Hawaii State Tax Credit For Solar Which cities have better solar tax exemptions and rebates in Hawaii Should I buy or lease my solar panels Learn about Hawaii solar incentives solar panel pricing tax credits and

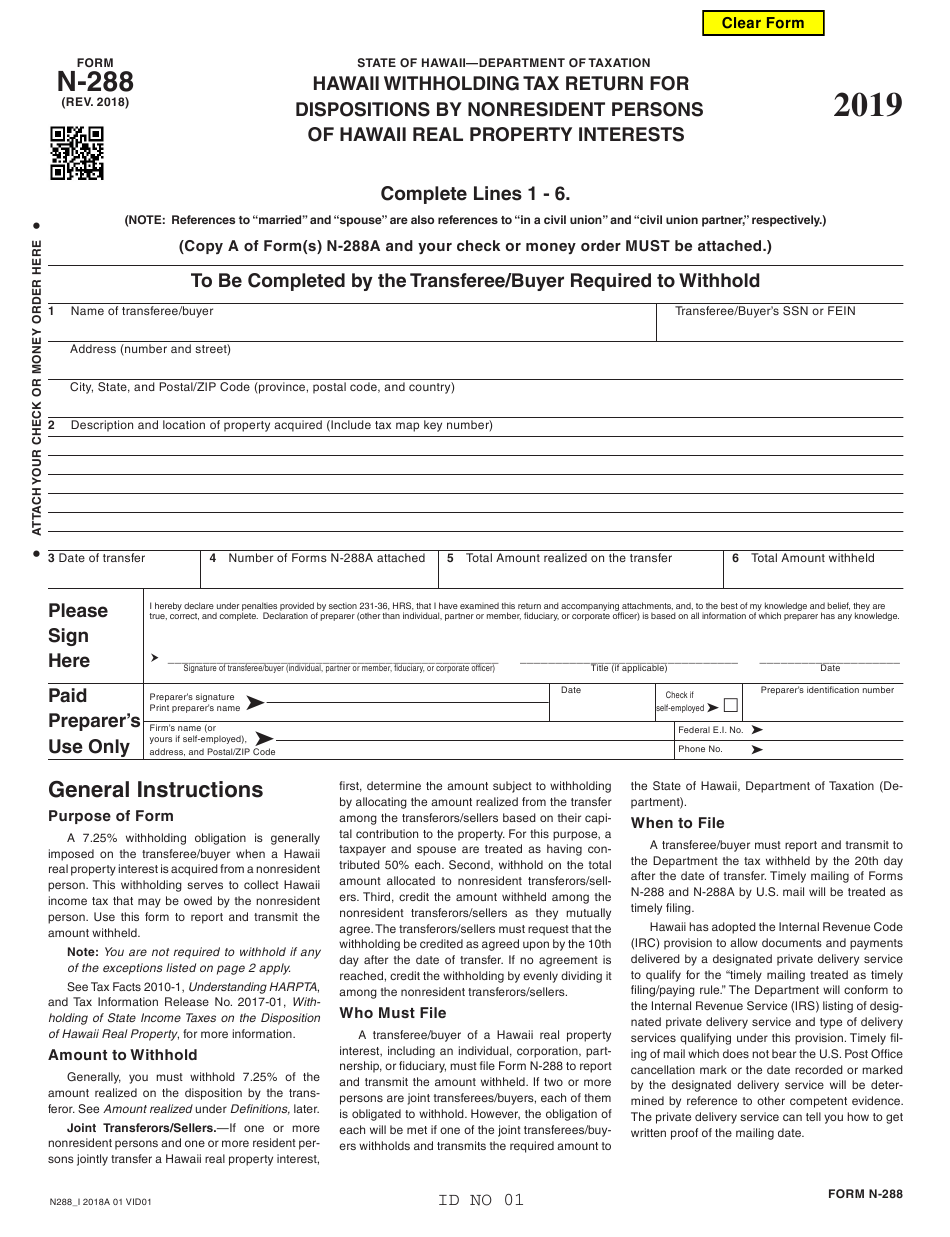

The Renewable Energy Technologies Income Tax Credit RETITC is a Hawai i State tax credit that allows individuals or corporations to claim an income tax credit for up to 35 To qualify for Hawaii s generous solar tax credit of up to 5 000 you must be a resident of the Aloha State and own and live in the home where the solar PV system is installed Both homeowners and

Hawaii State Tax Credit For Solar

Hawaii State Tax Credit For Solar

https://news.measuresolar.com/wp-content/uploads/2022/03/Large-Rectangle-2-1-1536x864.png

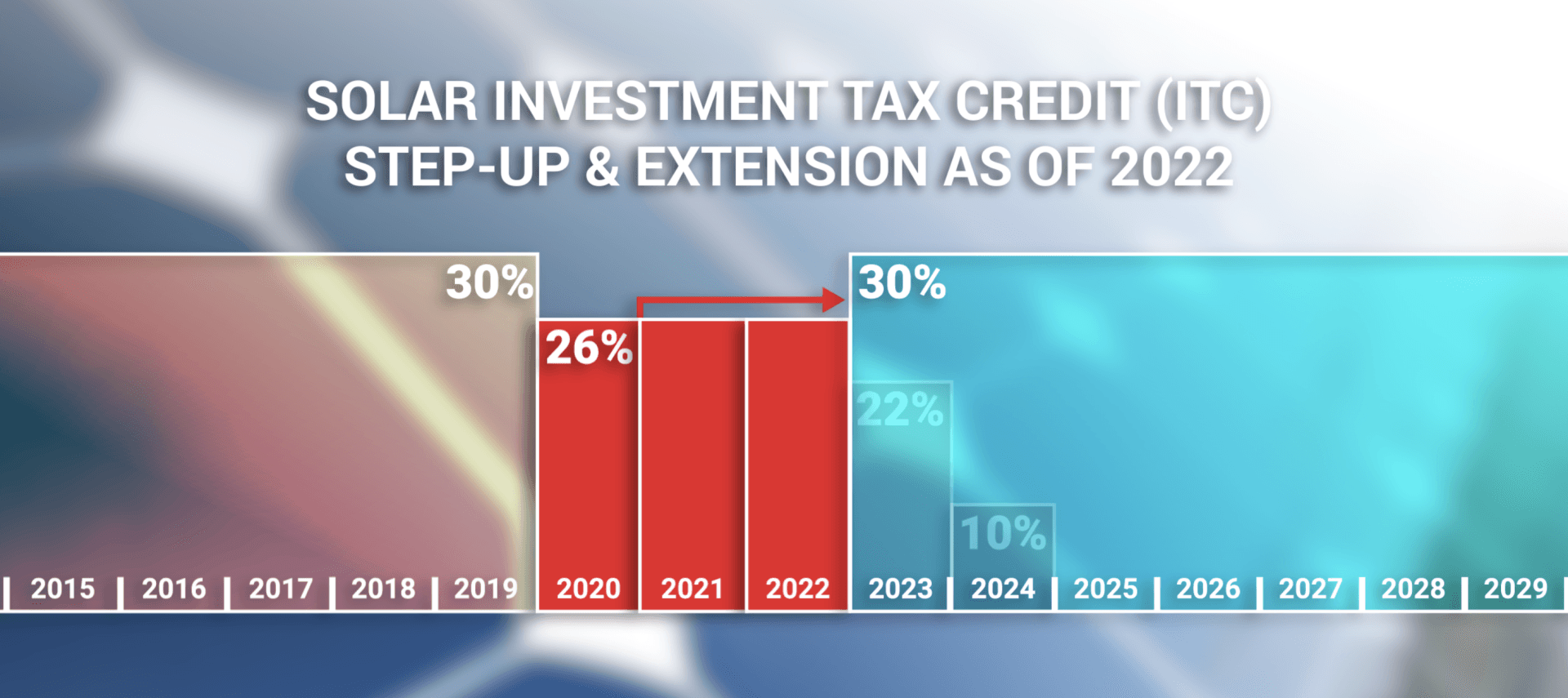

Solar Tax Credit

https://lirp.cdn-website.com/af303f9d/dms3rep/multi/opt/Screen+Shot+2022-12-11+at+5.33.42+PM-1920w.png

Understanding Tax Credits For Solar Energy Systems

https://thenewutility.com/wp-content/uploads/2016/11/solar-tax-credits.jpg

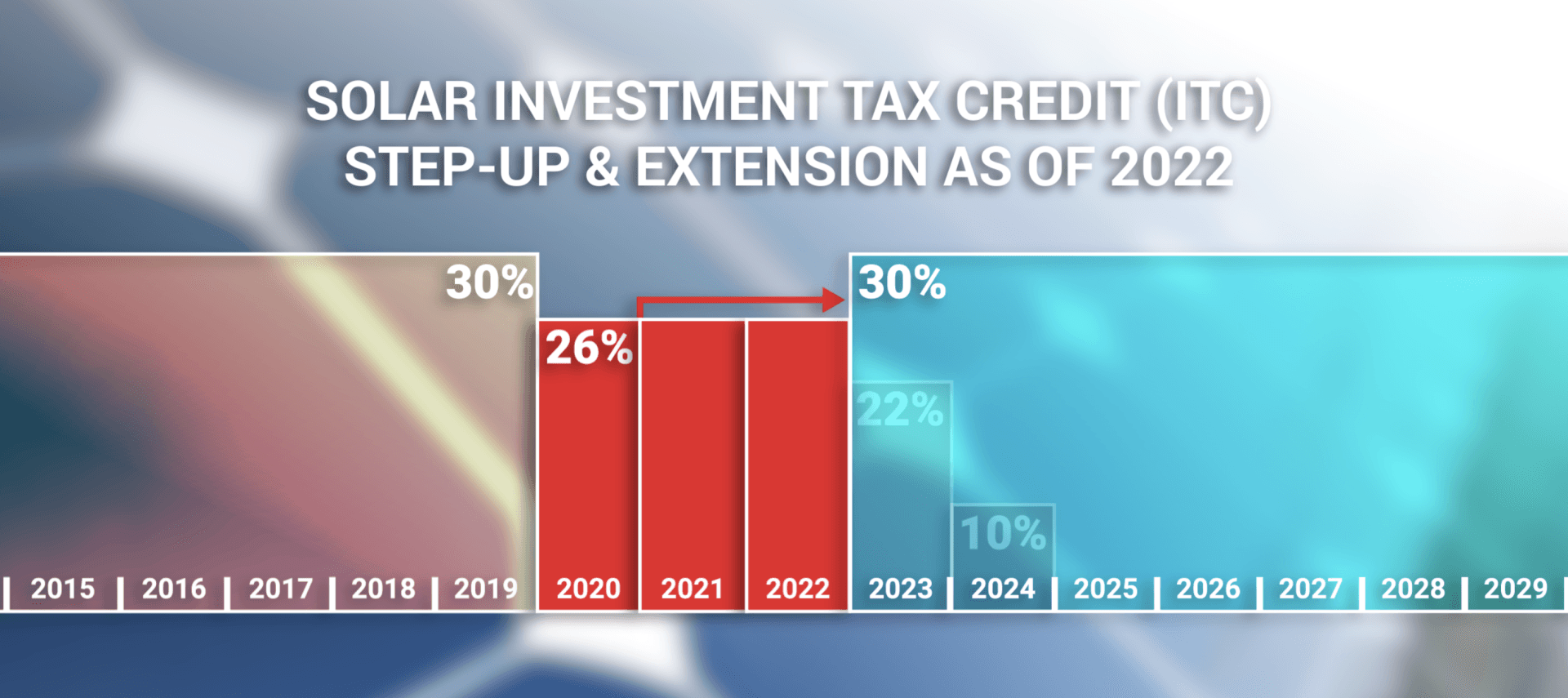

Under the RETITC rules all other solar energy systems such as photovoltaic systems must meet the new total output capacity requirements or an Any individual or corporate taxpayer who is eligible to claim the renewable energy technologies income tax credit for 10 or more systems or distributive shares of systems

Hawaii s 35 solar tax credit Here s where Hawaii wins when it comes to solar If you buy a solar system in the Aloha state you ll see 35 of the cost up to 2 250 come back Tax Credit Photovoltaic Systems This Tax Facts provides information about the renewable energy technologies income tax credit RETITC specifically the credit on the

Download Hawaii State Tax Credit For Solar

More picture related to Hawaii State Tax Credit For Solar

The Homeowner s Short Guide To The Hawaii Solar Tax Credit

https://www.maui-solar.com/wp-content/uploads/2019/03/Hawaii-Solar-Tax-Credit.jpg

Tution Tax Credit For Students NCS CA

https://www.ncscorp.ca/wp-content/uploads/2022/03/Untitled-design-12-e1648708763193.png

Federal Solar Tax Credits For Businesses Department Of Energy

https://www.energy.gov/sites/default/files/styles/full_article_width/public/2022-10/Summary-ITC-and-PTC-Values-Table.png?itok=_72eWNBC

Hawaii Solar Tax Credit Explained The Hawaii state solar tax credit is known as the Renewable Energy technologies Income Tax credit or RETITC When applied the credit directly reduces the amount Only the economic owner of the photovoltaic PV system may claim the credit The economic owner of the system need not be the owner of the property being served by

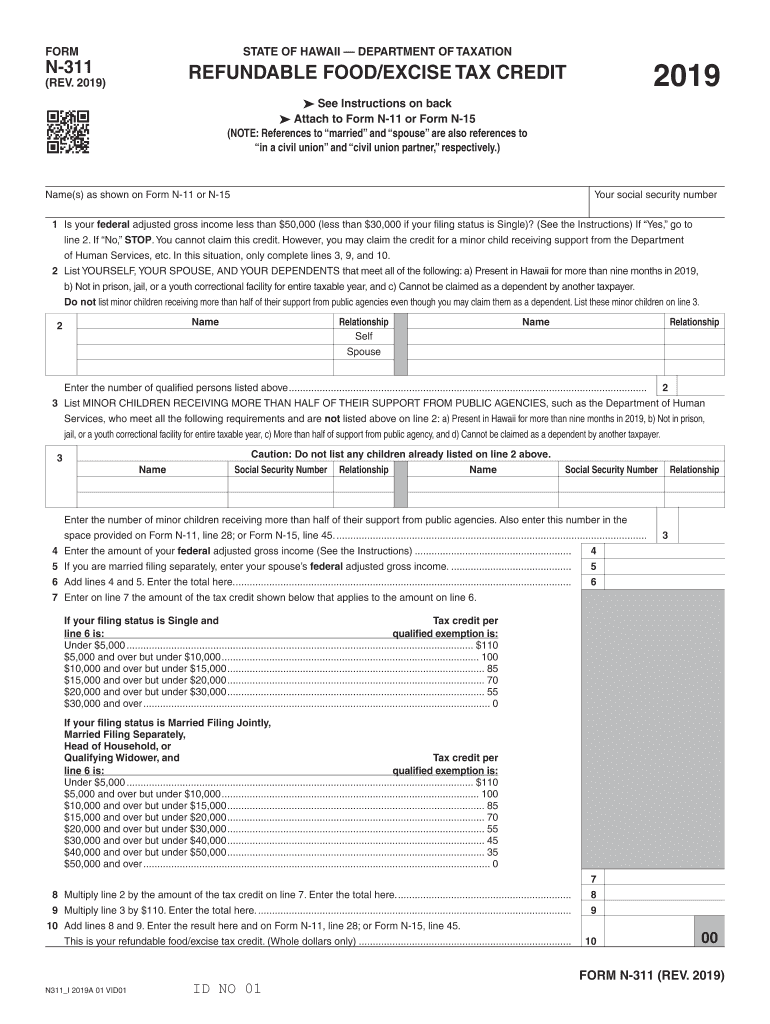

Q Who is eligible for tax credits A Homeowners including renters for certain expenditures who purchase energy and other efficient appliances and products Q Hawaiians looking to power their homes with clean sustainable energy have access to a few cost cutting solar incentives that can help speed up their payback

Filing Hawaii State Tax Things To Know Credit Karma

https://creditkarma-cms.imgix.net/wp-content/uploads/2018/11/GettyImages-545185575-TXSTHI-e1542728093402.jpg

California Earned Income Tax Credit CalEITC

https://res.cloudinary.com/yansusanto/image/upload/v1622380808/CA.png

https://www.forbes.com/.../hawaii-solar-in…

Which cities have better solar tax exemptions and rebates in Hawaii Should I buy or lease my solar panels Learn about Hawaii solar incentives solar panel pricing tax credits and

https://energy.hawaii.gov/.../income-guidelines-and-tax-resources

The Renewable Energy Technologies Income Tax Credit RETITC is a Hawai i State tax credit that allows individuals or corporations to claim an income tax credit for up to 35

How Does The Federal Tax Credit For Solar Work Tampa Bay Solar

Filing Hawaii State Tax Things To Know Credit Karma

Another Way To Save New Tax Credit For Plan Participants

Solar Growing In Iowa Howard County Energy District

US Treasury Department Issues Guidelines Around A New Tax Credit For

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

How To Claim The Federal Solar Tax Credit Form 5695 Instructions

Hawaii State Tax Withholding Form 2022 WithholdingForm

Hawaii State Income Tax Fill Out Sign Online DocHub

Georgia Tax Credits For Workers And Families

Hawaii State Tax Credit For Solar - Hawaii has a 35 state tax credit for wind and solar energy systems Honolulu provides its residents who are solar owners with a property tax exemption The