Hmrc Corporation Tax Return Online File your Company Tax Return by your deadline this is usually 12 months after the end of your accounting period Your accounting period is normally the same 12 months as the financial year

Sign in or set up a personal or business tax account Self Assessment Corporation Tax PAYE for employers VAT and other services You can use your HMRC business tax account to check your tax position for taxes that you have registered for make returns and payments add or remove a tax duty or scheme

Hmrc Corporation Tax Return Online

Hmrc Corporation Tax Return Online

https://www.sec.gov/Archives/edgar/data/315293/000110465912015030/g62431bai032.gif

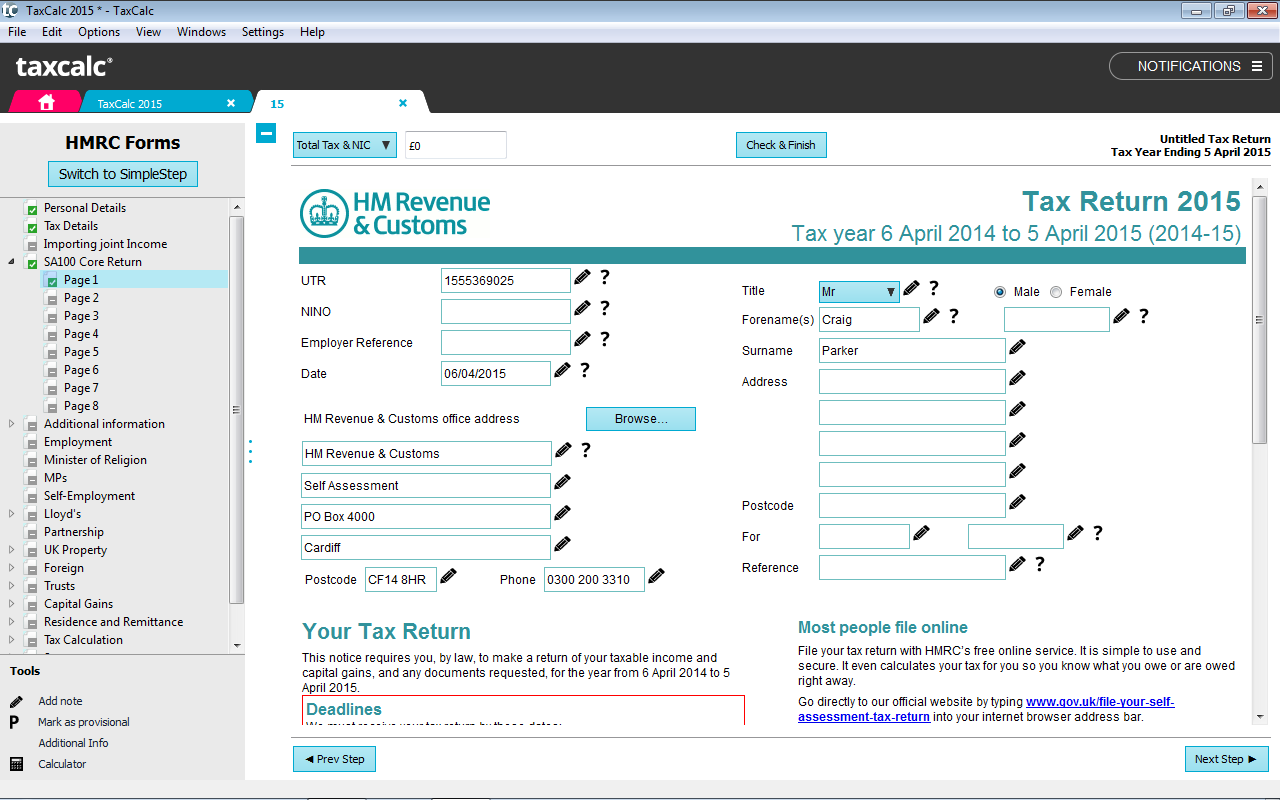

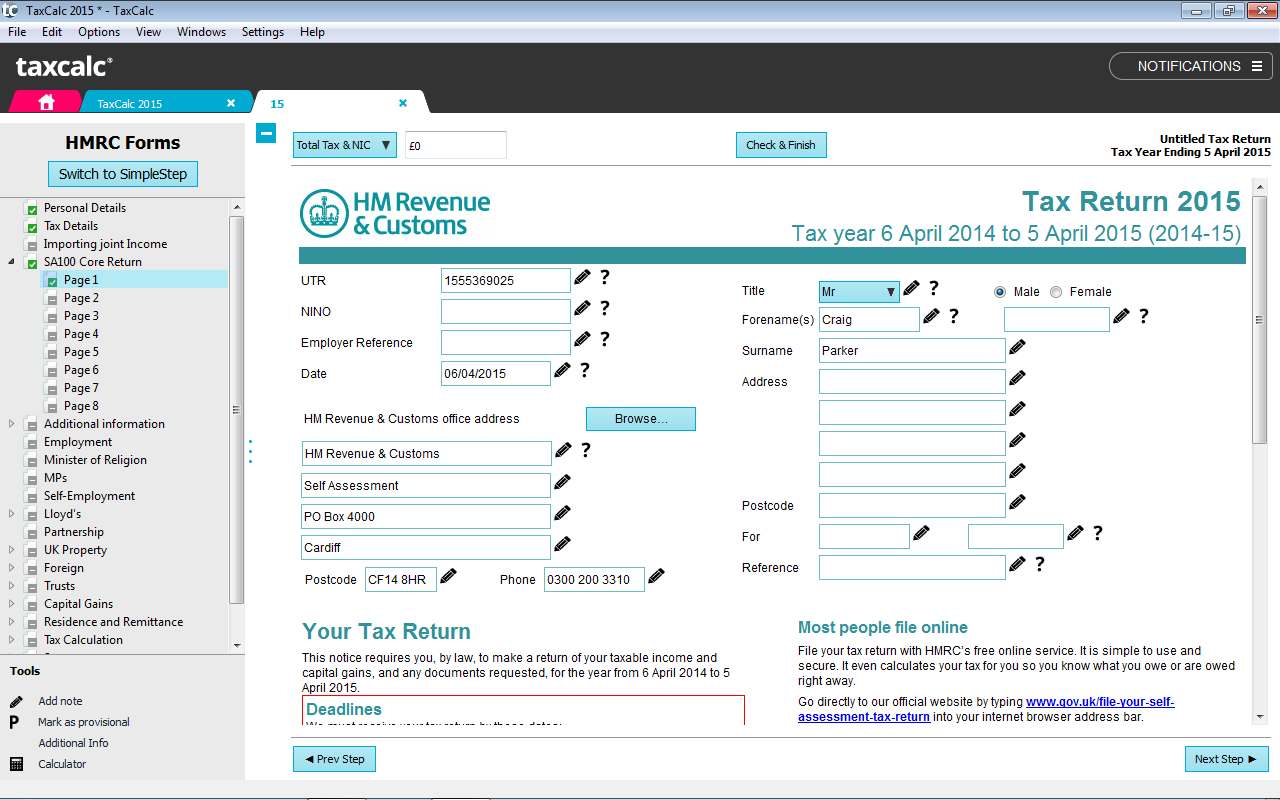

Online Tax Hmrc Online Tax Return

https://www.taxcalc.com/images/products/productScreenshots/Individual4.png

Exp Code On Invoice Hybridlasopa

https://i2.wp.com/www.invoiceberry.com/blog/wp-content/uploads/2018/09/HMRC-UTR-Number.jpg

How to complete your CT600 Company Tax Return form for Corporation Tax and what information you need to include You can use the HMRC online service to file your Company Tax Return with HMRC and accounts with Companies House at the same time if your company s turnover is up to 632 000 per year

How to pay Corporation Tax payment reference number online Bacs or CHAPS Direct Debit cheque or at your bank Your company or association must file a Company Tax Return if you get a notice to deliver a Company Tax Return from HM Revenue and Customs HMRC You must still send a return if you

Download Hmrc Corporation Tax Return Online

More picture related to Hmrc Corporation Tax Return Online

Hmrc Corporation Tax Registration Form Erin Anderson s Template

https://lh3.googleusercontent.com/proxy/KkgW-1Db18JoEBDUcX28B_bu-8a1BkSRBRAOcLG-KhT1Kr8T266knt4LcUCjhKro_t6fnoRC5aBxJbVb1SXa_l-GedtI_4weA1VO15rgqTErSNVW8WcT1uds3Irbhasxbzg6t8H6L2gw72zfLPiu-m8=w1200-h630-p-k-no-nu

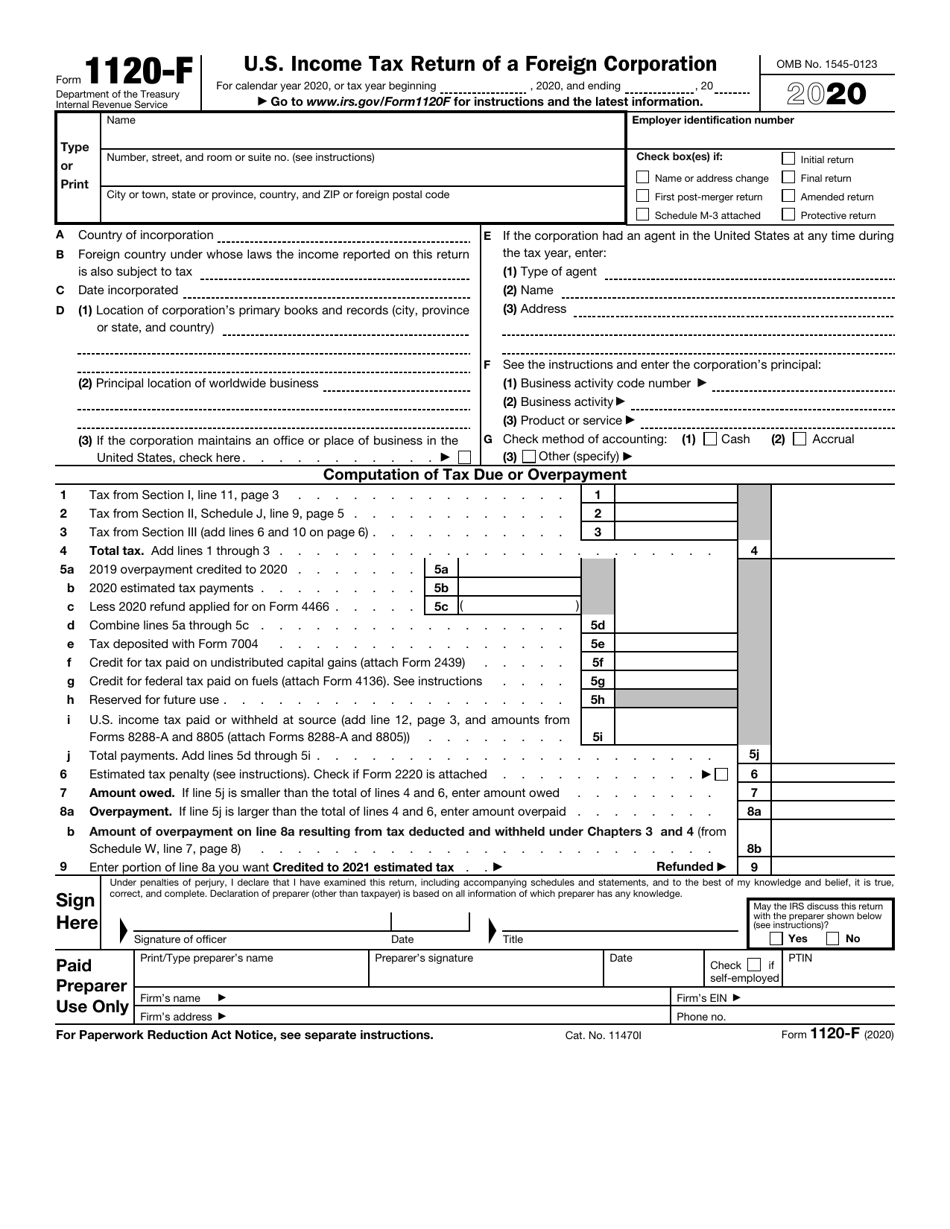

Download Fillable Tax Forms Printable Forms Free Online

https://data.templateroller.com/pdf_docs_html/2117/21172/2117281/irs-form-1120-f-u-s-income-tax-return-of-a-foreign-corporation_print_big.png

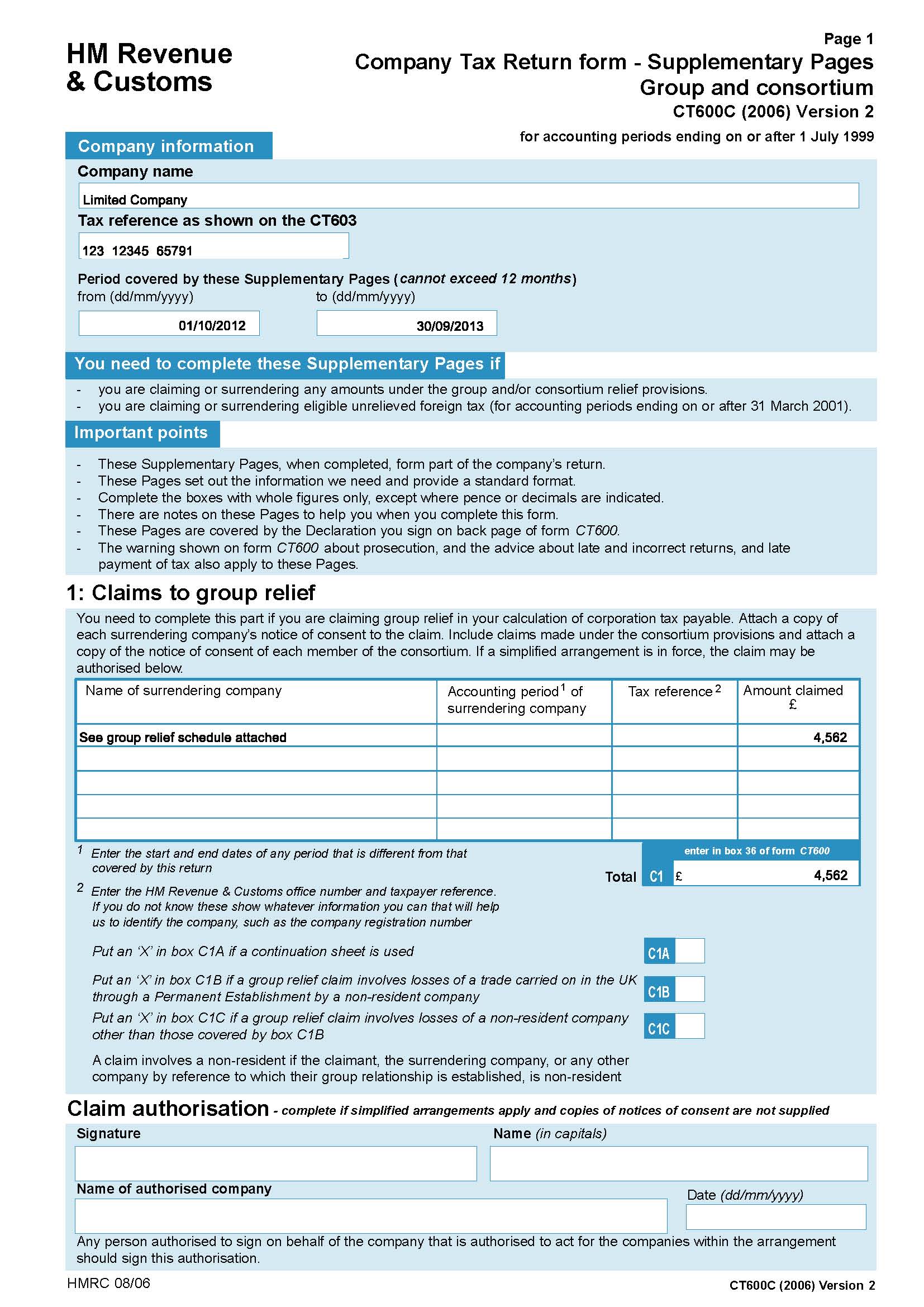

Company Tax Return Hmrc Company Tax Return Guide

http://www.real-price.co.uk/images/product-images/SPI3001_Page_19_2.jpg

About this guide This guide will help you prepare your Company Tax Return It tells you how to complete the Company Tax Return form CT600 and what other information you need to include in No Corporation Tax payment due You should let HMRC know if you have no Corporation Tax payment to make for an accounting period Unless you tell HMRC that there is nothing due they

How to File a Company CT600 Corporation Tax return to HMRC online In this video we show you how to create a Company Corporation Tax return sometimes referred to as a CT600 and You should record company tax return online with HMRC Suppose you are not utilizing a specialist accountant or tax advisor to finish and file tax returns for your sake In that case you should enlist for Corporation Tax Online and record your own tax returns electronically through that framework

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

http://c8.alamy.com/comp/BRA891/hmrc-tax-return-letters-with-logos-and-cash-BRA891.jpg

UTR UTR JapaneseClass jp

https://forces-money.co.uk/wp-content/uploads/2017/10/Screen-Shot-2018-04-30-at-21.57.46.png

https://www.gov.uk/corporation-tax

File your Company Tax Return by your deadline this is usually 12 months after the end of your accounting period Your accounting period is normally the same 12 months as the financial year

https://www.gov.uk/log-in-register-hmrc-online-services

Sign in or set up a personal or business tax account Self Assessment Corporation Tax PAYE for employers VAT and other services

HMRC Letter Action Required Before 8 April 2021 Alterledger

Hmrc Tax Return Letters With Logos And Cash Stock Photo Royalty Free

HMRC R D Compliance Check Eligibility Nudge Letters

HMRC Powers Set To Extend For CIS Deductions And Corporation Tax

HMRC Changes January 2018 Tax Return Online Services

HMRC Tax Overview Document Templates Online Self Templates

HMRC Tax Overview Document Templates Online Self Templates

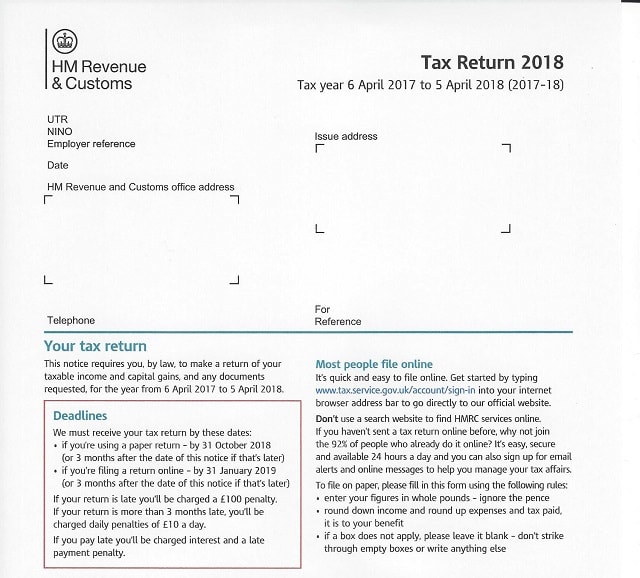

HMRC 2018 Tax Return Form

P87 Fill Out Sign Online DocHub

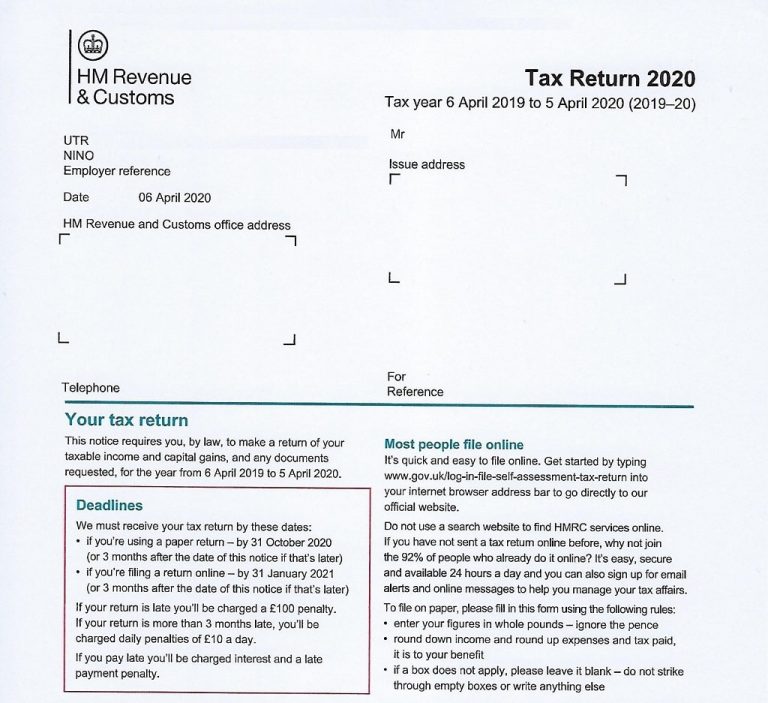

HMRC 2020 Tax Return Form SA100

Hmrc Corporation Tax Return Online - You can use the HMRC online service to file your Company Tax Return with HMRC and accounts with Companies House at the same time if your company s turnover is up to 632 000 per year