Health Insurance Rebate In Income Tax Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

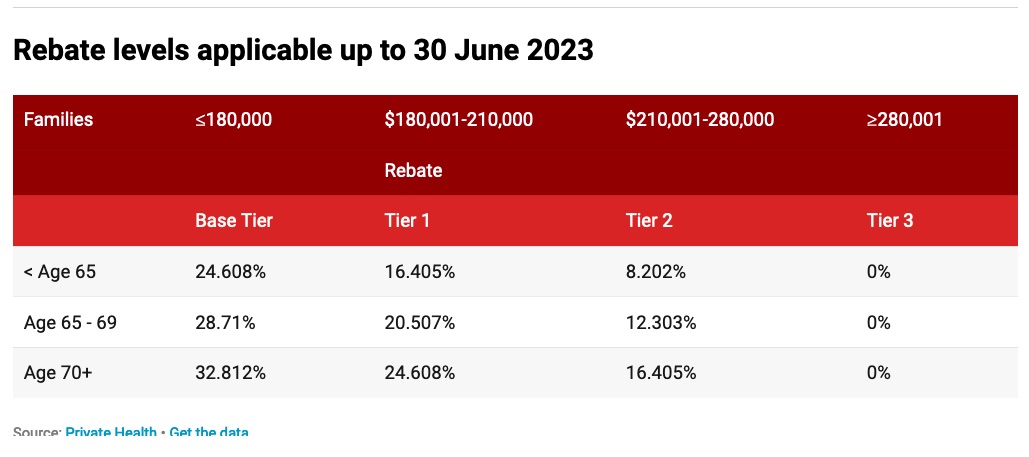

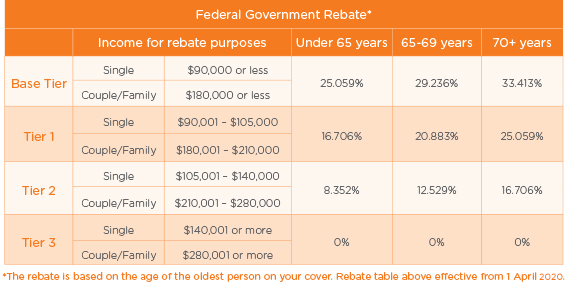

Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return Web When you apply for coverage in the Health Insurance Marketplace 174 you estimate your expected income for the year If you qualify for a premium tax credit based on your

Health Insurance Rebate In Income Tax

Health Insurance Rebate In Income Tax

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

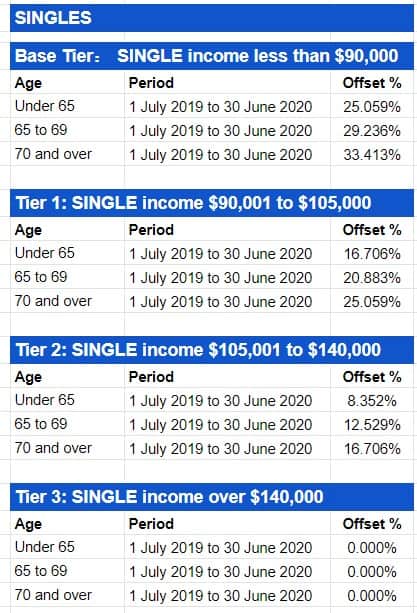

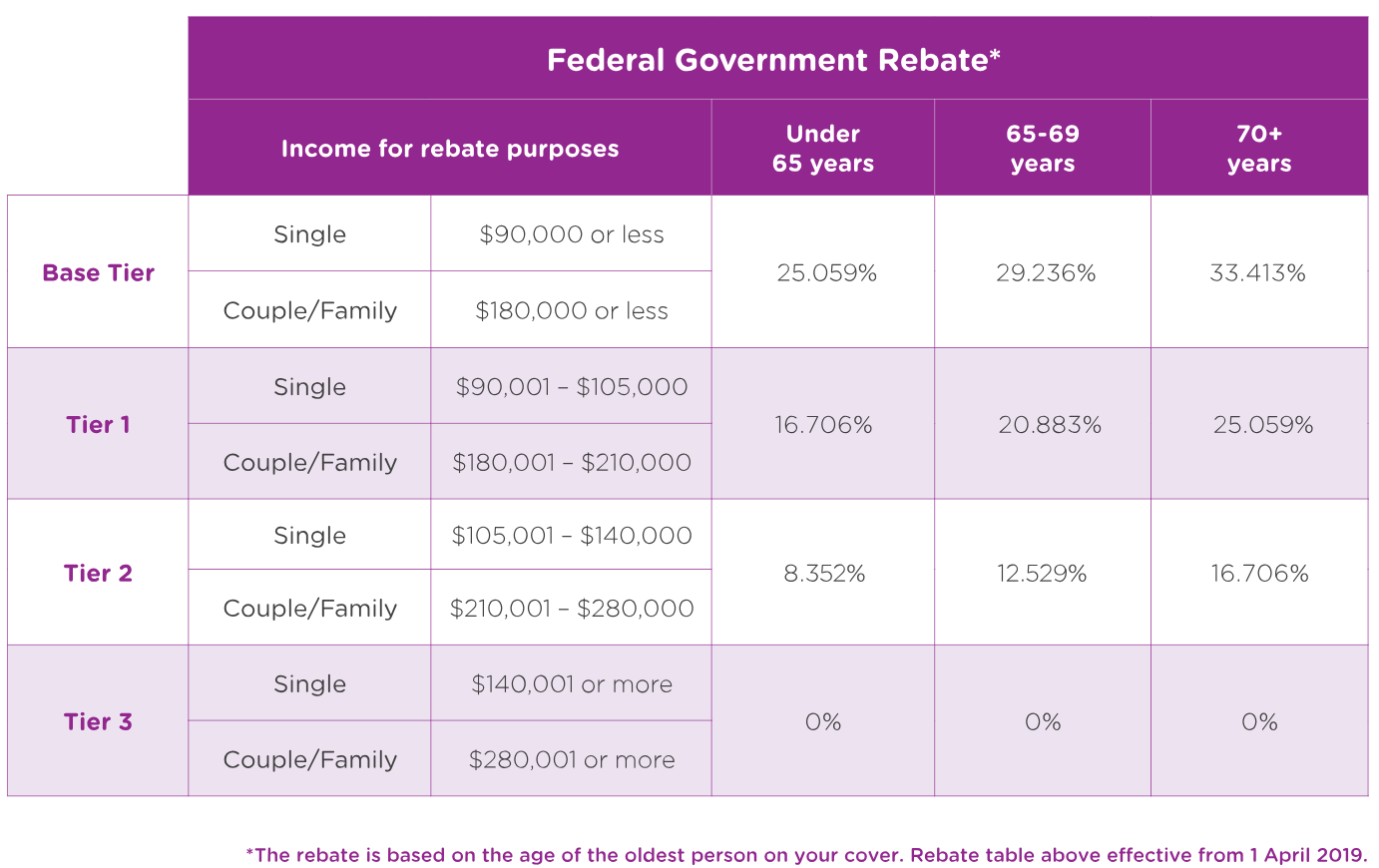

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2018/03/Federal-Government-Rebate-1-APR-2019.png

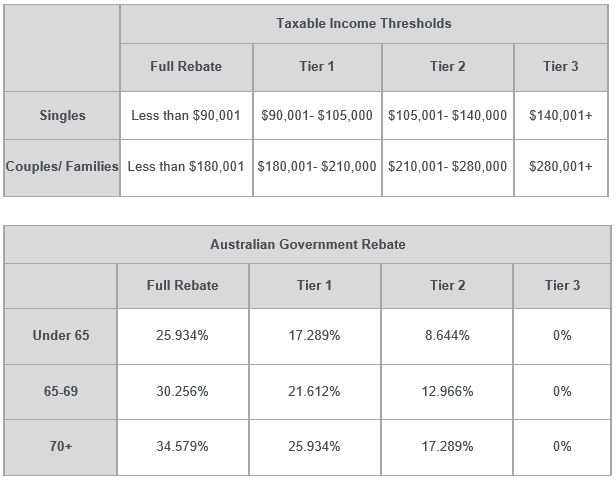

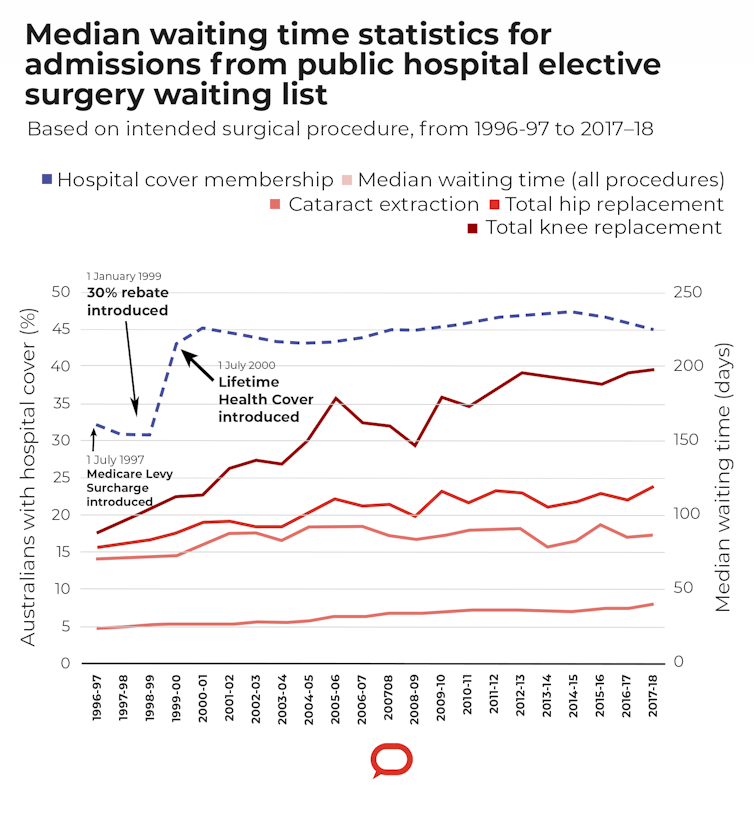

Medicare Levy Surcharge Private Health Insurance What s The Link

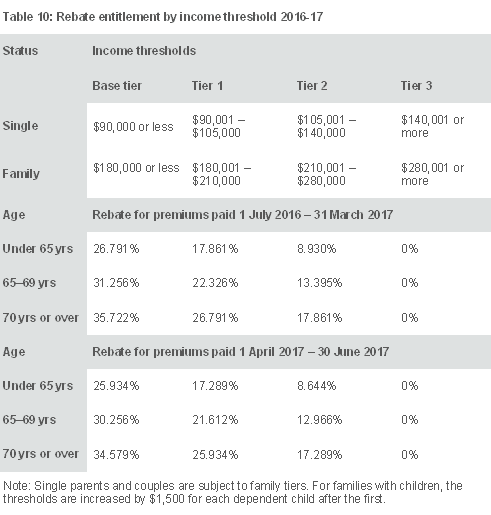

https://www.blgba.com.au/hs-fs/hubfs/Imported_Blog_Media/Table-10.png?width=609&height=639&name=Table-10.png

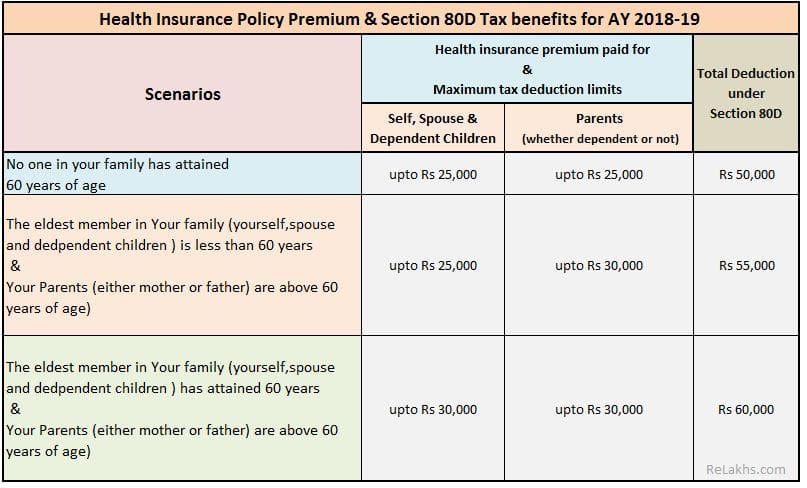

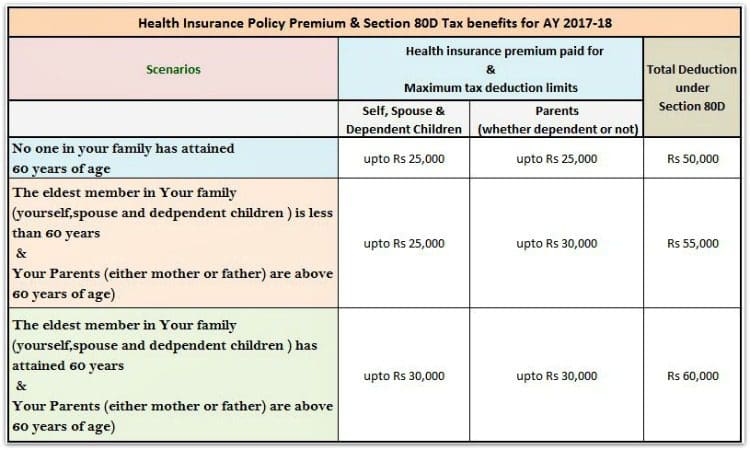

Web Section 80D of the Income Tax Act 1961 offers tax deductions of up to Rs 25 000 on health insurance premiums paid in a financial year The tax deduction limit increases to Web How health coverage affects your 2021 federal income tax return Notice If you haven t filed your 2021 taxes or filed but failed to reconcile your premium tax credit use the

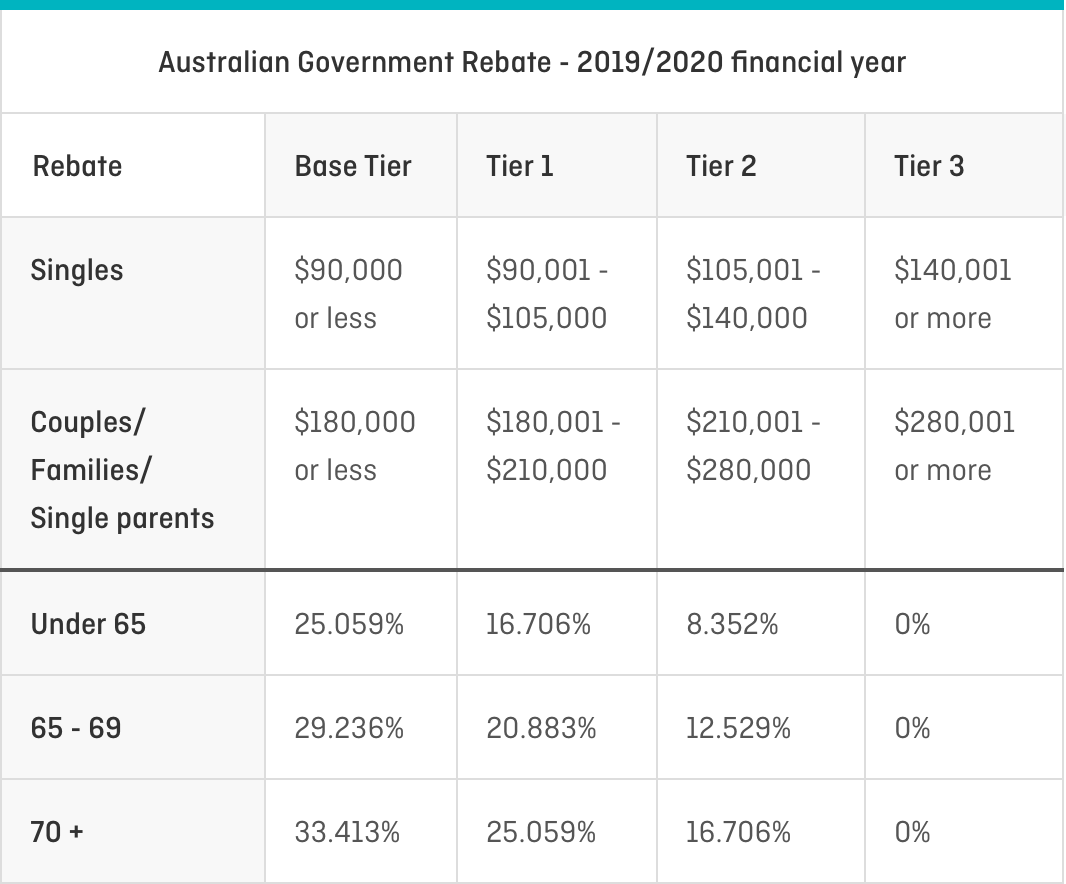

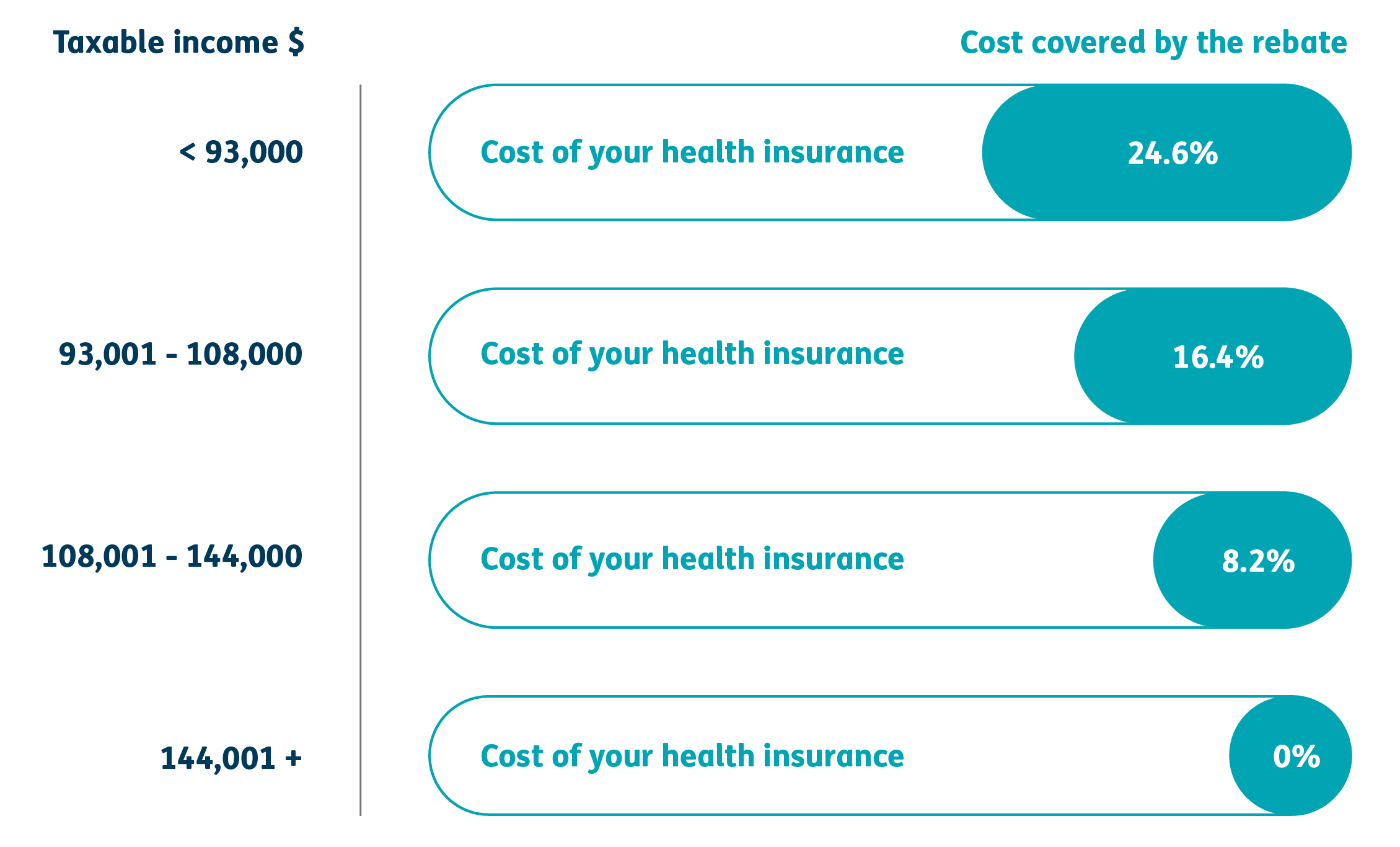

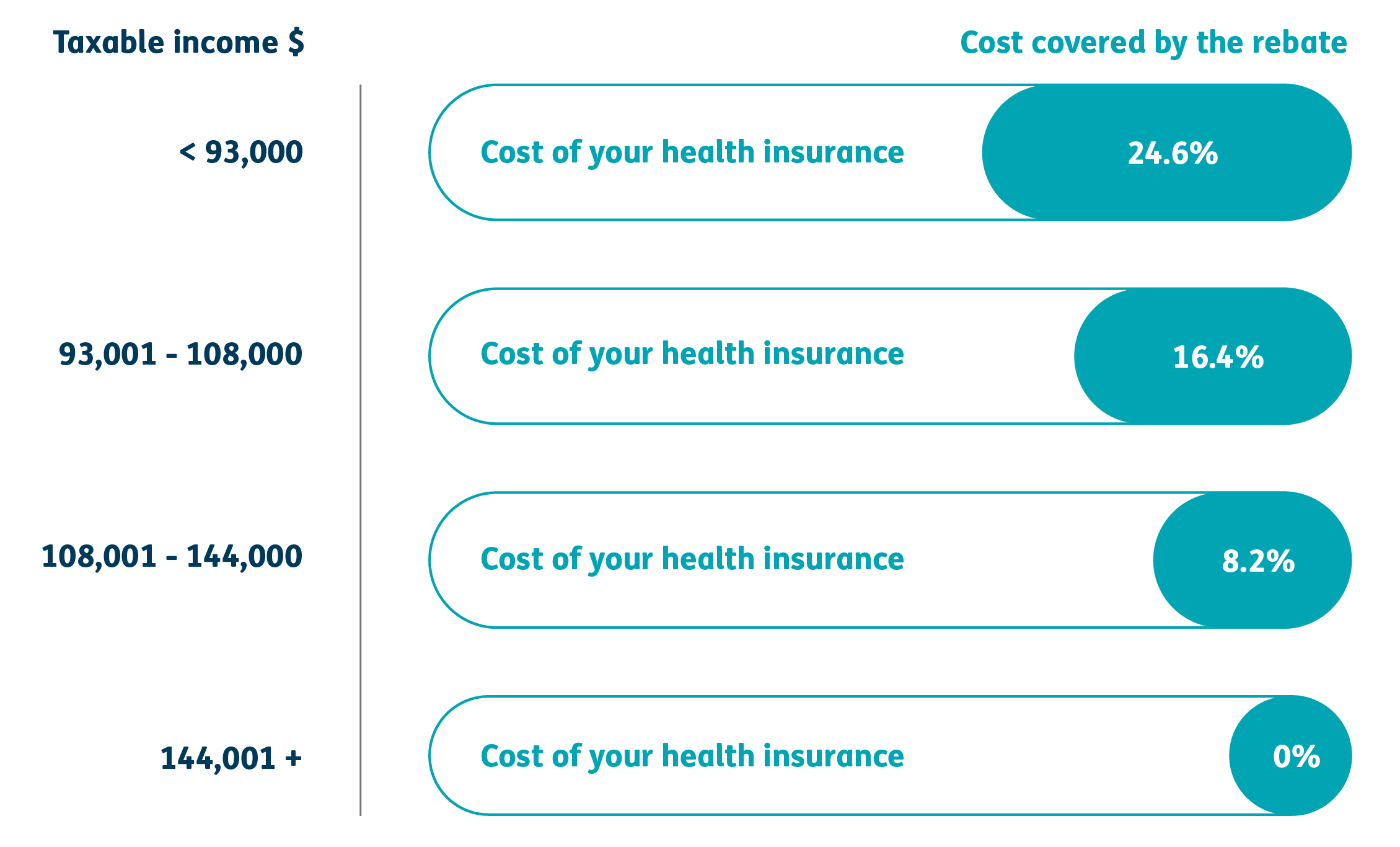

Web The private health insurance rebate is income tested If you share the policy you will be income tested on your share Your rebate entitlement depends on your family status on Web To be eligible for the private health insurance rebate your income for surcharge purposes must be less than the Tier 3 income threshold Tier 3 is the highest income threshold for

Download Health Insurance Rebate In Income Tax

More picture related to Health Insurance Rebate In Income Tax

Private Health Insurance Tax Offset Atotaxrates info

http://atotaxrates.info/wp-content/uploads/2020/05/Private-Health-Insurance-Rebate-Percentages-SINGLES-2019-20.jpg

Should You Get Private Health Insurance BCV Financial

https://www.bcvfs.com.au/wp-content/uploads/2020/02/592ba46f77d1db4322b6393e_table-should-i-get-private-health-insurance-frankston-2.png

Latest Income Tax Exemptions FY 2017 18 AY 2018 19 Tax Deductions

http://www.relakhs.com/wp-content/uploads/2017/03/Health-insurance-premium-Section-80D-Income-Tax-Exemptions-FY-2017-18-Medical-insurance-premium-AY-2018-19.jpg

Web 6 juil 2023 nbsp 0183 32 If you are looking for Health Insurance Rebate In Income Tax you ve come to the right place We have 28 rebates about Health Insurance Rebate In Income Tax Web Private health insurance rebate Completing your tax return Use the information shown on your statement to complete your tax return In most cases there will be two rows of

Web Income Tax Rebate in Health Insurance Policies Section 80D of the Income Tax Act 1961 essentially offers a tax deduction on an individual s taxable income if they have Web 4 ao 251 t 2020 nbsp 0183 32 While filing the Income Tax Return ITR Arup Sahay name changed got confused while putting the amount of health insurance premium u s 80D He had paid

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

Private Health Insurance Quote Qantas Insurance

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

https://cleartax.in/s/medical-insurance

Web 14 juin 2018 nbsp 0183 32 Deduction of Medical Expenses for Senior Citizens Section 80D For the welfare of senior citizens Resident aged 60 or above who don t have health

https://www.ato.gov.au/.../Claiming-the-private-health-insurance-rebate

Web 30 juin 2023 nbsp 0183 32 receive 16 405 of premium reduction from his health insurer for premiums paid in the respective months claim the rebate as a refundable tax offset in his tax return

What Should Happen To The Private Health Insurance Rebate This Election

Private Health Insurance Rebate Navy Health

What Should Happen To The Private Health Insurance Rebate This Election

Private Health Insurance Rebate Navy Health

Tax Benefit Of Buying Health Insurance In India For NRI Section 80D

Tax And Rebates HBF Health Insurance

Tax And Rebates HBF Health Insurance

How Does Private Health Insurance Affect My Tax Return Compare Club

ISelect What You Need To Know Tax Rebates On Health Insurance And

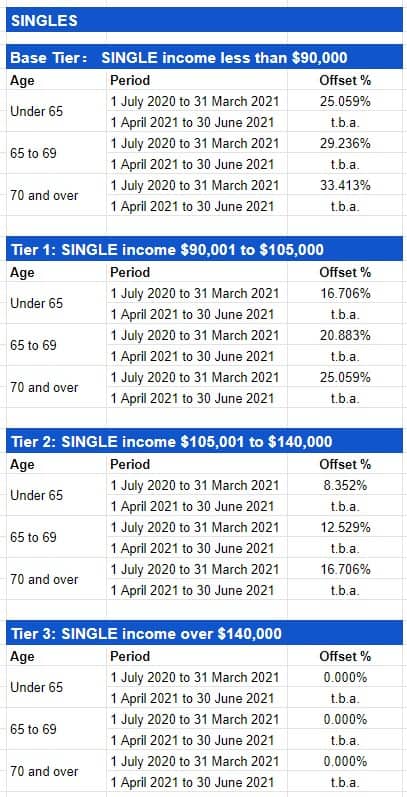

Private Health Insurance Tax Offset AtoTaxRates info

Health Insurance Rebate In Income Tax - Web The private health insurance rebate is income tested If you share the policy you will be income tested on your share Your rebate entitlement depends on your family status on