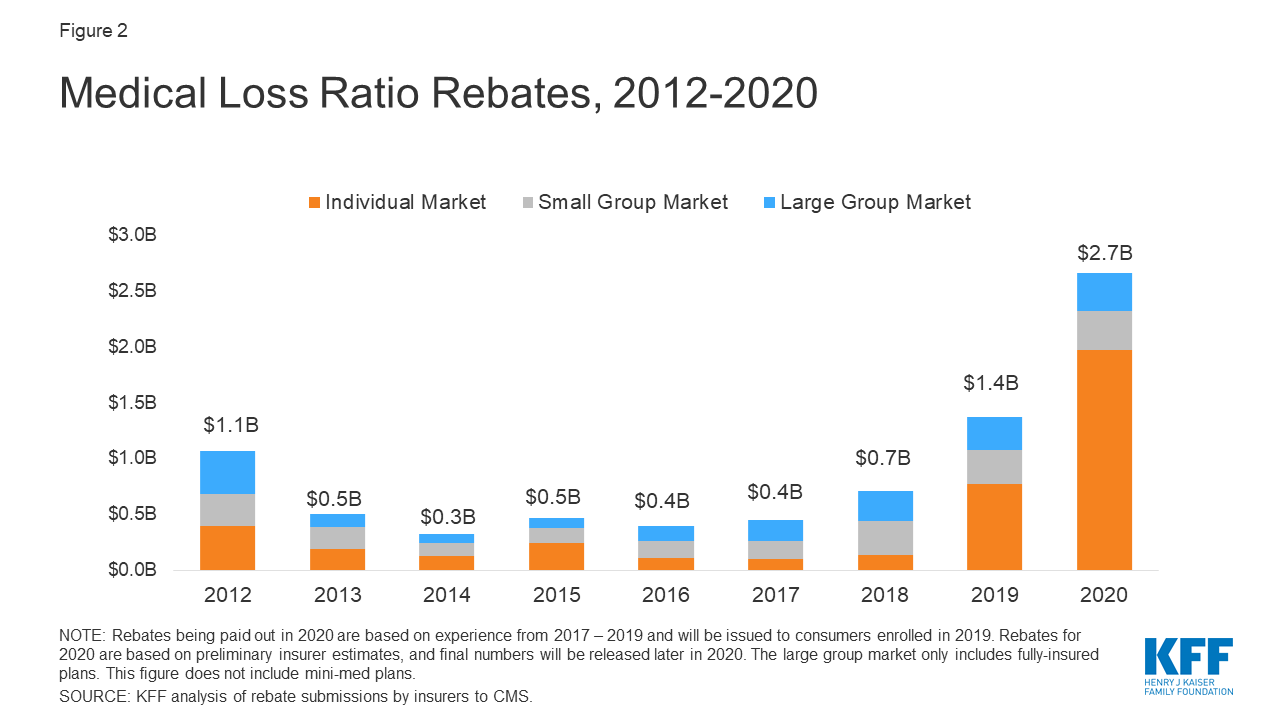

Health Insurance Rebate Taxable Income Web 27 sept 2012 nbsp 0183 32 U S health insurance companies sent out about 1 1 billion in rebates to 12 8 million policyholders in August to comply with the 80 20 rule under the new health

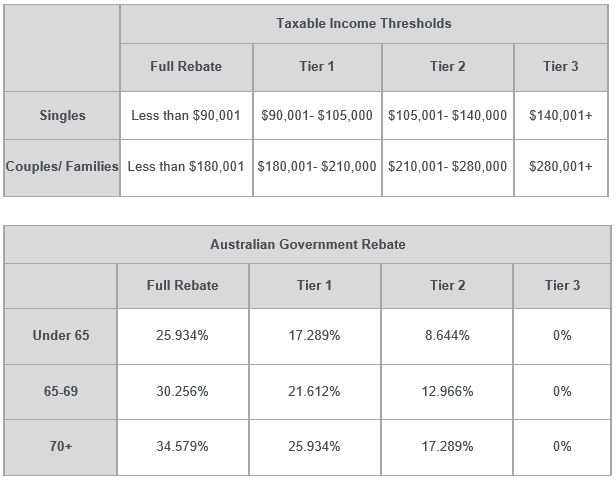

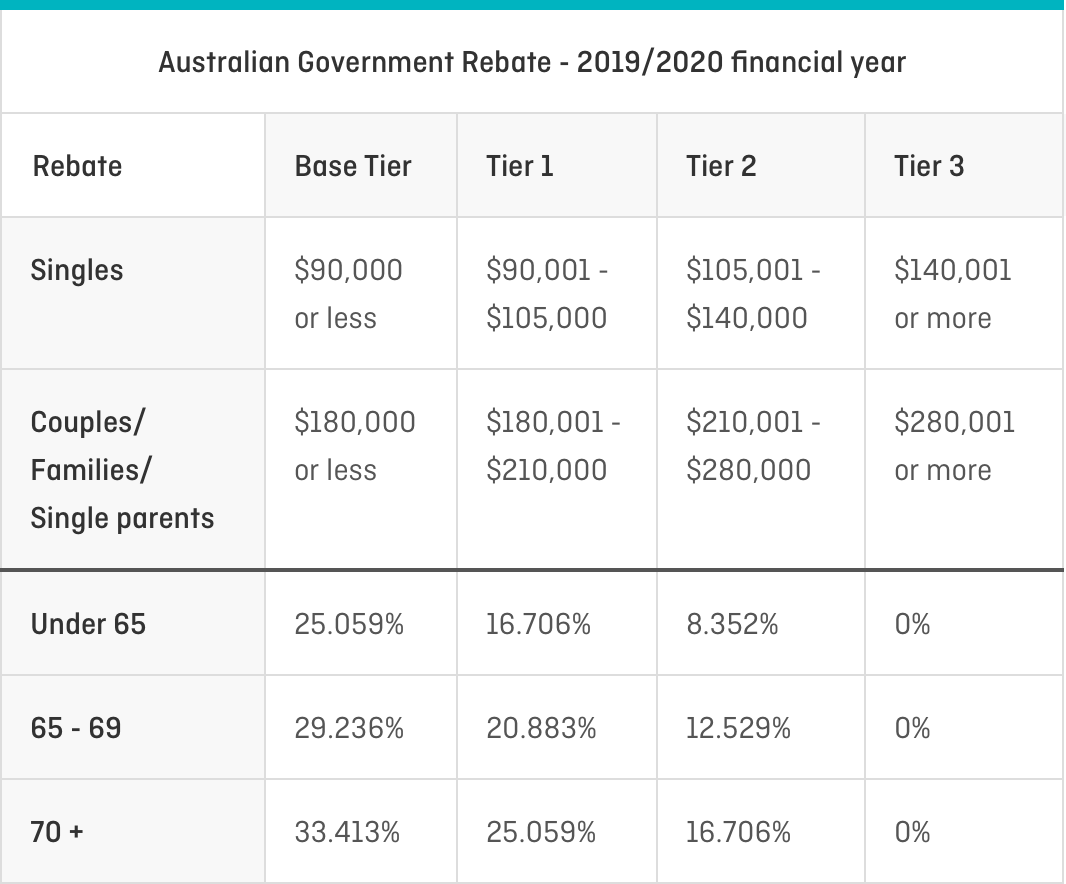

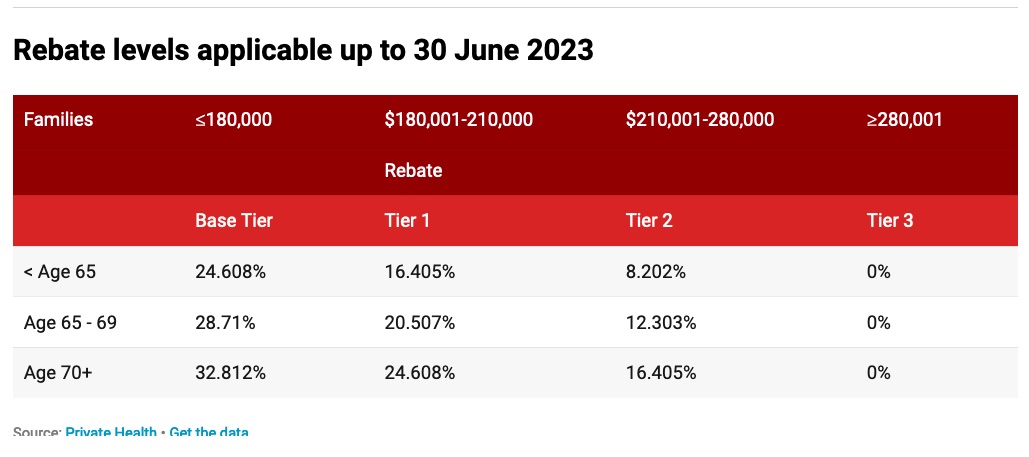

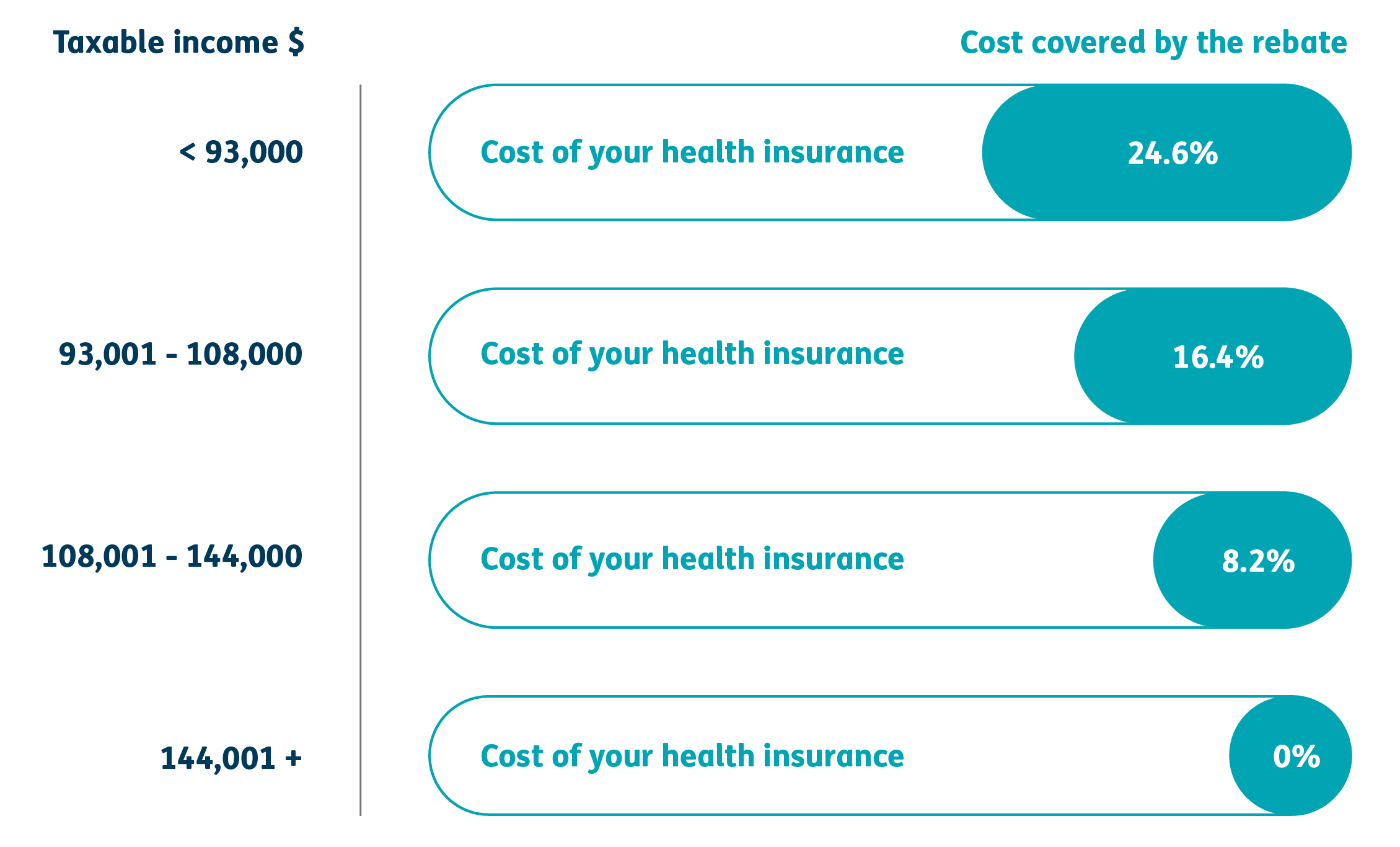

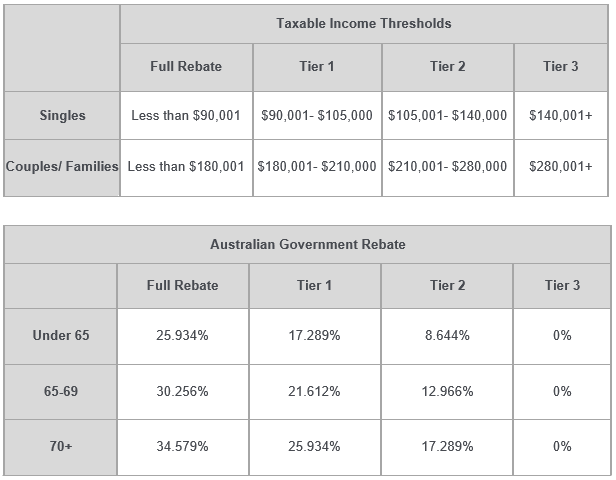

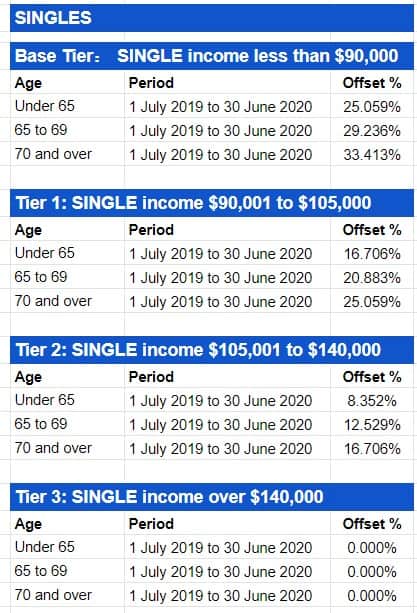

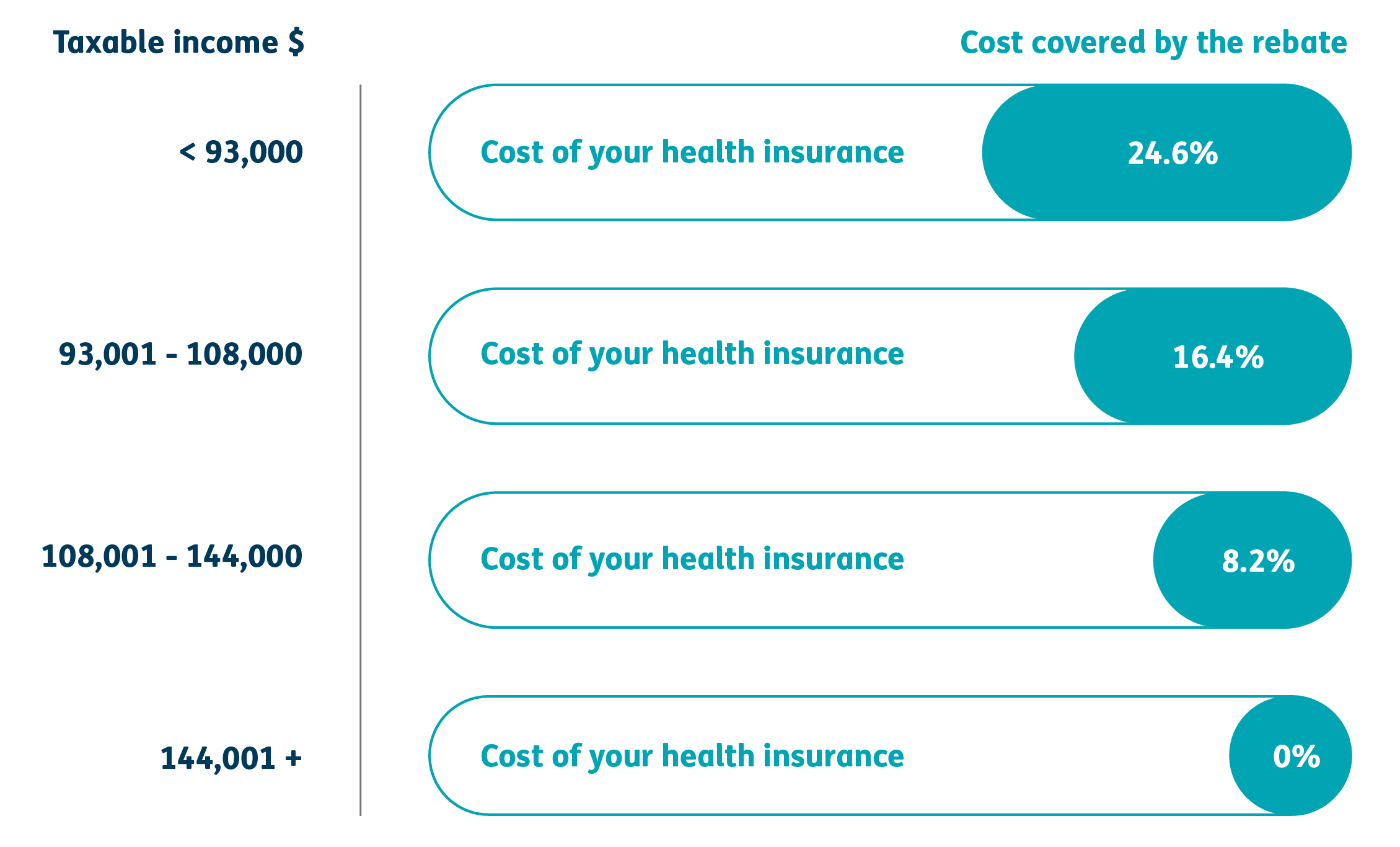

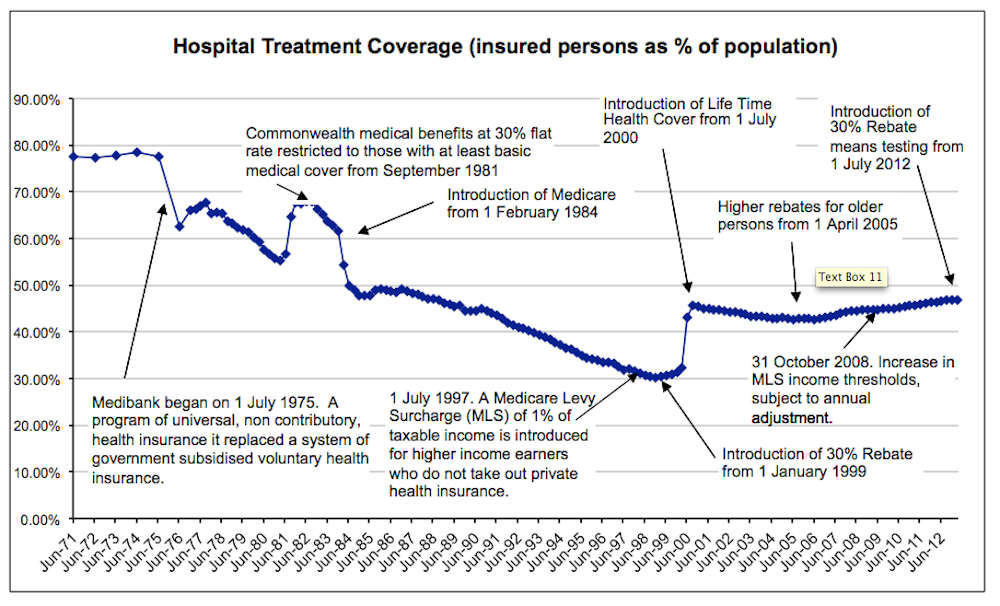

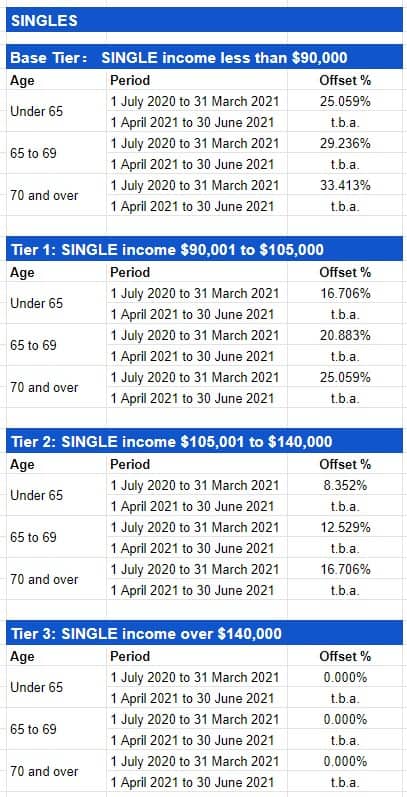

Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained Web Income for surcharge purposes is used to test your eligibility for the private health insurance rebate It is not the same as your taxable income To be eligible for the

Health Insurance Rebate Taxable Income

Health Insurance Rebate Taxable Income

https://asset.compareclub.com.au/content/guides/health-insurance/tax-return/private-health-rebate-levels.jpg

Should You Get Private Health Insurance BCV Financial

https://www.bcvfs.com.au/wp-content/uploads/2020/02/592ba46f77d1db4322b6393e_table-should-i-get-private-health-insurance-frankston-2.png

Private Health Insurance Quote Qantas Insurance

https://insurance.qantas.com/dist/static/table-agr-6a9b38.png

Web 9 d 233 c 2020 nbsp 0183 32 The law allows employers to give employees a lump sum of cash for purchasing health insurance pre tax through health reimbursement arrangements HRAs Until recently any lump sum Web How to claim the private health insurance rebate how to claim for your spouse and if you have prepaid your premium Find out the private health insurance rebate income

Web 5 oct 2022 nbsp 0183 32 The Good Brigade Getty Images The premium tax credit is a refundable credit that helps lower the cost of your monthly health insurance premium You must meet the requirements and file a specific form with Web When you apply for coverage in the Health Insurance Marketplace 174 you estimate your expected income for the year If you qualify for a premium tax credit based on your

Download Health Insurance Rebate Taxable Income

More picture related to Health Insurance Rebate Taxable Income

Private Health Insurance Rebate Navy Health

https://navyhealth.com.au/wp-content/uploads/2019/12/NAV20358-MLS-Rebate-Table-April-2020-Rates_DE1.4-1.jpg

The Private Health Insurance Rebate Explained ISelect

https://www.iselect.com.au/content/uploads/2018/05/Private-Health-Insurance-Rebate_table.jpg

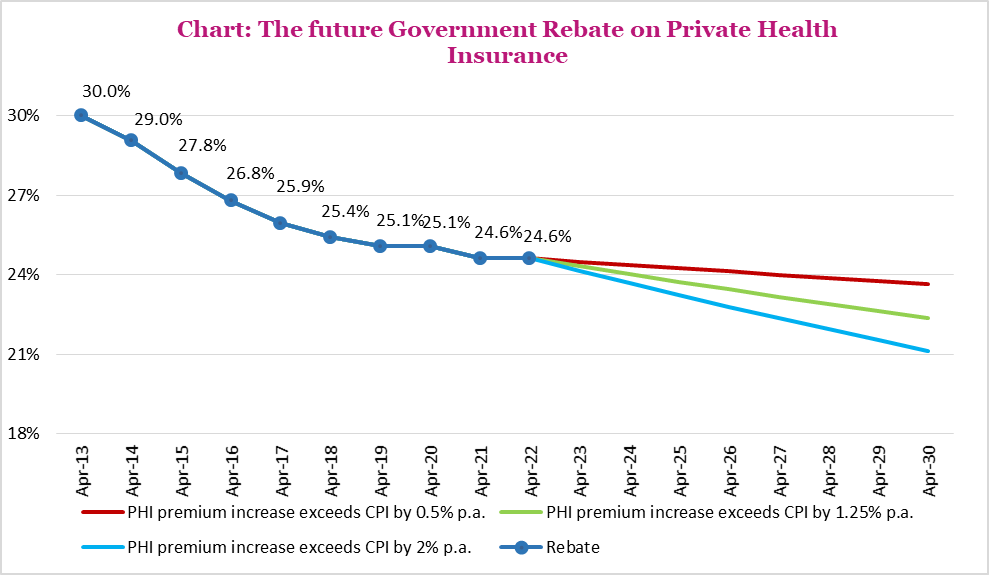

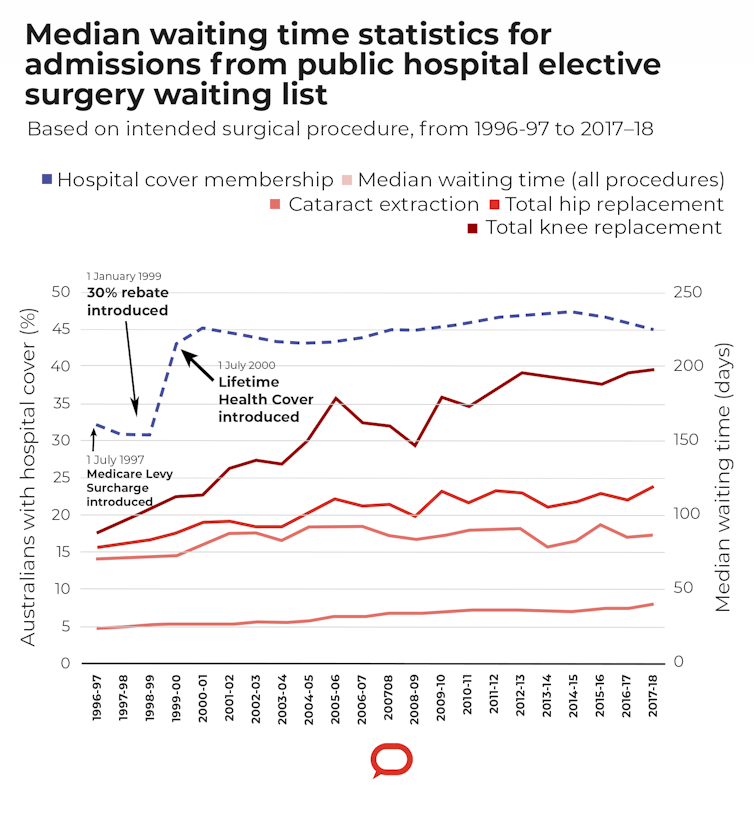

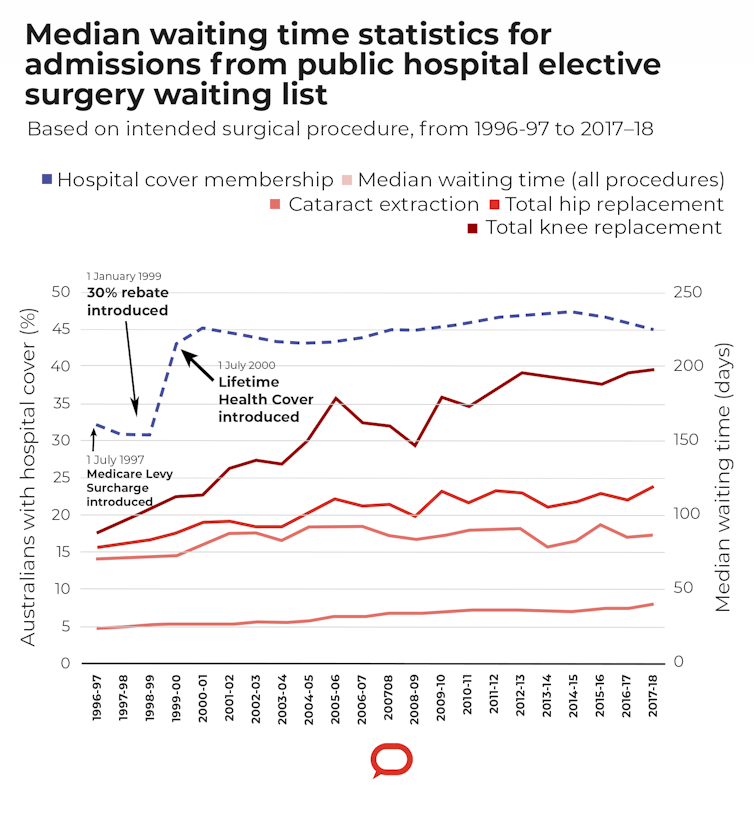

What Should Happen To The Private Health Insurance Rebate This Election

https://www.croakey.org/wp-content/uploads/2022/04/REBATELEVELS.jpg

Web 24 juil 2020 nbsp 0183 32 When your tax return is processed your Private Health Insurance PHI rebate will be income tested You may have over claimed your rebate based on your or Web ACA rebates are taxable if you pay your health insurance premiums with pre tax dollars or you your employer receive tax benefits after deducting premiums on your tax return If you did receive tax benefits in the

Web 16 juil 2012 nbsp 0183 32 The average rebate for households that get one will be about 151 The rebates are to be made by August 1 The table at the end of this story shows the average Web 25 f 233 vr 2022 nbsp 0183 32 From Jan 1 2014 when the first exchange plan coverage sold took effect till Congress passed temporary COVID 19 emergency legislation the tax credit

New To Private Health Insurance HBF Health Insurance

https://www.hbf.com.au/-/media/images/hbf/health-insurance/extras/singles-under-65.png?la=en&hash=46D4FB6E7BDC69C8763810EDA3F938B622C37A8C

Anything To Everything Income Tax Guide For Individuals Including

http://www.relakhs.com/wp-content/uploads/2016/03/Section-80D-Health-insurance-premium-Income-Tax-Deductions-FY-2016-17-pic.jpg

https://kaufmanrossin.com/news/is-your-health-insurance-rebate-taxable

Web 27 sept 2012 nbsp 0183 32 U S health insurance companies sent out about 1 1 billion in rebates to 12 8 million policyholders in August to comply with the 80 20 rule under the new health

https://www.ato.gov.au/Individuals/Medicare-and-private-health...

Web The income thresholds used to calculate the Medicare levy surcharge and private health insurance rebate have increased from 1 July 2023 Before 1 July 2023 they remained

Private Health Insurance Tax Offset Atotaxrates info

New To Private Health Insurance HBF Health Insurance

1 Billion In Health Insurance Rebates Taxable Or Tax free Kiplinger

Not For Profits Call For Pledge To Restore 30 Per Cent Private Health

Who Will Get Health Insurance Rebate Checks Anceinsru

What Should Happen To The Private Health Insurance Rebate This Election

What Should Happen To The Private Health Insurance Rebate This Election

Things You Should Know About Private Health Insurance Rebates

What Is The Annual Private Health Insurance Rate Rise

Private Health Insurance Tax Offset AtoTaxRates info

Health Insurance Rebate Taxable Income - Web 15 ao 251 t 2023 nbsp 0183 32 Aug 15 2023 Fact checked What you need to know Private health insurance is not tax deductible in Australia but there are other ways to save The