Hmrc Deadline For Corporation Tax Return After the end of its financial year your private limited company must prepare You need your accounts and tax return to meet deadlines for filing with Companies House and HM Revenue

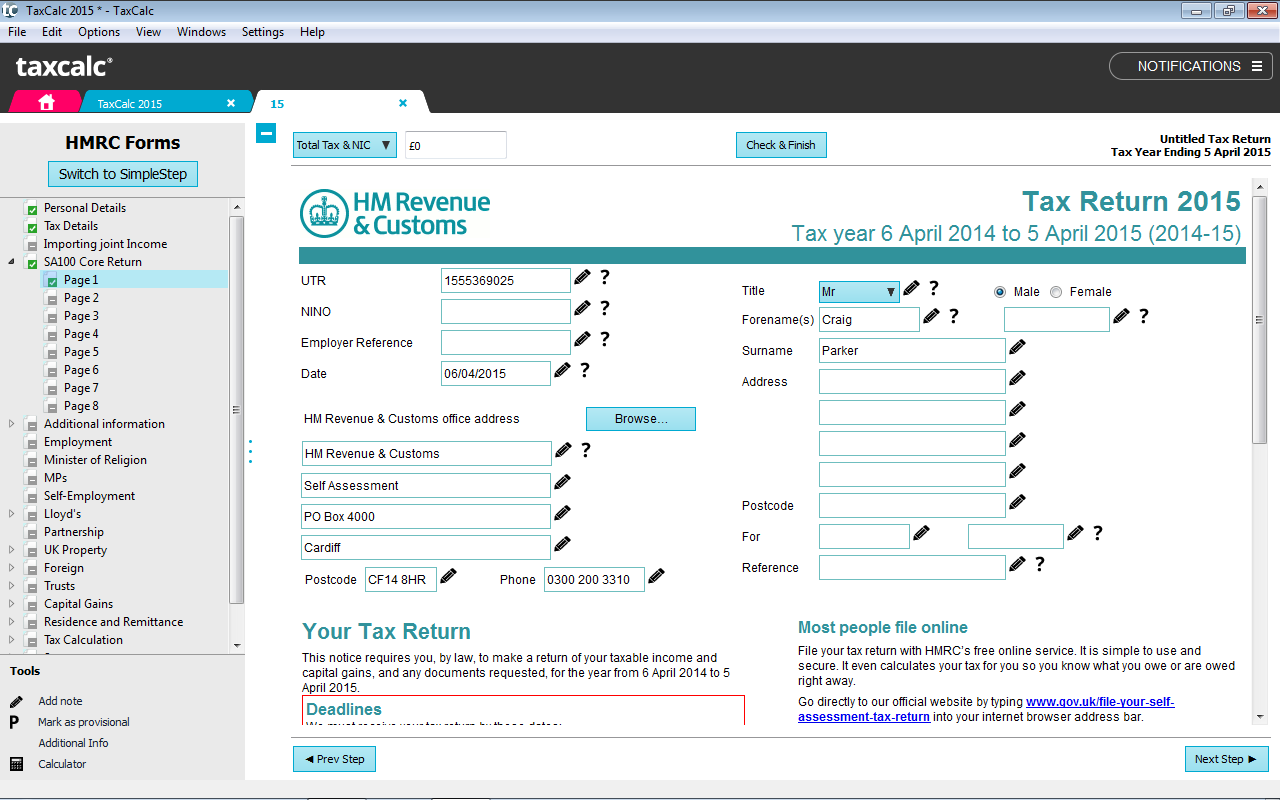

You would need to update your accounting period dates with HMRC before 31 December 2024 and file all returns by 31 March 2025 You may get a late filing penalty if you do not update According to HMRC Corporate Tax filing a Company Tax Return is 12 months after your accounting period for Corporation Tax ends It may have to file 2 tax returns to cover

Hmrc Deadline For Corporation Tax Return

Hmrc Deadline For Corporation Tax Return

https://techround.co.uk/wp-content/uploads/2023/01/self-assessment-tax-deadline.jpg

How To Pay Your Self assessment Tax Return HMRC Deadline Payment

https://wp.inews.co.uk/wp-content/uploads/2023/01/GettyImages-1022813134-4.jpg?crop=0px%2C44px%2C2233px%2C1260px&resize=1200%2C675

2023 Tax Deadline Important Extension Filing Dates Incite Tax

https://incitetax.com/wp-content/uploads/2023/01/2023-tax-deadline.jpg

Corporation Tax due 9 months and 1 day after the end of the accounting period VAT due normally one month and 7 days after the end of the quarter Self Assessment Tax Returns Need to know when your Corporation Tax payment deadline is Use our calculator to find out your Corporation Tax due date

Companies are required to file their Corporation Tax return form CT600 with HM Revenue Customs HMRC within 12 months after the end of the accounting period 3 Payment Corporation tax returns are a critical aspect of a company s financial obligations and timely filing is essential to maintain a good standing with HMRC In this discussion we ll break down the

Download Hmrc Deadline For Corporation Tax Return

More picture related to Hmrc Deadline For Corporation Tax Return

HMRC Rejects Calls To Relax Tax Return Deadline AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/istock-181853961_0.jpg

Corporation Tax Return Hmrc Corporation Tax Return Deadline

https://s-media-cache-ak0.pinimg.com/736x/5a/f0/14/5af014cff60da5523ac10038a3736dad.jpg

Tax Return Deadline How To Submit Your HMRC Self assessment Who Has

https://i.inews.co.uk/content/uploads/2021/01/PRI_178979538-1.jpg

File Online or by Post Submit your Corporation Tax Return online through HMRC s online services or by post adhering to the deadlines specified by HMRC Pay Corporation Tax After What s the deadline for paying Corporation Tax The deadline for paying your Corporation Tax is nine months and a day following the end of the accounting period that it

[desc-10] [desc-11]

HMRC 31st January 2021 Return Deadline Extended

https://taxhelp.uk.com/wp-content/uploads/HMRC-31st-January-2021-Return-Deadline-Extended-m.jpeg

Self Assessment Deadline Less Than One Month To Go HM Revenue

https://resources.mynewsdesk.com/image/upload/c_limit,dpr_auto,f_auto,h_700,q_auto,w_auto/lnswzsc1g8icelcquudq.jpg

https://www.gov.uk/prepare-file-annual-accounts-for-limited-company

After the end of its financial year your private limited company must prepare You need your accounts and tax return to meet deadlines for filing with Companies House and HM Revenue

https://www.gov.uk/corporation-tax-accounting-period

You would need to update your accounting period dates with HMRC before 31 December 2024 and file all returns by 31 March 2025 You may get a late filing penalty if you do not update

Online Tax Hmrc Online Tax Return

HMRC 31st January 2021 Return Deadline Extended

HMRC Deadline For Self Assessment Tax Returns Of 2017 2018 Brayan

Tax Return Deadline HMRC Issue Daily Fines

WHEN IS THE 2018 TAX RETURN DEADLINE HOW CAN I AVOID HMRC PENALTIES

HMRC Overdue Corporation Tax Letter Begbies Traynor Group

HMRC Overdue Corporation Tax Letter Begbies Traynor Group

HMRC Deadline To Register Trusts Approaching What You Need To Know

When Is The Tax Return Deadline Submit HMRC Self Assessment TODAY

Tax Credits Warning HMRC Deadline Looms And Failing To Renew Means

Hmrc Deadline For Corporation Tax Return - [desc-14]