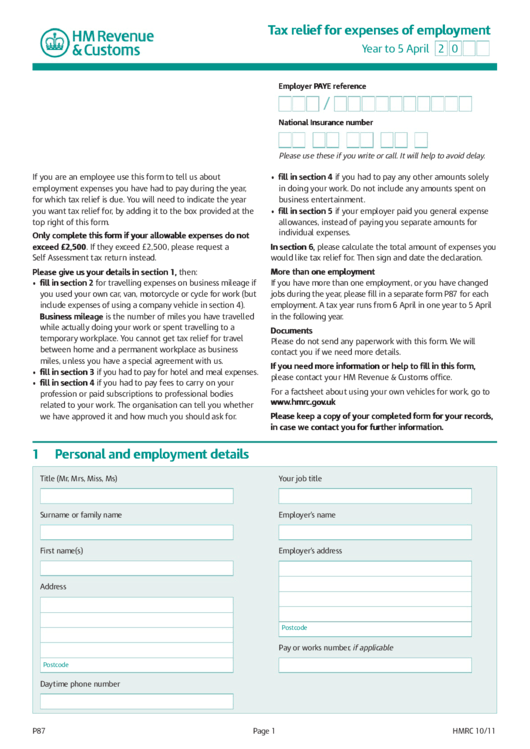

Hm Revenue And Customs Tax Relief For Expenses Of Employment If you re eligible you can claim Income Tax relief on your job expenses by post using form P87 or by phone

Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs If you are an employee use this form to tell us about employment expenses you have had to pay during the year for which tax relief is due These may relate to professional subscriptions

Hm Revenue And Customs Tax Relief For Expenses Of Employment

_(-2013).svg__5.png)

Hm Revenue And Customs Tax Relief For Expenses Of Employment

https://www.cwgrowthhub.co.uk/sites/default/files/HM_Revenue_and_Customs_(UK)_(-2013).svg__5.png

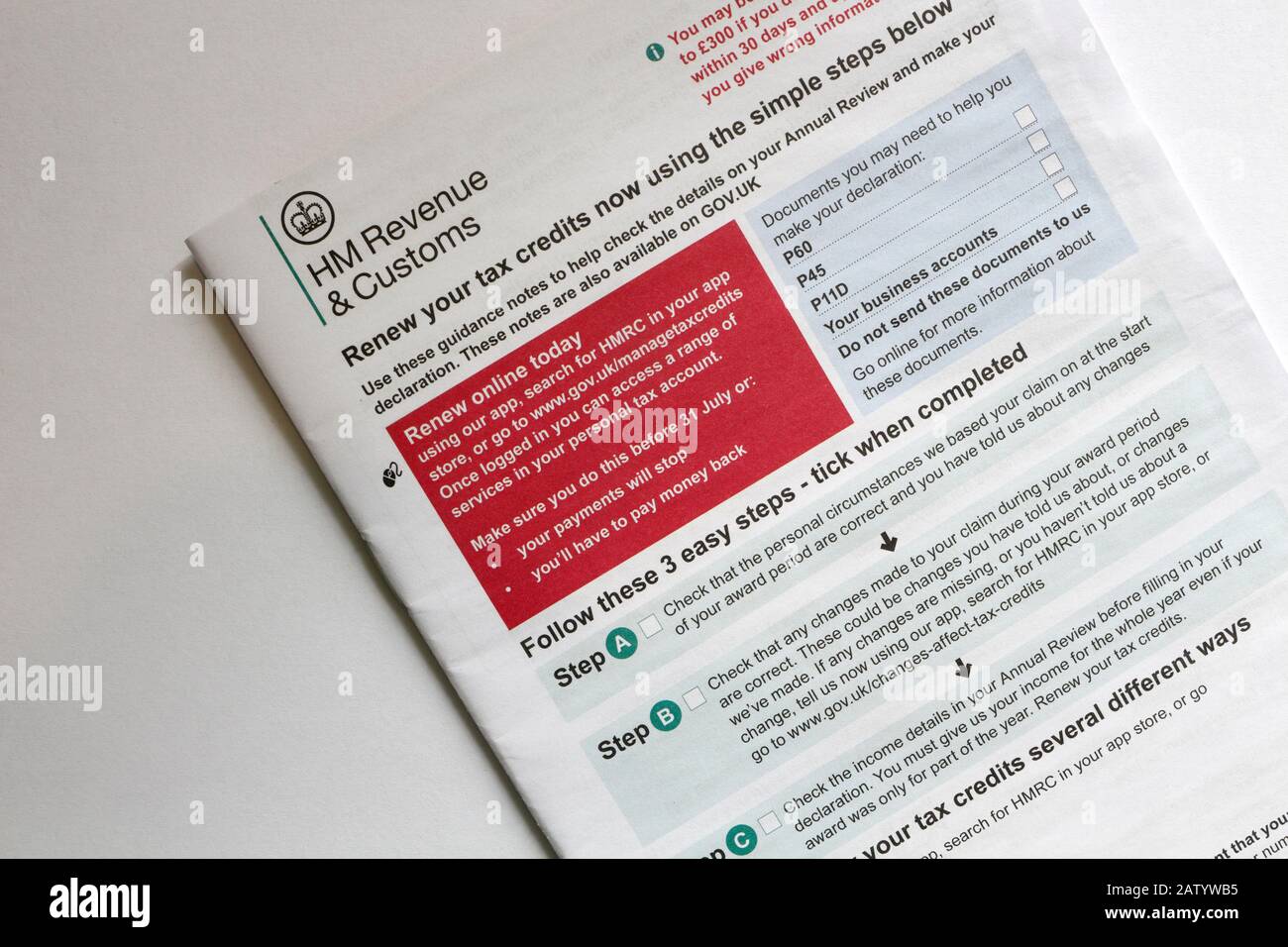

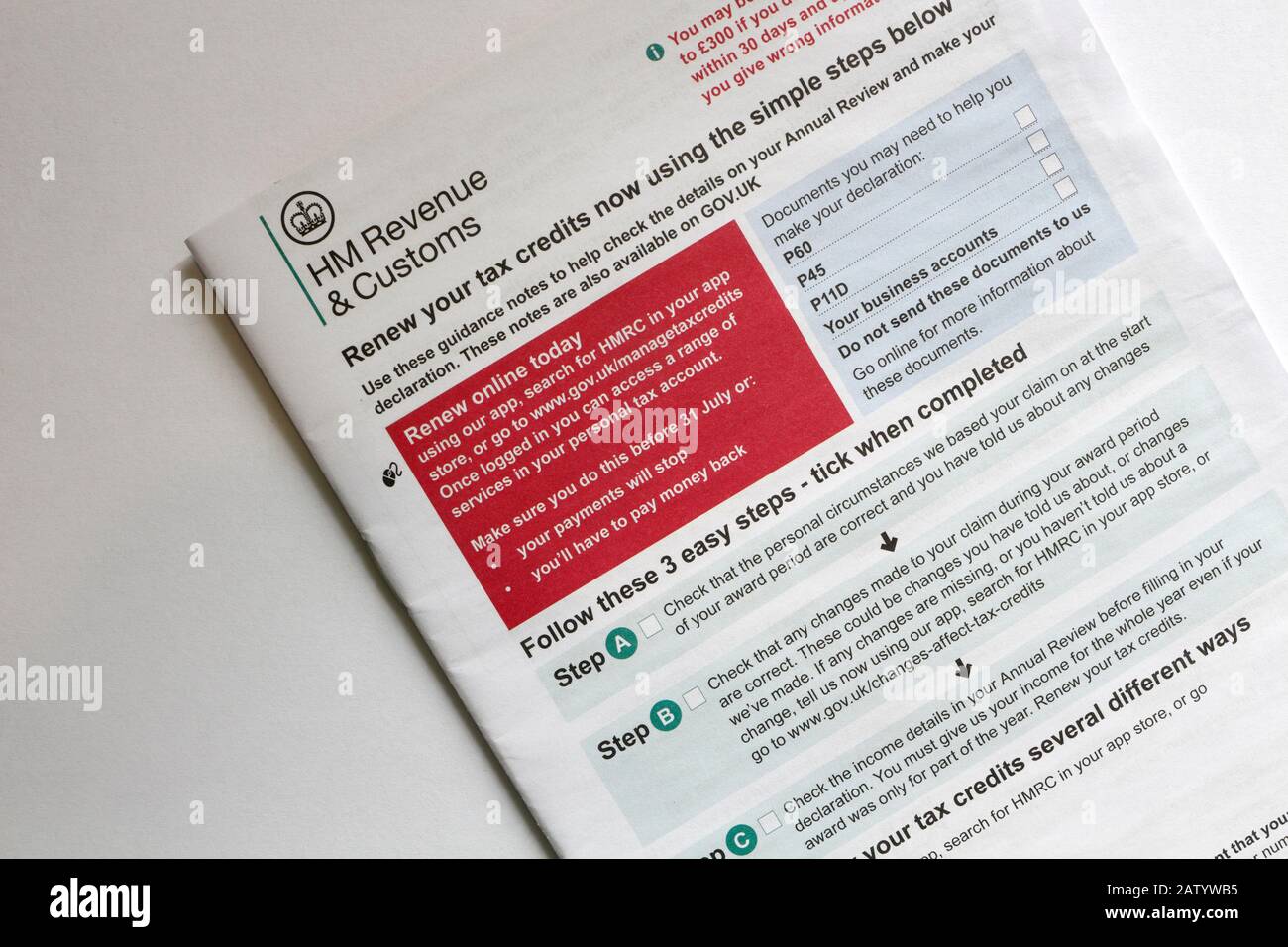

HM Revenue And Customs Tax Credit Renewal Form Stock Photo Alamy

https://c8.alamy.com/comp/2ATYWB5/hm-revenue-and-customs-tax-credit-renewal-form-2ATYWB5.jpg

Received A Letter From HMRC Following These Tips Will Help You Avoid

https://www.lamontpridmore.co.uk/wp-content/uploads/2022/08/Scam-letter.png

If you have paid expenses related to your employment you may be able to claim tax relief We provide an example showing you how to complete form P87 which you can use to claim tax relief on employment expenses Individuals in paid employment needing to claim tax relief on job expenses by post are required to use the P87 form However from 21 December 2022 the new Tax relief for expenses of employment P87 form and guidance notes will need to be used

HM Revenue and Customs HMRC have recently released a new form P87 to help standardise tax relief on work related expense claims What is a form P87 An employee can submit a form P87 to claim tax relief on employment expenses that they are liable for in the course of their employment You can go straight to HMRC and you re guaranteed to get 100 of the refund It s free and all you need to do is fill in some details online whether you re claiming tax relief at gov uk tax relief for employees or a tax rebate at gov uk claim tax refund

Download Hm Revenue And Customs Tax Relief For Expenses Of Employment

More picture related to Hm Revenue And Customs Tax Relief For Expenses Of Employment

HMRC R D Compliance Check Eligibility Nudge Letters

https://forrestbrown.co.uk/wp-content/uploads/2021/03/Example-HMRC-compliance-check-nudge-letter.png

Hm Revenue And Customs Tax Relief For Expenses Of Employment Printable

https://data.formsbank.com/pdf_docs_html/5/58/5871/page_1_thumb_big.png

HM Revenue And Customs Tax Credits And Revenue Benefits

https://www.yumpu.com/en/image/facebook/50749623.jpg

To obtain tax relief the expense must have been Incurred personally and not reimbursed by your employer Incurred wholly exclusively and necessarily in the performance of your employment You must be a taxpayer in order to claim relief All claims must be made to HM Revenue Customs HM Revenue and Customs agree the expenses fixed by the Treasury for flat rate deductions They are typical amounts spent each year by employees in different occupations For example all agricultural workers can get a deduction of 100 from the 2008 09 tax year onward

Employers wishing to pay or reimburse expenses are able to do so under the provisions of an exemption with no deductions for tax or NICs where they either pay or reimburse in an approved way or You can claim tax relief on professional membership fees if you must pay the fees to be able to do your job annual subscriptions you pay to approved professional bodies or learned

More Than 40 Clubs And 170 Players Facing Tax Investigation Express

https://www.expressandstar.com/resizer/ip7TKyOkZ_2fFwMAcyY-TqnlYl4=/1200x0/cloudfront-us-east-1.images.arcpublishing.com/mna/JUEM65Z22ZCIDCZLKOU63UPEUY.jpg

HM Revenue Customs Tax Return Stock Photo Alamy

https://c8.alamy.com/comp/D3YR88/hm-revenue-customs-tax-return-D3YR88.jpg

_(-2013).svg__5.png?w=186)

https://www.gov.uk/guidance/send-an-income-tax...

If you re eligible you can claim Income Tax relief on your job expenses by post using form P87 or by phone

https://www.gov.uk/tax-relief-for-employees/working-at-home

Claiming tax relief on expenses you have to pay for your work like uniforms tools travel and working from home costs

Customs Forms Printable Printable Forms Free Online

More Than 40 Clubs And 170 Players Facing Tax Investigation Express

HMRC 2021 Paper Tax Return Form

HM Revenue Customs Sets Out Making Tax Digital Plans For VAT And

HMRC To Sell Taxpayers Financial Data To Private Companies HuffPost UK

A Guide To HMRC s Accelerated Payment Notices APNs Bytestart

A Guide To HMRC s Accelerated Payment Notices APNs Bytestart

HM Revenue Customs Tax Form Stock Photo Alamy

HM Revenue Customs On Twitter If You Have Been Paid In Loans To

HM Revenue Customs On Twitter If You ve Used A Scheme That Paid

Hm Revenue And Customs Tax Relief For Expenses Of Employment - HM Revenue and Customs HMRC have recently released a new form P87 to help standardise tax relief on work related expense claims What is a form P87 An employee can submit a form P87 to claim tax relief on employment expenses that they are liable for in the course of their employment