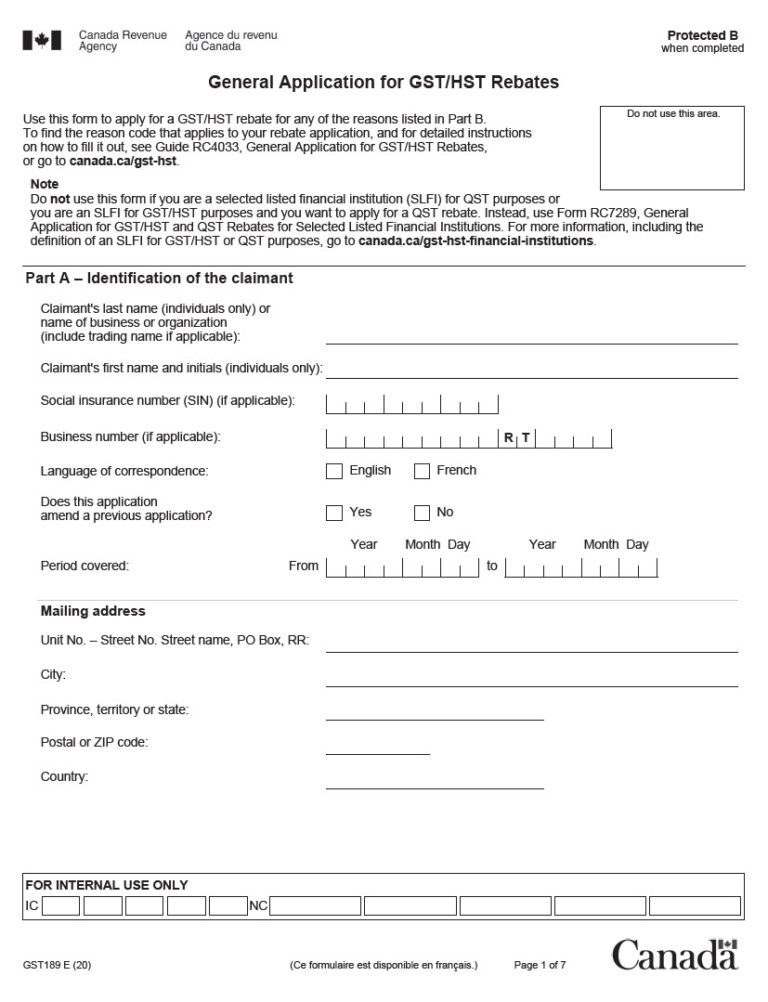

Gst Rebate On New Home Build Owners of new or substantially renovated housing may qualify for a GST HST new housing rebate for a portion of the GST HST paid on labour and materials but they must apply

The GST HST new housing rebate allows you to take back some of the federal portion of the tax also known as the Goods and Services tax GST and in select provinces there may also be rebates for the provincial part of the If you build or purchase a new home you may qualify for a rebate of a portion of the GST HST paid on the purchase if the home is purchased for use as the primary place of residence of the purchaser or a relation of the purchaser at

Gst Rebate On New Home Build

![]()

Gst Rebate On New Home Build

https://cdn.shortpixel.ai/spai8/q_lossy+ret_img+to_auto/piggybank.ca/wp-content/uploads/HST-Rebate.png

Menards Price Adjustment Rebate Form October 2022 RebateForMenards

https://i0.wp.com/www.rebateformenards.com/wp-content/uploads/2022/10/menards-price-adjustment-rebate-form-october-2022.jpg?resize=1536%2C1510&ssl=1

Top 5 Questions About The GST HST Housing Rebate

https://my-rebate.ca/wp-content/uploads/2021/03/shutterstock_745359235-1-768x509.jpg

The GST rebate is a Federal rebate on the 5 GST tax home buyers pay for a new house or new condo or for goods and services associated with building or substantially renovating a house Owners can apply for a maximum rebate The GST HST New Housing Rebate helps Canadian individuals recover some of the GST or the federal part of the HST paid for a new or extensively renovated house The maximum rebate you can receive for the

The GST HST New Housing Rebate is a valuable tax relief program for Canadians purchasing or constructing a new home This rebate helps reduce the financial burden by When you purchase a residential home or condominium from a builder you may be entitled to the HST rebate The program is officially called the Harmonized Sales HS Rebate which contains two programs the HST New Home

Download Gst Rebate On New Home Build

More picture related to Gst Rebate On New Home Build

GST HST New Housing Rebate And New Residential Rental Property Rebate

https://sqicpa.com/wp-content/uploads/2018/09/GST-HST-Rebate-1-e1537821386125.png

New Home HST GST Rebate By Nadene Milnes Issuu

https://image.isu.pub/130131143253-b171a3397fa948ceb10c5a961451c8bc/jpg/page_2.jpg

AY 2022 2023 GST Vouchers Everything You Need To Know

https://res.cloudinary.com/valuechampion/image/upload/c_limit,dpr_1.0,f_auto,h_1600,q_auto,w_1600/v1/GST_Voucher_pic.png

The new housing rebate is worth 36 of the GST or federal portion of the HST paid on a newly constructed home up to a maximum of 6 300 The rebate is valid on homes that are considered fair to the market with a value of Fortunately no matter where you live in Canada if your new home is priced below 450 000 before GST HST you may be eligible for a partial rebate of the 5 GST portion The

Canada has a new housing rebate known as the GST HST new housing rebate It gives qualifying Canadians up to 6 300 rebate on the federal tax portion of an eligible home If you built your own home you can also apply for a rebate of the GST HST you spent while building the house To do so complete Form GST191 WS Construction Summary Worksheet

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

https://www.texashomes2percentrebate.com/wp-content/uploads/2015/04/Texas_2_percent_Seller_Rebate_Program1.jpg

GST Refund Form Rfd 01 Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2021/07/GST-Rebate-Form-2021-768x1002.jpg

https://www.canada.ca › en › revenue-agency › services › ...

Owners of new or substantially renovated housing may qualify for a GST HST new housing rebate for a portion of the GST HST paid on labour and materials but they must apply

https://wowa.ca › ... › gst-hst-rebate-new-h…

The GST HST new housing rebate allows you to take back some of the federal portion of the tax also known as the Goods and Services tax GST and in select provinces there may also be rebates for the provincial part of the

GST HST New Housing Rebate

Home Buyer Rebates 2 5 Cash Back Of Total Purchase Price

The HST GST Rebate And One s Primary Place Of Residence

What Is The GST Rebate On Homes And How Does It Work TroiWest Builders

HWLLP Enhanced GST Rebate On New Purpose Built Rental Properties HWLLP

GST HST New Housing Rebate

GST HST New Housing Rebate

Gst191 Fillable Form Printable Forms Free Online

Office Conversions Eligible For Federal GST Rebate On New Rental

Thompson Center Arms Rebate On All New T C Firearms ArmsVault

Gst Rebate On New Home Build - The GST rebate is a Federal rebate on the 5 GST tax home buyers pay for a new house or new condo or for goods and services associated with building or substantially renovating a house Owners can apply for a maximum rebate