Gst Input Tax Credit Section 16 Unlock the nuances of Section 16 of CGST Act 2017 on Input Tax Credit eligibility and conditions Explore FAQs conditions and crucial details for seamless GST compliance

1 Every registered person shall subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49 be entitled to take credit of input tax charged on any Section 16 Eligibility and conditions for taking Input Tax Credit 1 Eligibility Criteria Every Registered Person shall be entitled to take Input tax Credit on any supply of goods or services or both to him which are used or

Gst Input Tax Credit Section 16

Gst Input Tax Credit Section 16

https://image.slidesharecdn.com/itcgstlaw-170523151105/95/input-tax-credit-under-gst-11-638.jpg?cb=1495552410

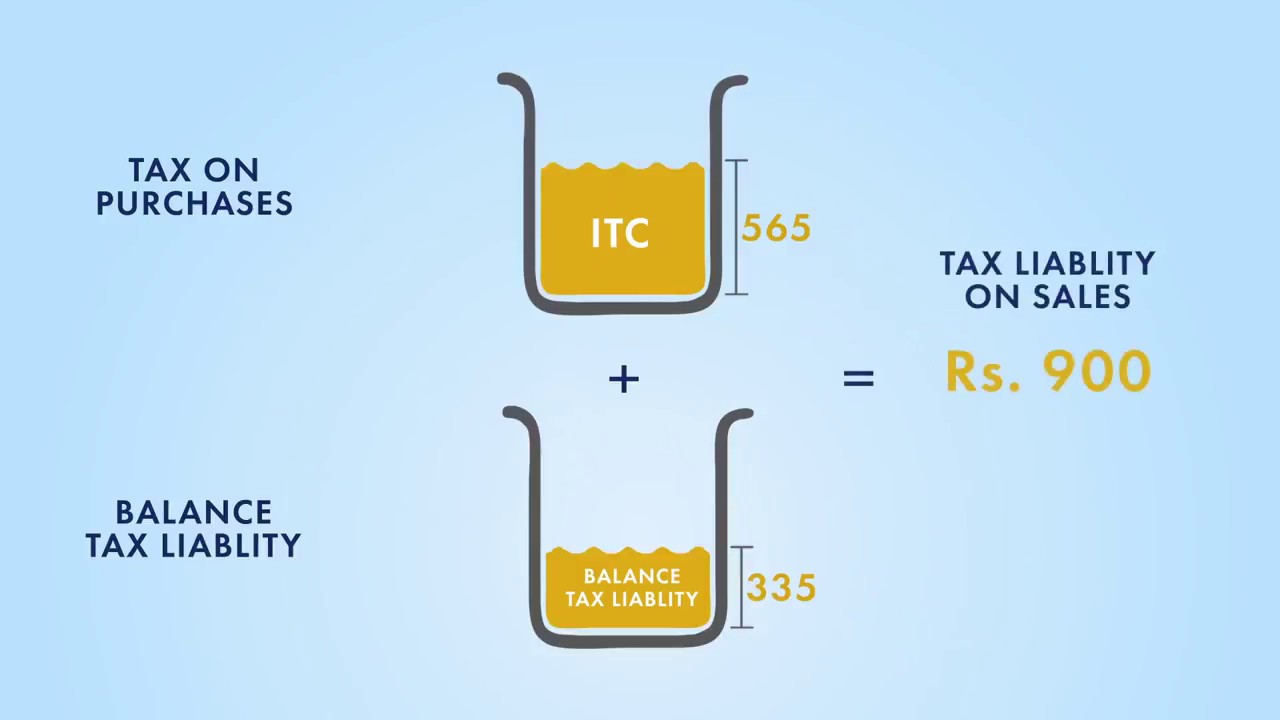

How GST Input Tax Credit Works YouTube

https://i.ytimg.com/vi/S8OuYsqrwWk/maxresdefault.jpg

Complete Guide To Input Tax Credit Under GST Busy

https://lh4.googleusercontent.com/5hwolQtDt61P7Mcah2HElnIoQsT2WceGufSC7Wq5tLISGADKSMir2eVSxHexbQxONOsMabhgjc6QkGyh1fCFZrn7ljeub6zzR1EvWan8mOtdtF7WzpXhyFssXjVJtXZ_YOiBnYgdEkDBh5fwpm2nkJ2Dzb5s8qin-_Ir7SSqkYC1Oxw1pB6fAhSEsbhL7Q

Section 16 2 b provides that the receiver should have received the goods or services for availment of credit When the payments are made on advance receipt of supplier the recipient has not received the goods or Section 16 of the CGST Act lays down the conditions to be fulfilled by GST registered buyers to claim ITC The conditions are summarised as follows Such input tax credit is eligible for claims if the goods or services

1 Every registered person shall subject to such conditions and restrictions as may be prescribed R 36 and in the manner specified in section 49 be entitled to take credit Section 16 of CGST 2017 provides for eligibility and conditions for taking input tax credit Recently we have discussed in detail section 15 Value of Taxable Supply of CGST Act 2017 Today we learn the provisions of section

Download Gst Input Tax Credit Section 16

More picture related to Gst Input Tax Credit Section 16

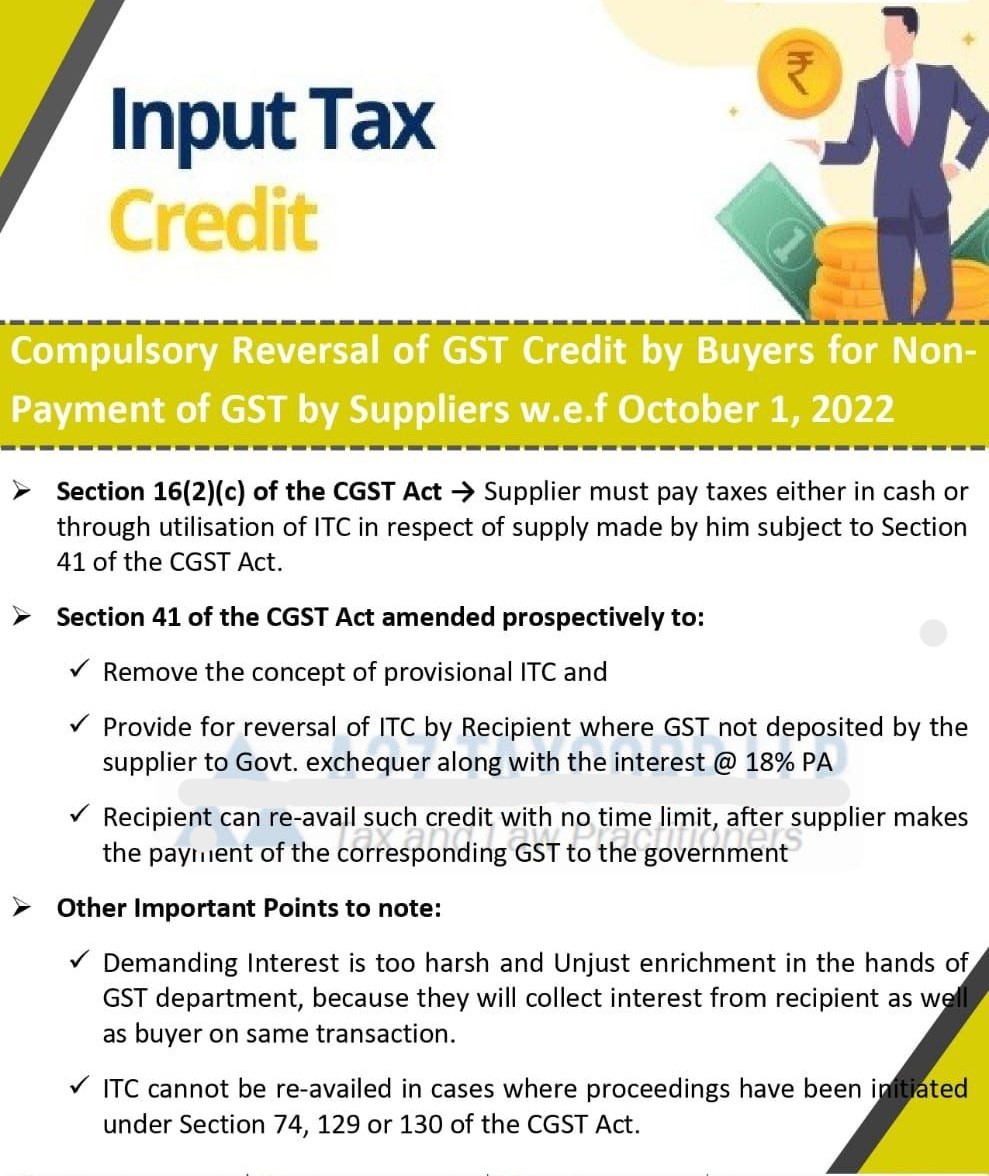

Input Tax Credit Under Goods And Services Tax Act RJA

https://carajput.com/blog/wp-content/uploads/2021/09/Compulsory-Reversal-of-GST-Credit-by-Buyers-for-Non-Payment-.jpg

GST Reduced But Input Tax Credit Eliminated

https://realtynxtmedia201121.s3.ap-south-1.amazonaws.com/media/2019/02/544.jpg?q=4070

A COMPLETE GUIDE TO INPUT TAX CREDIT ITC UNDER GST

https://i0.wp.com/taxconcept.net/wp-content/uploads/2019/09/Input-Tax-Credit-under-GST.jpg?fit=1412%2C540&ssl=1

The Input Tax Credit ITC mechanism covered under Section 16 of the CGST Act 2017 allows taxpayers to offset their GST input tax with their GST output tax liability Input Tax Credit ITC is a vital feature of the GST system allowing taxpayers to claim credit for the GST paid on purchases or expenses against the GST liability on their

Check out the point wise guide for input tax credit under GST which includes sections 16 17 and 18 of CGST Act Check now for more details Section 16 Eligibility and conditions for taking input tax credit of CGST ACT 2017 16 1 Every registered person shall subject to such conditions and restrictions as may be prescribed and

Know About GST Input Tax Credit With Illustrations Taxmann Blog

https://www.taxmann.com/post/wp-content/uploads/2021/08/Know-about-GST-Input-Tax-Credit-_Blog_Aug21.jpg

GST Input Tax Credit Buy GST Input Tax Credit By V S Datey At Low

https://rukminim1.flixcart.com/image/832/832/kkoc70w0/book/e/m/s/gst-input-tax-credit-original-imafzzyfbjecbmgf.jpeg?q=70

https://taxguru.in › goods-and-service-tax

Unlock the nuances of Section 16 of CGST Act 2017 on Input Tax Credit eligibility and conditions Explore FAQs conditions and crucial details for seamless GST compliance

https://taxinformation.cbic.gov.in › ... › active

1 Every registered person shall subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49 be entitled to take credit of input tax charged on any

A Complete Guide On Input Tax Credit ITC Under GST

Know About GST Input Tax Credit With Illustrations Taxmann Blog

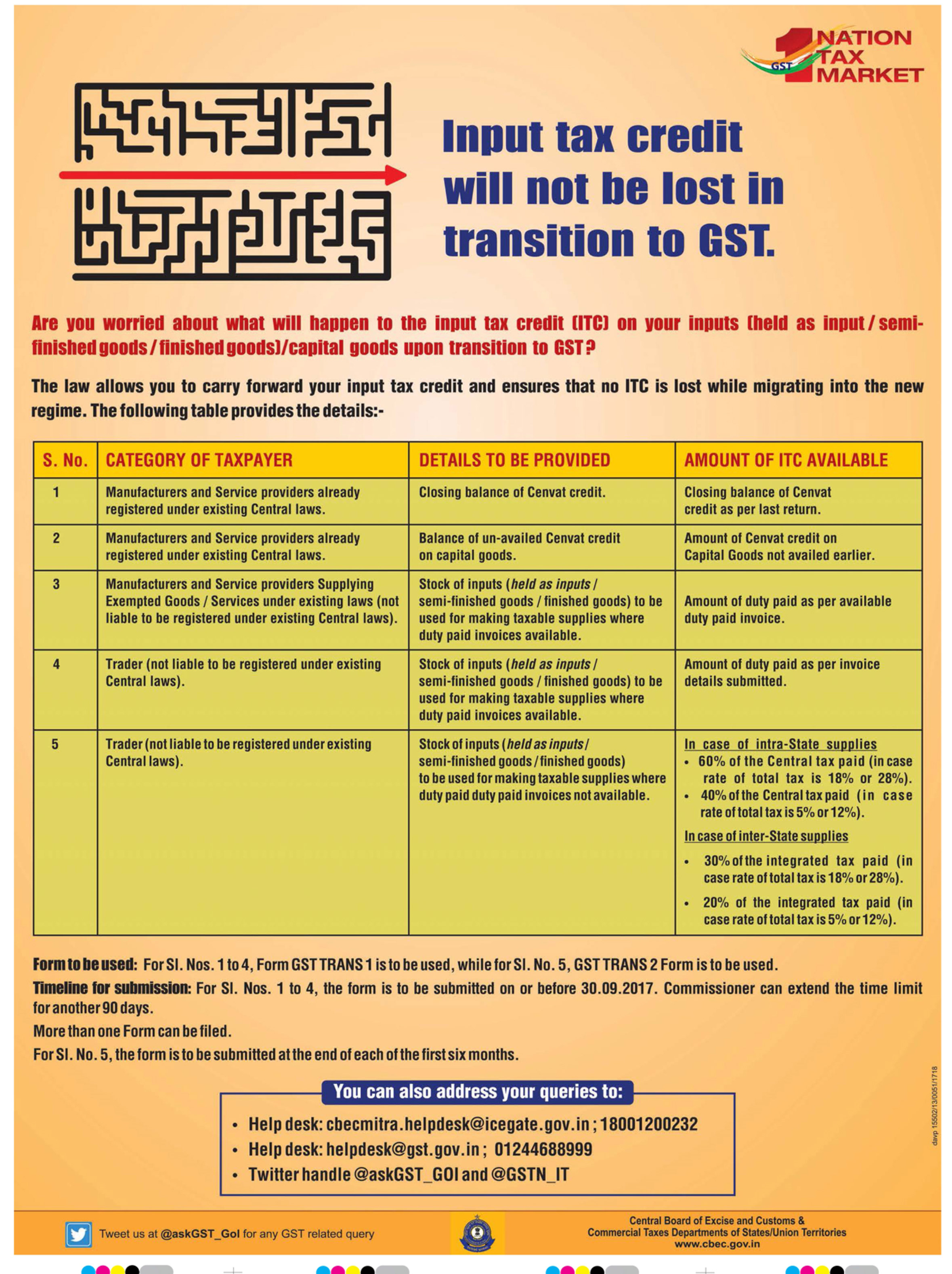

GST Input Tax Credit Will Not Be Lost In Transition To GST Ad Advert

Guide To Maximizing The Utilization Of GST Input Tax Credit

Itc Rules Under Gst Guide On Types Conditions Eligibility Input Hot

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

All About Input Tax Credit Under GST Ebizfiling India Pvt Ltd

Comparison Of Various Definitions For Input Tax Credit Under GST And

GST Input Tax Credit On Supply Of Goods Or Services

All About Input Tax Credit Under GST

Gst Input Tax Credit Section 16 - 1 Every registered person shall subject to such conditions and restrictions as may be prescribed R 36 and in the manner specified in section 49 be entitled to take credit