Gst Refund Application Process The GST Refund Process involves submitting a request processing the application and receiving confirmation through various forms ranging from RFD 01 to RFD 10 This blog dives deep into the GST Refund Process outlining the essential phases steps online tracking and the timeframe for application

A The Government has now decided that that for a refund application assigned to a Central tax officer both the sanction order FORM GST RFD 04 06 and the corresponding payment order FORM GST RFD 05 for the sanctioned refund amount under all tax heads shall be issued by the Central tax officer only Similarly for refund applications RFD 01 is an application for the online processing of refunds under GST It is to be e filed on the GST portal to claim the refund of Taxes cess and interest paid in case of zero rated supplies except the export of goods with tax payment

Gst Refund Application Process

Gst Refund Application Process

https://gstindianews.info/wp-content/uploads/2018/10/GST-Refund-Process.jpg

How To Get GST Refund

https://img.indiafilings.com/learn/wp-content/uploads/2017/06/12010435/GST-Refund-Application-Process.png

GST Refund Key Points To Keep In Mind HSCO

https://hscollp.in/wp-content/uploads/2020/06/gst-refund.jpg

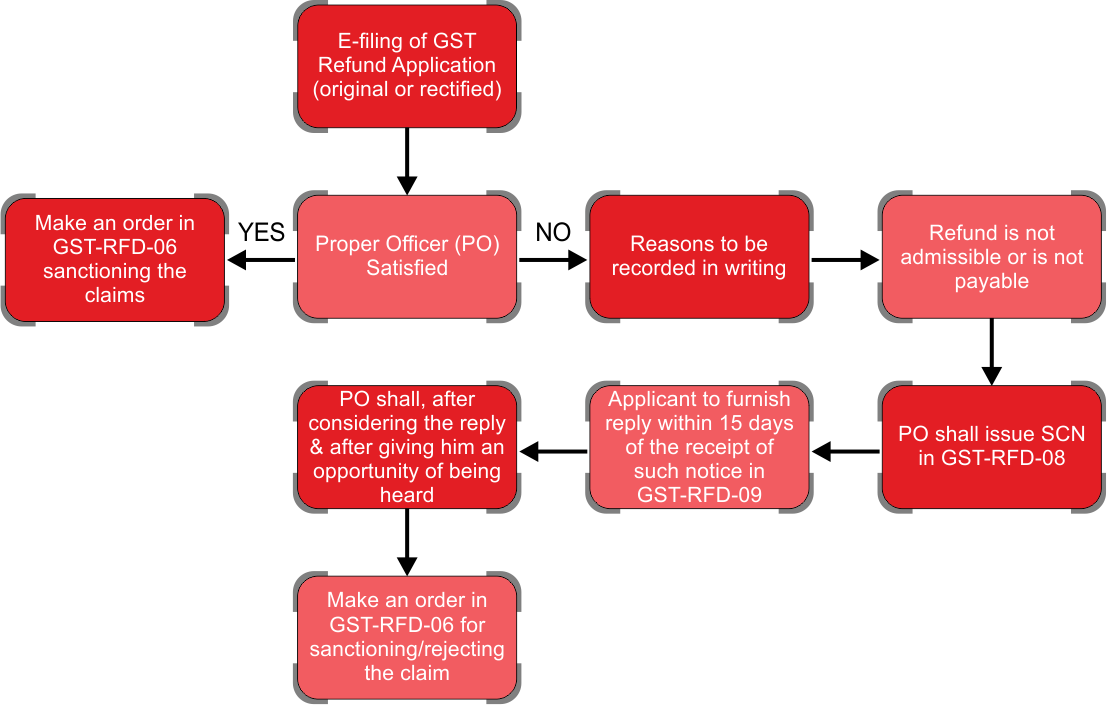

Refund under GST is the process of reversal of taxes paid by the taxpayer for one or the other reason You can claim a refund of the tax that you paid if you are eligible for it by filing a refund return form under GST Filing for GST refunds can be done online with certain amendments like extension for COVID period and time limits for refunds Different forms for claiming vary based on type of refund needed Refund applications must be supported by specific documents Filing process includes submission review and potential deficiency memo issuance

The GST regime aims to simplify and standardize refund procedures through an automated tech driven mechanism for timely processing and disbursal of refunds This guide covers types of refund process documentation timelines and key aspects How can I claim refund of excess amount available in Electronic Cash ledger 1 Login to GST portal for filing refund application under refunds section 2 Navigate toServices Refunds Application for Refund option 3 Select the reason of Refund as Refund on account of excess balance in cash ledger File refund application in GST RFD 01 4

Download Gst Refund Application Process

More picture related to Gst Refund Application Process

GST Refund Key Points To Keep In Mind HSCO

https://hscollp.in/wp-content/uploads/2020/06/gst-flowchart.png

HOW TO APPLY FOR GST REFUND ONLINE Online Refund Of GST Gst Refund

https://i.ytimg.com/vi/_VzD-AfQLyQ/maxresdefault.jpg

FAQs Related To GST Refund Cheng Co Group

https://chengco.com.my/wp/wp-content/uploads/2020/06/GST-Refund_Eng-Cover-scaled.jpg

GST refund refers to the process wherein registered taxpayers can claim any excess charge they paid in terms of GST liability It can be done post submitting a refund application with the required details in the GST portal Refunds Quick Links Track Application Status Loading Top

Learn how to file and claim GST refunds with ease Our comprehensive guide provides a step by step process to help you navigate the application process smoothly Discover the key procedures including the submission of documentary evidence declaration certification requirements and the processing of your refund claim This article provides a useful overview of the GST refund procedure including the eligibility criteria and required documents It s crucial for businesses to understand the process to claim refunds accurately and avoid any non compliance issues

Declaration For Gst Refund

https://caindelhi.in/wp-content/uploads/2021/08/What-is-the-Process-and-Scenario-to-Claim-GST-Refund.jpg

A Comprehensive Guide To GST Refund For Exports

https://mlhnytz51z83.i.optimole.com/w:auto/h:auto/q:mauto/f:avif/https://www.mygstrefund.com/wp-content/uploads/2022/06/1-1-scaled.webp

https://www.theknowledgeacademy.com › blog › gst-refund-process

The GST Refund Process involves submitting a request processing the application and receiving confirmation through various forms ranging from RFD 01 to RFD 10 This blog dives deep into the GST Refund Process outlining the essential phases steps online tracking and the timeframe for application

https://taxguru.in › goods-and-service-tax › refund...

A The Government has now decided that that for a refund application assigned to a Central tax officer both the sanction order FORM GST RFD 04 06 and the corresponding payment order FORM GST RFD 05 for the sanctioned refund amount under all tax heads shall be issued by the Central tax officer only Similarly for refund applications

Loophole In GST Refund Application On Portal ITATOrders in Blog

Declaration For Gst Refund

GST Refund Process 6 Easy Steps To Claim Excess Payment Of GST

GST Refund Claim Process By MyGST Refund Issuu

GST Refund Claim On Input Services U S 54 Of CGST Act

Refund Process Under GST Refund Application Under RFD 01 GST Refund

Refund Process Under GST Refund Application Under RFD 01 GST Refund

Tips To Upload Multiple Invoices With GST Refund Application

GST Official Refund Process Learn Step By Step By Fibota

GST Refund Application Can t Be Rejected On Limitation Since Period

Gst Refund Application Process - Filing for GST refunds can be done online with certain amendments like extension for COVID period and time limits for refunds Different forms for claiming vary based on type of refund needed Refund applications must be supported by specific documents Filing process includes submission review and potential deficiency memo issuance