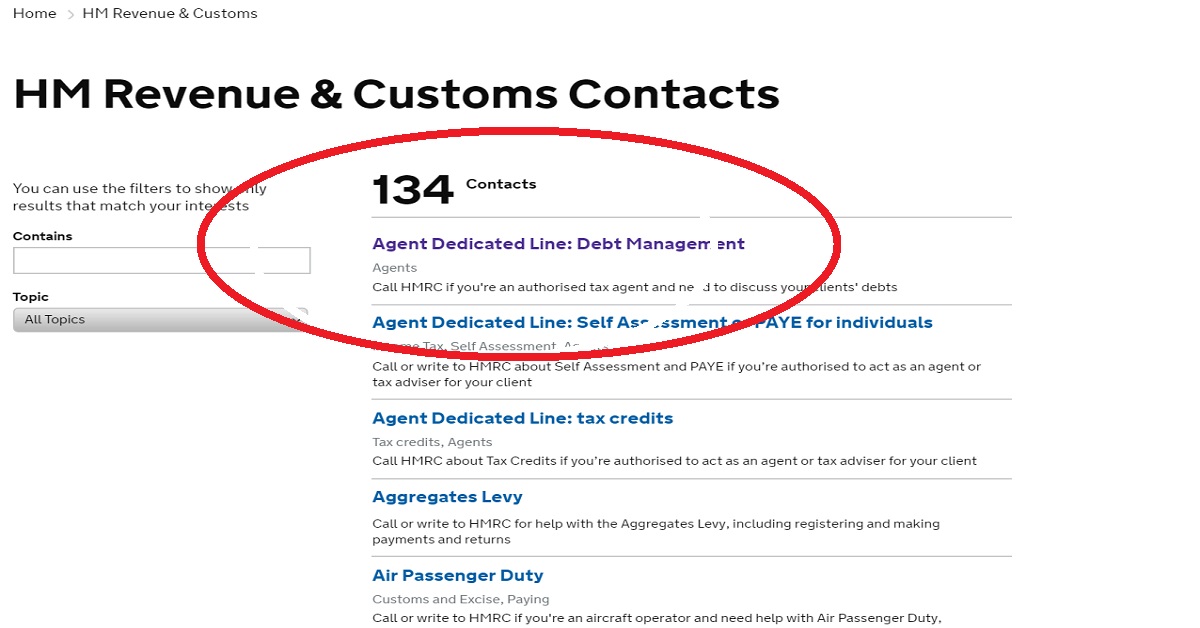

Hmrc Company Tax Return Contact Number If you need more help please phone your HM Revenue and Customs HMRC office on the number shown on the front of the Non resident Company or Other Entity Tax Return or

Here are some of the different numbers for the departments you might need to speak to Self Assessment helpline 0300 200 3310 Child Benefits helpline 0300 200 Find out how to file your corporation tax with HMRC online using the Companies House service You can also access information on other companies accounts annual

Hmrc Company Tax Return Contact Number

Hmrc Company Tax Return Contact Number

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC.jpg

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

Hmrc Ssp Form Printable Printable Forms Free Online

https://i.pinimg.com/originals/d0/97/69/d09769f169cef36df0974f32cd49b9a8.jpg

No Corporation Tax payment due You should let HMRC know if you have no Corporation Tax payment to make for an accounting period Unless you tell HMRC that there is 0300 200 3310 0300 200 3319 textphone or 44 161 931 9070 outside UK Warning This line is often inaccessible through sheer volume of calls during busier

Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help

Download Hmrc Company Tax Return Contact Number

More picture related to Hmrc Company Tax Return Contact Number

How To Print Your SA302 Or Tax Year Overview From HMRC Love

https://www.loveaccountancy.co.uk/wp-content/uploads/2017/10/Screen_Shot_2017-10-11_at_18_12_37.png

New HMRC Rules For Self Assessment From April 2018

https://media.thebestof.co.uk/v2/rule/blog_gallery/resource_page/3/59/70/5970c497c6a71175580024a2_1520957248/HMRC-logo-1.png

Hmrc Customs Contact Number

https://gmpdrivercare.com/wp-content/uploads/2018/12/hmrc-scam-1080x675.jpg

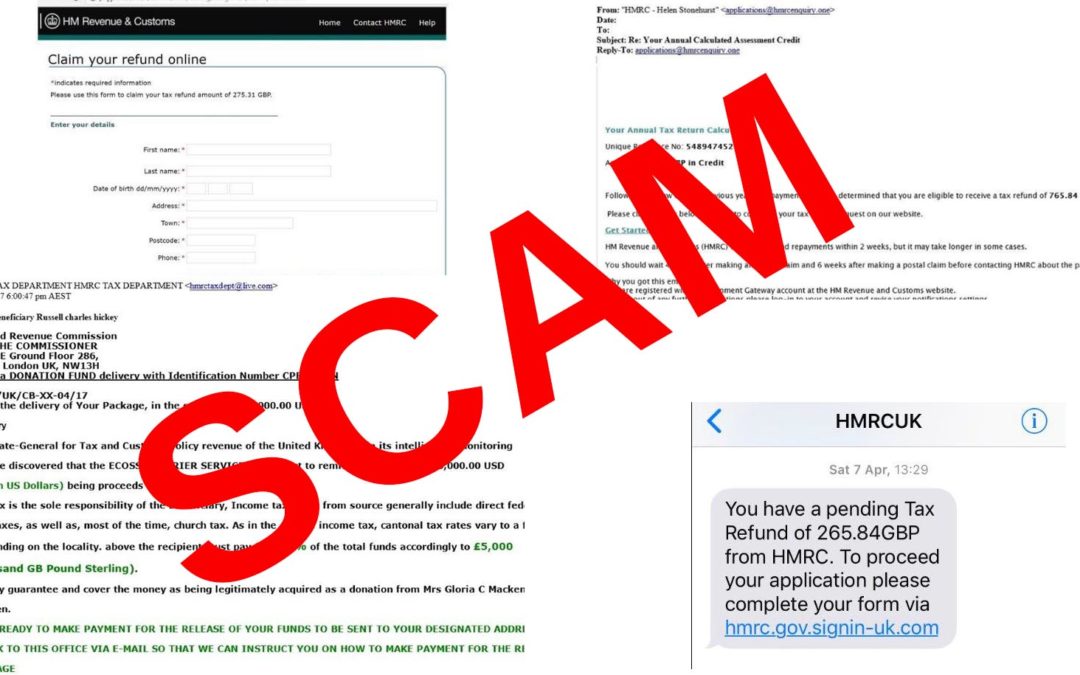

No Message Claim Now If you need help with your tax rebate or looking for our help with claiming back tax all of our contact details can be found here Get in touch today Ways to reach a tax agent for disputed payments undeclared income and debt Rob White 21 April 2024 6 00am The main ways to get in touch with HMRC are

So if you do need to contact HMRC about your Self Assessment be sure to have the following Your personal details full name address date of birth Your National 0300 200 3200 Outside UK 44 151 268 0558 Fax 03000 523 030 Opening times Our phone line opening hours are Monday to Friday 8am to 6pm Closed weekends and

2017 Hmrc Vat Certificate Of Registration Vistech Security Free Nude

https://vistechservices.co.uk/wp-content/uploads/2021/03/2017-HMRC-VAT-Certificate-of-Registration-724x1024.jpg

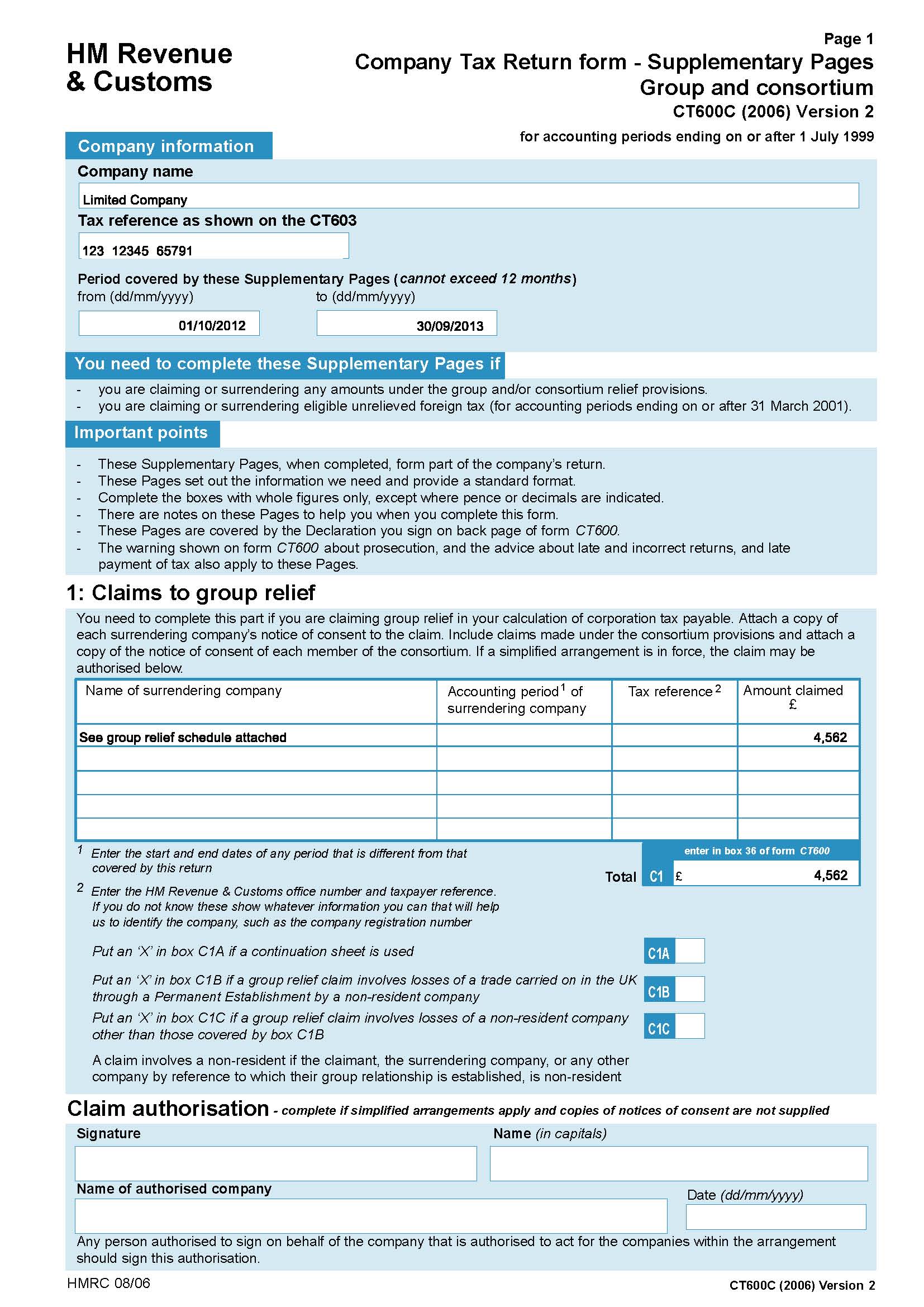

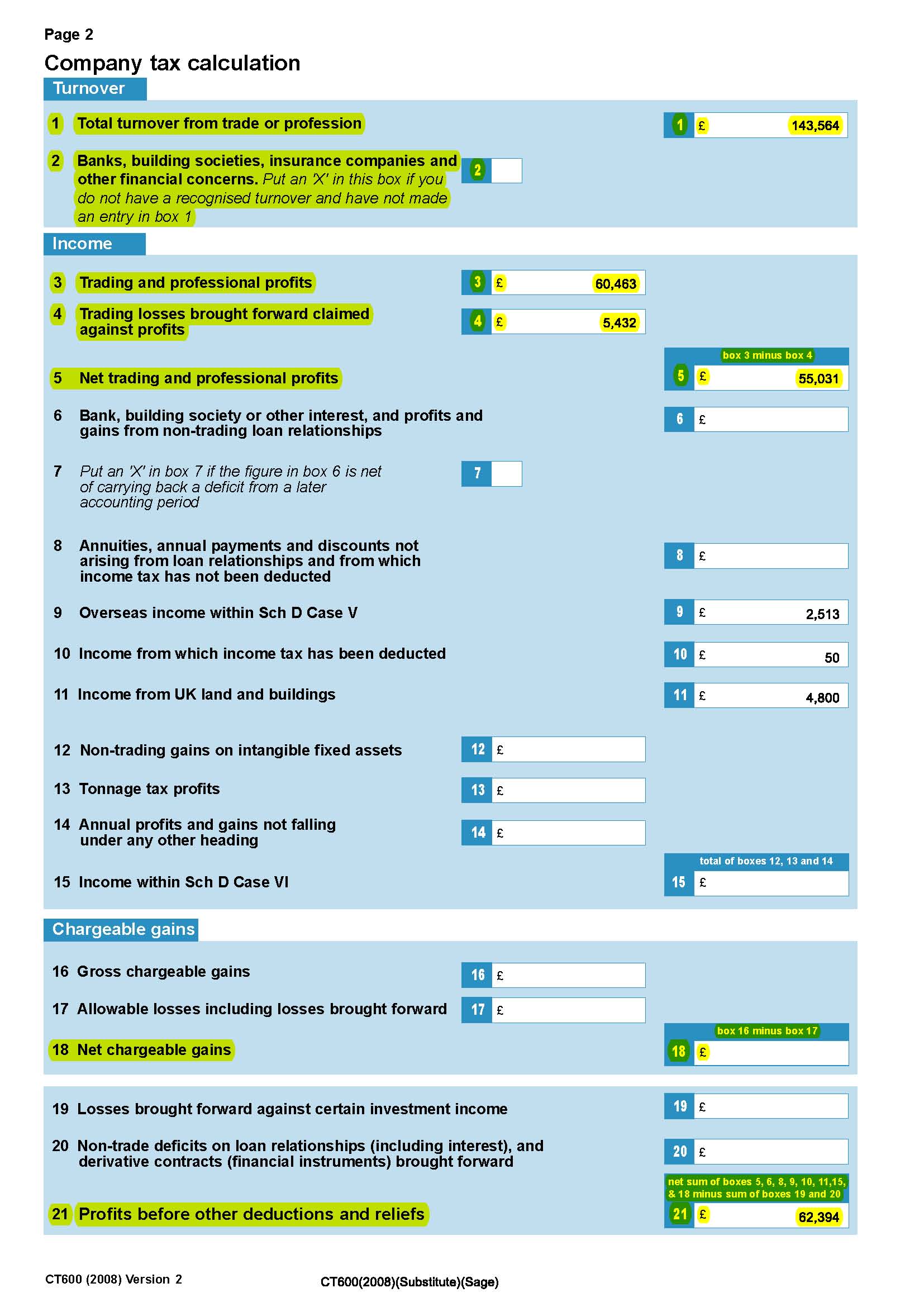

Company Tax Return Hmrc Company Tax Return Guide

http://www.real-price.co.uk/images/product-images/SPI3001_Page_19_2.jpg

https://assets.publishing.service.gov.uk/media/...

If you need more help please phone your HM Revenue and Customs HMRC office on the number shown on the front of the Non resident Company or Other Entity Tax Return or

https://www.lovemoney.com/guides/55286

Here are some of the different numbers for the departments you might need to speak to Self Assessment helpline 0300 200 3310 Child Benefits helpline 0300 200

Trust Tax Return Hmrc Address TAX

2017 Hmrc Vat Certificate Of Registration Vistech Security Free Nude

Propozition Helps Fujitsu Become Successful Bidder To Deliver The HMRC

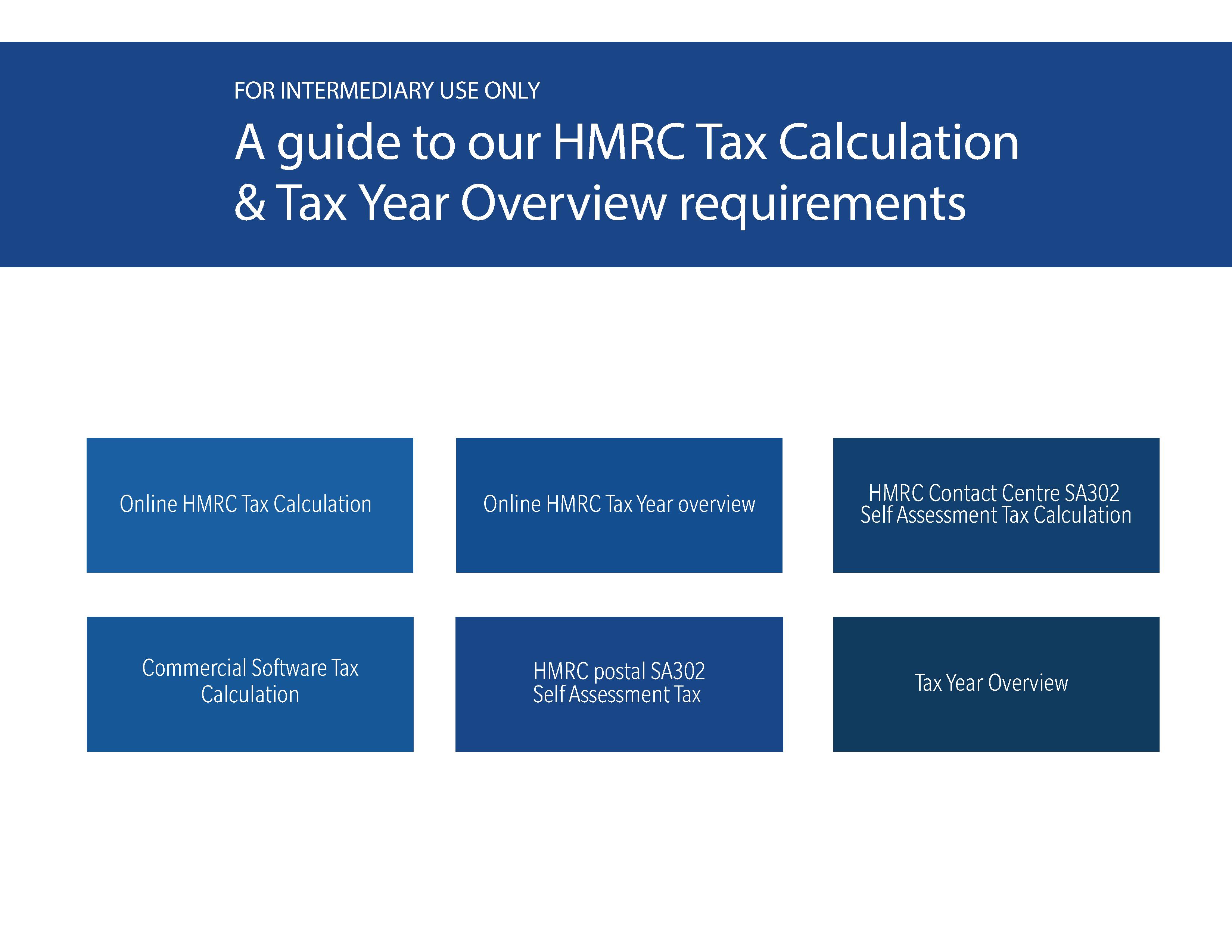

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

Gov Tax Return Contact Number TAXW

Tashapb I Will File Your UK Company Accounts And Tax Return For 110

Tashapb I Will File Your UK Company Accounts And Tax Return For 110

HMRC Customer Service Contact Numbers Tax Helpline 0845 697 0288

2016 HMRC Tax Return Form

Company Tax Return Hmrc Company Tax Return Guide

Hmrc Company Tax Return Contact Number - Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not