Health Insurance Rebate Checks 2021 Taxable The following questions and answers provide information on the federal tax consequences to a health insurance issuer that pays a MLR rebate and an individual policyholder that receives the MLR rebate

Your rebate rate is the percent that you get back from your health insurance premiums in the form of a reduction of the premium or as a refundable tax offset Your rebate entitlement depends on your family status at the end of the income year 30 June In general rebates are taxable if you pay health insurance premiums with pre tax dollars or you received tax benefits by deducting premiums you paid on your tax return Talk with your tax preparer to determine if you need to report your

Health Insurance Rebate Checks 2021 Taxable

Health Insurance Rebate Checks 2021 Taxable

https://www.the-sun.com/wp-content/uploads/sites/6/2021/12/NINTCHDBPICT000680202619-5.jpg

Minnesota Rebate Checks And Child Tax Credit In 2023

https://images.inkl.com/s3/article/lead_image/18595899/6s7GLrUiaDFw4PtLwHLk5U.jpg

Why Are My Rebates So Low Dental At Keys

https://www.dentalatkeys.com.au/wp-content/uploads/2017/10/time2switch-health-insurance-rebate.png

Plans that exceeded MLR requirements in 2020 are required to distribute MLR reimbursement checks by 9 30 2021 Employers have several options when it comes to utilizing or dispersing the MLR rebate funds In the 11th year of MLR rebates the rebate checks in 2022 amounted to more than 1 billion Ever since 2012 millions of Americans have received rebates from their health insurers each fall refunding portions of prior year premiums that were essentially too high

The medical loss ratio has returned billions in health insurance premium rebates to consumers since 2012 The average American household received 205 in the tenth year with the highest average rebates in Oregon 647 South Dakota 508 and Montana 501 So the rebates this year derive from insurance companies financial data from 2019 2020 and 2021 If you qualify for the rebate you should either receive a check in the mail by Sept 30 or

Download Health Insurance Rebate Checks 2021 Taxable

More picture related to Health Insurance Rebate Checks 2021 Taxable

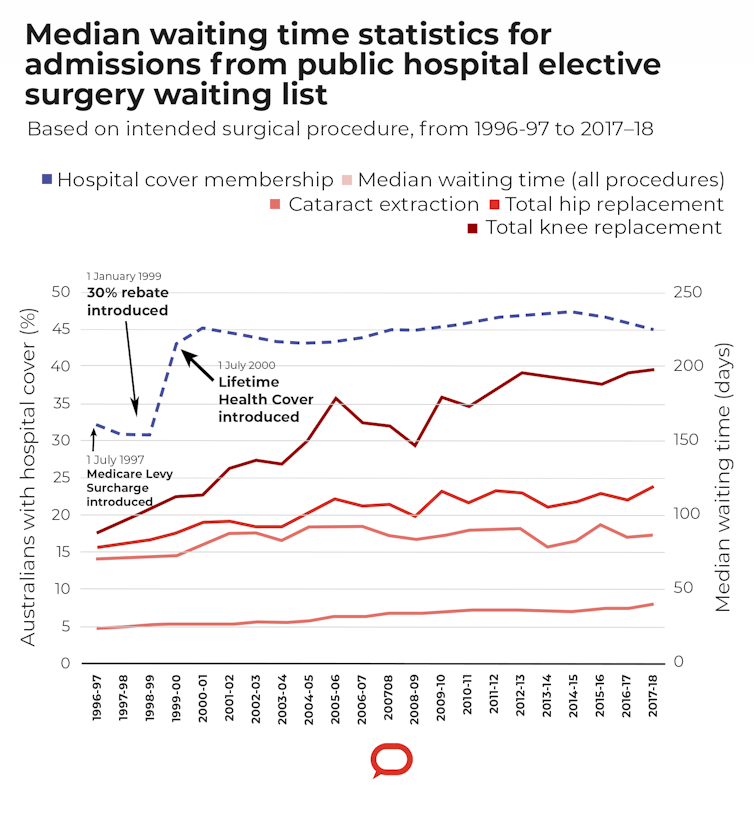

Is It Time To Ditch The Private Health Insurance Rebate It s A

https://images.theconversation.com/files/258417/original/file-20190212-174864-1jiaqn9.jpg?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

What Should Happen To The Private Health Insurance Rebate This Election

https://images.theconversation.com/files/458508/original/file-20220419-24-8c9jju.png?ixlib=rb-1.1.0&q=45&auto=format&w=754&fit=clip

Are Insurance Claim Checks Taxable Income The Oasis Firm Credit

https://www.theoasisfirm.com/wp-content/uploads/2022/04/Are-Insurance-Claim-Checks-Taxable-Income.png

How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium If a rebate is available carriers were required to distribute MLR checks to employers by September 30 2021 Importantly employers must distribute any amounts attributed to employee contributions to employees and handle the tax consequences if any

Insurers estimate they will pay 1 1 billion in Medical Loss Ratio MLR rebates in 2024 to select individuals and employers that purchase their health coverage according to a KFF analysis of Expert Alumni You do not have to include it as income on your tax return as long as you did not take an itemized deduction for the premiums on last year s return The rebate represents an adjustment of your Marketplace plan premiums Please see the last question of the IRS Q A on Medical Loss Ratio rebates

No Reduction In The Private Health Insurance Rebate As Of 1 April 2022

https://muntzpartners.com.au/wp-content/uploads/2022/05/Muntz-Partners-blog-post-May.jpg

Stimulus Checks Will Still Be Issued In 2022 As Final 2021 Child Tax

https://www.the-sun.com/wp-content/uploads/sites/6/2021/12/KB_OFF-PLAT_CTC-dec-15.jpg?strip=all&quality=100&w=1500&h=1000&crop=1

https://www.irs.gov/newsroom/medical-loss-ratio-mlr-faqs

The following questions and answers provide information on the federal tax consequences to a health insurance issuer that pays a MLR rebate and an individual policyholder that receives the MLR rebate

https://www.ato.gov.au/individuals-and-families/...

Your rebate rate is the percent that you get back from your health insurance premiums in the form of a reduction of the premium or as a refundable tax offset Your rebate entitlement depends on your family status at the end of the income year 30 June

The Private Health Insurance Rebate Advanced Credly

No Reduction In The Private Health Insurance Rebate As Of 1 April 2022

No Reduction In The Private Health Insurance Rebate As Of 1 April 2022

Does A Tax Credit Give You Money Leia Aqui Do You Get Money From Tax

Private Health Insurance Tax Rebate MakesCents Health Insurance

Health Insurance Rebate With Gym Membership Healthier Sustainable

Health Insurance Rebate With Gym Membership Healthier Sustainable

Obamacare Support May Rise When Health Insurance Rebate Checks Arrive

Health Fund Rebates Using HICAPS Double Bay Massage

2022 Tax Rates Table Printable Forms Free Online

Health Insurance Rebate Checks 2021 Taxable - Plans that exceeded MLR requirements in 2020 are required to distribute MLR reimbursement checks by 9 30 2021 Employers have several options when it comes to utilizing or dispersing the MLR rebate funds