Hennepin County Tax Value Verkko January 2 assessed property value as of this date is used for this year s proposed taxes and next year s tax statement March April valuation and classification notices mailed to taxpayers April May time frame to discuss or appeal valuation or classification Mid June county board of appeal and equalization convenes

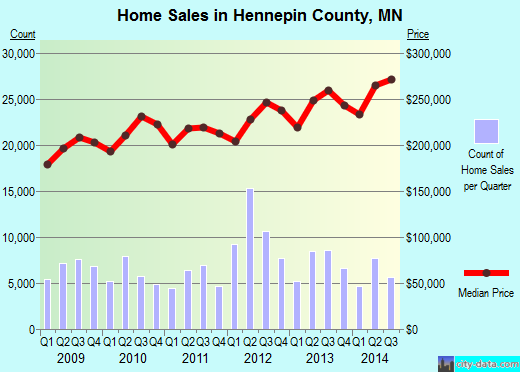

Verkko Property Information Search Delinquent and Contract Amounts Due Contract the Property Tax area for additional information 612 348 3011 or taxinfo hennepin us Property Verkko The median home value in Hennepin County is 292 100 and the median annual property tax payment is 3 856 Similarly those numbers are higher than the overall median home value and median property taxes paid for Minnesota which are 285 400 and 2 915 respectively

Hennepin County Tax Value

Hennepin County Tax Value

http://datausa.io/api/profile/geo/05000US27053/splash

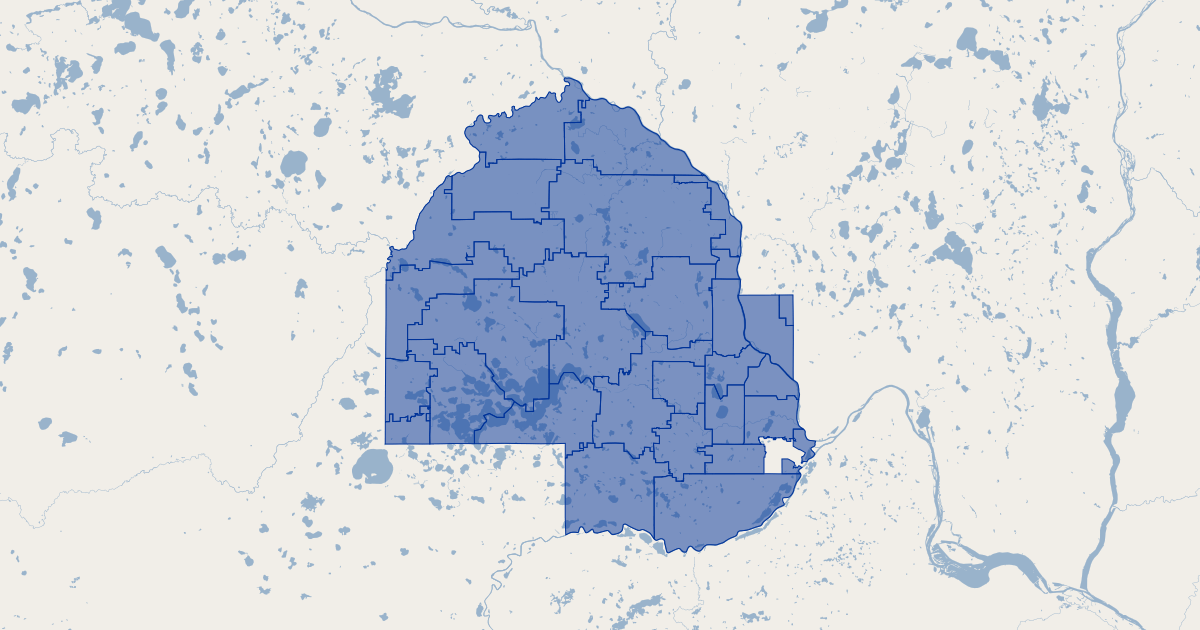

Map Of Hennepin County Minn David Rumsey Historical Map Collection

https://media.davidrumsey.com/MediaManager/srvr?mediafile=/Size4/D0074/00744092.jpg

Property Tax Calculator Hennepin County STAETI

https://i.pinimg.com/originals/95/0c/44/950c44fd02a90c88fa39911e03f98bff.jpg

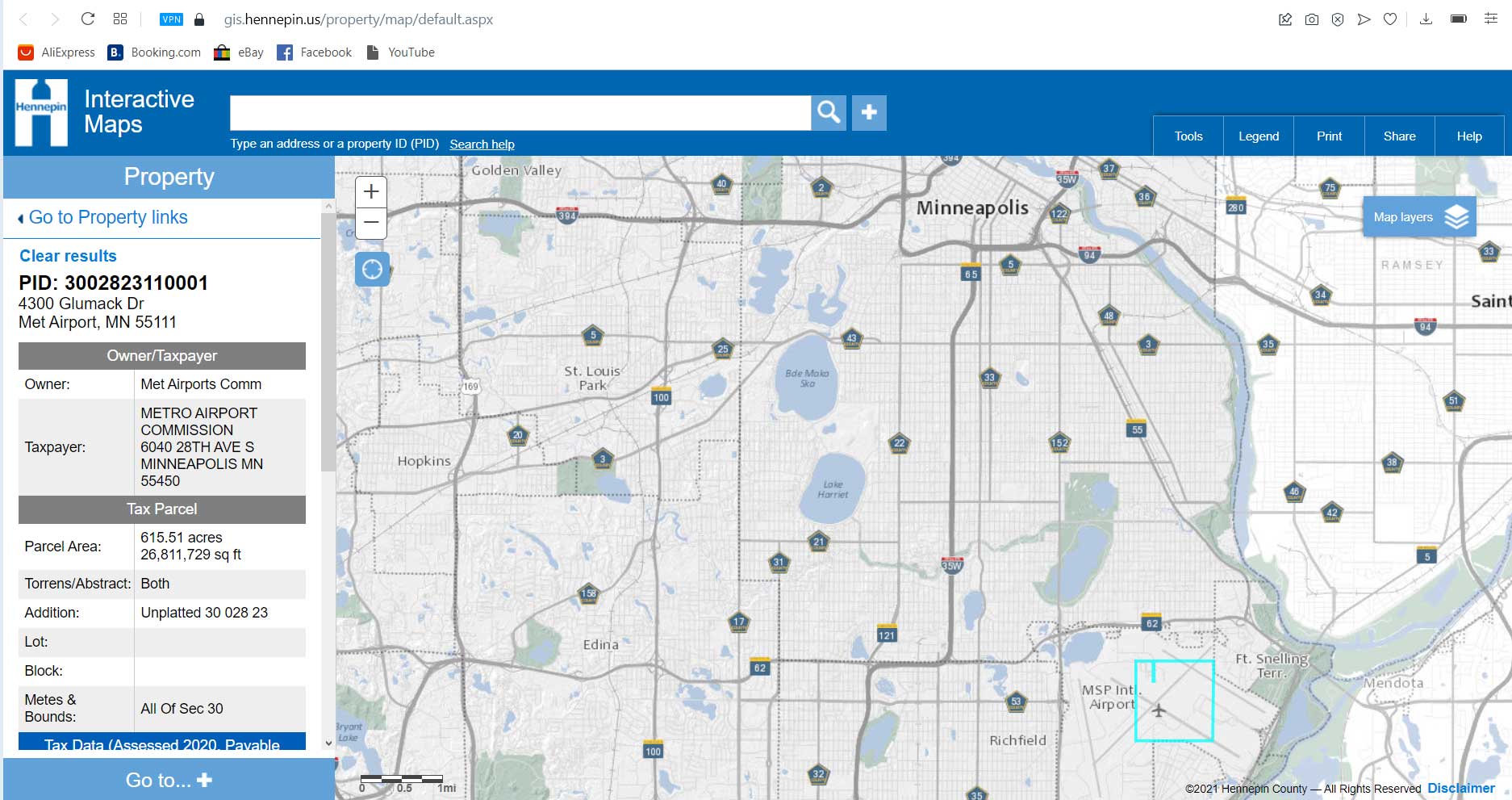

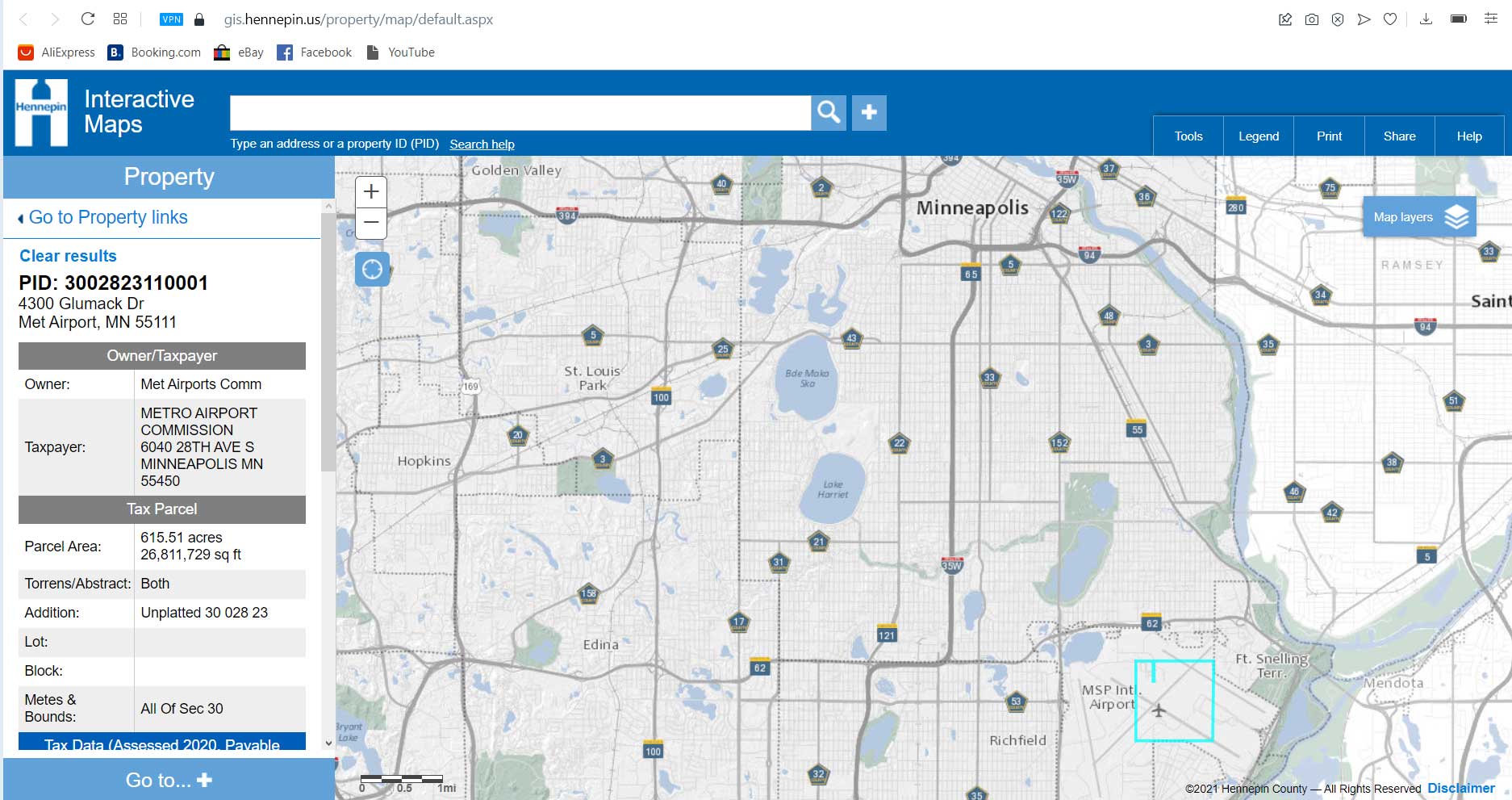

Verkko Hennepin County mails property tax statements in March Your first payment is due May 15 Verkko Assessed values 741 000 Taxable Value amp Exemptions Taxable value represents the assessed value less any tax exemptions that apply Hennepin County provides several tax relief programs that may lower the property s tax bill This property does not benefit of any exemption so the taxable values will be equal to the assessed values Property Tax

Verkko The median property tax in Hennepin County Minnesota is 2 831 per year for a home worth the median value of 247 900 Hennepin County collects on average 1 14 of a property s assessed fair market value as property tax Hennepin County has one of the highest median property taxes in the United States and is ranked 191st of the 3143 Verkko This database is updated daily Monday Friday at approximately 9 15 p m CST Property ID number 30 116 21 44 0152

Download Hennepin County Tax Value

More picture related to Hennepin County Tax Value

LES MEILLEURES Choses Faire Hennepin 2024 avec Photos

https://dynamic-media-cdn.tripadvisor.com/media/photo-o/08/4f/98/b8/hennepin-canal-parkway.jpg?w=1000&h=-1&s=1

Hennepin County Action On Unsheltered Minnesota Women s Press

https://www.womenspress.com/wp-content/uploads/2018/07/Minnesotarefuge-1024x987.jpg

CONTENTdm

https://digitalcollections.hclib.org/digital/api/singleitem/image/p17208coll17/279/default.jpg

Verkko 6 maalisk 2023 nbsp 0183 32 Hennepin County mails a property tax statement to all Minneapolis property owners in March The tax statement lists The estimated market value and classification of your property Verkko From April 1 to June 30 of the tax year you may appeal the market value and classification The market value and classification become final on July 1 of the tax year For example the timeline for estimating a property s 2020 market value looks like this The assessor reviews property sales from October 1 2018 to September 30 2019

Verkko Here cities schools and other taxing districts will find information about tax base values tax rates and other data specific to their district In addition summary value and rate tables are available to anyone interested in property tax issues in Hennepin County Verkko For comparison the median home value in Hennepin County is 247 900 00 If you need to find your property s most recent tax assessment or the actual property tax due on your property contact the Hennepin County Tax Appraiser s office

Hennepin Laminated Tote Inkmule

https://products.mpowerpromo.com/DEBCO/TO9399/ATO9399WHITE/BLACK/TO9399_Royal_Blue_large.jpg

Hennepin County Property Map

https://i.pinimg.com/736x/93/f9/0d/93f90d897d7acc73bf6f3a0943cec6dc--vintage-maps-minnesota.jpg

https://www.hennepin.us/residents/property/assessment

Verkko January 2 assessed property value as of this date is used for this year s proposed taxes and next year s tax statement March April valuation and classification notices mailed to taxpayers April May time frame to discuss or appeal valuation or classification Mid June county board of appeal and equalization convenes

https://propertyinformation.hennepin.us

Verkko Property Information Search Delinquent and Contract Amounts Due Contract the Property Tax area for additional information 612 348 3011 or taxinfo hennepin us Property

Hennepin County Horticultural Society

Hennepin Laminated Tote Inkmule

Property Tax Petitions Hennepin County Property Tax Hennepin

Hennepin County District 1 Candidate Questionnaire LaptrinhX News

Hennepin County Minnesota School Districts Koordinates

Property Tax Hennepin 2023

Property Tax Hennepin 2023

0 24 Acres In Hennepin County Minnesota

Lobbyceiv Hennepin County Property Tax Search

Singles Hennepin CES Assessor Training Hennepin CoC Coordinated

Hennepin County Tax Value - Verkko This database is updated daily Monday Friday at approximately 9 15 p m CST Property ID number 30 116 21 44 0152