Heat Pump Tax Credit 2022 Inflation Reduction Act Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 25C of the Internal Revenue Code Code and residential energy property under 25D of the Code

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a 2 000 per year for qualified heat pumps biomass stoves or biomass boilers The credit has no lifetime dollar limit You can claim the maximum annual credit every year that you make eligible improvements until 2033 The credit is nonrefundable so you can t get back more on the credit than you owe in taxes

Heat Pump Tax Credit 2022 Inflation Reduction Act

Heat Pump Tax Credit 2022 Inflation Reduction Act

https://iecatlantaga.org/wp-content/uploads/2022/09/AdobeStock_Inflation-scaled.jpeg

Inflation Reduction Act May Have Little Impact On Inflation AP News

https://storage.googleapis.com/afs-prod/media/477fcdbf300e4006816515ff6366dca9/3000.jpeg

What You Need To Know About The Inflation Reduction Act Traders

https://www.tradersaccounting.com/wp-content/uploads/2022/08/Inflation-Reduction-Act.jpg

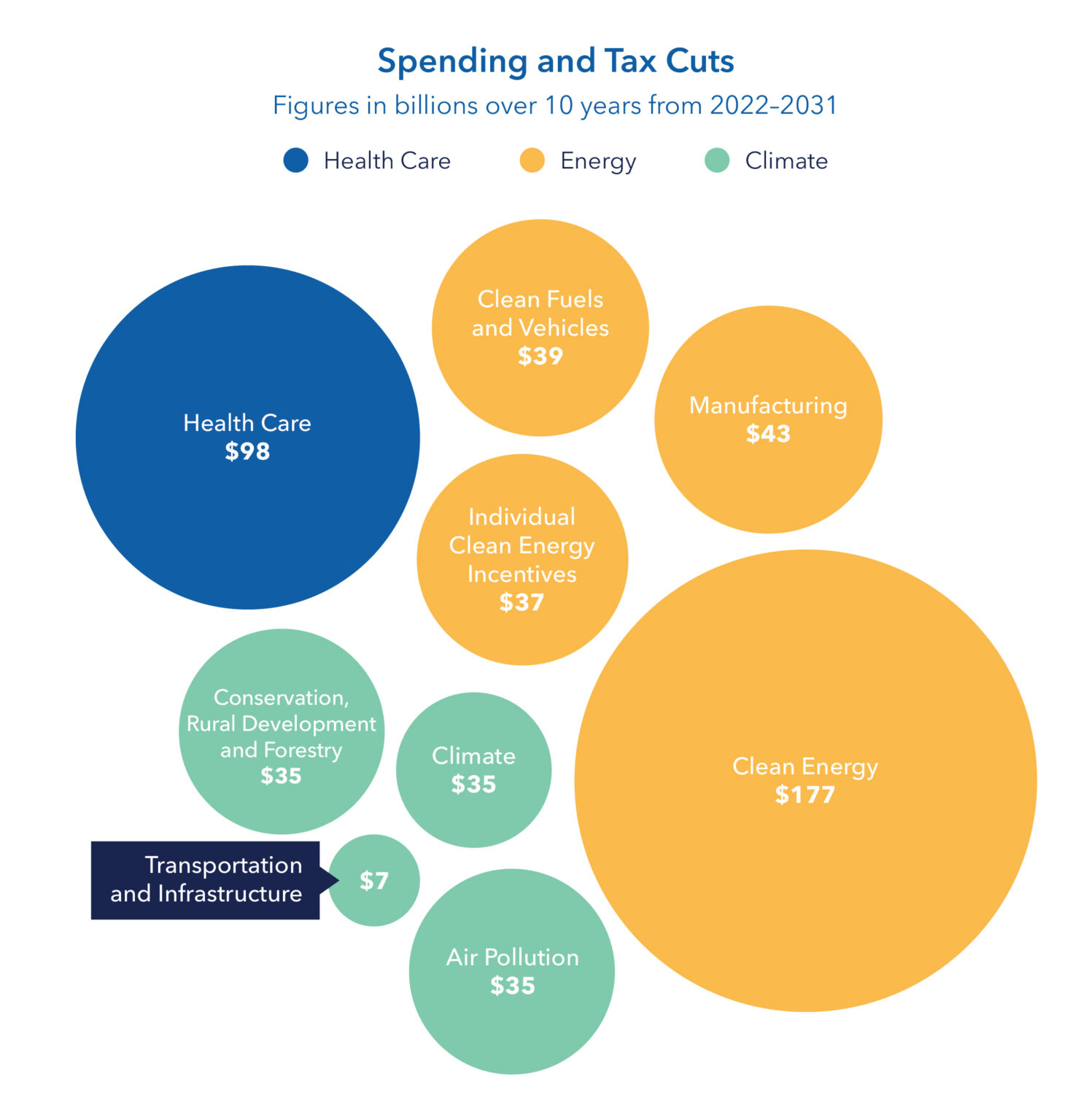

Tax Credit Available for 2022 Tax Year Updated Tax Credit Available for 2023 2032 Tax Years Home Clean Electricity Products Solar electricity 30 of cost Fuel Cells Wind Turbine Battery Storage N A 30 of cost Heating Cooling and Water Heating Heat pumps 300 30 of cost up to 2 000 per year Heat pump water Dramatically Reducing Greenhouse Gas Pollution DOE s preliminary assessment finds that the Inflation Reduction Act and the Bipartisan Infrastructure Law in combination with past actions are projected to drive 2030 economy wide

DOE has published a door hanger detailing the tax credits consumers can receive from the Inflation Reduction Act for installing heat pumps or rooftop solar making energy efficiency improvements On Aug 16 2022 President Joseph R Biden signed the landmark Inflation Reduction Act which provides nearly 400 billion to support clean energy and address climate change including 8 8 billion for the Home Energy Rebates

Download Heat Pump Tax Credit 2022 Inflation Reduction Act

More picture related to Heat Pump Tax Credit 2022 Inflation Reduction Act

Summary Of Tax Incentives In The Inflation Reduction Act Of 2022

https://cdn.catf.us/wp-content/uploads/2022/08/15115831/ira-tax-incentives_Page_1-scaled.jpg

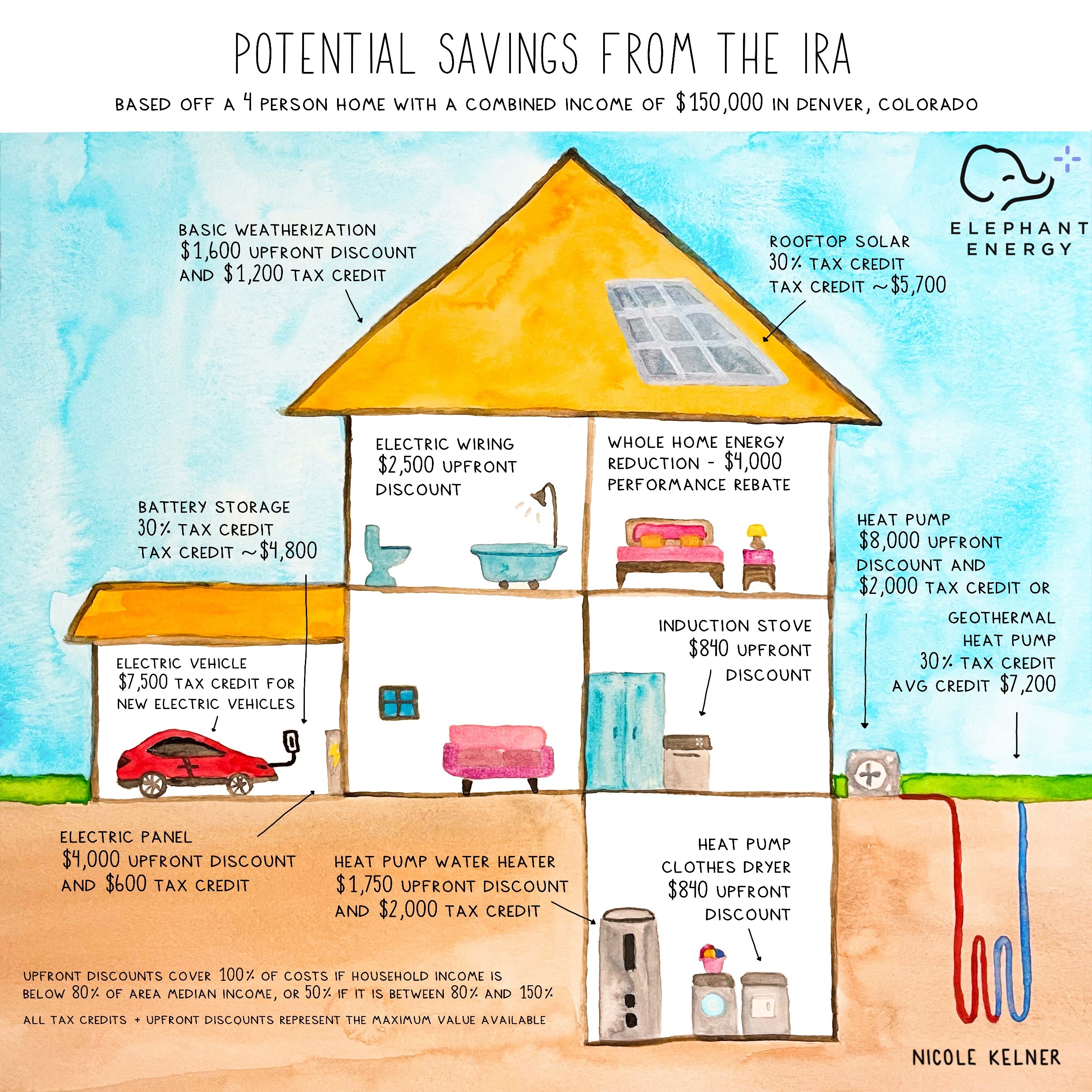

Inflation Reduction Act IRA The Ultimate Guide To Saving

https://elephantenergy.com/wp-content/uploads/2022/09/IRA-Summary-Image-by-Nicole-Kelner-Made-Exclusively-for-Elephant-Energy.jpg

Inflation Reduction Act Of 2022 IRA ESG Hydrus Sustainability

https://www.hydrus.ai/wp-content/uploads/2022/09/ezgif.com-gif-maker-1568x1078.jpg

Published Sat Aug 13 20228 30 AM EDT Greg Iacurci GregIacurci Key Points The Inflation Reduction Act includes thousands of dollars in tax credits and rebates for consumers who buy Up to 1 750 for a heat pump water heater Up to 8 000 for a heat pump for space heating or cooling Up to 840 for an electric stove cooktop range or oven or an electric heat pump

8 000 for heat pump installation 1 750 for a heat pump water heater 840 to offset the cost of a heat pump clothes dryer or an electric stove Rebates for non appliance upgrades are also available up to the following amounts 4 000 for electrical panel upgrades 1 600 for insulation air sealing and ventilation Yes heat pumps are included in the Inflation Reduction Act Homeowners can qualify for a tax credit of 30 for the purchase and installation of a qualified heat pump up to 2 000 Through the High Efficiency Electric Home Rebate Act HEEHRA some homeowners may receive rebates of 100 or 50 off heat pump installation up to 8 000 if they

Renewable Reboot A Download On The Inflation Reduction Act Of 2022

https://media.velaw.com/wp-content/uploads/2022/08/01100031/Detail-hero_Renewable-Reboot-A-Download-on-the-Inflation-Reduction-Act_web.jpg

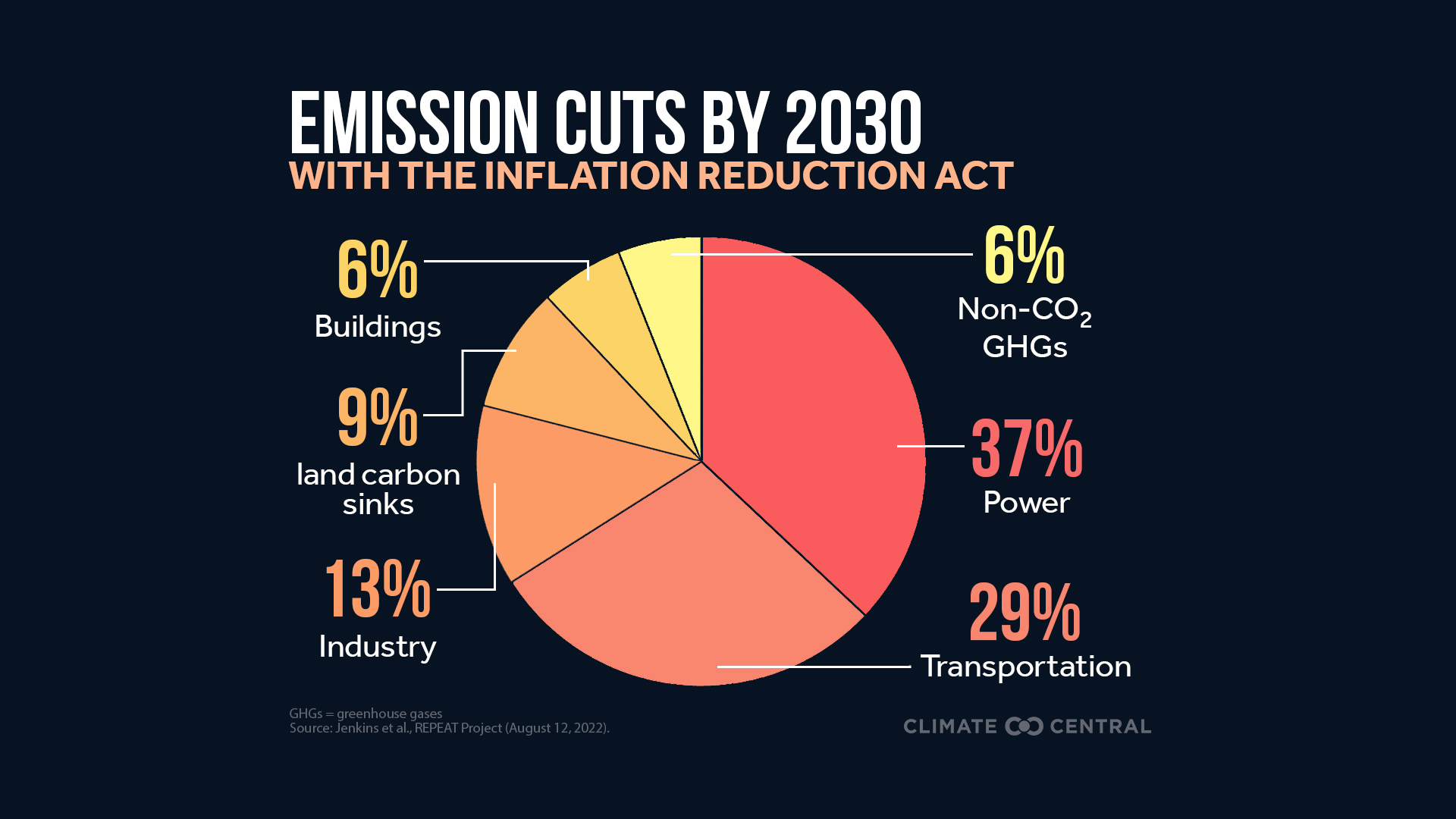

Inflation Reduction Act Resources Climate Central

https://images.ctfassets.net/cxgxgstp8r5d/5fBHkBRDInyf5CExLh2ox0/3a6f83c1675d8058096167d389124ef0/2022IRA_ShareReductions_en_title_lg.jpg

https://www.irs.gov/pub/taxpros/fs-2022-40.pdf

Public Law 117 169 136 Stat 1818 August 16 2022 commonly known as the Inflation Reduction Act of 2022 IRA amended the credits for energy efficient home improvements under 25C of the Internal Revenue Code Code and residential energy property under 25D of the Code

https://home.treasury.gov/news/press-releases/jy1830

The Inflation Reduction Act modifies and extends the Renewable Energy Production Tax Credit to provide a credit of up to 2 75 cents per kilowatt hour in 2022 dollars adjusted for inflation annually of electricity generated from qualified renewable energy sources where taxpayers meet prevailing wage standards and employ a

The Inflation Reduction Act pumps Up Heat Pumps Hvac

Renewable Reboot A Download On The Inflation Reduction Act Of 2022

Key Provisions Of The Inflation Reduction Act Of 2022 Abdo

Inflation Reduction Act Contains Some Health Reforms The Benefit Works

Will The Inflation Reduction Act Raise Your Taxes

TAX UPDATE Inflation Reduction Act Of 2022 RDG Partners

TAX UPDATE Inflation Reduction Act Of 2022 RDG Partners

The National Inflation Reduction Act Of 2022 Effect On Health Care My HST

Inflation Reduction Act 2022 Infographic Infogram

Chart How The Inflation Reduction Act Will Affect U S Emissions

Heat Pump Tax Credit 2022 Inflation Reduction Act - Heat Pump Provisions in the Inflation Reduction Act If you opt to install a heat pump you ll be eligible for a federal tax credit for models that achieve the Consortium for Energy Efficiency s