Gst Rebate On Rental Property Web If you are a GST HST registrant you may be able to include your total new residential rental property NRRP rebate amount including any Ontario NRRP rebate amount

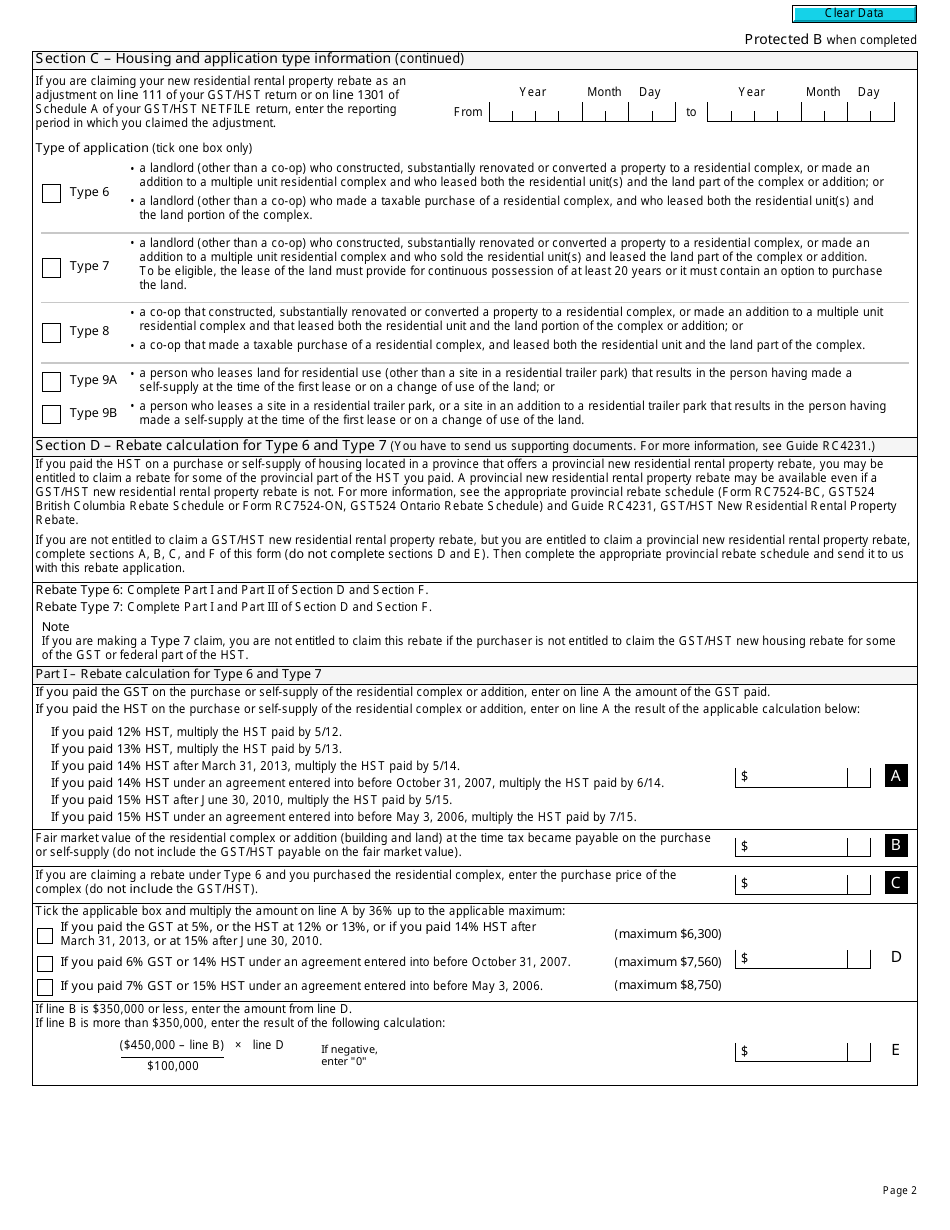

Web 2 mars 2022 nbsp 0183 32 To help partially offset the GST HST cost related to new housing landlords that use new housing to generate long term residential rent may be eligible for the Web 14 juin 2001 nbsp 0183 32 The maximum rebate amount for each qualifying residential rental property is 8 750 The new residential rental property rebate applies to construction

Gst Rebate On Rental Property

Gst Rebate On Rental Property

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2023/05/gst-hst-new-residential-rental-property-rebate-application-guide.jpg?fit=358%2C506&ssl=1

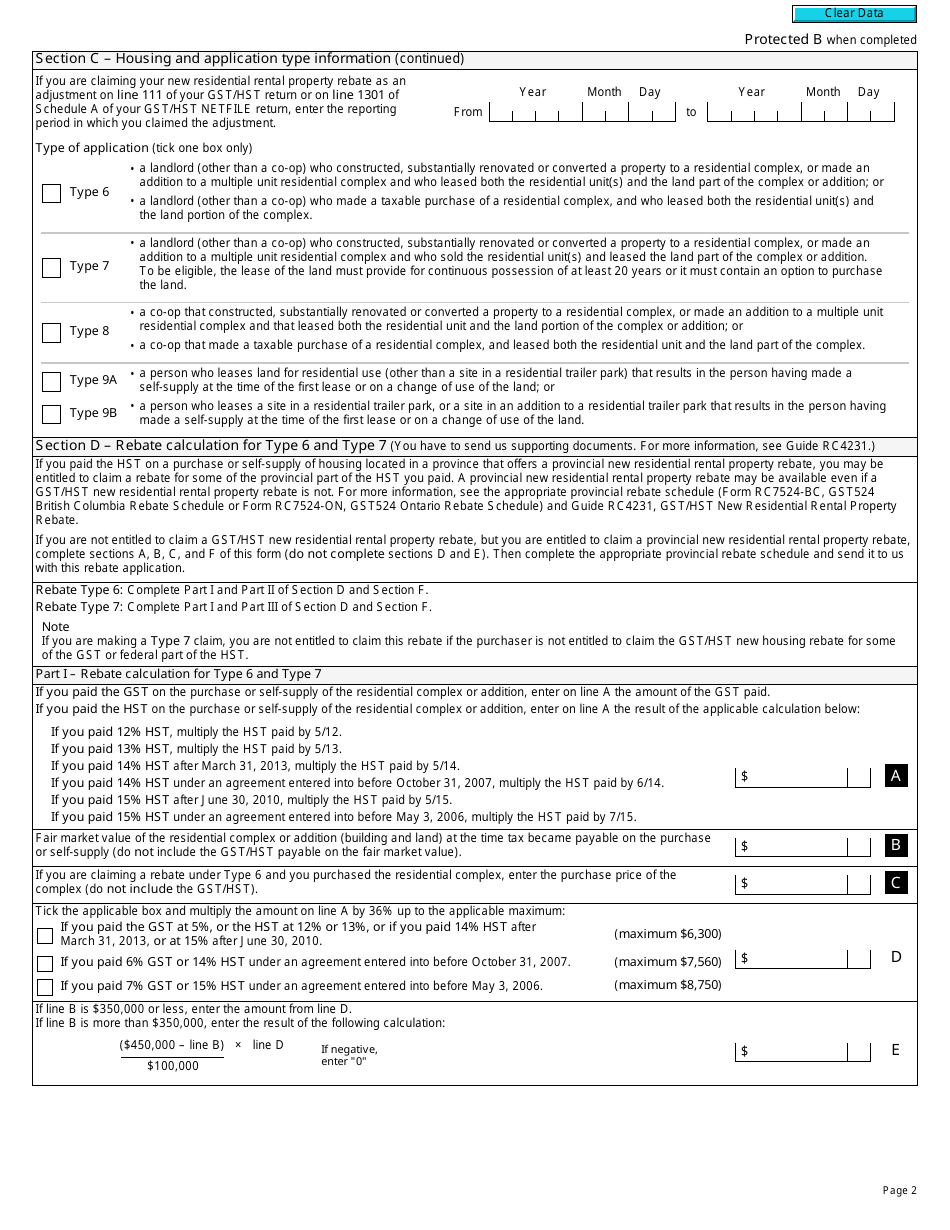

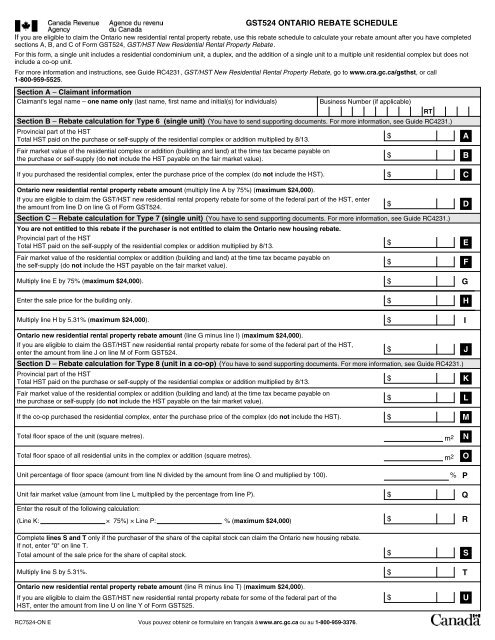

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://data.templateroller.com/pdf_docs_html/1869/18693/1869358/page_2_thumb_950.png

GST HST New Residential Rental Property Rebate Agence Du

https://www.yumpu.com/en/image/facebook/7898976.jpg

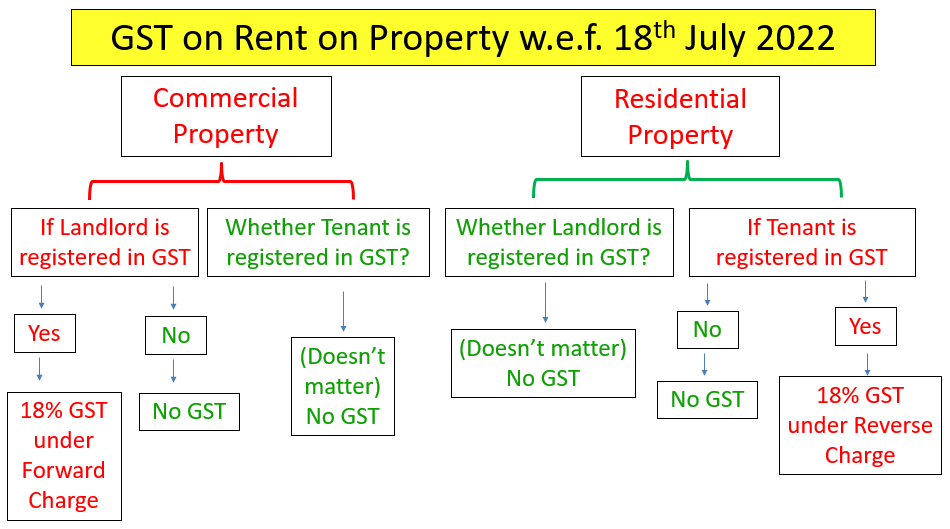

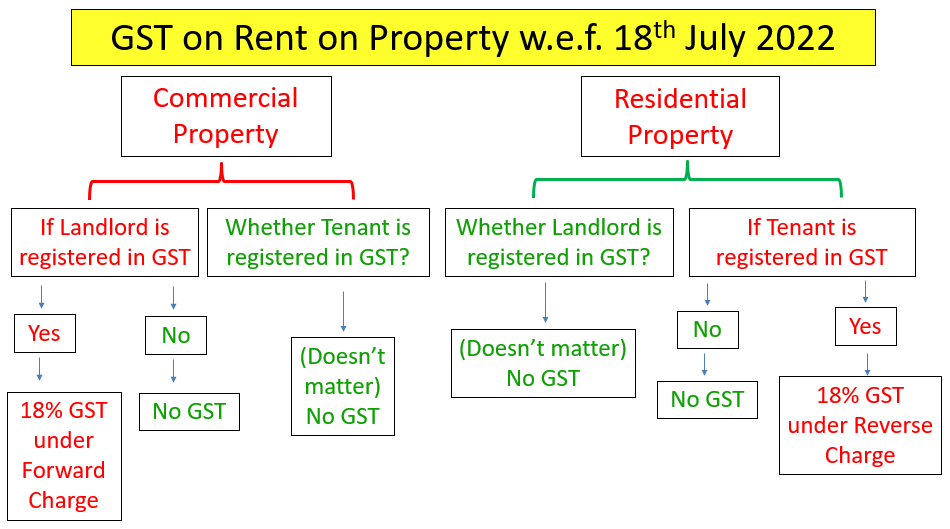

Web 23 janv 2023 nbsp 0183 32 When you rent out a residential property for residential purposes it is exempt from GST Any other type of lease or renting out of the immovable property for Web The amount of the rebate is progressively reduced when the purchase price or FMV of the new residential unit is more than 350 000 for GST purposes and 200 000 for QST

Web Example 1a The landlord is passing the property tax rebate of 100 to the tenant by reducing current rental The rental is 1 000 before GST As the property tax rebate is Web 4 juin 2020 nbsp 0183 32 June 4 2020 As part of the collective effort in managing the impact COVID 19 has on tenants and owners of non residential properties rental waivers in full or in

Download Gst Rebate On Rental Property

More picture related to Gst Rebate On Rental Property

Guide Rc4231 Gst Hst New Residential Rental Property Rebate

https://i0.wp.com/www.propertyrebate.net/wp-content/uploads/2022/10/guide-rc4231-gst-hst-new-residential-rental-property-rebate-property-6.png?fit=791%2C1024&ssl=1

You May Be Eligible To Cl

https://img.yumpu.com/5553203/7/500x640/gst-hst-new-residential-rental-property-rebate.jpg

Rental Property GST Rebate For New Residential Homes Condo Millionaire

http://static1.squarespace.com/static/621d9692ec1be8680a5926c5/621e379deb4b915868e49b86/63a26b6cd673c5048b06d060/1672927175407/INSTAGRAM+-+Multiple+Pages.png?format=1500w

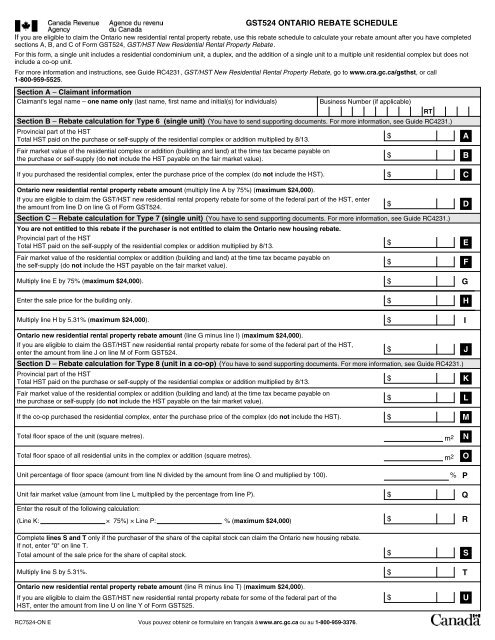

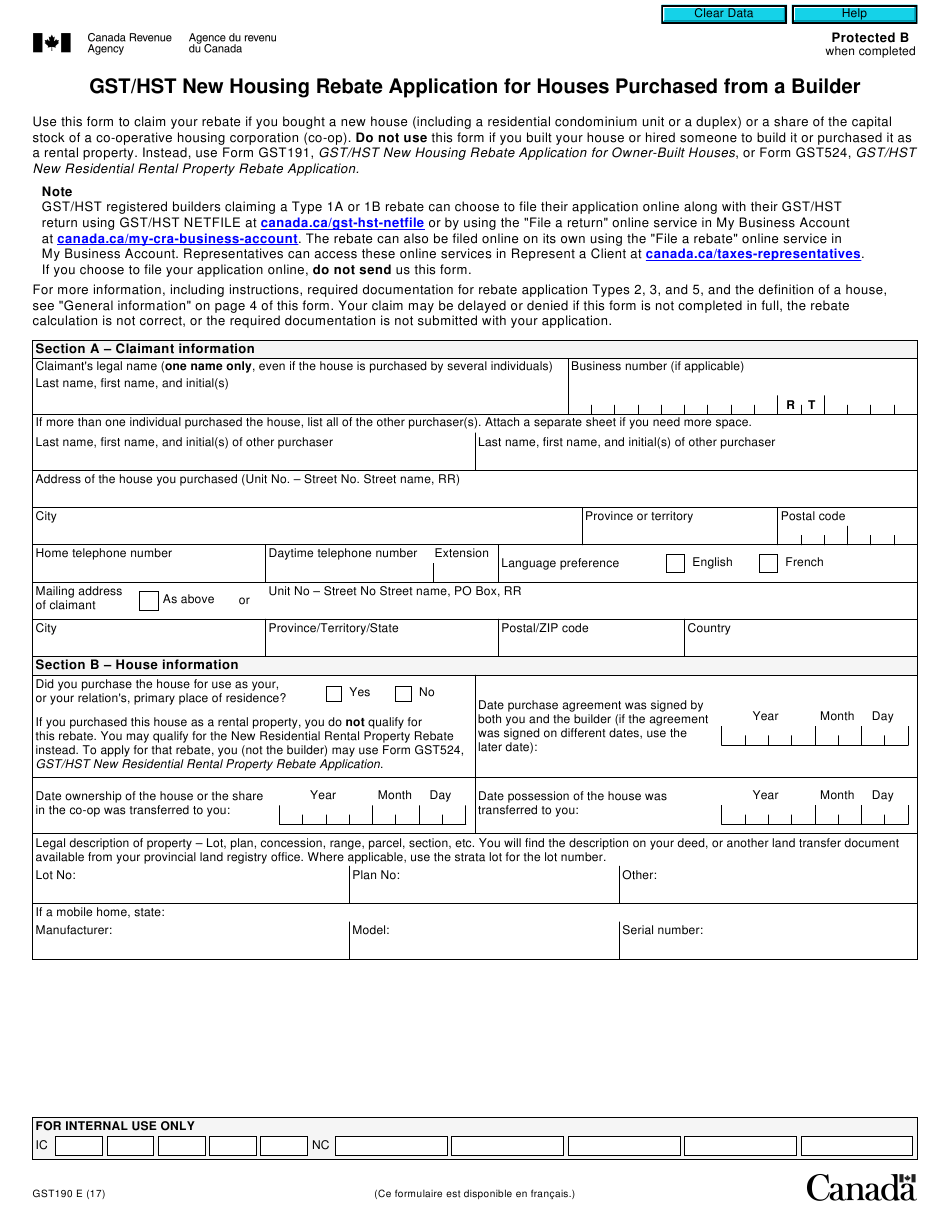

Web 21 d 233 c 2022 nbsp 0183 32 Rental Property GST Rebate for New Residential Homes Insights Every investor who purchased a pre construction property in Calgary needs to look at this Web 3 d 233 c 2020 nbsp 0183 32 All applicants must complete Form GST524 GST HST New Residential Rental Property Rebate Application Depending on the specific situation under which

Web Requirements for the New Residential Rental Rebate First the property must be considered to be a purchase of a newly constructed home from a builder or a Web A supply of the use or right to use real property by way of lease licence or similar arrangement is treated for GST HST purposes as a supply of real property Definition

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

https://img.yumpu.com/6665969/1/500x640/gst524-ontario-rebate-schedule-.jpg

Form GST524 Download Fillable PDF Or Fill Online Gst Hst New

https://www.propertyrebate.net/wp-content/uploads/2022/10/form-gst190-download-fillable-pdf-or-fill-online-gst-hst-new-housing-14.png

https://www.canada.ca/en/revenue-agency/services/forms-publications/...

Web If you are a GST HST registrant you may be able to include your total new residential rental property NRRP rebate amount including any Ontario NRRP rebate amount

https://welchllp.com/.../gst-hst-and-new-residential-rental-properties

Web 2 mars 2022 nbsp 0183 32 To help partially offset the GST HST cost related to new housing landlords that use new housing to generate long term residential rent may be eligible for the

Form GST191 Download Fillable PDF Or Fill Online Gst Hst New Housing

Guide Rc4231 Gst Hst New Residential Rental Property Rebate Property

HOW TO QUALIFY FOR GST HST NEW HOUSING REBATE On RENTAL PROPERTIES

Gst hst Rebate Other Property And Services PropertyRebate

The GST HST NRRP Rebate For Residential Rental Property

All About GST On Rental Property Rajput Jain Associates

All About GST On Rental Property Rajput Jain Associates

Gst Hst New Housing Rebate Application For Owner Built Houses

RAJESH AHUJA NOTARY CORPORATION

GST HST New Residential Rental Property Rebate

Gst Rebate On Rental Property - Web 23 janv 2023 nbsp 0183 32 When you rent out a residential property for residential purposes it is exempt from GST Any other type of lease or renting out of the immovable property for