Health Plan Income Tax Deduction You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health You may be eligible to deduct health insurance premiums on your taxes if you pay for your own insurance and meet certain requirements The self employed health insurance deduction allows

Health Plan Income Tax Deduction

Health Plan Income Tax Deduction

https://standard-deduction.com/wp-content/uploads/2020/10/latest-income-tax-slab-rates-fy-2020-21-ay-2021-22-11.jpg

Special Tax Deduction Flexible Working Arrangement Mar 01 2022

https://cdn1.npcdn.net/image/16461036862a2b9367f2ff16eb9b748ff28b5b7ef8.jpg?md5id=956f9d4b926a8af07bf32de21edd8eee&new_width=1000&new_height=1000&w=-62170009200

Income Tax Deduction In Hindi Free Income Tax Course deductions

https://i.ytimg.com/vi/rJ8shGfokKw/maxresdefault.jpg

The contribution you make to your HSA is 100 tax deductible up to a limit in 2024 of 4 150 if your HDHP covers just yourself and 8 300 if it also covers at A health FSA allows employees to be reimbursed for medical expenses FSAs are usually funded through voluntary salary reduction agreements with your employer No

The IRS allows all taxpayers to deduct their qualified unreimbursed medical care expenses that exceed 7 5 of their adjusted gross income You must itemize your Generally you are allowed to deduct health insurance rates on your taxes if you itemize your deductions pay your health insurance premiums directly and your medical expenses totaled more than 7 5

Download Health Plan Income Tax Deduction

More picture related to Health Plan Income Tax Deduction

Qualified Business Income Deduction And The Self Employed The CPA Journal

https://www.nysscpa.org/cpaj-images/CPA.2022.92.5.006.t001.jpg

Mandatory Government Deductions From Salary SSS Philhealth Pag Ibig

https://i.ytimg.com/vi/lBO3PaW69Mc/maxresdefault.jpg

Tax Deductions You Can Deduct What Napkin Finance

https://napkinfinance.com/wp-content/uploads/2020/12/NapkinFinance-TaxDeductions-Napkin-10-13-20-v05-1.jpg

Health insurance premiums can be tax deductible under some circumstances Taxpayers who itemize may be able to use this deduction to the extent that their total You may be able to deduct the cost of health insurance premiums on your income tax return You may need to itemize your deductions to take this deduction

You can claim a medical expense deduction for unreimbursed healthcare costs that exceed 7 5 of your adjusted gross income AGI You ll use Schedule A to Employer paid premiums for health insurance are exempt from federal income and payroll taxes Additionally the portion of premiums employees pay is typically excluded from

Tax Deduction Taxable Income Deduction Viva Business Consulting

https://www.vivabcs.com.vn/assets/uploads/2017/03/Tips-on-taxable-income-deduction-1.jpg

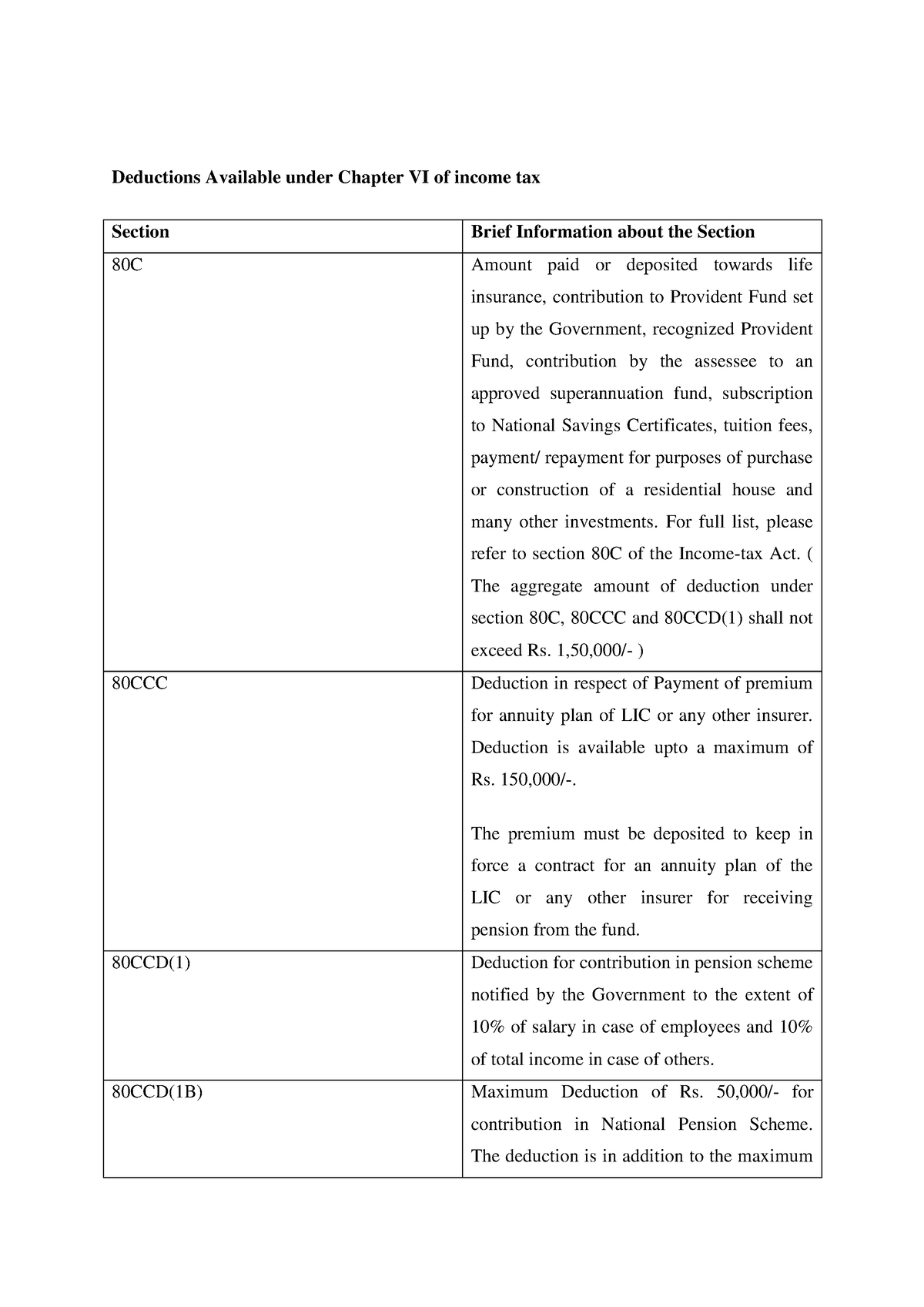

Deductions Available Under Chapter VI Of Income Tax Taxation KSLU

https://d20ohkaloyme4g.cloudfront.net/img/document_thumbnails/0f3b2dd2cf4681a9e9ef89161d21ba13/thumb_1200_1697.png

https://www.forbes.com/advisor/health-insurance/is...

You might be able to deduct your health insurance premiums and other health care costs from your taxable income which can lower the amount of money you

https://blog.turbotax.intuit.com/health-care/when...

Health insurance premiums paid with your own after tax dollars are tax deductible For example if you purchased insurance on your own through a health

Printable Itemized Deductions Worksheet

Tax Deduction Taxable Income Deduction Viva Business Consulting

Income Tax Deductions For The FY 2019 20 ComparePolicy

From Pan To Crypto New Income Tax Reforms That Take Effect On July 1

2020 Standard Deduction Over 65 Standard Deduction 2021

Allowable Deductions From Income While Filing Return Of Income

Allowable Deductions From Income While Filing Return Of Income

The Master List Of All Types Of Tax Deductions INFOGRAPHIC Small

How Much Is Your State s 529 Plan Tax Deduction Really Worth

INCOME TAX DEDUCTION 2023 24 Financesjungle

Health Plan Income Tax Deduction - A health FSA allows employees to be reimbursed for medical expenses FSAs are usually funded through voluntary salary reduction agreements with your employer No