Hmrc Claiming Tax Back On Pension Contributions Your member or their representative must make a declaration to you before they can contribute to your scheme and before you can claim the tax relief back from

If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as net of basic How to tell if you re due a pension tax refund You may have been affected by this and could be due a refund from HMRC if you are over 55 the age you re allowed to access your pension pot from and

Hmrc Claiming Tax Back On Pension Contributions

Hmrc Claiming Tax Back On Pension Contributions

https://nursingnotes.co.uk/wp-content/uploads/2018/09/Revenue-and-Customs.jpeg

Self Employed Pension Tax Relief Explained Penfold Pension

https://images.prismic.io/penfold/d68abe56-2255-43f5-8412-5d0e13153a09_yearly-self-employed-pension-tax-relief.png?auto=compress

OS Payroll Your P60 Document Explained

https://uploads-ssl.webflow.com/600aa65f147a4d133842bc76/600aa65f147a4dc8e142bd49_p60-explained-1_2x.jpeg

You can claim an extra 20 tax relief on 29 730 the amount you paid higher rate tax on through your self assessment return or by writing or calling HMRC There is no extra relief on the remaining Your pension provider will claim back basic rate tax at 20 from HMRC and add this to your pension pot This gives you tax relief This means that if you contribute 80 your

You ll get the amount you paid into the pension scheme back minus any tax that needs to be paid you won t pay tax on a refund of excess contributions lump sum 20 tax on If you are a higher rate taxpayer you need to claim higher rate tax relief either via your self assessment tax return or by contacting HMRC If you file a tax return then

Download Hmrc Claiming Tax Back On Pension Contributions

More picture related to Hmrc Claiming Tax Back On Pension Contributions

Independent Pension Consolidation Advice Joslin Rhodes

https://www.joslinrhodes.co.uk/wp-content/webpc-passthru.php?src=https://www.joslinrhodes.co.uk/wp-content/uploads/2020/08/pension-consolidation-couple-discussing-1024x583.jpg&nocache=1

Pension Tax Relief In The United Kingdom UK Pension Help

http://ukpensionhelp.com/wp-content/uploads/2021/03/5.png

Pension Tax Relief On Pension Contributions Freetrade

https://assets-global.website-files.com/62547917cb5599e815e4d83b/62547917cb55990ea1e4de17_61b74be6f5d5edc718480a4b_gDObMQSDDNari7LqWnLAJSAMHEkRKX3JX3x2Qf05FcphokBhpl_MWghsAeYEYXE1F9T6T16wylYqNFBn0Prz8WqP_qTz8yCz2_IIhCE0A-jDaUtCm3pTMDejbYhvwA.jpeg

You ll only get tax relief on personal pension contributions up to 100 of your UK earnings or 3 600 if this is greater if you re a low or non earner Let s say you earned Claim your tax back if you ve taken a small pot normally a pension plan worth 10 000 or less as a lump sum Complete a P53 on GOV UK opens in a new tab Basic rate

If you do not complete a tax return you can give HMRC details of pension contributions online via your Personal Tax Account You can also give the details on You can claim the tax relief on your Self Assessment tax return by stating the gross amount of your total pension contributions for the tax year i e including the

Pension Tax Relief On Pension Contributions Freetrade

https://assets-global.website-files.com/62547917cb5599e815e4d83b/62547917cb559944a8e4de15_61b89c21239fee52c5e81153_hqoO9fMryTKRpnpdV2ZiIxT7ZDJC5fHBX_liGusogxuhBXP3ILsovEpqBXxBHX0sXCQy79MiLRIAaEXmK1c2vJcBYleshZHHX7Jsfqdd-7hM7hPmIZC3zDfhut2hKggUXHvAHoah.jpeg

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

https://www.cliveowen.com/wp-content/uploads/2020/12/Claiming-higher-rate-tax-relief-for-pension-contributions-and-gift-aid-donations.jpg

https://www.gov.uk/guidance/pension-administrators...

Your member or their representative must make a declaration to you before they can contribute to your scheme and before you can claim the tax relief back from

https://www.which.co.uk/money/pensions-and...

If you re paying into a pension through your employer your employer will take 80 of your pension contribution from your salary technically known as net of basic

How To Claim Pension Higher Rate Tax Relief

Pension Tax Relief On Pension Contributions Freetrade

Tax Relief On Pension Contributions FKGB Accounting

HMRC Tax Overview Online Self Document Templates Documents

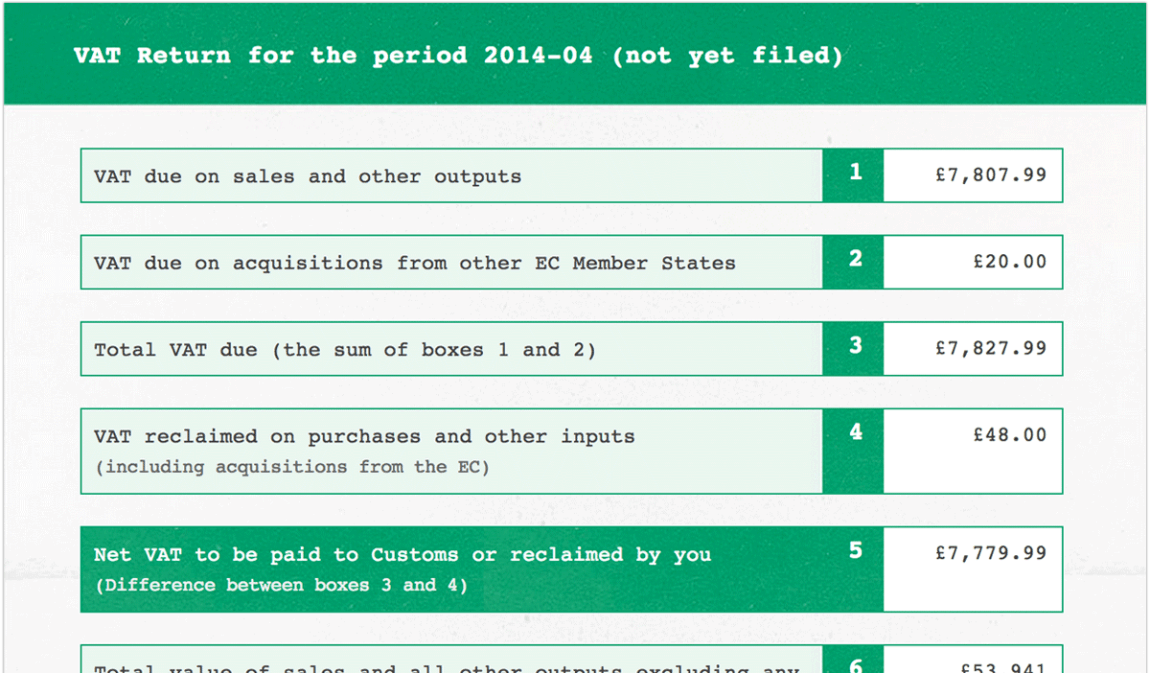

FreeAgent VAT Online Submission 1Stop Accountants

How To Write A Letter Requesting Pension Benefits

How To Write A Letter Requesting Pension Benefits

Acoplador frica Platillo How To Calculate Your Pension Pot Cuestiones

Letter Template Hmrc Penalty Appeal Letter Example 3 Easy Ways To

How To Get Tax Back On Pension Contributions Asbakku

Hmrc Claiming Tax Back On Pension Contributions - A 25 basic rate tax relief top up from HMRC on anything you put into your pension it means every 1 000 you contribute magically becomes 1 250 And if you