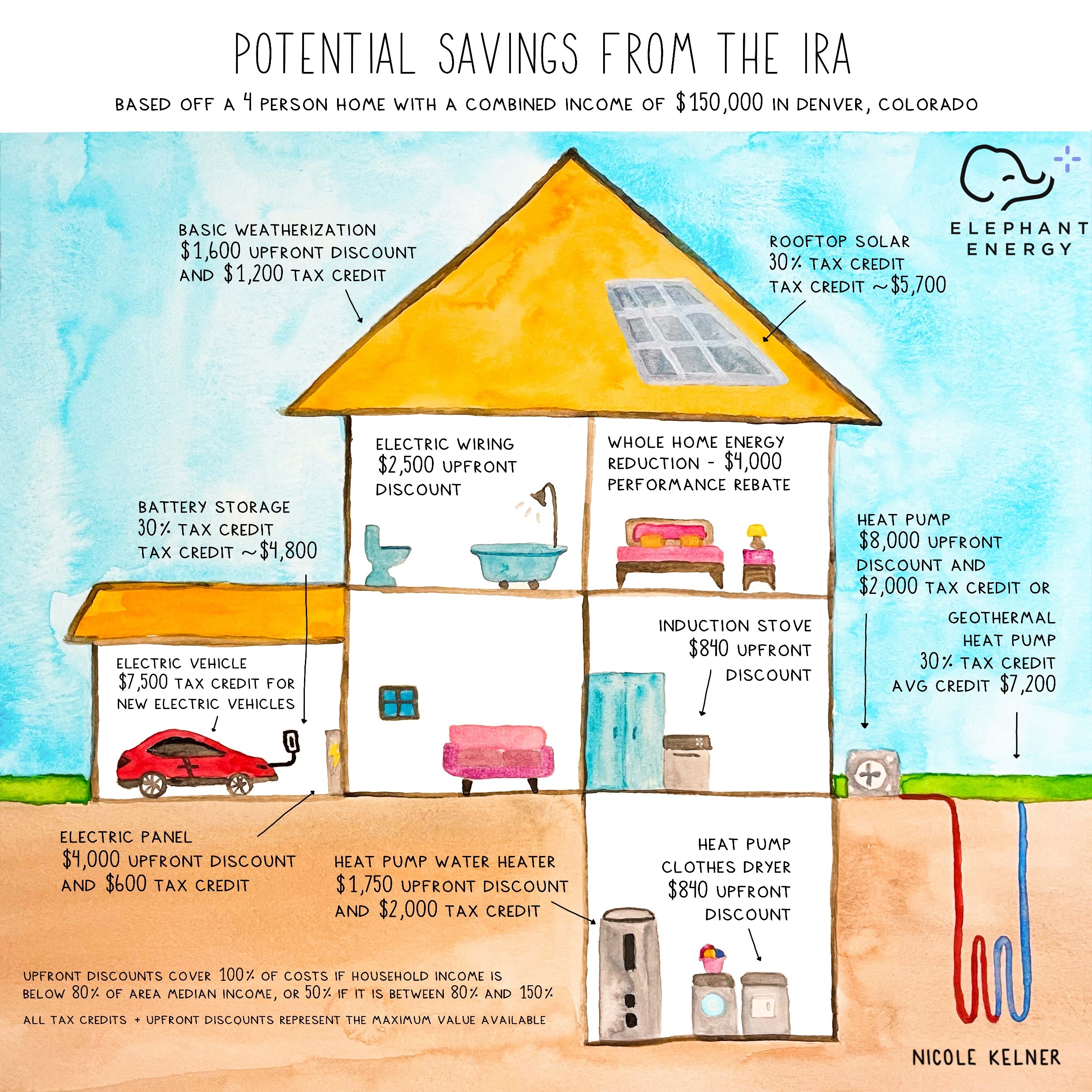

Heat Pump Tax Credit 2023 Texas 8 000 for a heat pump 1 750 for a hot water heater 840 for certain appliances 4 000 for electrical upgrades 1 600 for adding more insulation or ventilation Efficiency Tax Credits Efficiency tax credits are also available for homeowners through the Inflation Reduction Act

Roughly a third of the 10 million households in Texas should qualify for the full heat pump rebate based on the 80 AMI threshold In theory a full rebate would pay for all or most of the cost of an air source heat pump depending on how prices evolve More than half of Texas households would qualify for at least the 50 rebate Air Source Heat Pumps Tax Credit This tax credit is effective for products purchased and installed between January 1 2023 and December 31 2032 How to Claim the Federal Tax Credits Strategies to Maximize Your Federal Tax Savings

Heat Pump Tax Credit 2023 Texas

Heat Pump Tax Credit 2023 Texas

https://www.rescueairtx.com/images/blog/iStock-1444118278.jpg

What You Need To Know About The Federal Tax Credit For Heat Pumps In 2023

https://www.rescueairtx.com/images/blog/Jan-9.png

Air Source Heat Pump Tax Credit 2023 Comfort Control

https://comfortcontrolspecialists.com/wp-content/uploads/2023/06/CCS-Air-Source-Heat-Pumps-Tax-Credit-750x420.jpg

If you make qualified energy efficient improvements to your home after Jan 1 2023 you may qualify for a tax credit up to 3 200 You can claim the credit for improvements made through 2032 For improvements installed in 2022 January 08 2023 Want to upgrade your HVAC system and take advantage of rebates and incentives to minimize the cost Texas and the federal government have several programs that can help make switching to a more energy efficient heating and

Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are made As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses If your household income is 81 150 of your area s median income you re eligible to receive up to 50 of the maximum heat pump rebate If your household income exceeds 150 of your area s median income you aren t eligible for the HEEHRA rebates but can still receive a 30 tax credit of up to 2 000 on a new heat pump

Download Heat Pump Tax Credit 2023 Texas

More picture related to Heat Pump Tax Credit 2023 Texas

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/QX3ShkFit/1600x837/heat-pump-1-1660837497727.jpg?position=top

Your Guide To The Heat Pump Tax Credit Rebates In 2023 Rapid

https://rapidhvactn.com/wp-content/uploads/2022/10/IMG_1761.jpg

How To Take Advantage Of The Heat Pump Tax Credit

https://media.marketrealist.com/brand-img/bjAd12-bt/1024x536/heat-pump-2-1660837533114.jpg

For the tax credit program the new incentives will apply to equipment installed on January 1 2023 or later A smaller tax credit of up to 300 for a heat pump meeting the CEE s top tier of You can receive up to 50 of the max if your household income is 81 150 of your area s median income House hold incomes exceeding 150 aren t eligible for the HEEHRA rebate program but you can still receive a 30 tax credit totalling up to 2000 a year on a new heat pump

According to the IRA heat pumps eligible for tax credits must meet or exceed the highest efficiency tier outlined by the Consortium for Energy Efficiency CEE Currently the CEE s highest efficiency tiers for heat pumps are much more stringent than those set by Key Takeaways High efficiency heat pumps and mini splits are eligible for a federal tax credit up to 2 000 Larger federally funded rebates will be available eventually though Texas SECO has not said when Those rebates may not be easy to claim either

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

https://media1.moneywise.com/cdn-cgi/image/fit=cover,g=left,width=756,height=336,f=auto,quality=80/a/23311/heat-pump-tax-credit-rebate_hero_1800x800_v20220927160431.jpg

Tax Credits Offered For Heat Pump Installation YouTube

https://i.ytimg.com/vi/j5EODeZMn-0/maxresdefault.jpg

https://airauthorityllc.com/2023-guide-texas-hvac-rebates-tax-credits

8 000 for a heat pump 1 750 for a hot water heater 840 for certain appliances 4 000 for electrical upgrades 1 600 for adding more insulation or ventilation Efficiency Tax Credits Efficiency tax credits are also available for homeowners through the Inflation Reduction Act

https://texasclimatenews.org/2023/03/02/heat-pumps...

Roughly a third of the 10 million households in Texas should qualify for the full heat pump rebate based on the 80 AMI threshold In theory a full rebate would pay for all or most of the cost of an air source heat pump depending on how prices evolve More than half of Texas households would qualify for at least the 50 rebate

New Electric Heat Pump Tax Credits Climate Control

Heat Pump Tax Credits And Rebates Continue In 2024 Moneywise

Heat Pump Tax Credit 2023 All You Need To Know Clover Contracting

Federal Tax Credits For Air Conditioners Heat Pumps 2023

Inflation Reduction Act IRA The Ultimate Guide To Saving

2023 Heat Pump Tax Credit What You Need To Know Flotechs Plumbing

2023 Heat Pump Tax Credit What You Need To Know Flotechs Plumbing

Heat Pump Tax Credit Reddit PumpRebate

Heat Pump Tax Credit

Heat Pumps Rebates 2019 Coastal Energy PumpRebate

Heat Pump Tax Credit 2023 Texas - Taxpayers that make qualified energy efficient improvements to their home after Jan 1 2023 may qualify for a tax credit up to 3 200 for the tax year the improvements are made As part of the Inflation Reduction Act beginning Jan 1 2023 the credit equals 30 of certain qualified expenses