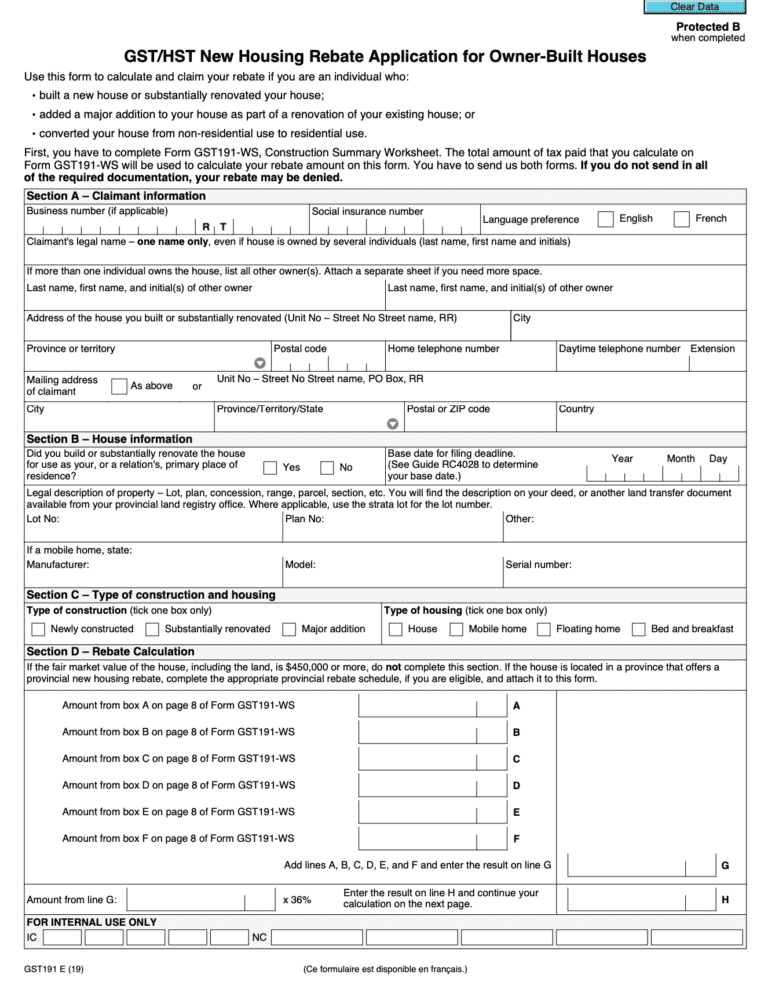

You can get up to 36 of the GST or federal portion of HST paid on the purchase price to a maximum rebate amount of 6 300 for homes valued at 350 000 or less For homes over 350 000 and up to Enter your base date for your filing deadline in Section B of Form GST191 GST HST New Housing Rebate Application for Owner Built Houses Your base date will be the day the construction or renovation of your home has concluded You must claim your rebate within 24 months of the sale or renovation

Gst Hst Rebate New Home

Gst Hst Rebate New Home

https://goodservicetax.com/wp-content/uploads/2021/12/image-7-1024x683.png

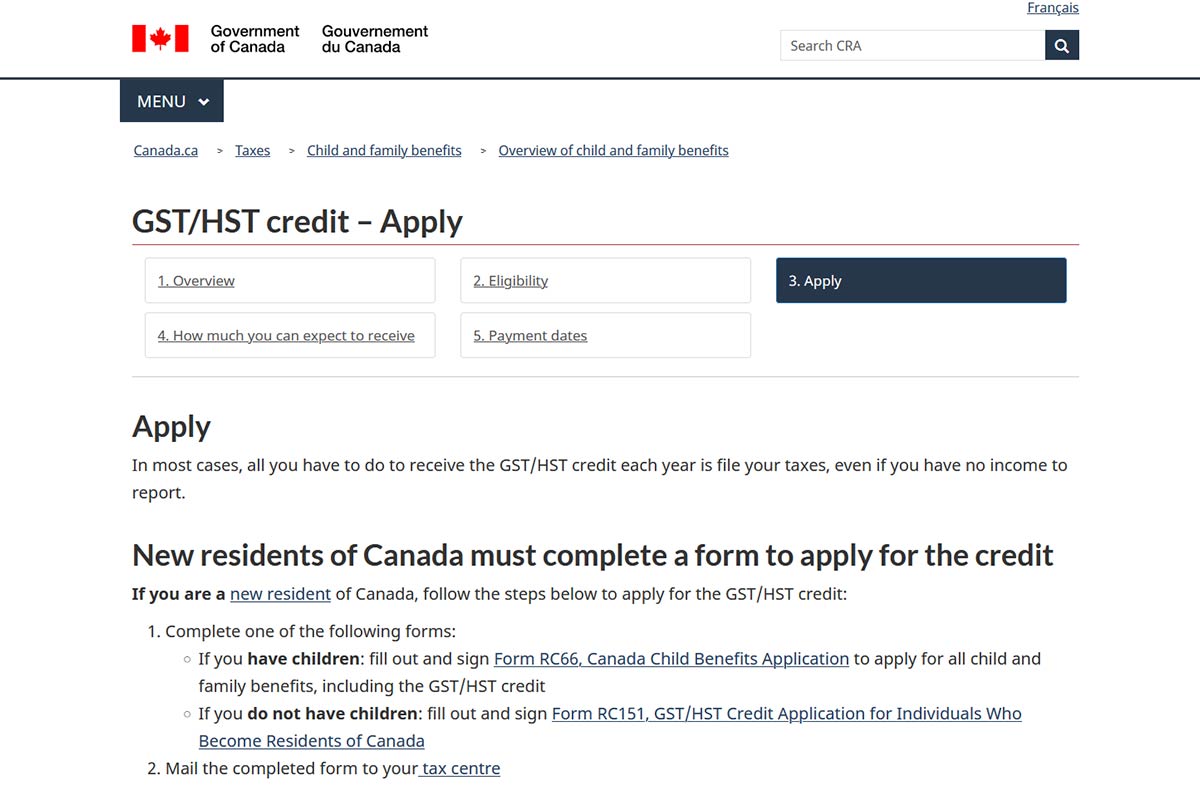

Apply For The GST HST Credit Settlement Calgary

https://i0.wp.com/settlementcalgary.com/wp-content/uploads/2019/07/GST.png?resize=768%2C448&ssl=1

Top 5 Questions About The GST HST Housing Rebate

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

This rebate allows individuals to reclaim part of the goods and service tax GST or the federal portion of the harmonized sales tax HST paid on the home However only individuals who satisfy all of the conditions for claiming the rebate which can be found online may apply If you build or purchase a new home you may qualify for a rebate of a portion of the GST HST paid on the purchase if the home is purchased for use as the primary place of residence of the purchaser or a relation of the purchaser at the time that the purchaser becomes liable under a purchase agreement See link to Tax Court case at bottom

The GST HST new housing rebate allows you to take back some of the federal portion of the tax also known as the Goods and Services tax GST and in select provinces there may also be rebates for the provincial part of the tax Fortunately no matter where you live in Canada if your new home is priced below 450 000 before GST HST you may be eligible for a partial rebate of the 5 GST portion The GST HST New Housing Rebate amount changes on a sliding scale depending on the purchase price of your home

Download Gst Hst Rebate New Home

More picture related to Gst Hst Rebate New Home

How Do I Claim GST HST Housing Rebate RKB Accounting Tax Services

https://www.rkbaccounting.ca/wp-content/uploads/2021/01/Home-renovation-contractors-rkb-accounting-1.jpg

GST New Home Rebate Calculation And Examples YouTube

https://i.ytimg.com/vi/2-0zuKt4bBk/maxresdefault.jpg

How To Fill Out Hst Rebate Form Home Depot Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/10/How-To-Fill-Out-HST-Rebate-Form-768x721.png

First the new housing rebate equals 36 of the GST that all buyers need to pay when buying a new home in Canada This rebate is up to 6 300 and valid on homes with a fair market value of 350 000 or less If you re buying a home priced above this amount but still less than 450 000 don t fret The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s primary place of residence

The new housing rebate is worth 36 of the GST or federal portion of the HST paid on a newly constructed home up to a maximum of 6 300 The rebate is valid on homes that are considered fair to the market with a value of 350 000 or less Fill out this form to calculate and claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house as part of a renovation of your existing house or converted your house from non residential use to residential use

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

https://www.canada.ca/.../forms/gst190.html

Fill out this form to claim your GST HST new housing rebate if you bought a new house including a residential condominium unit or a duplex or a share of the capital stock of a co operative housing corporation co op

https://money.ca/real-estate/gst-hst-new-housing-rebate

You can get up to 36 of the GST or federal portion of HST paid on the purchase price to a maximum rebate amount of 6 300 for homes valued at 350 000 or less For homes over 350 000 and up to

How To Calculate The GST HST New Housing Rebate

GST HST New Housing Rebate And New Residential Rental Property Rebate

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

Who Is Eligible For HST New Home Rebate PrintableRebateForm

GST Payment Dates 2021 2022 All You Need To Know Insurdinary 2022

HST Rebate New Home Services In Toronto ON

HST Rebate New Home Services In Toronto ON

Gst190 Fillable Form Printable Forms Free Online

Optimize GST HST Rebate Benefits Top 5 Methods

How Much HST Do You Pay On A New Home Sproule Associates

Gst Hst Rebate New Home - This rebate allows individuals to reclaim part of the goods and service tax GST or the federal portion of the harmonized sales tax HST paid on the home However only individuals who satisfy all of the conditions for claiming the rebate which can be found online may apply