Higher Education Tax Rebate Web 10 mars 2022 nbsp 0183 32 There are two education tax credits designed to help offset these costs the American opportunity tax credit and the lifetime learning credit Taxpayers who paid

Web 30 mars 2023 nbsp 0183 32 The loan must only be availed to pursue higher education in India or overseas in order to qualify for tax deductions under Section 80E According to the Web 26 sept 2016 nbsp 0183 32 26th September 2016 The Higher Education Sector includes many different professionals and most are missing out on their legitimate tax rebates Higher

Higher Education Tax Rebate

Higher Education Tax Rebate

https://www.city-plap.com/cityplap/wp-content/uploads/2022/07/EPTC-1-768x576.jpg

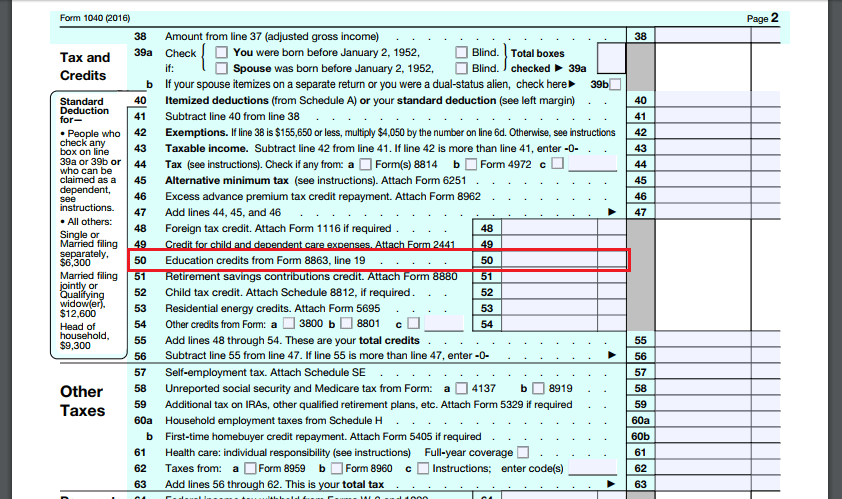

Education Tax Credits For College Students The Official Blog Of TaxSlayer

https://www.taxslayer.com/blog/wp-content/uploads/2020/04/Education-Tax-Breaks-1.jpg

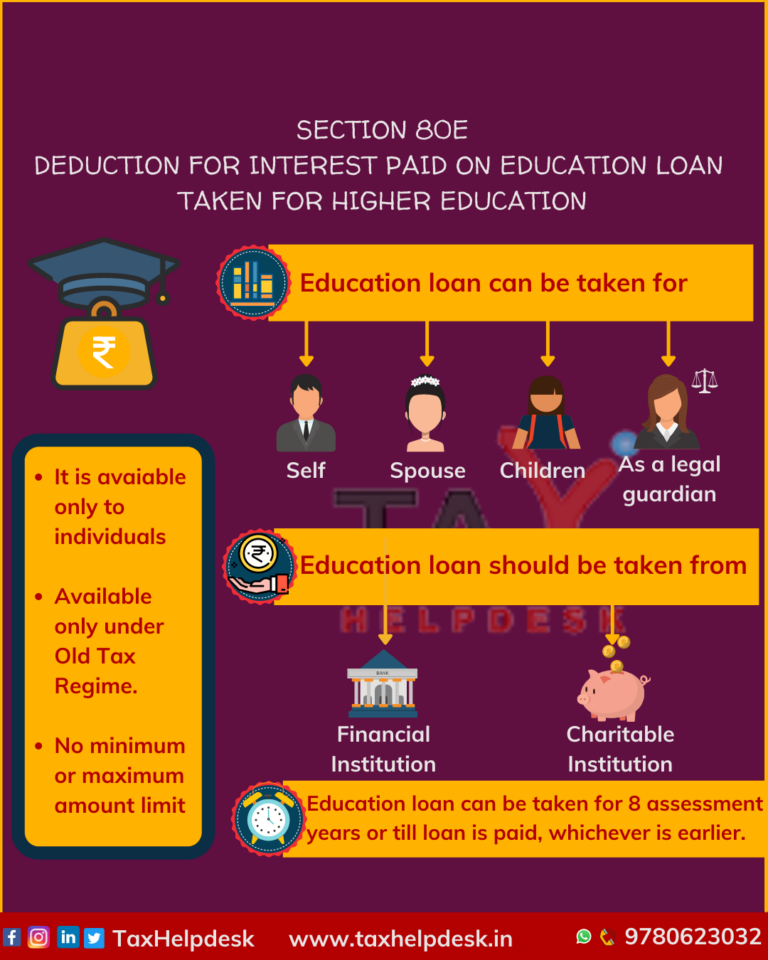

Deduction Under Section 80E Interest Paid On Higher Education

https://www.taxhelpdesk.in/wp-content/uploads/2021/08/SECTION-80E-DEDUCTION-FOR-INTEREST-PAID-ON-EDUCATION-LOAN-TAKEN-FOR-HIGHER-EDUCATION-1-768x960.png

Web 27 juin 2023 nbsp 0183 32 Updated on Dec 28th 2022 3 27 43 AM 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well Web 17 f 233 vr 2017 nbsp 0183 32 Let us say you fall in the highest income bracket and you pay 31 2 per cent as tax and you pay Rs 80 000 a year as schools fees Here the tax saved will amount

Web 25 f 233 vr 2021 nbsp 0183 32 Is the deduction under Section 80C only allowed for tuition fees paid for Higher education Ans No Not only colleges or universities but fees paid to schools playschools Nursery schools and cr 232 ches are Web 14 sept 2019 nbsp 0183 32 The Income Tax Act allows tax benefits for a loan taken for higher education when certain conditions are met Tax benefits have been laid down under Section 80E of the Income Tax Act

Download Higher Education Tax Rebate

More picture related to Higher Education Tax Rebate

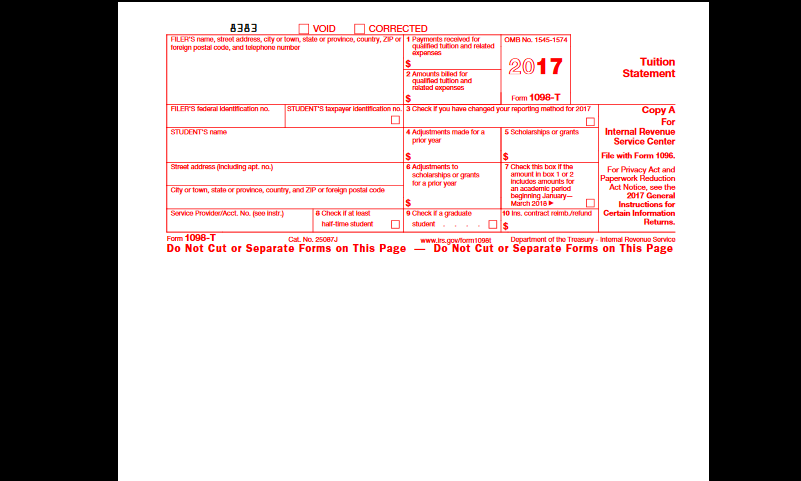

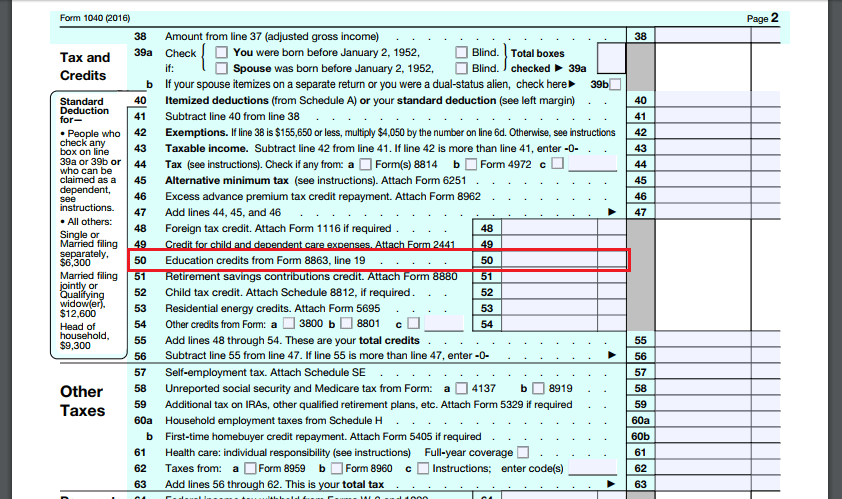

AOTC LLC Two Higher Education Tax Benefits For US Taxpayers The

http://theusualstuff.com/wp-content/uploads/2017/11/1098-T-min-e1510647027757.png

HIGHER EDUCATION TAX BENEFITS 2014 TAX YEAR 4

https://s2.studylib.net/store/data/011801263_1-273319d6cc82a29091c953aefe5bbd94-768x994.png

You May Be Eligible For Higher Education Tax Benefits Higher

https://i.pinimg.com/736x/f0/aa/f1/f0aaf1b760a084d3c0f290c793ca3f57--tax-deductions-cmo.jpg

Web Any individual who has applied for a loan for higher education can avail the benefits of tax saving provided by Section 80E of the Income Tax Act 1961 Even if an individual has Web Deduct higher education expenses on your income tax return as for example a business expense and also claim a lifetime learning credit based on those same expenses Claim a lifetime learning credit for

Web An individual who has taken an education loan for higher education can avail the tax deduction under Section 80E of the Income Tax Act 1961 The best part about this Web 25 mai 2022 nbsp 0183 32 Definition of qualified education expenses tuition and fees room and board books supplies equipment other expenses such as transportation Determining how

AOTC LLC Two Higher Education Tax Benefits For US Taxpayers The

http://theusualstuff.com/wp-content/uploads/2017/11/1040-min.png

More Tax Credits More Rebates Education Magazine

https://i0.wp.com/educationmagazine.ie/wp-content/uploads/2022/10/bbb-Irish-Tax-Rebates.jpg?fit=1200%2C800&ssl=1

https://www.irs.gov/newsroom/two-tax-credits-that-can-help-cover-the...

Web 10 mars 2022 nbsp 0183 32 There are two education tax credits designed to help offset these costs the American opportunity tax credit and the lifetime learning credit Taxpayers who paid

https://cleartax.in/s/tax-benefits-on-education-loan

Web 30 mars 2023 nbsp 0183 32 The loan must only be availed to pursue higher education in India or overseas in order to qualify for tax deductions under Section 80E According to the

Higher Education Tax Benefits 2013 Tax Year

AOTC LLC Two Higher Education Tax Benefits For US Taxpayers The

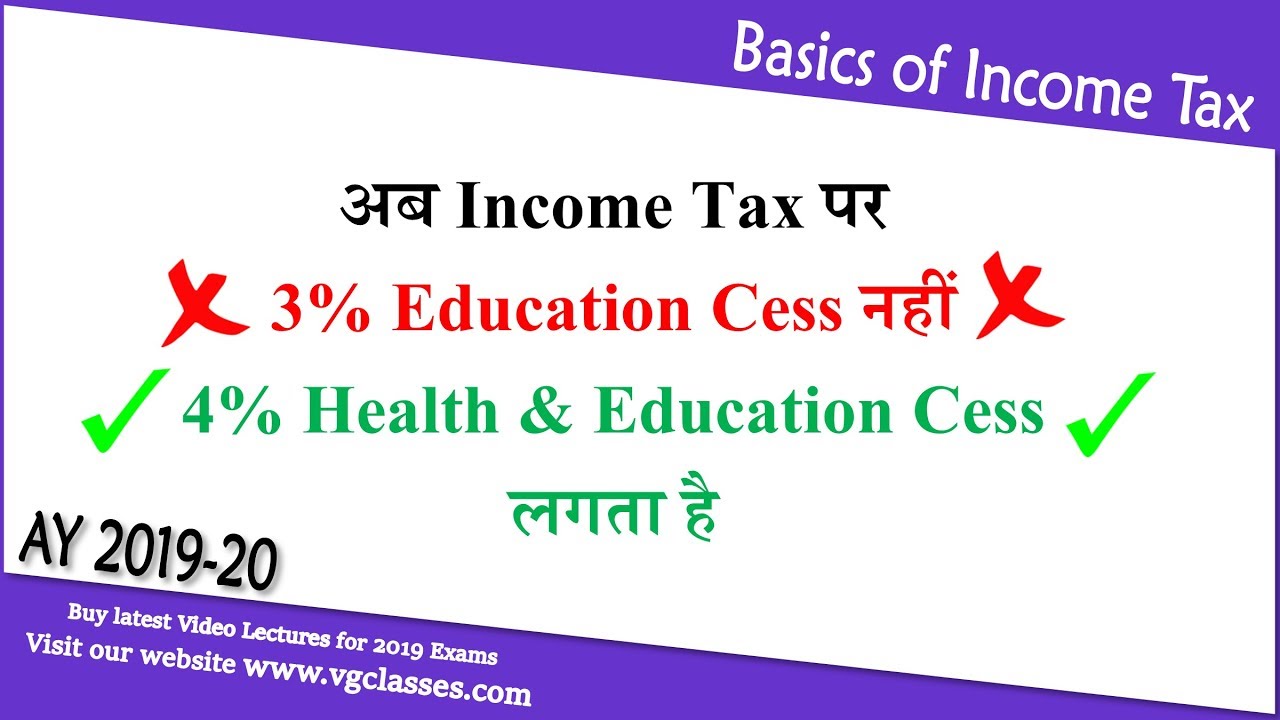

Health Education Cess Rebate U s 87A Marginal Relief Income Tax

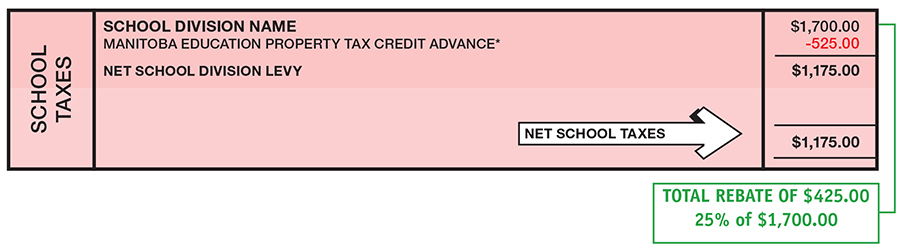

Provincial Education Property Tax Rebate Roll Out Rural Municipality

Owners Of Pricey Properties Pocketed Big Bucks From Tax Cuts Promised

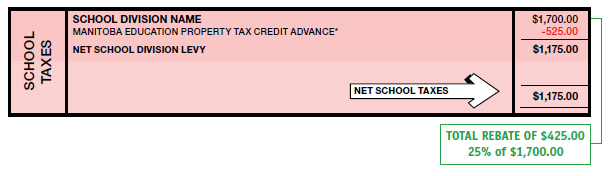

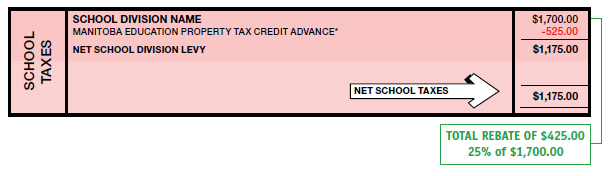

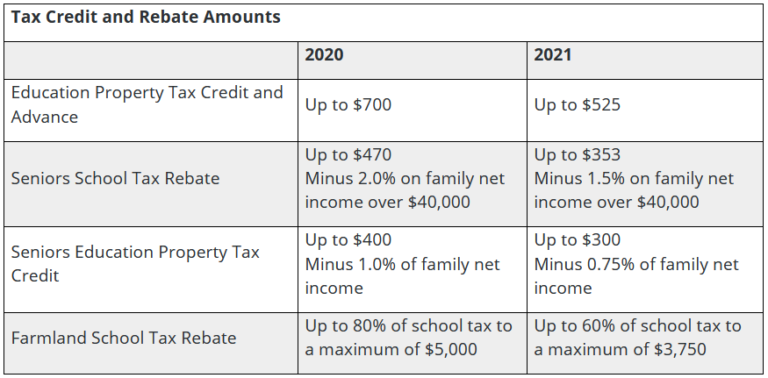

Changes To Educational Property Tax The Education Property Tax Rebate

Changes To Educational Property Tax The Education Property Tax Rebate

Most Residential Properties To Incur Higher Tax From Jan 1 2023

Province Of Manitoba Education Property Tax

Provincial Education Property Tax Rebate Roll Out Rural Municipality

Higher Education Tax Rebate - Web 27 juin 2023 nbsp 0183 32 Updated on Dec 28th 2022 3 27 43 AM 5 min read CONTENTS Show An education loan helps you not only finance your foreign studies but it can save you a lot of tax as well