Hmrc Corporation Tax Refund Contact Number Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

Online Tell HMRC that a Corporation Tax payment is not due Apply to make a multiple or composite CHAPS payment Your message using these forms is secure If HMRC reply by email the Corporation tax 0300 200 3410 Corporation tax group payment arrangements 0300 058 3947 Corporation tax forms ordering 0300 200 3411

Hmrc Corporation Tax Refund Contact Number

Hmrc Corporation Tax Refund Contact Number

https://www.signnow.com/preview/560/820/560820246/large.png

How Long To Get My Tax Refund From HMRC Swift Refunds

https://www.swiftrefunds.co.uk/wp-content/uploads/2019/08/tax-refund-min-2-e1566379535551.jpg

Corporation Tax Ambiance Accountants Sheffield Accountants

https://ambiance-accountants.co.uk/wp-content/uploads/2020/07/Corporation-tax-top-new.png

To claim a refund companies should use their Company Tax Return to notify HMRC of the overpayment and specify how they wish to receive the refund Options include direct bank transfers applying the refund against future tax liabilities or using it to settle other tax dues like PAYE or VAT Corporation Tax Refund UK If you believe you should get a Corporation Tax refund use your Company Tax Return to inform HMRC about it HM Revenue and Customs call it a repayment There are several ways to get it paid including Having it paid direct to your company bank account

The Income Tax Office at HM Revenue Customs HMRC can accept most information over the phone but in certain circumstances you will need to write in This table will help you decide how Remember to be cautious about email or text scams from organisations claiming to be HMRC offering you a tax refund The real HMRC will not need any bank details from you If in doubt give HMRC a call on 0300 200 3300 to double check

Download Hmrc Corporation Tax Refund Contact Number

More picture related to Hmrc Corporation Tax Refund Contact Number

HMRC Customer Service Contact Numbers Tax Helpline 0300 200 3300

https://customerservicecontactnumber.uk/wp-content/uploads/2016/08/HMRC.jpg

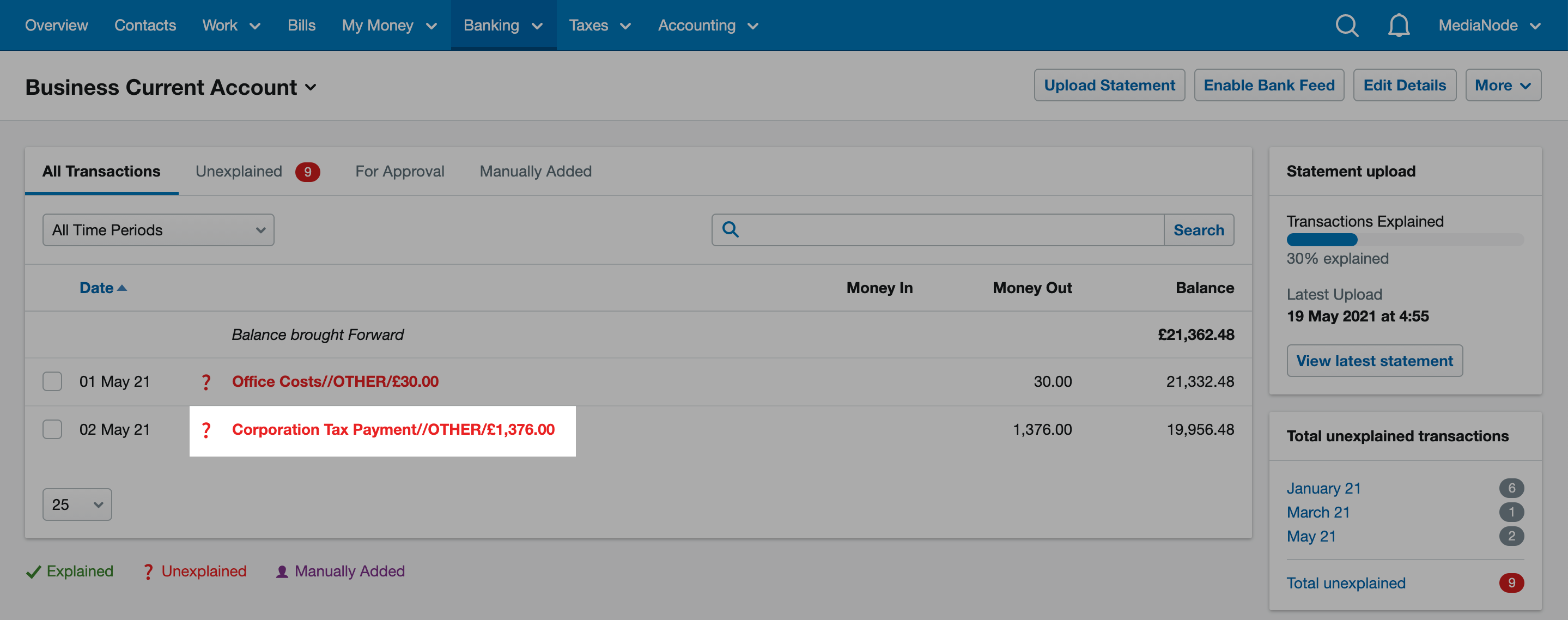

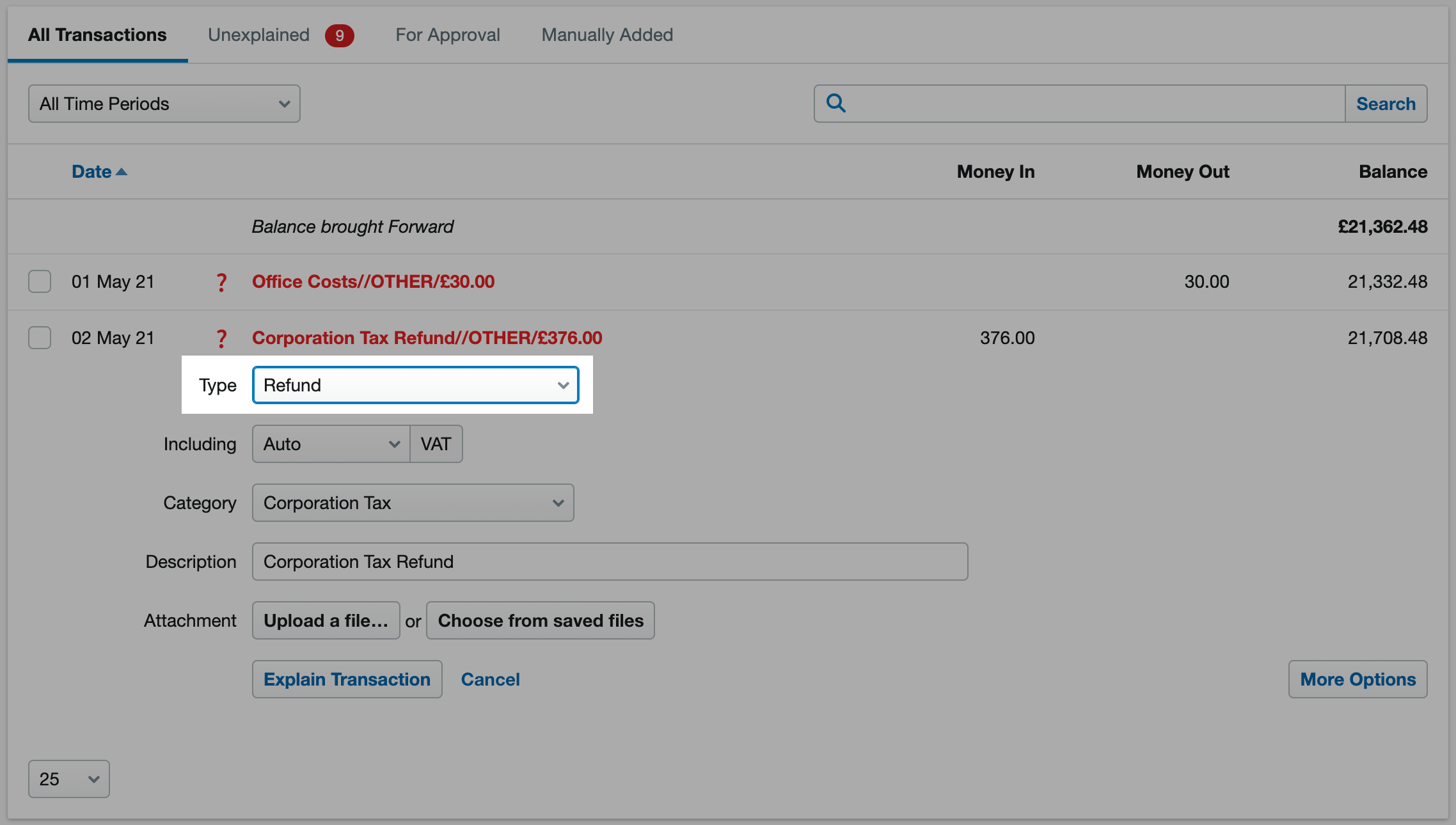

How To Explain A Corporation Tax Payment To HMRC FreeAgent

https://support.freeagent.com/hc/article_attachments/360026438819/Screenshot_2021-05-19_at_16.56.23.png

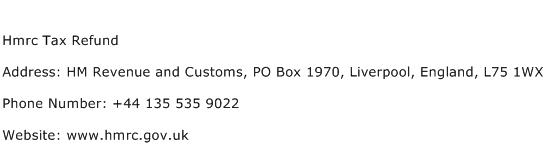

Hmrc Tax Refund Address Contact Number Of Hmrc Tax Refund

https://findaddressphonenumbers.com/Address_Images/Hmrc-Tax-Refund-Address-Contact-Number-19364.jpeg

Contact the Corporation Tax helpline Explore the topic Business tax Running a limited company When your company or organisation pays Corporation Tax paying reporting and dormant Some companies contact taxpayers out of the blue and claim they can obtain a tax refund an idea that is likely to be attractive to many Yes you can appeal a discovery assessment either in its entirety or just the numbers that HMRC have assessed they are unlikely to involve assignments Instead the agent will have filled

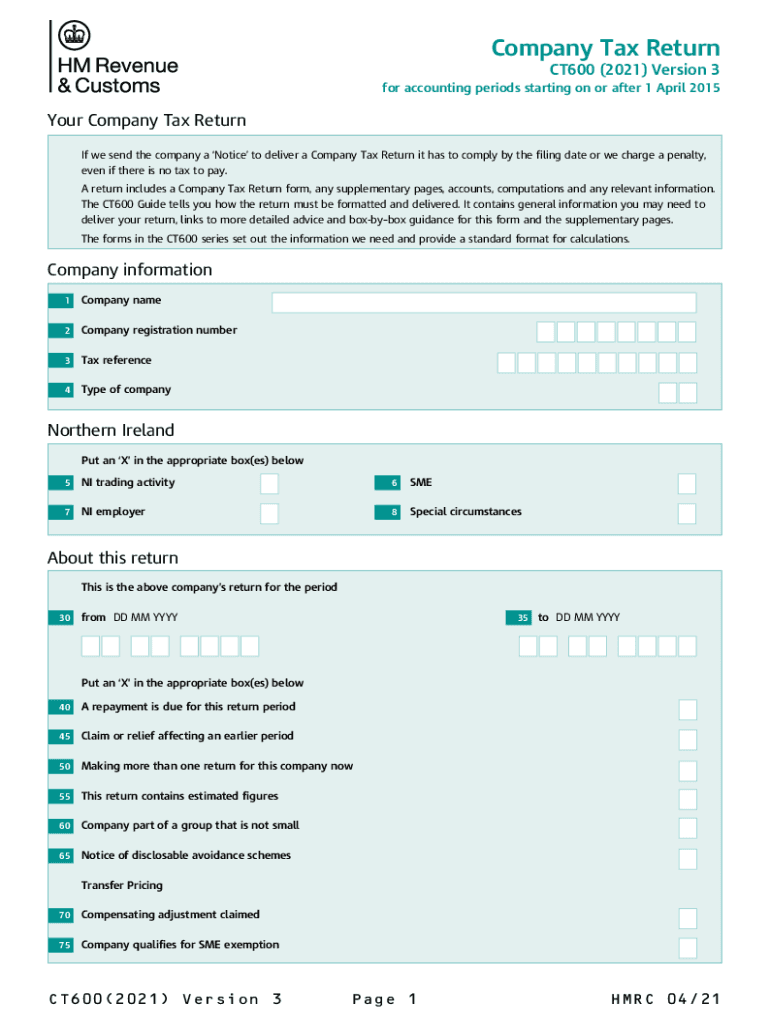

Five tips for tackling delays 1 Do your preparation before contacting HMRC In theory your registered address should bring up all of your tax details But not in my experience Before you It tells you how to complete the Company Tax Return form CT600 and what other information you need to include in your return but it is not a guide to the Corporation Tax Acts You will find links to further HM Revenue

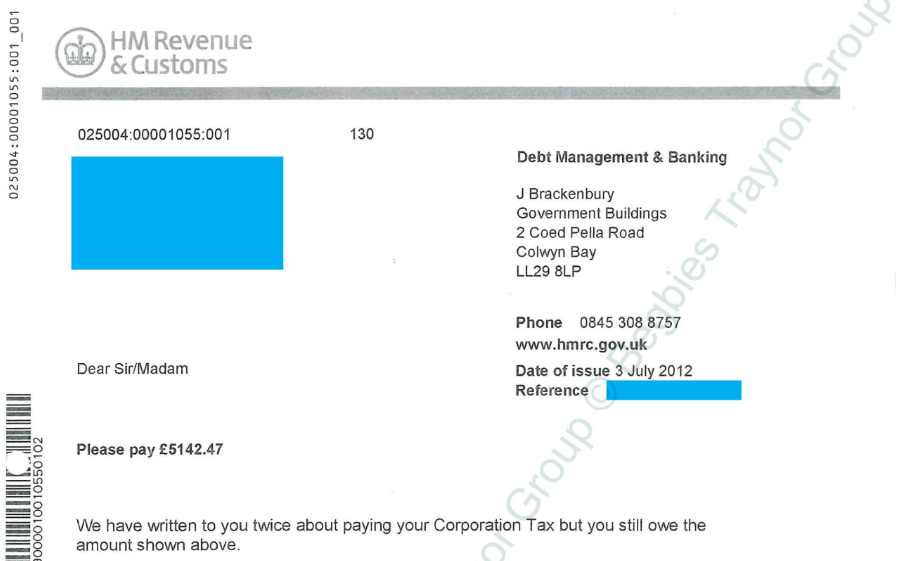

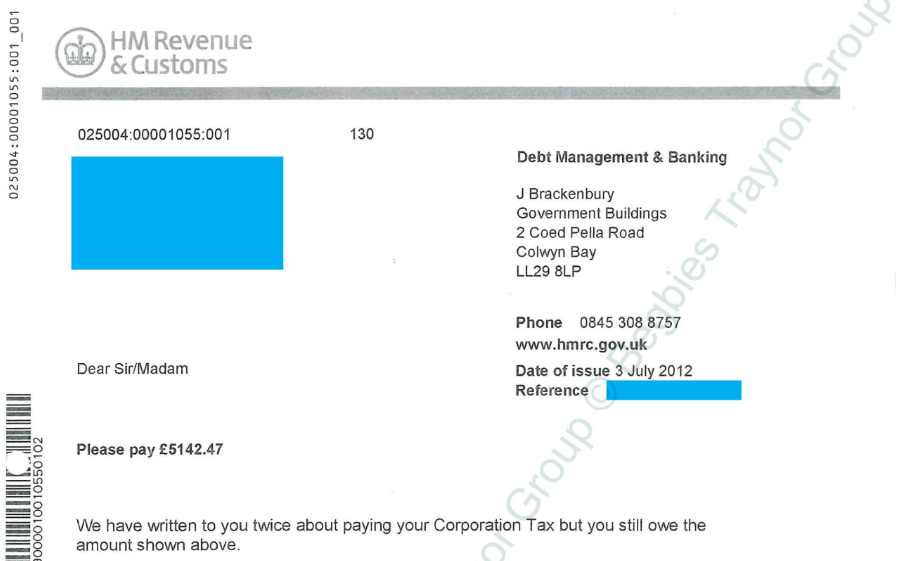

HMRC Overdue Corporation Tax Letter Begbies Traynor Group

https://www.begbies-traynorgroup.com/images/articles/hmrc-corporation-tax.png

HMRC TAX SCAM If You Get This Surprising refund E mail Do NOT Click

https://cdn.images.express.co.uk/img/dynamic/59/590x/HMRC-913654.jpg

https://www.gov.uk/contact-hmrc

Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

https://www.gov.uk/.../contact/corporation-tax-payment

Online Tell HMRC that a Corporation Tax payment is not due Apply to make a multiple or composite CHAPS payment Your message using these forms is secure If HMRC reply by email the

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Overdue Corporation Tax Letter Begbies Traynor Group

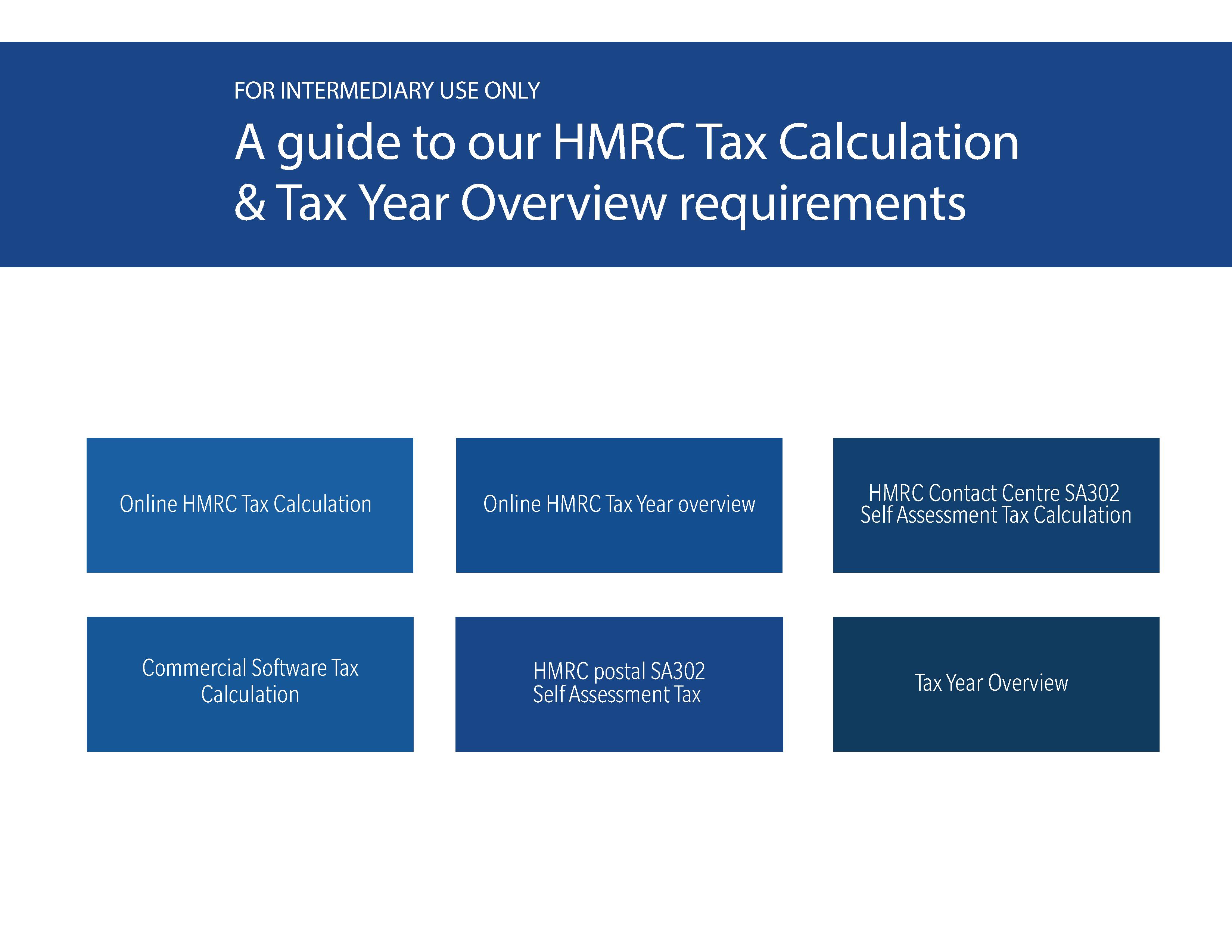

A Guide To Our HMRC Tax Calculation Tax Year Overview Requirements

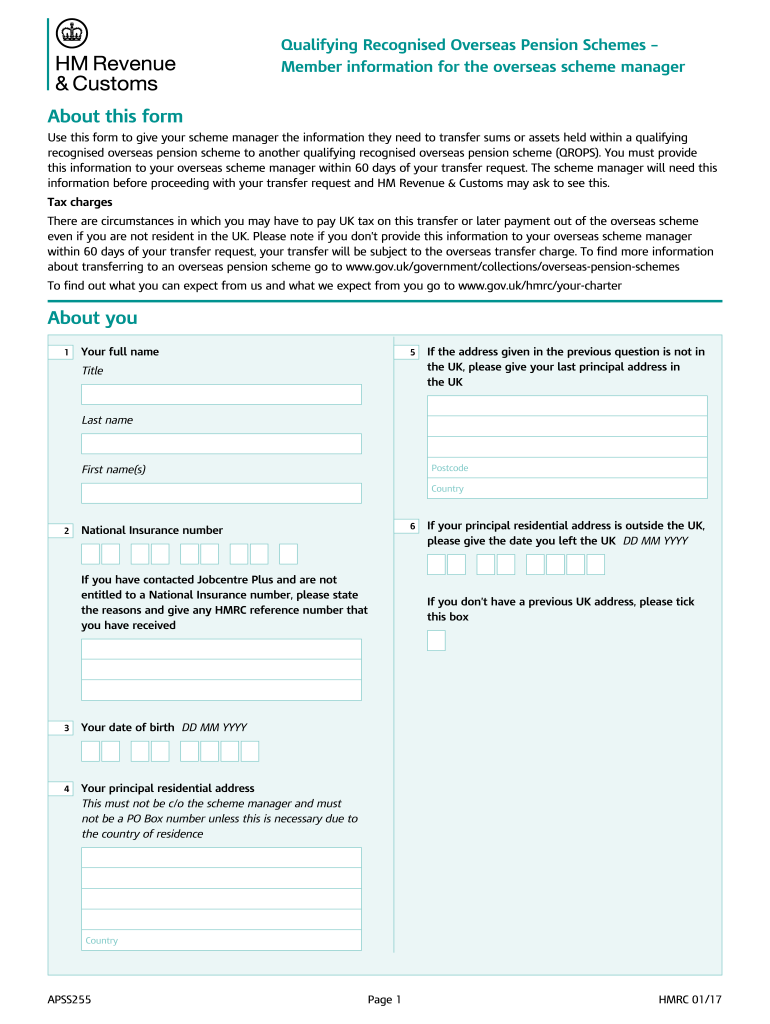

C1603 Form Fill Out And Sign Printable PDF Template SignNow

Paying Corporation Tax To HMRC Pay Your Corporation Tax Bill DNS

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

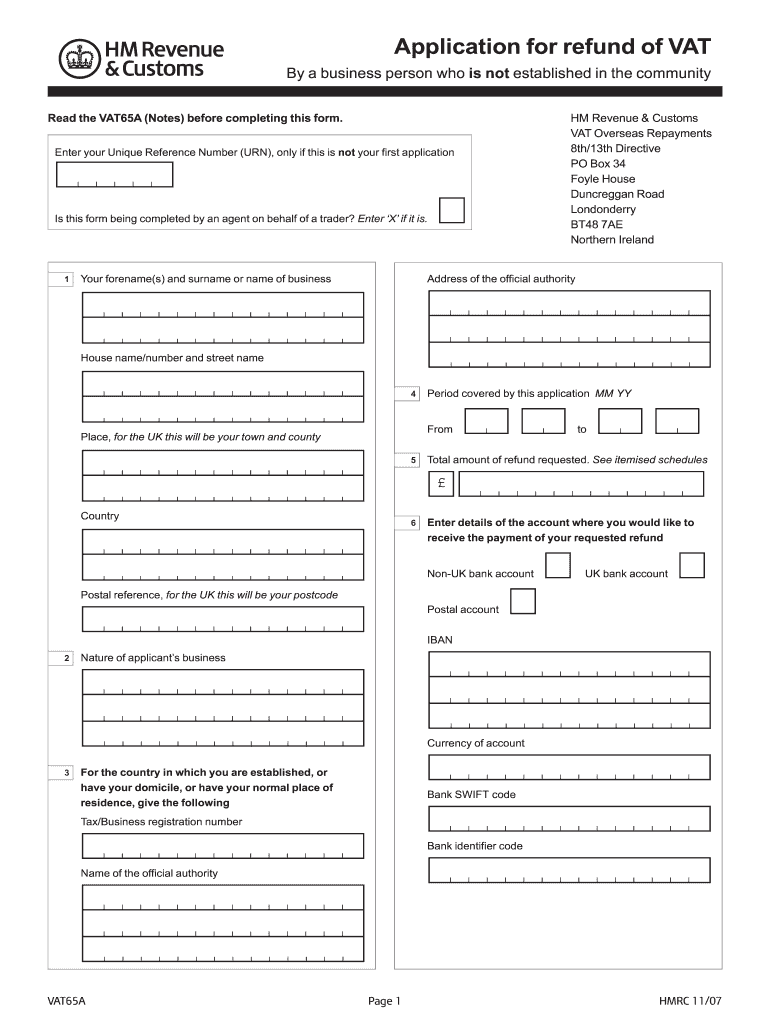

HMRC Form Refund Fill Out And Sign Printable PDF Template SignNow

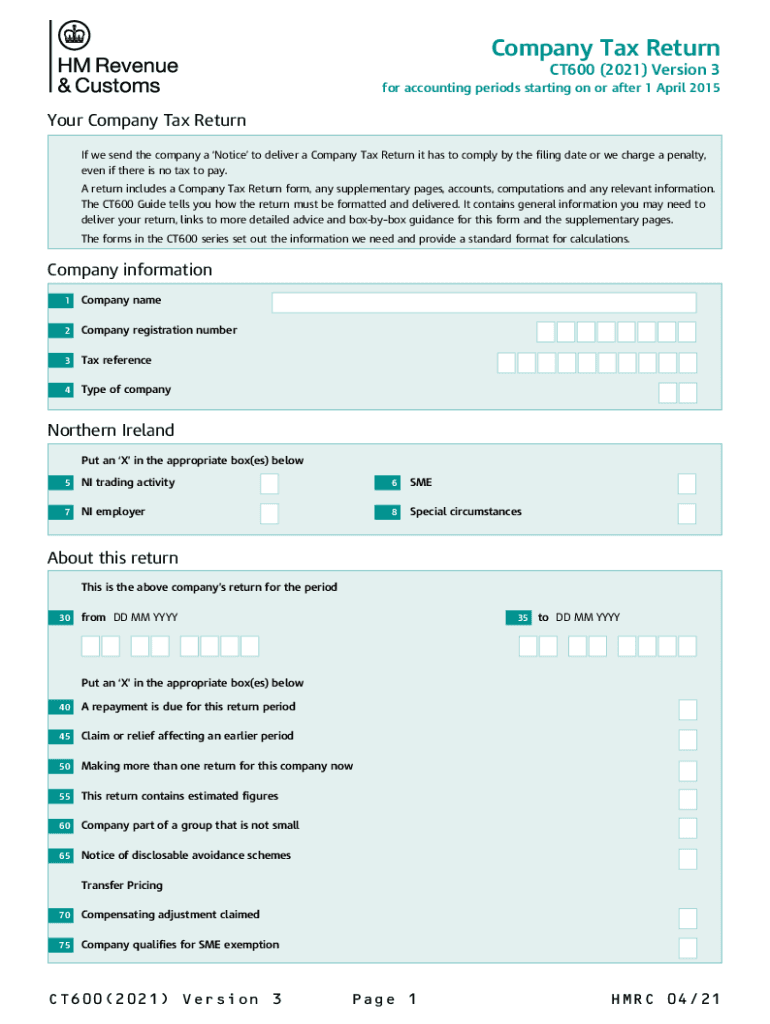

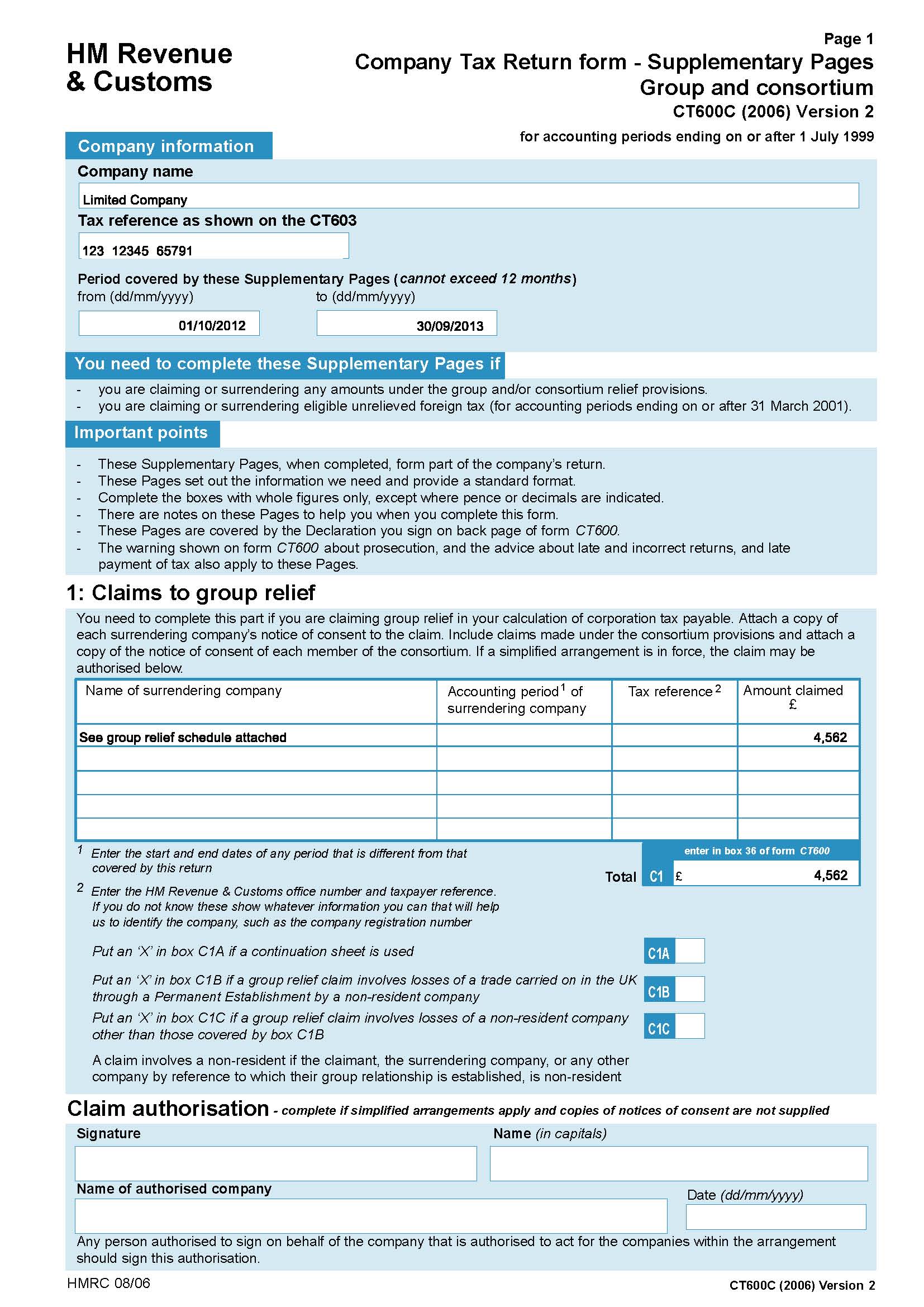

Company Tax Return Hmrc Company Tax Return Guide

How To Explain A Corporation Tax Refund From HMRC FreeAgent

Hmrc Corporation Tax Refund Contact Number - Higher rate taxpayers can claim 40 of the 6 2 40 a week Over the course of the year this means people could reduce the tax they pay by 62 40 or 124 80 respectively It s still possible to claim this tax relief for 2021 22 however for claims for 2022 23 these rules are no longer relaxed If you re employed you cannot claim tax