Gst New Housing Rebate Eligibility This housing includes apartment buildings student housing and seniors residences Applications for the PBRH rebate can be made online starting May 13

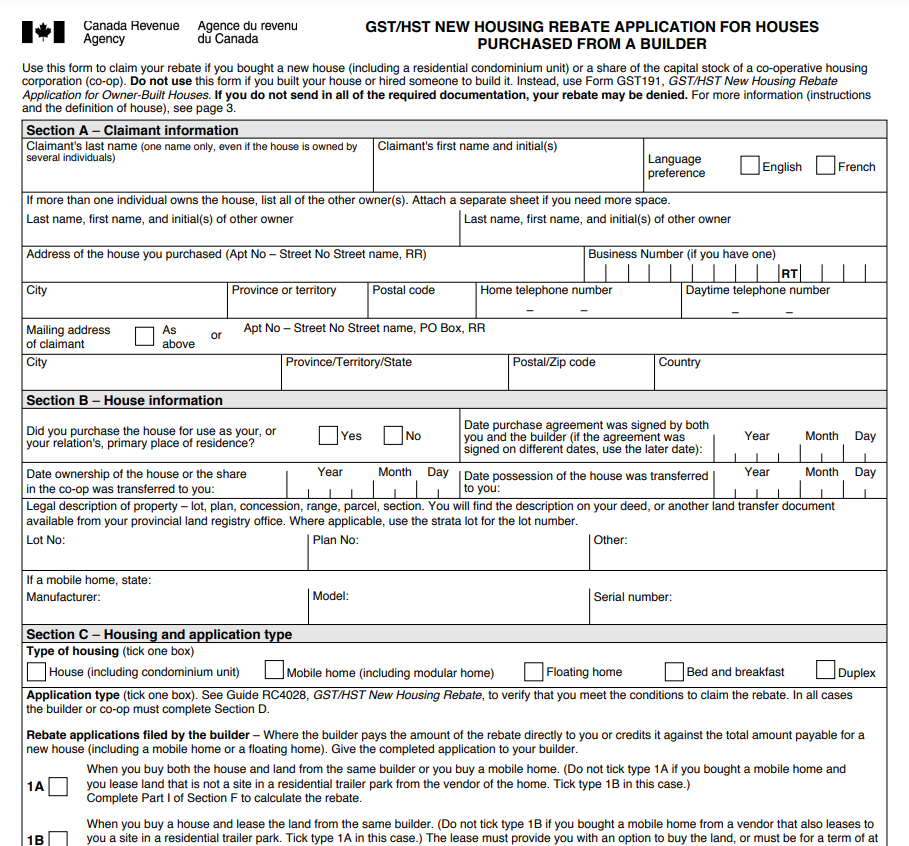

To qualify the home must be in Canada and Be purchased from a builder registered with the GST HST New Housing Rebate program Be an owner built home Who s eligible for the GST HST rebate As long as you and anyone else you re buying with are an individual home buyer and not a corporation or business

Gst New Housing Rebate Eligibility

Gst New Housing Rebate Eligibility

https://goodservicetax.com/wp-content/uploads/2021/12/image-7-1024x683.png

13064 Mclaughlin Rd 7600000 00

https://idx-media.s3.ca-central-1.amazonaws.com/commercial/PhotoW5610897-1.jpeg

BC Housing Plan To Help Some Homeowners CityNews Vancouver

https://vancouver.citynews.ca/wp-content/blogs.dir/sites/9/2022/11/21/Premier-David-Eby-Housing-Announcement-3-scaled.jpg

To qualify residential units need to meet the requirements for the current GST HST new residential rental property rebate and must be in a multi unit residential complex with at Here is what you need to know Key Points You Should Know The GST HST New Housing Rebate helps Canadian individuals recover some of the GST or the federal part of the HST paid for a new

The federal government recently enhanced the GST new residential rental property rebate and eliminated the rebate phase out thresholds This increases the When the fair market value of the property exceeds 450 000 00 you will be entitled to claim only the GST portion of the New Residential Rental Rebate The residential real

Download Gst New Housing Rebate Eligibility

More picture related to Gst New Housing Rebate Eligibility

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

GST HST New Housing Rebates Amount Eligibility How To Apply TNNMC

https://tnnmc.org/wp-content/uploads/2024/02/GSTHST-New-Housing-Rebates-Amount-Eligibility-How-to-apply.png

GST HST Filings And Rebates NBG Chartered Professional Accountant

https://www.nbgcpa.ca/wp-content/uploads/2022/09/Housing-rebate-ontario.png

Eligibility for the GST HST New Housing Rebate Depending on your conditions and province you may be eligible for both the provincial and federal rebate The clarification includes 1 the extension of the PBRH rebate to new student residences 2 that the PBRH rebate may be available for each individual qualifying

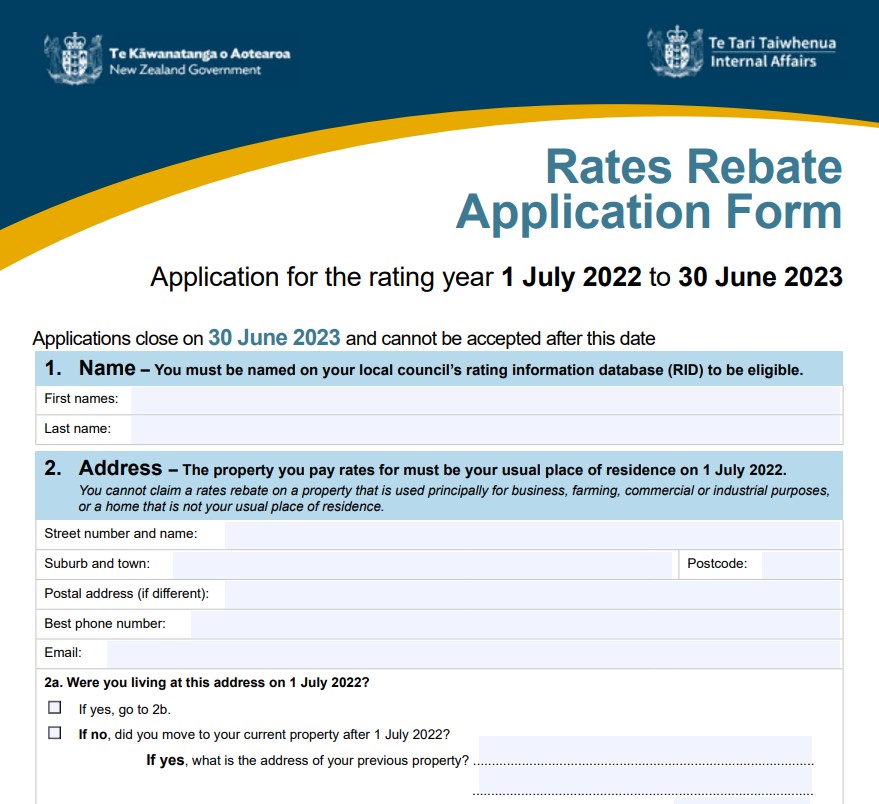

Which new housing rebate am I eligible for Individuals can claim the GST HST new housing rebate when they have paid for a new house or significantly renovated house GST HST New Housing Rebate Application for Owner Built Houses Use this form to calculate and claim your rebate if you are an individual who built a new house or

What First Time Home Buyer Benefits Are Available In Edmonton In 2022

https://www.lincolnberg.com/blog/wp-content/uploads/2021/07/Blog-image-9.png

How Do I Claim GST HST Housing Rebate RKB Accounting Tax Services

https://www.rkbaccounting.ca/wp-content/uploads/2021/01/Home-renovation-contractors-rkb-accounting-1.jpg

https://www.canada.ca/en/revenue-agency/news/...

This housing includes apartment buildings student housing and seniors residences Applications for the PBRH rebate can be made online starting May 13

https://www.canadalife.com/.../what-is-the-gst-hst-new-housing-rebate.html

To qualify the home must be in Canada and Be purchased from a builder registered with the GST HST New Housing Rebate program Be an owner built home

Gst New Housing Rebate Application Form Printable Rebate Form

What First Time Home Buyer Benefits Are Available In Edmonton In 2022

GST HST New Housing Rebate Jenna Lee Law

How To Calculate The GST HST New Housing Rebate Sproule Associates

How To Qualify For GST HST NEW HOUSING REBATE On RENOVATED And OWNER

What Is The HST GST New Housing Rebate

What Is The HST GST New Housing Rebate

GST New Housing Rebate Form Printable Rebate Form

GST HST New Housing Rebate

GST HST New Housing Rebate

Gst New Housing Rebate Eligibility - If you are a home buyer who has purchased a new build has purchased a new property for investment purposes or has substantially renovated your home you