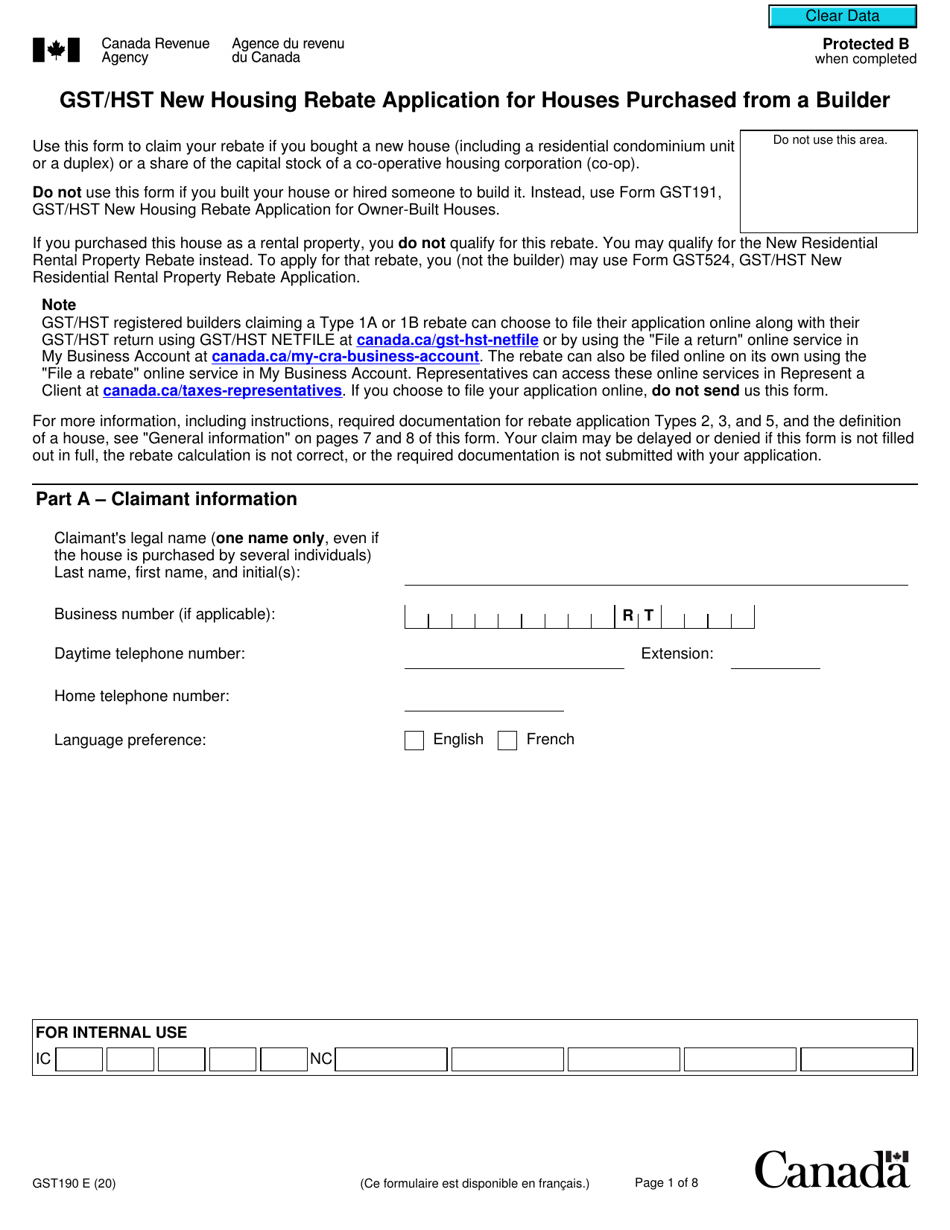

Gst Rebate Forms New Home Construction Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

Web A GST HST new housing rebate is provided for part of the tax paid by an individual who builds or substantially renovates his or her own primary place of residence or that of a Web 7 juil 2022 nbsp 0183 32 This worksheet is to be used when filing a claim for a GST HST new housing rebate if you built a new house or substantially renovated your existing house

Gst Rebate Forms New Home Construction

Gst Rebate Forms New Home Construction

https://data.templateroller.com/pdf_docs_html/2030/20309/2030941/form-gst191-gst-hst-new-housing-rebate-application-for-owner-built-houses-canada_print_big.png

Gst Hst New Housing Rebate Application For Owner Built Houses

https://vislab-us.net/images/958929.png

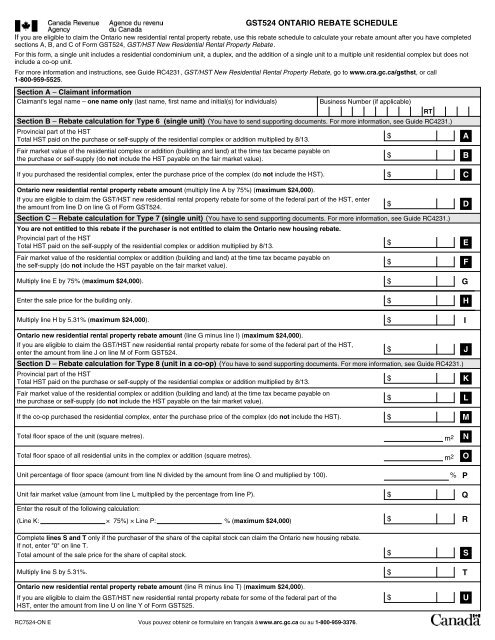

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

https://img.yumpu.com/6665969/1/500x640/gst524-ontario-rebate-schedule-.jpg

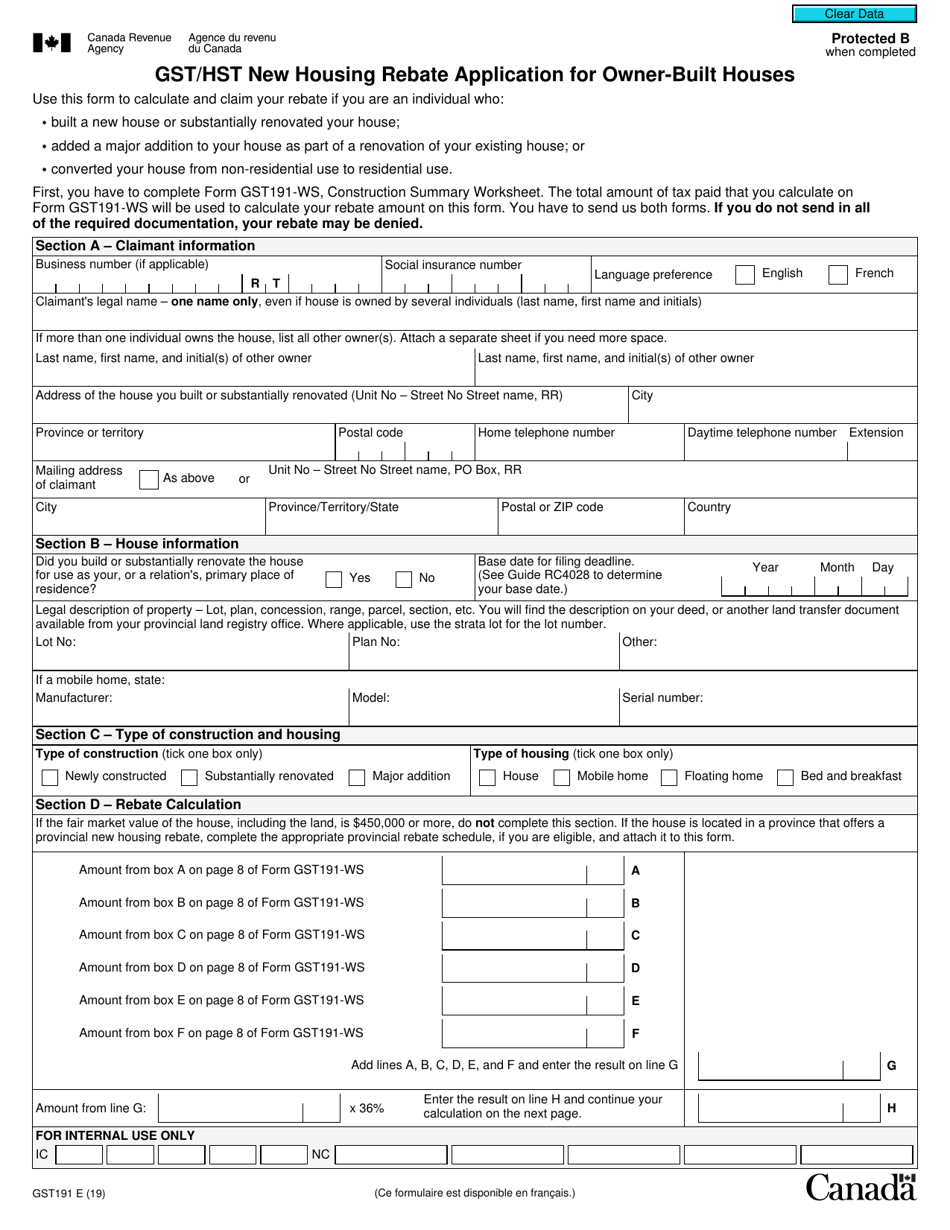

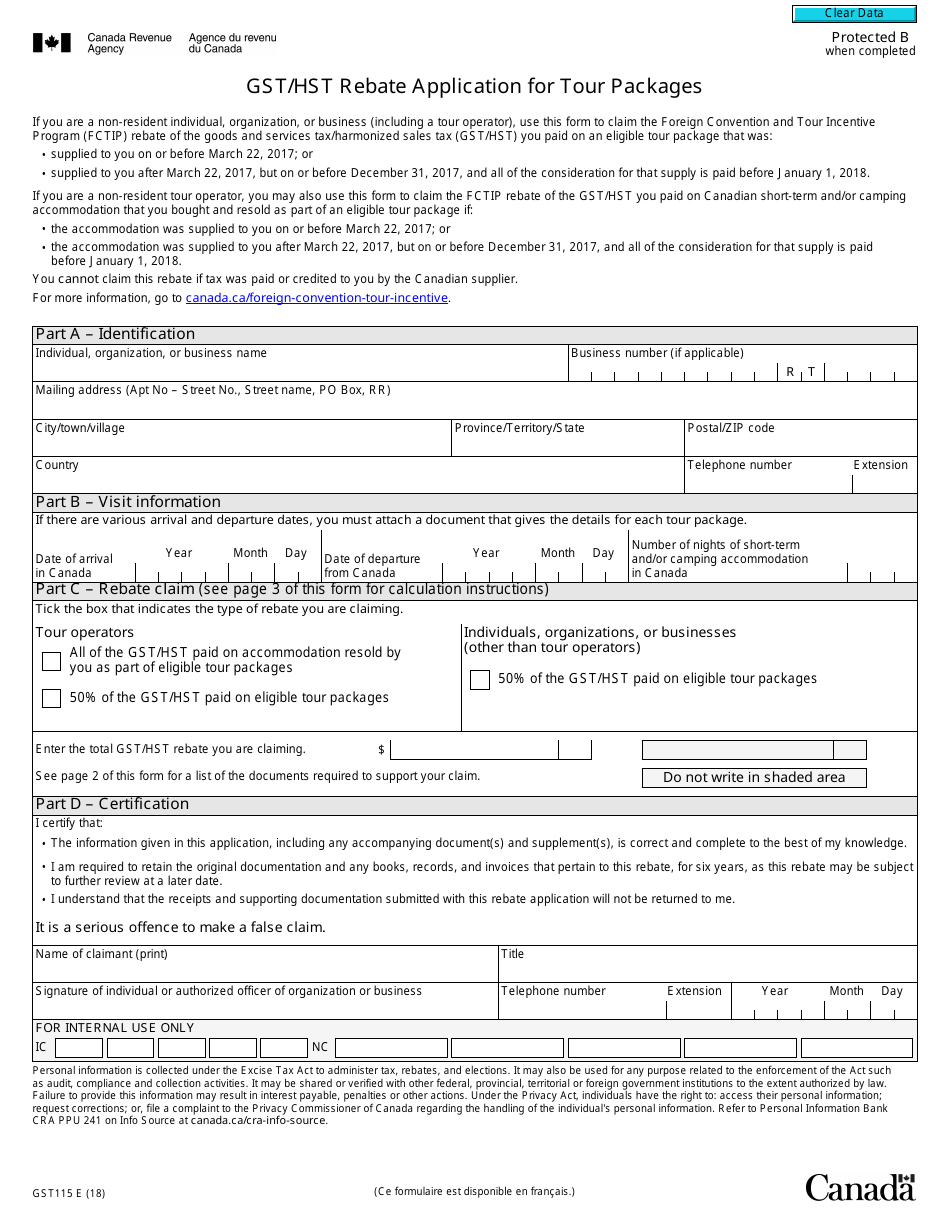

Web 3 juin 2022 nbsp 0183 32 Which form will I need to apply for the GST HST New Housing Rebate There are two types of rebates available with differing rates rebates for owner built houses Web To apply for a tax rebate you or a co owner must use the form below best suited to your situation GST QST New Housing Rebate Application for a New Home Purchased from a Builder FP 2190 AC V GST QST New

Web 20 mai 2021 nbsp 0183 32 Form GST191 WS is for those undergoing substantial renovations or who have an owner built home Our experts will guide you through how to fill out the form Skip to content 647 281 5399 email Web The GST HST new housing rebate allows an individual to recover some of the GST or the federal part of the HST paid for a new or substantially renovated house that is for use as the individual s or their relation s

Download Gst Rebate Forms New Home Construction

More picture related to Gst Rebate Forms New Home Construction

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_26.jpg

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/form-gst524-gst-hst-new-residential-rental-property-rebate-application-canada_print_big.png

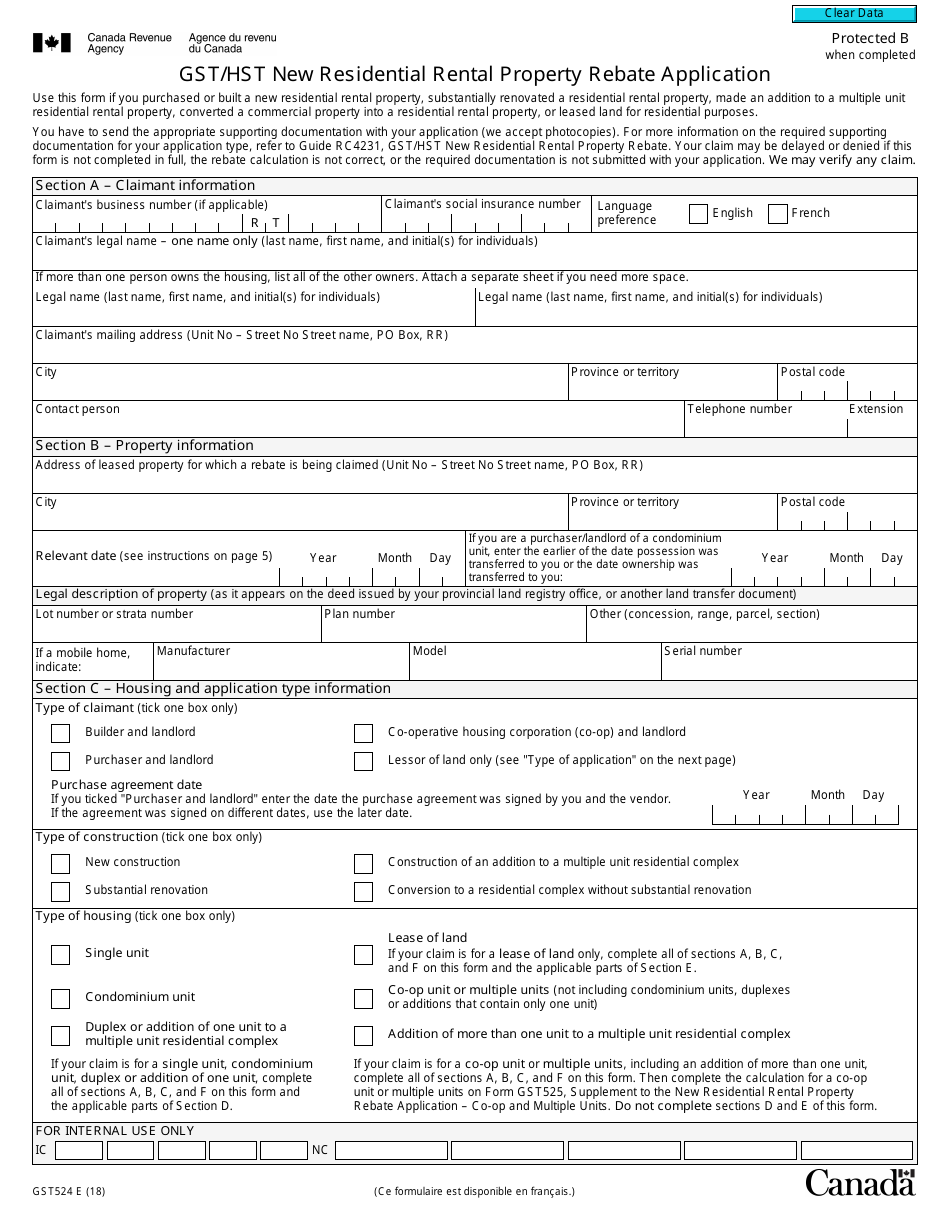

Form GST190 Download Fillable PDF Or Fill Online Gst Hst New Housing

https://data.templateroller.com/pdf_docs_html/2148/21480/2148090/form-gst190-gst-hst-new-housing-rebate-application-for-houses-purchased-from-a-builder-canada_print_big.png

Web 19 avr 2021 nbsp 0183 32 GST QST New Housing Rebate Application Owner of a Home on Leased Land or a Share in a Housing Co Op FP 2190 L V QST and GST Rebates New or Web Eligibility for the GST HST new residential rental property rebate You may be eligible for the GST HST new residential rental property NRRP rebate if you are in one of the

Web You could receive a maximum rebate of 6 300 You will need to make sure that you fit the criteria to be able to claim the new housing rebate You ll have to fill out an application Web Use this form to claim your rebate if you bought a new house including a residential condominium unit or a share of the capital stock of a co operative housing corporation

Gst Hst New Housing Rebate Application For Owner Built Houses

https://vislab-us.net/images/443177.jpg

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

https://www.canada.ca/.../services/forms-publications/forms/gst191.html

Web 9 sept 2022 nbsp 0183 32 Application form to claim the GST HST new housing rebate if you built a new house or substantially renovated or added a major addition to your house

https://www.canada.ca/.../19-3-4/rebate-owner-built-homes.html

Web A GST HST new housing rebate is provided for part of the tax paid by an individual who builds or substantially renovates his or her own primary place of residence or that of a

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Hst New Housing Rebate Application For Owner Built Houses

Gst Return Working Copy Form Fill Out And Sign Printable PDF Template

Pin On Moving Buying Selling Home

Gst Fillable Form Printable Forms Free Online

Gst Remittance Form Fill Online Printable Fillable Blank PdfFiller

Gst Remittance Form Fill Online Printable Fillable Blank PdfFiller

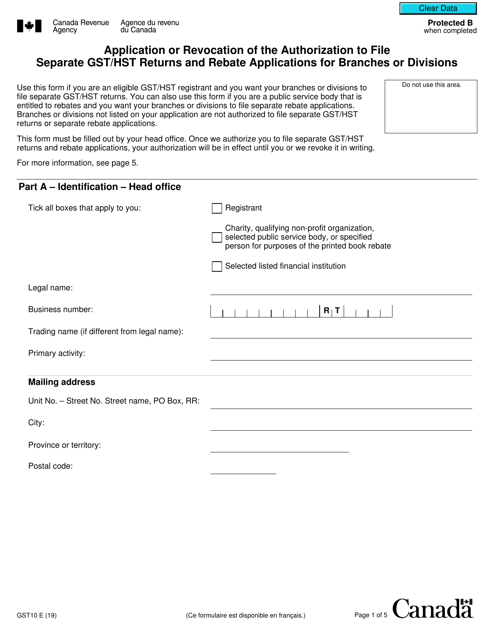

Form GST10 Download Fillable PDF Or Fill Online Application Or

GST HST New Housing Rebate Rebates House With Land Home Construction

Ontario New Housing Rebate Form By State Printable Rebate Form

Gst Rebate Forms New Home Construction - Web 20 mai 2021 nbsp 0183 32 Form GST191 WS is for those undergoing substantial renovations or who have an owner built home Our experts will guide you through how to fill out the form Skip to content 647 281 5399 email