Gst Refund Application Time Limit Verkko 2 elok 2022 nbsp 0183 32 However vide this amendment since period from 1 st March 2020 to 28 th February 2022 is excluded the new time limit for applying for refund would be 1 st

Verkko 13 huhtik 2020 nbsp 0183 32 Time Limit to apply for the GST Refund GST refund application needs to be filed within 2 years from the relevant date Relevant date is provided under section 54 of CGST Act which is Verkko 27 marrask 2023 nbsp 0183 32 A9 Yes the time limit for issuing a refund order is 60 days from the date of receipt of a completed application Q10 Has there been any relaxation due

Gst Refund Application Time Limit

Gst Refund Application Time Limit

https://i.ytimg.com/vi/_VzD-AfQLyQ/maxresdefault.jpg

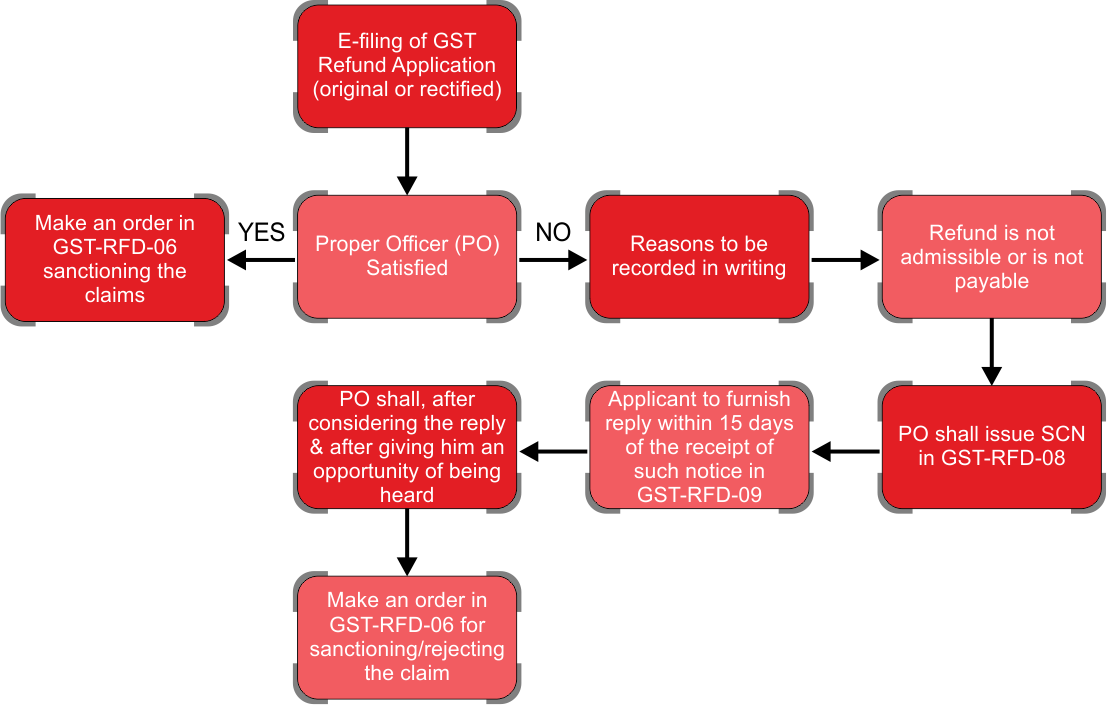

Notice For Rejection Of GST Refund In Form RFD08 Notice For GST

https://i.ytimg.com/vi/gzv1kzO-7ZU/maxresdefault.jpg

GST Refund Key Points To Keep In Mind HSCO

https://hscollp.in/wp-content/uploads/2020/06/gst-refund.jpg

Verkko According to the GST law and recommendations a refund application is to be processed within a period of 90 days If the refund application is not processed within Verkko 8 helmik 2023 nbsp 0183 32 How to claim GST refund The refund application has to be made in Form RFD 01 within 2 years from relevant date The form should also be certified by a Chartered Accountant You can file your

Verkko Time limit and frequency for claiming refund of accumulated ITC As per Section 54 of the CGST Act any person claiming the refund of GST or the interest paid should Verkko 13 rivi 228 nbsp 0183 32 Where the time limit to pass orders for rejecting any refund claim fully or partly falls between 15th April 2021 and 30th May 2021 it is extended The extended time limit shall be later of two dates 1 15

Download Gst Refund Application Time Limit

More picture related to Gst Refund Application Time Limit

GST Refund Application For IGST Paid Instead Of CGST SGST To Be Filed

https://www.taxmann.com/post/wp-content/uploads/2023/01/GST-Refund-application-for-IGST-paid-instead-of-CGST-SGST-to-be-filed-separately.jpg

Time Limit For Refund Application Under GST

https://taxguru.in/wp-content/uploads/2021/08/Refund-Application.jpg

GST Refund For Exporters Application Time Limit

https://desk.zoho.com/DocsDisplay?zgId=675425301&mode=inline&blockId=ki6krc0b9206d99544ae3990afa1b3690bed2

Verkko 14 hein 228 k 2020 nbsp 0183 32 Claiming GST Refunds is squared into a time frame The refunds may best be claimed within the boundaries of this time frame A GST refund may be Verkko Where the time limit to pass orders for rejecting any refund claim fully or partly falls between 15th April 2021 and 30th May 2021 it is extended The extended time limit shall be later of two dates 1 15 days after

Verkko 22 tammik 2023 nbsp 0183 32 The process of refund is online and time limits have also been set for the same You can exclude the COVID pandemic period 1st March 2020 and 28th Verkko 23 tammik 2023 nbsp 0183 32 Let s get started The time limit for GST refund is 60 days from the date of receipt of the application complete in all respects However in case of non

GST Refund Procedure And Limitations

https://taxguru.in/wp-content/uploads/2021/09/GST-Refund-procedure-and-limitations.jpg

GST Refund Key Points To Keep In Mind HSCO

https://hscollp.in/wp-content/uploads/2020/06/gst-flowchart.png

https://taxguru.in/.../extension-time-limits-gst-refund.html

Verkko 2 elok 2022 nbsp 0183 32 However vide this amendment since period from 1 st March 2020 to 28 th February 2022 is excluded the new time limit for applying for refund would be 1 st

https://taxguru.in/.../gst-refund-applicability-ti…

Verkko 13 huhtik 2020 nbsp 0183 32 Time Limit to apply for the GST Refund GST refund application needs to be filed within 2 years from the relevant date Relevant date is provided under section 54 of CGST Act which is

Loophole In GST Refund Application On Portal ITATOrders in Blog

GST Refund Procedure And Limitations

GST Refund Applicability Time Limit Procedure

Tips To Upload Multiple Invoices With GST Refund Application

2 Years Time Limit For Making GST Refund Application Directory In

Manual

Manual

GST Refund Time Limit

GST Notice Reply Service In Pan India Rs 5000 session HSVJ CO ID

GST Refund Application Can t Be Rejected On Limitation Since Period

Gst Refund Application Time Limit - Verkko Time limit and frequency for claiming refund of accumulated ITC As per Section 54 of the CGST Act any person claiming the refund of GST or the interest paid should