Healthcare Worker Tax Credit 2022 The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased Last updated 26 October 2022 in News Health insurance can be expensive But thanks to Obamacare people who otherwise can t get affordable coverage through their employers can purchase insurance

Healthcare Worker Tax Credit 2022

Healthcare Worker Tax Credit 2022

https://sharedeconomycpa.com/wp-content/uploads/2022/04/child-tax-credit-2022.png

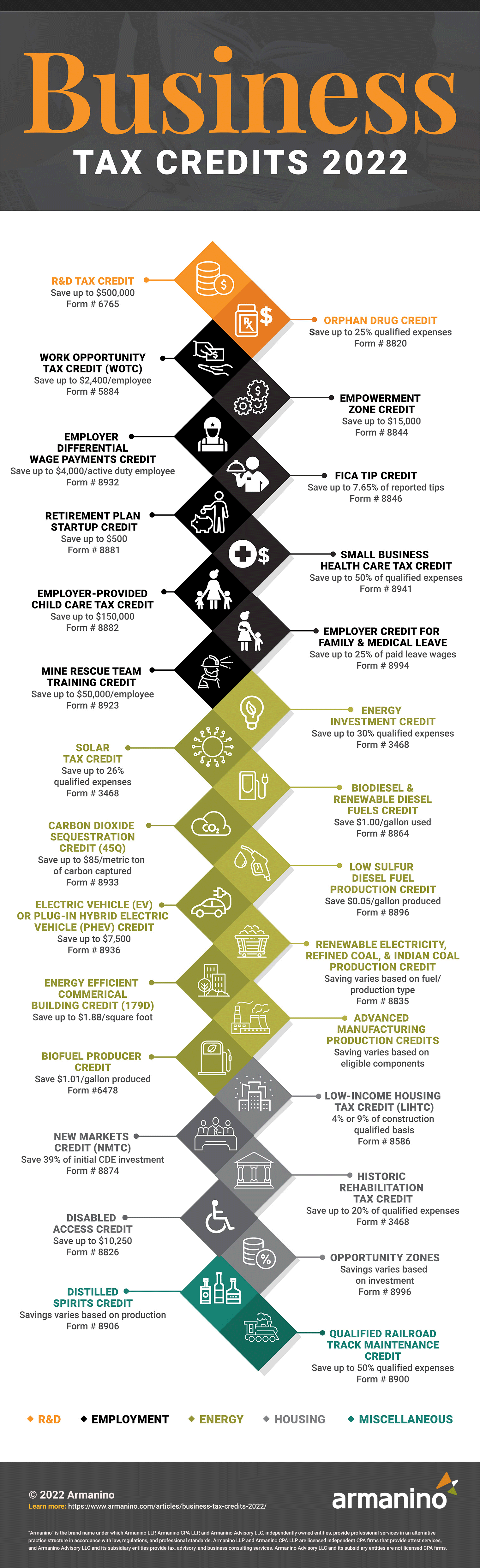

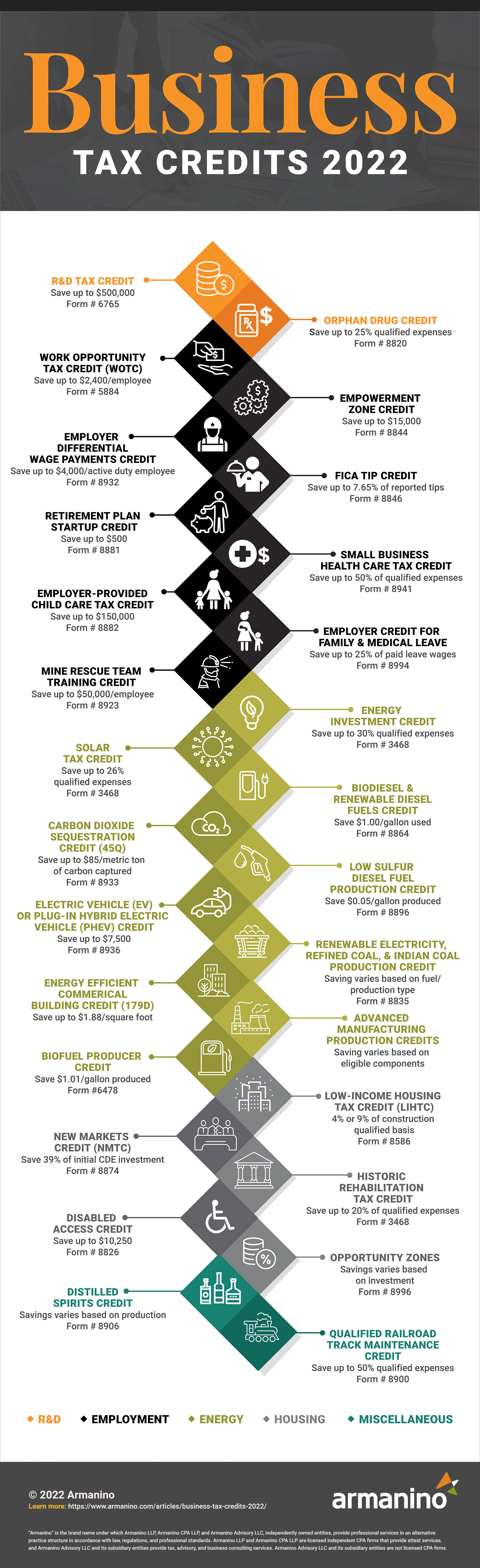

2022 Business Tax Credits Armanino

https://www.armanino.com/-/media/images/articles/business-tax-credits-2022-infographic.jpg

The Benefits Of ERC Tax Credit For Nonprofit Organizations Corensic

https://www.mdaprograms.com/wp-content/uploads/O_-Employee-Retention-Credit-ERC-ad_FP_Sept-2022_8-scaled.jpg

You may qualify for the Small Business Health Care Tax Credit that could be worth up to 50 of the costs you pay for your employees premiums 35 for non profit employers See if you A tax credit you can use to lower your monthly insurance payment called your premium when you enroll in a plan through the Health Insurance Marketplace Your tax

The health coverage tax credit HCTC expired on January 1 2022 For reference purposes this report provides a discussion of key features and program administration of the You must file tax return for 2022 if you are enrolled in a Health Insurance Marketplace plan Learn how to maximize health care tax credit get highest return

Download Healthcare Worker Tax Credit 2022

More picture related to Healthcare Worker Tax Credit 2022

EITC TAX CREDIT 2022 EARNED INCOME TAX CREDIT CALCULATOR 2022 YouTube

https://i.ytimg.com/vi/X1SvVe3_JzA/maxresdefault.jpg

Child Tax Credit 2022 How Much Of Your CTC Payment Is Expected In Your

https://phantom-marca.unidadeditorial.es/988259e034d1160741cebb5cc94b0719/resize/1320/f/jpg/assets/multimedia/imagenes/2021/12/18/16398410536614.jpg

Child Tax Credits May Be Extended Into 2022 As Payments Worth Up To

https://www.the-sun.com/wp-content/uploads/sites/6/2021/12/EP_CTC_2022_OFFPLATFORM.jpg

Hampered by high health insurance premiums The enhanced premium tax credit includes provisions to improve affordability and reduce those costs To be eligible to receive the premium tax credit in 2024 individuals must have annual household income at or above 100 of the federal poverty level not be eligible for

2021 and 2022 Premium Tax Credit Eligibility For tax years 2021 and 2022 the American Rescue Plan of 2021 ARPA temporarily expanded eligibility for the premium tax One of these health insurance subsidies is the premium tax credit which helps pay your monthly health insurance premiums This article will explain how these subsidies

2022 Income Tax Brackets Chart Printable Forms Free Online

https://ocdn.eu/pulscms-transforms/1/qTck9ktTURBXy8xMDA3MTBjYS1jNzY0LTQ0OTQtOTJhNy0xNjRkNDc0NzU0YzMucG5nkIGhMAA

TaxTips ca Business 2022 Corporate Income Tax Rates

https://www.taxtips.ca/smallbusiness/corporatetax/corporate-tax-rates-2022.jpg

https://www.irs.gov › affordable-care-act › ...

The premium tax credit also known as PTC is a refundable credit that helps eligible individuals and families cover the premiums for their health insurance purchased through the

https://www.irs.gov › affordable-care-act › ...

The Premium Tax Credit is a refundable tax credit designed to help eligible individuals and families with low or moderate income afford health insurance purchased

How To Pay Taxes Quarterly A Simple Tax Guide For The Self Employed

2022 Income Tax Brackets Chart Printable Forms Free Online

Healthcare Worker Tax Rebate Free Stuff

Who Benefits Most From Expanded Low Middle Income Worker Tax Credit

Child Tax Credit 2022 Still Time To Collect 3 600 Credit See How

Work Opportunity Tax Credit Available To Employers

Work Opportunity Tax Credit Available To Employers

Philippines Health Workers Protest Neglect As COVID 19 Strains

2022 Education Tax Credits Are You Eligible

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Healthcare Worker Tax Credit 2022 - The health coverage tax credit HCTC expired on January 1 2022 For reference purposes this report provides a discussion of key features and program administration of the