Gst Return Filing Date 2024 The last date to file gstr 3b for April 2023 is 20th July 2023 In a nutshell by keeping track of the GST return due date you can prevent penalties and late payment fees GST Return Due Dates GST Monthly Calendar 2024 helps businesses and professionals to keep a track of the GST return filing dates

Key lodgment and payment dates for business GST annual returns and instalments 28 July GST instalments Quarter 4 April June instalment notices forms S and T Final date for payment and if varying the instalment amount lodgment 21 August Final date for eligible monthly GST reporters to elect to report GST annually 28 October Upcoming Due Dates to file GST Returns The due dates for filing GST returns can be extended by issuing orders or notifications Here we have the list of GST return due dates for the FY 2024 25 Download FY 2024 25 calendar here GST return filing calendar April 2024 March 2025 Upcoming due dates for all returns up to June

Gst Return Filing Date 2024

Gst Return Filing Date 2024

https://www.sensystechnologies.com/blog/wp-content/uploads/2022/04/20220429_120210-768x524.jpg

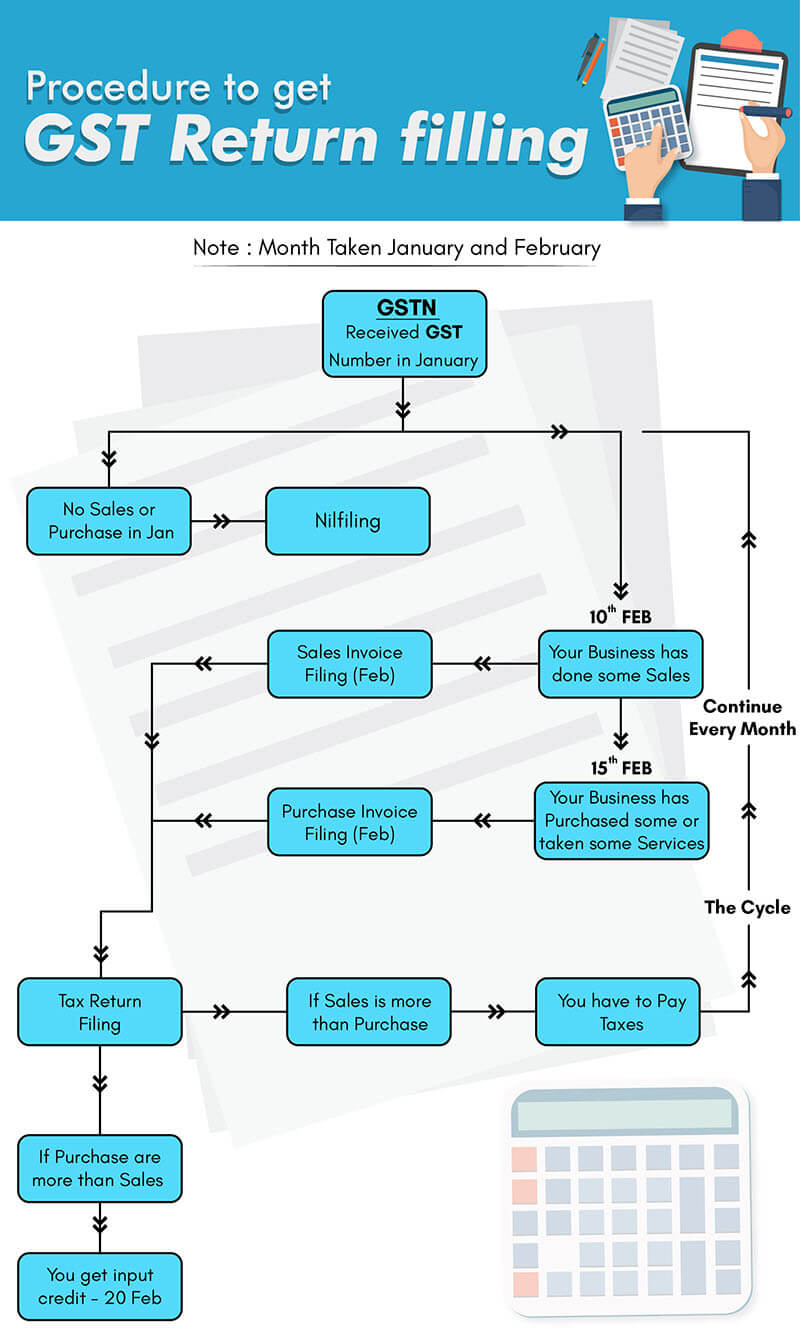

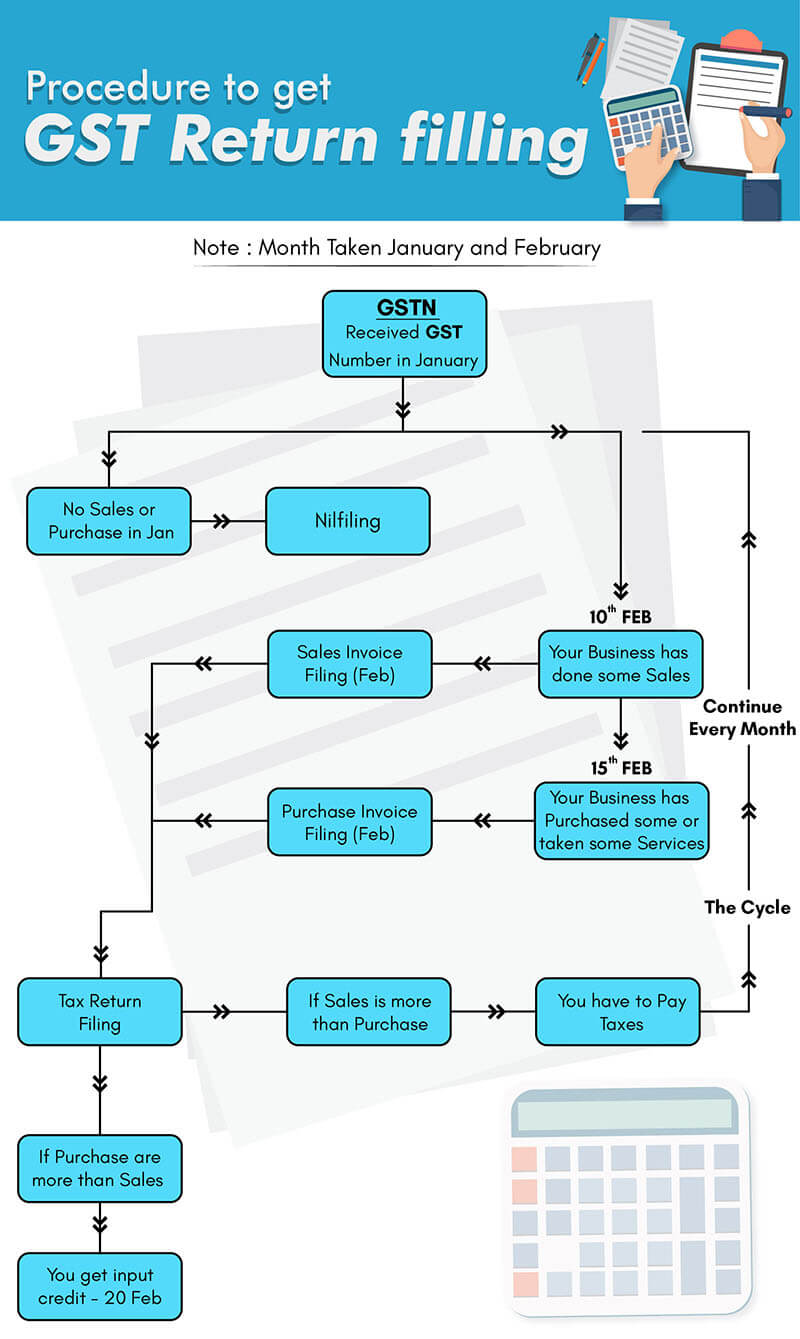

PROCESS FOR GST RETURN FILING SERVICES ONLINE CA CS ADV Service PUNE

https://legaldocs.co.in/img/gst-filling/gst-return-filling.jpg

GSTR 9 Return How To Fill File GSTR 9 Return WAG Consulting Group

https://wagconsulting.in/wp-content/uploads/2020/10/one-year-of-gst-the-hits-misses-and-opportunities-around-indias-biggest-tax-reform.jpg

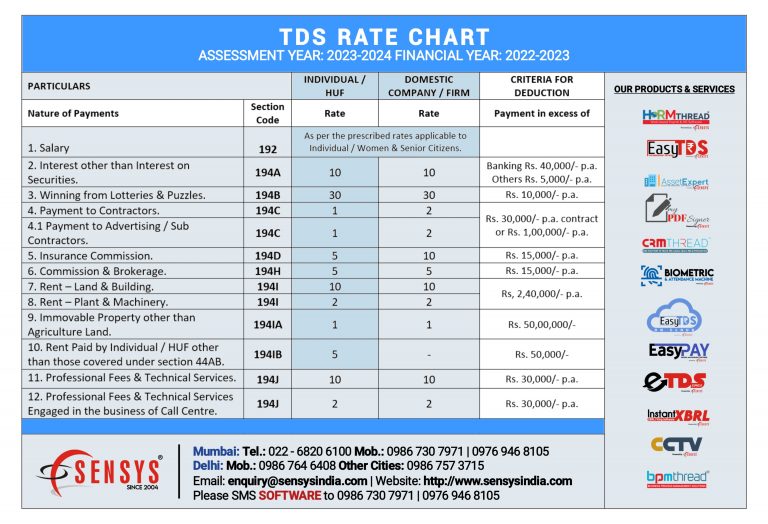

Updated on Apr 15th 2024 17 min read GSTR 1 is a monthly quarterly return that summarises all sales outward supplies of a taxpayer You must make sure that a valid GSTIN is filled while entering sales invoice details Basics of GSTR 1 What is GSTR 1 A list of such compliances required to be done in the financial year 2024 25 has been covered in this article 1 Yearly Compliances The list of yearly compliances has been enumerated in the table below 2 Half Yearly Compliances The list of half yearly compliances has been enumerated in the table below 3 Quarterly Compliances

If a due date falls on a weekend or public holiday we can receive your return and payment on the next working day without a penalty being applied Where a payment due date falls on a provincial anniversary date this only applies if you re in the province celebrating the holiday and only if you usually make tax payments over the counter at Are filing a GST HST return for a filing period beginning on or after January 1 2024 and before April 1 2024 The following information will help you complete and file a return Sections When to file Find out the GST HST filing and payment deadlines Calculate the net tax Methods for calculating your net tax

Download Gst Return Filing Date 2024

More picture related to Gst Return Filing Date 2024

Relief To Taxpayers Govt Extends GST Return Filing Date To Oct 25

https://cdn.statically.io/img/blog.ziploan.in/wp-content/uploads/2018/10/GST.jpg

GST Return Filing In India Types Steps And Documents Required

https://static-assets.business.amazon.com/assets/in/31st-march/370_AB_Marketing-Website_GST_2800x960_A.jpg.transform/2880x960/image.jpg

Government Extends GST Return Filing Date To August 25 Times Of India

https://static.toiimg.com/thumb/msid-60135305,width-1070,height-580,imgsize-120527,resizemode-75,overlay-toi_sw,pt-32,y_pad-40/photo.jpg

Date modified 2024 05 07 GST HST Information on handling your GST HST returns online how to get GST HST returns methods to file GST HST returns when to file GST HST returns and consequences for filing a GST HST return late Due Dates Year 2024 31 Jan 2024 Property Tax 2024 Property Tax Bill 31 Jan 2024 e Submission e Submission of Donation 31 Jan 2024 Goods And Services Tax GST File GST return period ending in Dec 01 Mar 2024 e Submission e Submission of Employment Income 01 Mar 2024 e Submission e Submission of Commission

Top Stories GST Compliance Due Date Calendar March 2024 Edition Adhere to Due Dates to Stay Compliant and avoid penalties By Manu Sharma On March 2 2024 1 47 pm 2 mins read This article offers the Goods and Services Tax Compliance schedule for March 2024 For reporting periods that begin after December 31 2023 all GST HST registrants with the exception of charities and selected listed financial institution SLFIs are required to file returns electronically If you continue to file a

Gst Return Filing At Rs 1500 person In Aurangabad ID 23180758273

https://5.imimg.com/data5/SELLER/Default/2021/2/CA/CZ/OB/124046853/gst-return-filing-1000x1000.jpg

GST Return Filing Date Extended GST Suvidha Kendra

https://s3.amazonaws.com/lms24x7/gsktestimonials/uploads/2020/10/01134840/GST-Return-filing-date-extended-1024x512.jpg

https://www.taxmani.in/gst/gst-return-due-date.html

The last date to file gstr 3b for April 2023 is 20th July 2023 In a nutshell by keeping track of the GST return due date you can prevent penalties and late payment fees GST Return Due Dates GST Monthly Calendar 2024 helps businesses and professionals to keep a track of the GST return filing dates

https://www.ato.gov.au/.../due-dates-by-topic/goods-and-services-tax

Key lodgment and payment dates for business GST annual returns and instalments 28 July GST instalments Quarter 4 April June instalment notices forms S and T Final date for payment and if varying the instalment amount lodgment 21 August Final date for eligible monthly GST reporters to elect to report GST annually 28 October

Due Dates For GST Returns Types Of GST Returns Ebizfiling

Gst Return Filing At Rs 1500 person In Aurangabad ID 23180758273

GST Return Filing In Simple Steps Know How To File GSTR 1 GSTR 3B

GST Return Filing Due Date Extended For July August Month

Govt Extends GST Return Filing Date To August 25 Auto News ET Auto

Big Relief For GST Taxpayers Return Filing Date Extended GST

Big Relief For GST Taxpayers Return Filing Date Extended GST

GST Return Filing Date Has Extended YouTube

Gst Return Filing Due Date GSTHero Online GST Return Filing E Way

GST Returns

Gst Return Filing Date 2024 - What are the Types of GST Returns and Their Due Dates In 2024 May 30 2024 12 Mins Read A GST return is a document that contains information about a taxpayer s sales purchases and tax liability under