Hmrc Company Benefits Overview If you re an employer and provide expenses or benefits to employees or directors you must usually report them to HM Revenue and Customs HMRC pay tax and

Company car tax otherwise known as Benefit in Kind tax is the means by which the Government taxes the benefit of having a company car The car s Benefit in Kind BiK rate based on CO2 emissions current rates range from 2 to 37 Your income tax band HMRC takes the P11D value of your car

Hmrc Company Benefits

Hmrc Company Benefits

https://arthurboyd.co.uk/wp-content/uploads/2022/02/tim-mossholder-jicxB6ooyeU-unsplash-scaled.jpg

Getting SEIS EIS Approval Advance Assurance From HMRC

https://www.spondoo.co.uk/wp-content/uploads/2022/07/HMRC-Advance-Assurance-application-form.png

Tell HMRC That Your Company Is Dormant Accounting Firms

https://www.accountingfirms.co.uk/wp-content/uploads/2022/01/Tell-HMRC-That-Your-Company-Is-Dormant.png

Reimbursements Company Car Mileage Rates Explained An Easy Guide for Business Owners and Employees Henry Bewicke July 20 2023 Zeit 7 Minuten Company cars are a great benefit for By Select Car Leasing 13 02 2024 Drivers looking to take advantage of the generous company car tax rules for double cab pick ups should move quickly as the

This official guidance and toolkit from HMRC explains how tax officers calculate the benefit and gives you an indication of much income tax is payable Find out about the tax HMRC has provided various interpretations of the rules for trivial benefits in the last three employer bulletins as it apparently views those rules as too generous 10th Dec 2019 6 comments From 6 April

Download Hmrc Company Benefits

More picture related to Hmrc Company Benefits

What Is A Company Car The Pros Cons Blog H ng

https://blog-media.vimcar.com/uk-blog/uploads/2021/06/21163332/Poolcar-vs-Company-Car-EN-version-2-410x1024.png

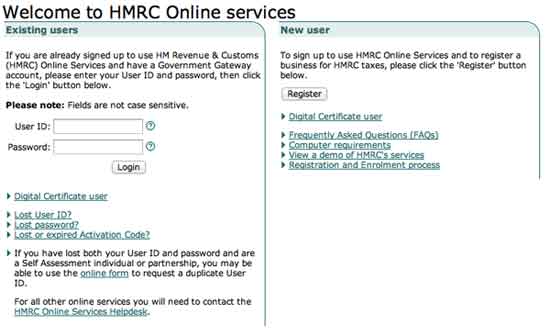

HMRC Online Login Registration On Www hmrc gov uk

https://my-account-online.co.uk/wp-content/uploads/2014/05/create-hmrc-account.jpg

HMRC Job Roles

https://www.manpower.ie/getasset/?uiAssetID=d68f7140-0bf2-47ef-86ac-2fbb29ddc425

HMRC closes valuable tax loophole for drivers Pick ups will be reclassified as cars and lose their commercial vehicle status benefits Joe Wright 14 February 2024 6 tax breaks every small business should know about You could add thousands of pounds to your small business bottom line by applying these little known tax breaks Haydn Rogan explains the tax

Company car fuel benefit is the tax you pay to HMRC on the free for personal use fuel you get from your employer Like all HRMC taxes there is a calculation that is used to The most common double cab pick up in the UK is the Ford Ranger with a list price of circa 60 000 and CO2 emissions of over 200g km putting it squarely in the 37

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

Hmrc Company Car Benefit In Kind Rates Amibeachwebdesign

https://www.cliveowen.com/wp-content/uploads/2020/11/Company-Vehicles-–-Court-Rules-in-Favour-of-HMRC.jpg

https://www.gov.uk/employer-reporting-expenses-benefits

Overview If you re an employer and provide expenses or benefits to employees or directors you must usually report them to HM Revenue and Customs HMRC pay tax and

https://www.autoexpress.co.uk/tips-advice/90125/...

Company car tax otherwise known as Benefit in Kind tax is the means by which the Government taxes the benefit of having a company car

HMRC Trivial Benefits Explained Goselfemployed co

Exp Code On Invoice Hybridlasopa

Employee Benefits Don t Get Caught Out When Submitting HMRC Forms

NEWS HMRC Issues Important Update For Anyone Who Claims Tax Credits

New HMRC Data Reveals Contribution Businesses Make To UK Tax Receipts

New HMRC Rules For Self Assessment From April 2018

New HMRC Rules For Self Assessment From April 2018

The Benefits Of Voluntary VAT Registration With HMRC

Payrolling Benefits In Kind Your Simple Guide To PBIK For SME s

Pin On Politics

Hmrc Company Benefits - HMRC has provided various interpretations of the rules for trivial benefits in the last three employer bulletins as it apparently views those rules as too generous 10th Dec 2019 6 comments From 6 April