Health Care Costs Tax Credit The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put on your Marketplace application You may be allowed a premium tax credit if You or a tax family member enrolled in health insurance coverage through the Marketplace for at least one month of a calendar year in which the enrolled individual was not eligible for affordable coverage through an eligible employer sponsored plan that provides minimum value or eligible to

Health Care Costs Tax Credit

![]()

Health Care Costs Tax Credit

https://lifetimeparadigm.com/wp-content/uploads/2021/09/Health-care-costs-retirement-Depositphotos_118559288_xl-2015-small-web-2500-pixels.jpg

The Burden Of Health Care Costs RAND

https://wwwassets.rand.org/content/rand/multimedia/video/2020/01/28/the-burden-of-health-care-costs/jcr:content/par/teaser_copy_copy.fit.0x1200.jpeg/1580242611828.jpeg

Managing Rising Healthcare Costs In 2023 Strategies For Employers

https://capital-services.com/wp-content/uploads/2023/03/Healthcare-cost-.jpg

Everything You Need to Know About The Health Care Tax Credit Need to get health insurance through an Affordable Care Act exchange You may be eligible for help We would like to show you a description here but the site won t allow us

The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit The ACA established two types of cost sharing reductions CSRs One type of subsidy reduces annual cost sharing limits the other directly reduces cost sharing requirements e g lowers a deductible Individuals

Download Health Care Costs Tax Credit

More picture related to Health Care Costs Tax Credit

Report Billions Of Health Care Dollars Supported Cincinnati Economy In

http://media.bizj.us/view/img/1731571/health-care-costs*1200.jpg

Rationing Of Health Care Private Gain Vs The Common Good HuffPost

http://i.huffpost.com/gen/1111198/images/o-HEALTH-CARE-COSTS-facebook.jpg

2023 Medicare Premiums And Open Enrollment

https://www.myfederalretirement.com/wp-content/uploads/2021/11/2023-medicare-premiums.jpg

To be eligible to receive the premium tax credit in 2022 individuals must have annual household income at or above 100 of the federal poverty level not be eligible for certain types of health insurance coverage with exceptions file federal income tax returns and enroll in a plan through The premium tax credit is a refundable tax credit that helps cover the cost of health insurance premiums It s available to taxpayers who have purchased a health insurance plan from the

A premium tax credit can help you save on health insurance costs by reducing your monthly bill It s only available for those who purchase insurance through a state or federal health insurance marketplace and your income must fall below a certain threshold to qualify The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with your tax return to qualify for it

Health Insurance Costs Cost Of Health Insurance Health Ca Flickr

https://live.staticflickr.com/7472/16348712205_ae6ef7e44d_b.jpg

Managing Your Healthcare Costs MaineHealth

https://mainehealthaco.org/-/media/Learning-Resource-Center/Images/Health-care-costs.jpg?h=400&w=400&hash=856D2FD9E7CB78A3A175612137C2A550

https://www. irs.gov /affordable-care-act/...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the Health Insurance Marketplace To get this credit you must meet certain requirements and file a tax return with Form 8962 Premium Tax Credit PTC

https://www. healthcare.gov /taxes

A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax credit is based on the income estimate and household information you put on your Marketplace application

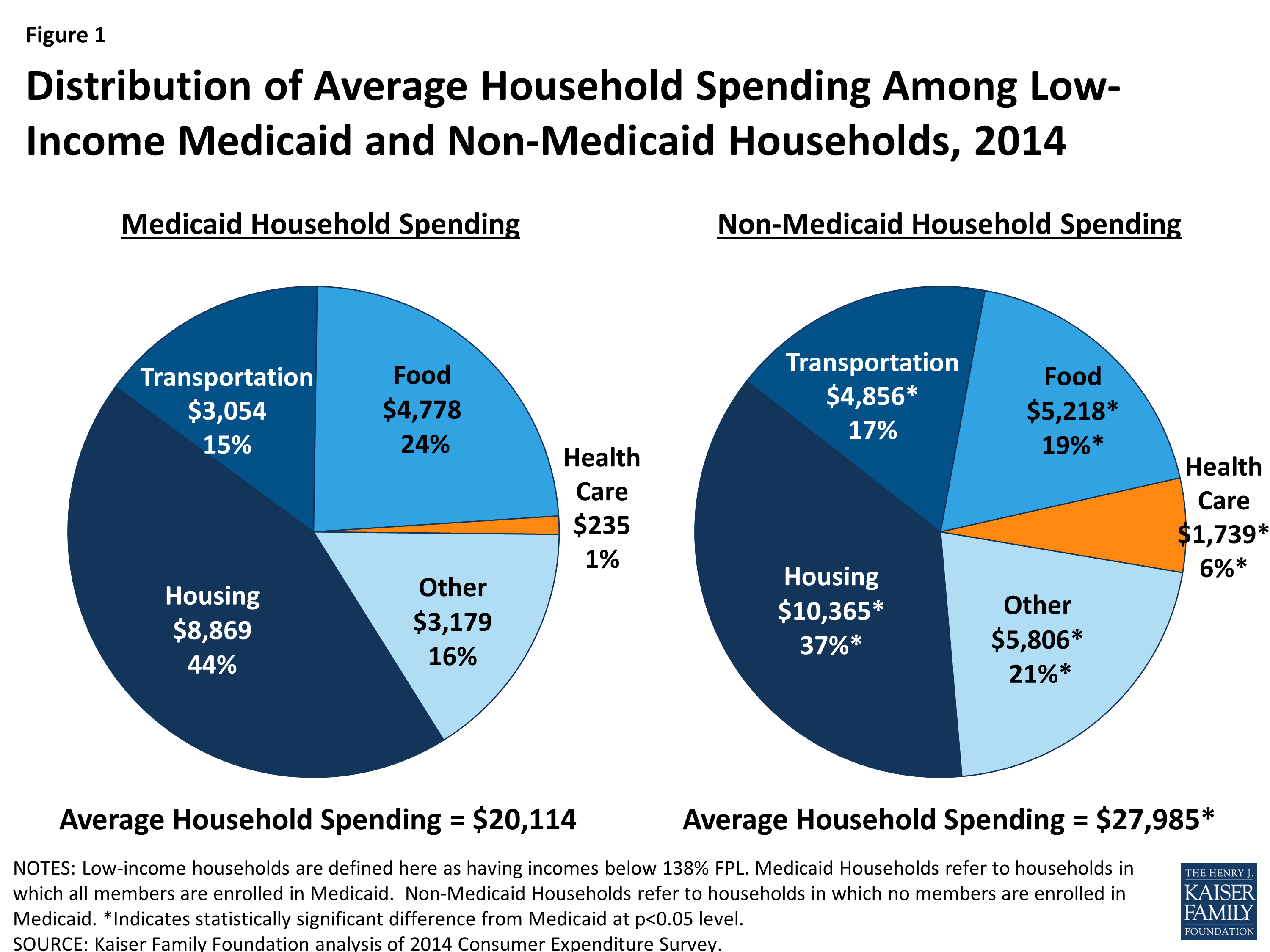

Health Care Spending Among Low Income Households With And Without

Health Insurance Costs Cost Of Health Insurance Health Ca Flickr

/GettyImages-1026036240-4e42f775bd3a498b9579b0e1ae692d6a.jpg)

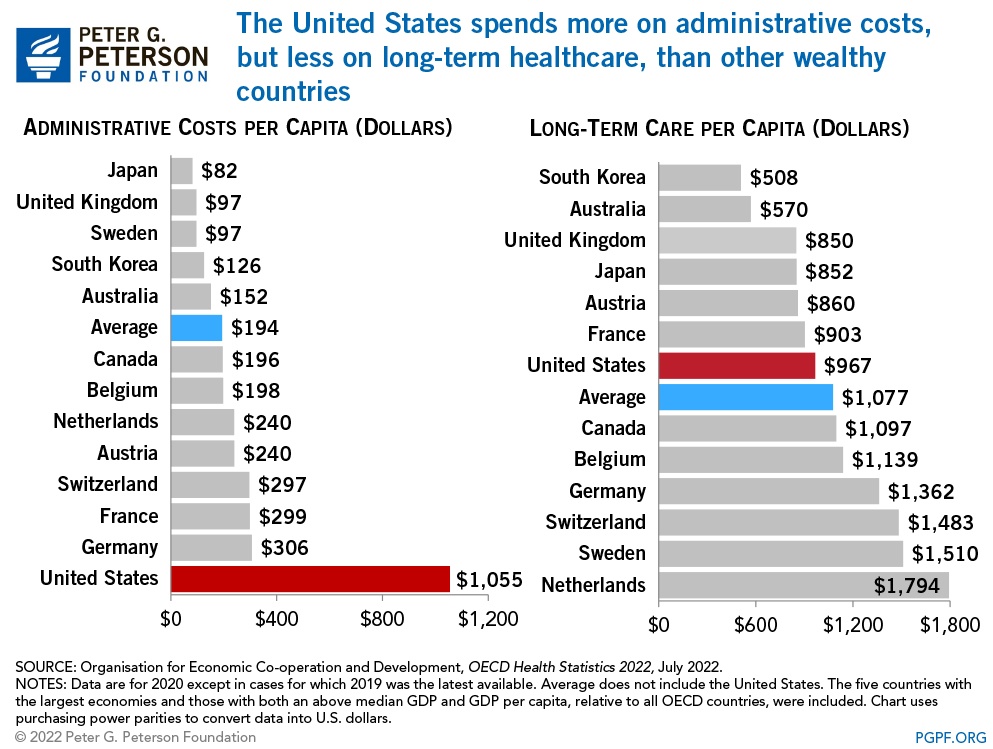

How U S Healthcare Costs Compare To Other Countries

Healthcare Administrative Costs Per Capita By Country Chart

Proposal On Capping Health Care Costs Would Impact Oregonians Oregon

How To Save Money On Health Care Costs Best Health Insurance Health

How To Save Money On Health Care Costs Best Health Insurance Health

Healthcare In The US Pros Cons And Costs In 2020 HealthStatus

Best And Worst States For Group Health Care Costs

Health Care Costs Attributable To Overweight Calculated In A

Health Care Costs Tax Credit - The Premium Tax Credit PTC makes health insurance more affordable by helping eligible individuals and their families pay premiums for coverage purchased through the Health Insurance Marketplace also referred to as the Marketplace or Exchange There are two ways to get the credit