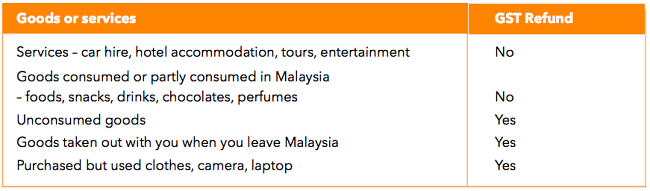

Gst Refund In Malaysia Claiming GST Refunds Any refund of tax may be offset against other unpaid GST customs and excise duties Refund will be made to the claimant within 14 working days if the

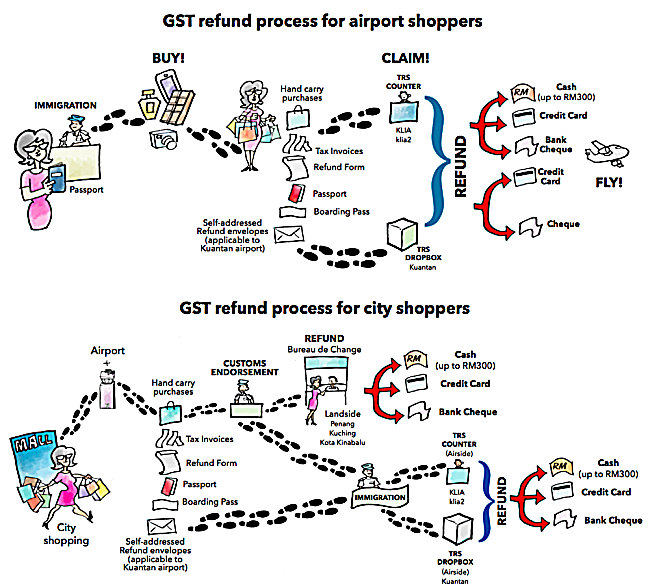

The tax itself is not a cost to the intermediaries since they are able to claim back GST incurred on their business inputs GST is imposed on goods and services at every production and distribution stage in the supply chain Tourist Refund Scheme TRS allows tourists to claim a refund of the Goods and Services Tax GST they paid on eligible goods purchased from Approved Outlets shops that

Gst Refund In Malaysia

Gst Refund In Malaysia

https://www.12fly.com.my/images/lifestyle/Travel/2015/march/gst-refund-for-tourist/image1.png

How To Claim gst Refund In Malaysia Stephanie Kerr

https://ebizfiling.com/wp-content/uploads/2022/03/GST-RETURNS-ON-EXPORTS.png

How To Claim gst Refund In Malaysia Michael James

https://www.deskera.com/care/content/images/2021/10/Screenshot-2021-10-20-at-2.43.36-PM.png

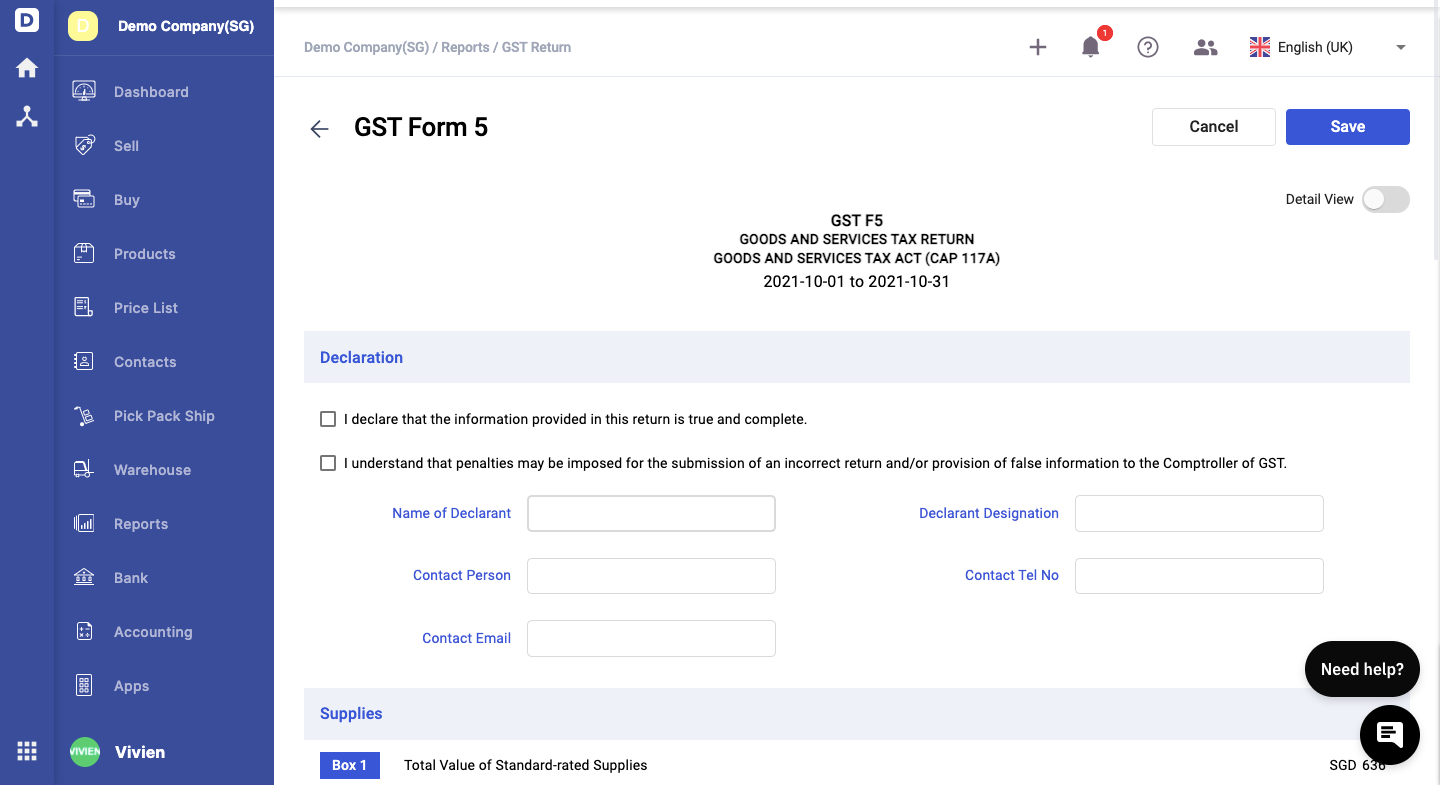

What is a VAT Refund The VAT Value Added Tax or GST Goods and Services Tax in Malaysia is a form of tax levied on most goods and services For The tourist should be ready to present the tax invoice or receipt the completed original refund form and the eligible goods for export to an RMCD Officer for verification at the GST Customs Refund Verification

According to the GST law a GST refund should be made to the taxpayer within 14 days for online submission or 28 days for manual submission from the day Customs August 28 2020 On 16th June 2020 Royal Malaysian Customs Department RMCD has announced the Frequently Asked Questions FAQs related to GST refund as below Table of Contents 1 Where

Download Gst Refund In Malaysia

More picture related to Gst Refund In Malaysia

GST Refund Singapore The Singapore Guide

http://the-singapore-guide.com/wp-content/uploads/2012/07/VAT-Refund-in-Singapore.jpg

How To Claim GST Refund For Tourists In Singapore Procedure

https://yoursingaporeguide.com/wp-content/uploads/2018/09/GST-refund-counter-at-Changi-Airport.png

Businesses With Turnover Over Rs 2 Cr Can Start Filing GST Audit

https://www.thestatesman.com/wp-content/uploads/2019/04/GST.jpg

With effect from 1 st April 2015 Goods Service Tax GST will be implemented throughout Malaysia Thus tourist to Malaysia can apply for GST Refund on eligible goods purchased in Malaysia when A Tourist Refund Scheme TRS is a scheme that allows any tourist who qualifies to claim a refund of GST paid on certain goods purchased in Malaysia from approved outlets g he has spent at least three hundred

A Tourist Refund Scheme TRS is a scheme that allows any tourist who qualifies to claim a refund of Goods and Services Tax GST paid on certain goods purchased in Malaysia Claiming your GST Refund Malaysia is not difficult but you need to know what to do before you make your purchases With updated information on how to follow

How To Claim gst Refund In Malaysia RivertaroSchmidt

https://enterslice.com/learning/wp-content/uploads/2017/07/Eligibility-to-Claim-Input-Tax-Credit-under-GST.png

Foreign Tourists Might Soon Start Getting GST Refund For Local Shopping

https://static.toiimg.com/photo/93301040/gst.jpg?width=748&resize=4

https://www.customs.gov.my/en/ip/Pages/ip_cr.aspx

Claiming GST Refunds Any refund of tax may be offset against other unpaid GST customs and excise duties Refund will be made to the claimant within 14 working days if the

https://www.customs.gov.my/en/faq/Pag…

The tax itself is not a cost to the intermediaries since they are able to claim back GST incurred on their business inputs GST is imposed on goods and services at every production and distribution stage in the supply chain

Affect Of GST On Export Of Goods GST Refund Claimed Services

How To Claim gst Refund In Malaysia RivertaroSchmidt

How To Claim gst Refund In Malaysia RivertaroSchmidt

17 Questions You Might Have About GST Refund For Tourist In Malaysia

A Comprehensive Guide To GST Refund For Exports

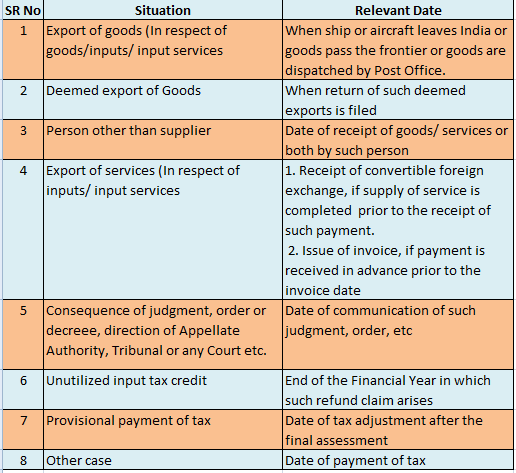

GST Refund For Taxation II What Is Refund GST Paid Is More Than The

GST Refund For Taxation II What Is Refund GST Paid Is More Than The

How To Claim gst Refund In Malaysia Connor Baker

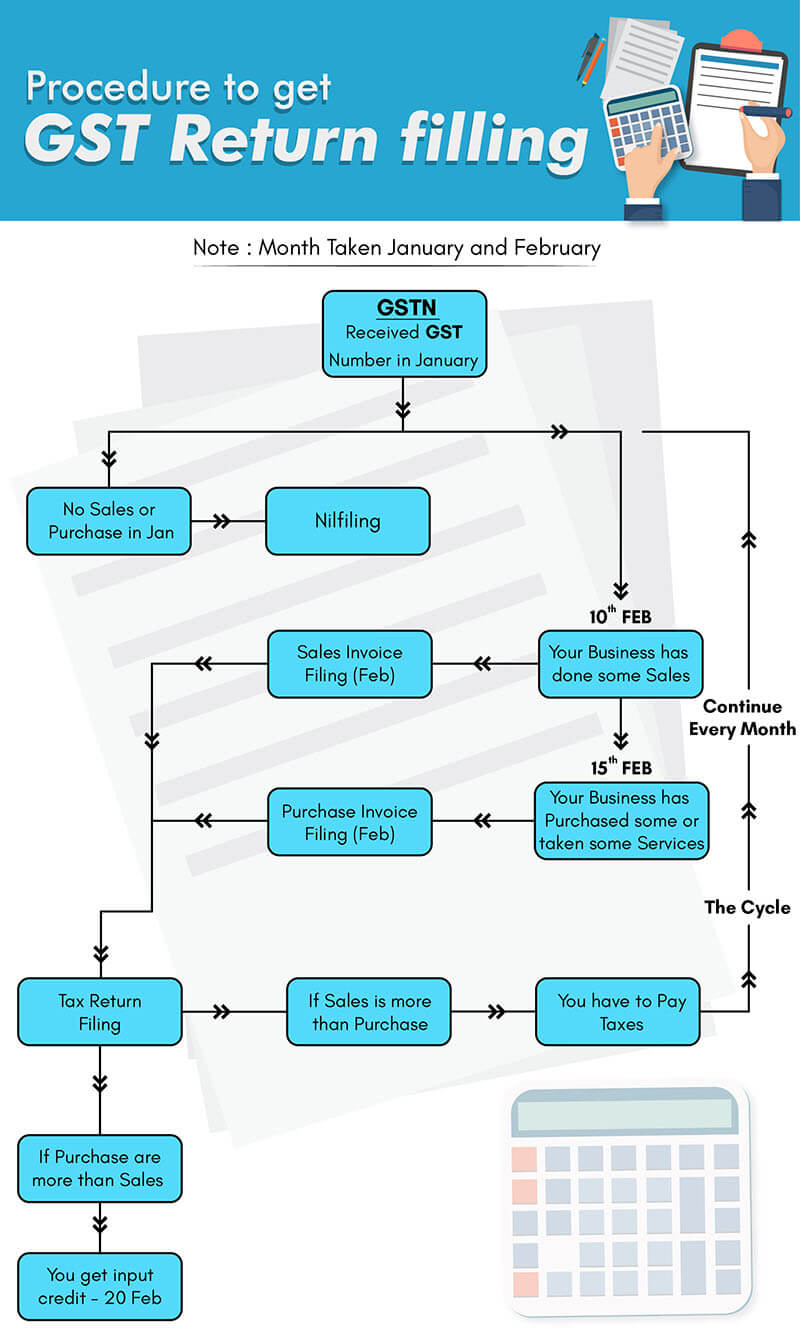

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

Report On GST Refund Process REPORT OF THE JOINT COMMITTEE ON

Gst Refund In Malaysia - August 28 2020 On 16th June 2020 Royal Malaysian Customs Department RMCD has announced the Frequently Asked Questions FAQs related to GST refund as below Table of Contents 1 Where