Health Expenses Tax Deduction 2023 The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare costs In 2023 these deductions continue to play a significant role in financial planning for those with substantial medical expenses Medical and dental expenses qualify for a tax deduction though you can deduct only the costs that exceed 7 5 of your AGI To claim medical related expenses on your 2023 tax return which

Health Expenses Tax Deduction 2023

Health Expenses Tax Deduction 2023

https://i.pinimg.com/originals/80/f5/2d/80f52dac2182daa554539d9580ab22d3.png

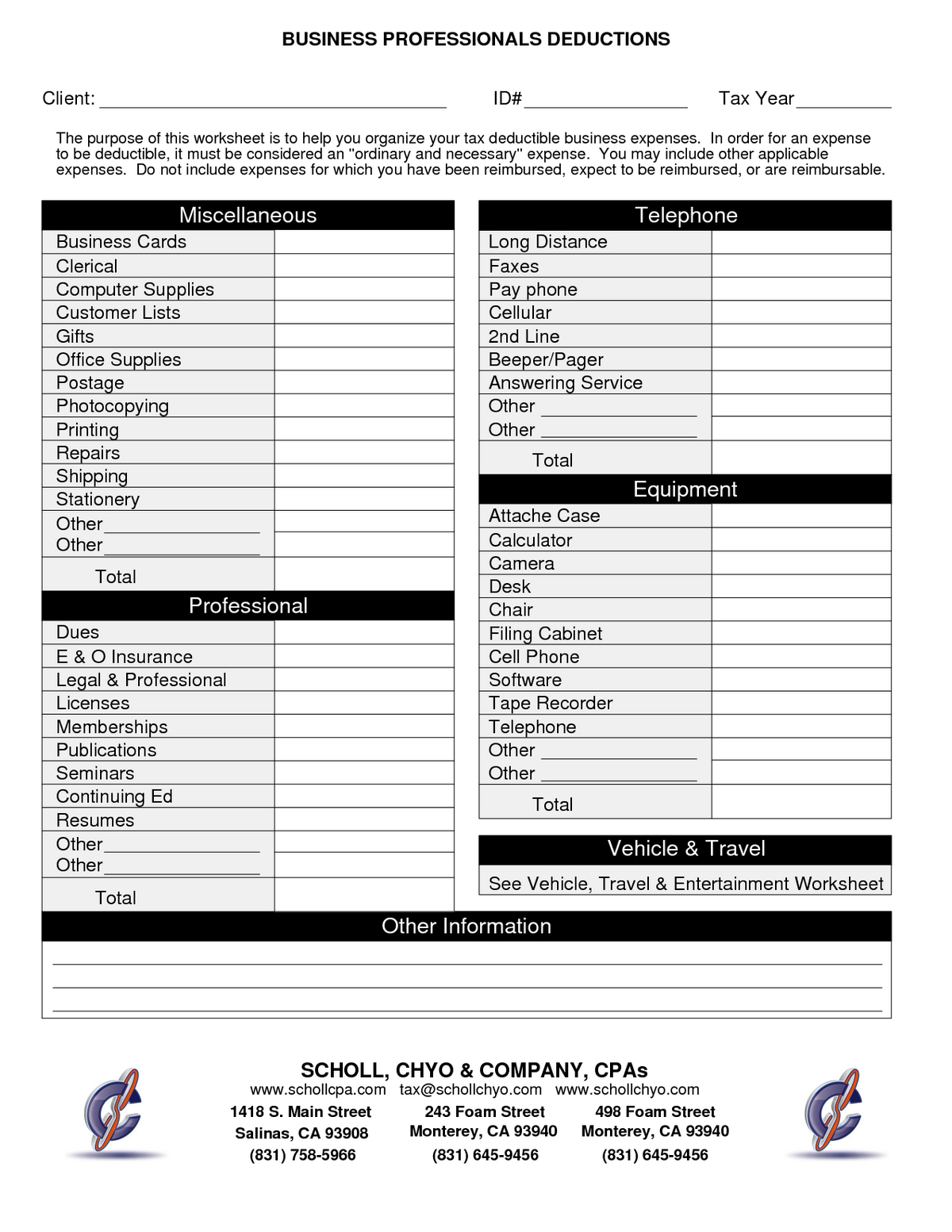

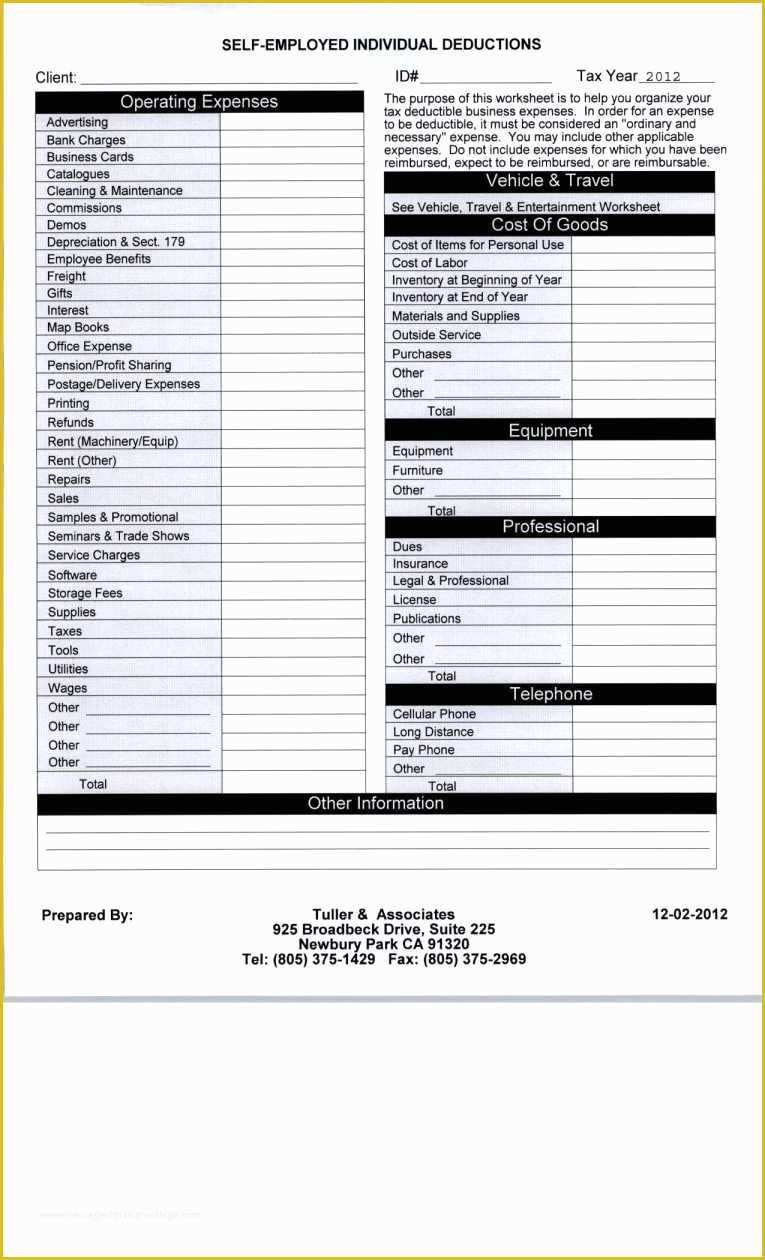

Printable Yearly Itemized Tax Deduction Worksheet Fill And Sign

https://www.pdffiller.com/preview/391/382/391382225/large.png

List Of Tax Deductions Fill Online Printable Fillable Blank

https://www.pdffiller.com/preview/100/302/100302714/large.png

It discusses what expenses and whose expenses you can and can t include in calculating the deduction It explains how to treat reimbursements and how to figure the deduction It also tells you how to report the deduction on your tax return and what to do if you sell medical property or receive damages for a personal injury You can deduct qualifying medical expenses that exceed 7 5 of your adjusted gross income You must itemize your deductions to be able to claim medical expenses on your tax return

At this time all unreimbursed medical expenses incurred as a result of COVID 19 are tax deductible If you pay for your medical expenses using money from a flexible spending account or health savings account those expenses aren t deductible because the money in those accounts is already tax advantaged Taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their adjusted gross income The 7 5 threshold used to be 10 but legislative changes at the end of

Download Health Expenses Tax Deduction 2023

More picture related to Health Expenses Tax Deduction 2023

![]()

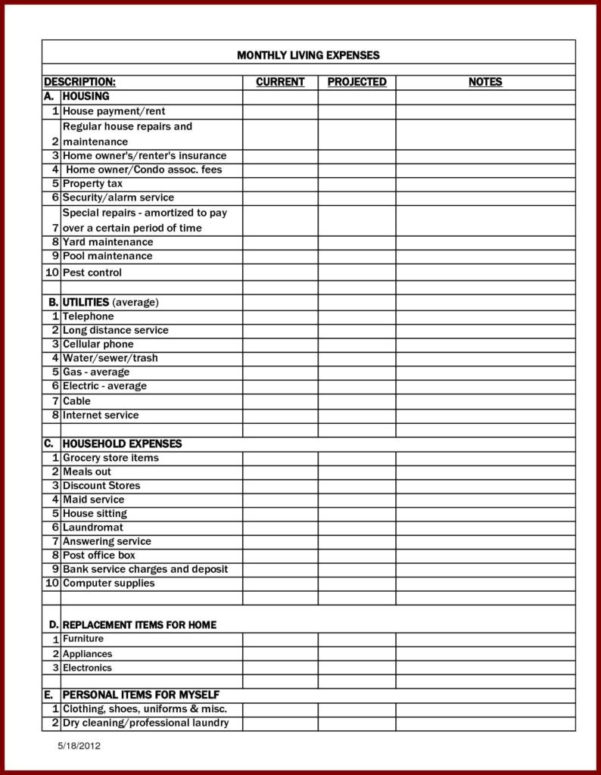

Tracking Medical Expenses Spreadsheet Spreadsheet Downloa Tracking

http://db-excel.com/wp-content/uploads/2019/01/tracking-medical-expenses-spreadsheet-for-medical-expense-tracker-elegant-luxury-medical-bill-tracking-tracker.jpg

Commercial Loan Comparison Spreadsheet Spreadsheet Downloa Commercial

http://db-excel.com/wp-content/uploads/2019/01/commercial-loan-comparison-spreadsheet-within-small-business-tax-expense-spreadsheet-income-preparation-return.jpg

Printable Small Business Tax Deductions Worksheet

https://i.pinimg.com/originals/e6/3e/e8/e63ee8d396dea4070503cc153faf2de5.jpg

Key Highlights of what medical expenses are tax deductible in 2023 and 2024 Adjusted Gross Income AGI Threshold Taxpayers can deduct qualified medical expenses that exceed 7 5 of their AGI Medical expenses are deductible only to the extent the total exceeds 7 5 of your adjusted gross income AGI For example if you itemize your AGI is 100 000 and your total medical expenses

[desc-10] [desc-11]

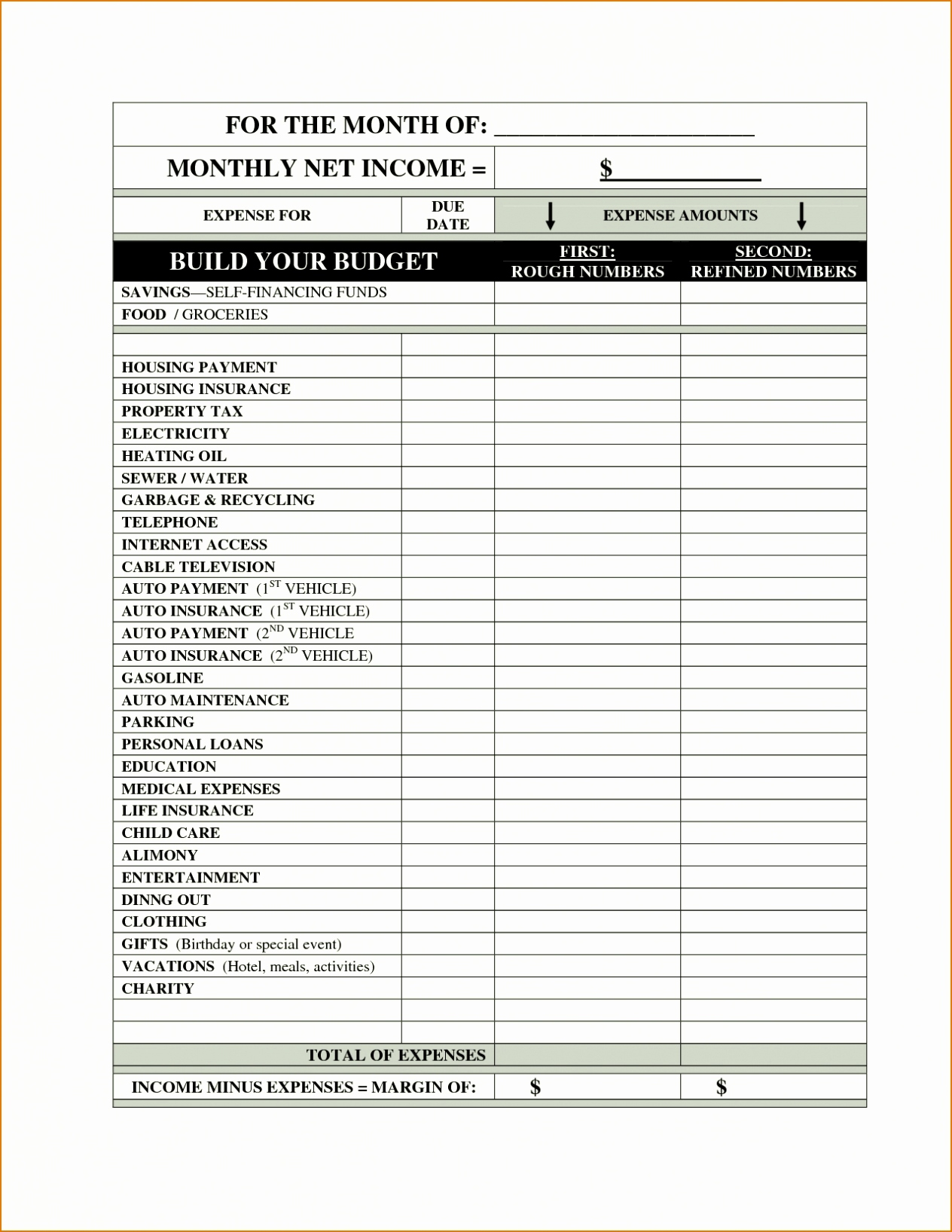

Business Itemized Deductions Worksheet Beautiful Business Itemized For

https://db-excel.com/wp-content/uploads/2018/11/business-itemized-deductions-worksheet-beautiful-business-itemized-for-business-expense-deductions-spreadsheet-750x970.jpg

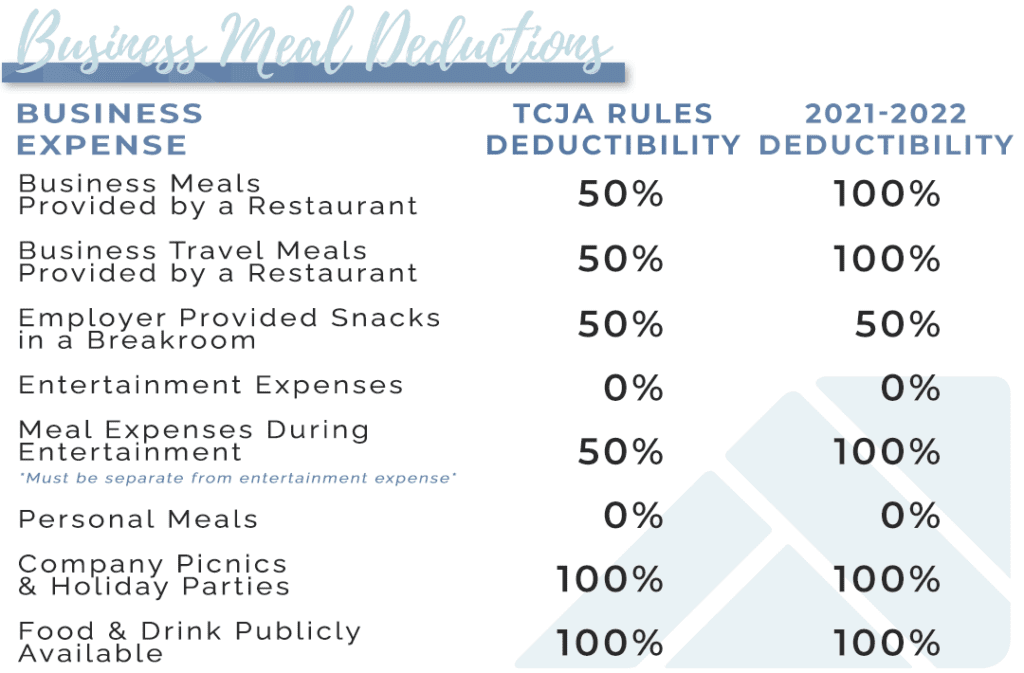

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein

https://alloysilverstein.com/wp-content/uploads/2021/04/Meal-100-graph-1024x673.png

https://www.usatoday.com › story › money › taxes › ...

The rule for claiming a medical expense deduction is that you can only write off healthcare costs that exceed 7 5 of your adjusted gross income And that s where things get a little

https://www.taxfyle.com › blog › can-i-deduct-my-medical-expenses

Medical expense deductions are a tax relief provision that allows taxpayers to reduce their taxable income by the amount of certain healthcare costs In 2023 these deductions continue to play a significant role in financial planning for those with substantial medical expenses

Farm Expense Spreadsheet Template Throughout Spreadsheet For Taxes

Business Itemized Deductions Worksheet Beautiful Business Itemized For

Tax Deduction Spreadsheet Excel For Tax Deduction Spreadsheet Excel On

An Image Of A Printable Form For Employees To Fill Out Their Individual

Cheat Sheet Of 100 Legal Tax Deductions For Real Estate Agents Real

Printable Itemized Deductions Worksheet

Printable Itemized Deductions Worksheet

Real Estate Expense Tracking Spreadsheet With Regard To Realtor Expense

Free Profit And Loss Template For Self Employed Of Free Profit And Loss

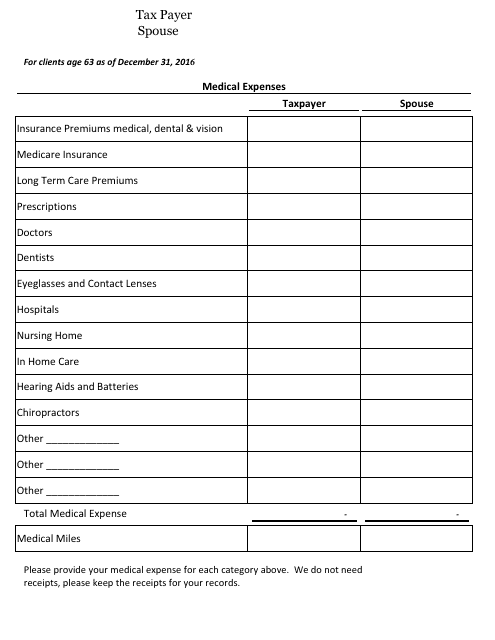

Medical Expenses Worksheet Download Fillable PDF Templateroller

Health Expenses Tax Deduction 2023 - [desc-13]