Hmrc Electric Car Benefit Calculator The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in

HM Treasury calculates how much benefit they receive based on a percentage BiK rate of the car s P11D value see below compared to just receiving HMRC classes company cars as a benefit in kind BIK which is a term applied to most perks provided on top of your salary Tax bills vary enormously but the

Hmrc Electric Car Benefit Calculator

Hmrc Electric Car Benefit Calculator

https://www.accountingweb.co.uk/sites/default/files/hmrc_photot.jpg

HMRC Criticized As Mileage Rates Lag Behind Cost Of Charging Electric

https://s3.eu-west-2.amazonaws.com/geads.co.uk/wp-content/uploads/2022/06/01135212/HMRC-criticized-as-mileage-rates-lag-behind-cost-of-charging-1536x1024.jpg

Electric Car Tax Breaks Proactive Accounting

https://www.proactive-accounting.com/wp-content/uploads/2022/05/benefit-in-kind-rates-2402298.jpg

You can use the government s calculator tool to work out exactly how much you owe The amount of tax due can be very high easily running into thousands of pounds per year unless you have an electric Calculate the company car tax and any fuel benefit charge on your actual income Just select your vehicle or enter the P11D value and BIK rate to calculate Instantly

HMRC s calculators default to assuming that the car is a high CO2 emitting petrol car This calculates the annual BiK at 37 of the list price of the car rather than In 2021 22 pure electric cars will see a BIK rate of only 1 This means that company car drivers who switch to an electric car will see their tax bill significantly reduced Car benefit is calculated in a series of

Download Hmrc Electric Car Benefit Calculator

More picture related to Hmrc Electric Car Benefit Calculator

HMRC To Announce Advisory Fuel Rate For pure Electric Cars

https://www.accountingweb.co.uk/sites/default/files/istock_omada_aw.jpg

Help With HMRC Pressure The Directors Helpline

https://www.thedirectorshelpline.org/media/nu4pdniz/logo-jpg.png

HMRC Updates Simplified Proliferation Financing Arcarta

https://assets-global.website-files.com/5eda4b49bca2fa2f57885262/630895bdfaa5a5003dadd820_HMRC Update Thumbnail.jpg

Select a car and our Company Car Tax Calculator will calculate benefit in kind and other figures using HMRC rates Results are based on CO2 emissions fuel and taxable price Step 1 The price of the car Step 2 Accessories Step 3 Capital contributions Step 4 The appropriate percentage Step 5 Calculating the car benefit

Our Company Car Tax Calculator gives you an instant calculation of the company car benefit and tax often called the benefit in kind or BIK calculator on a company car Calculating how much tax to pay To know how much tax to pay on electric company cars you can use HMRC s Company Car and Car Fuel Benefit Calculator

Login Order Calculator Application

https://oc.prevail.com/Images/Order_Calculator_QTool_Logo.PNG

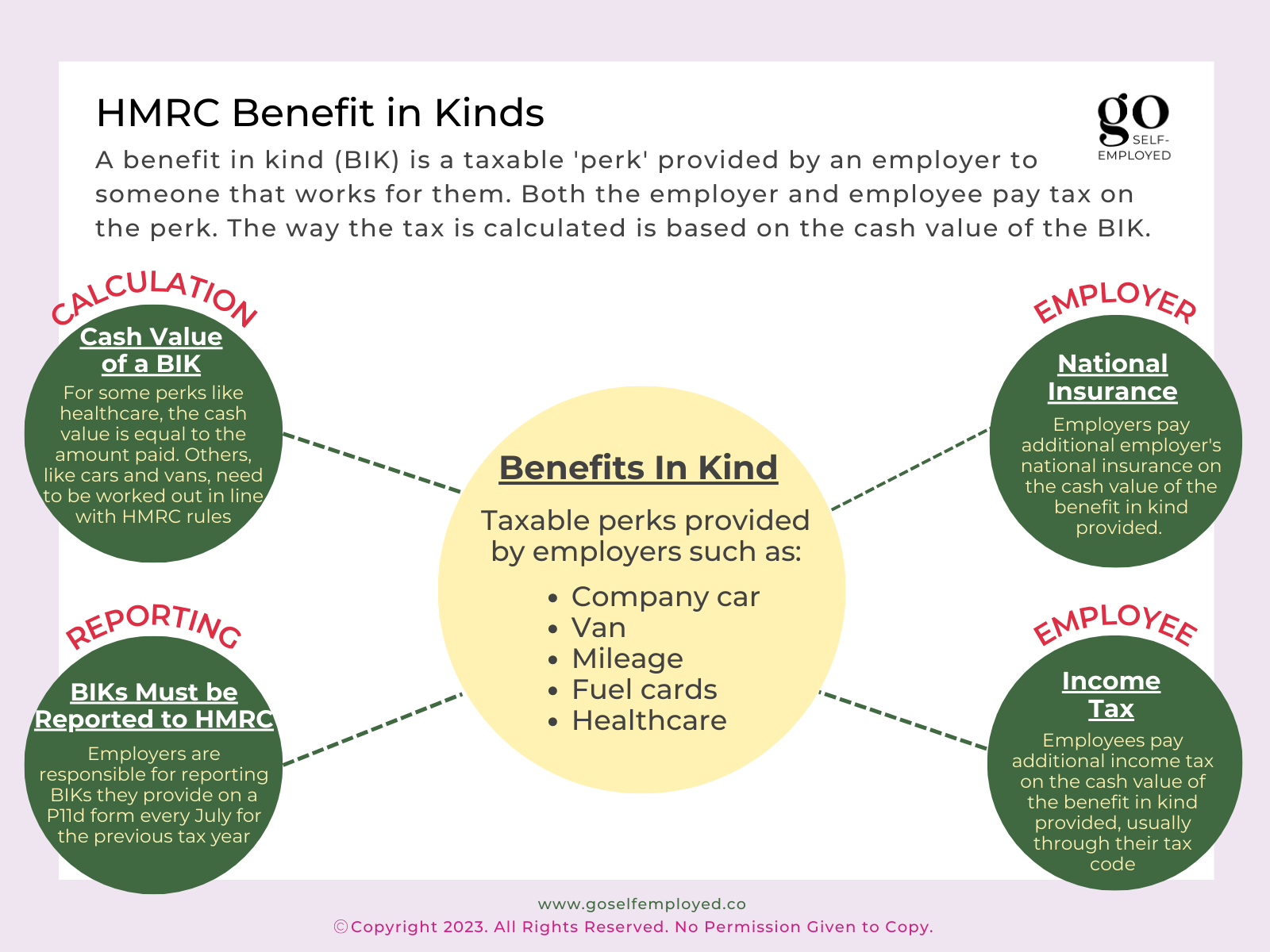

What Are HMRC Benefit In Kinds Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/01/benefit-in-kinds.png

https://electriccarguide.co.uk/what-are-t…

The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in

https://pod-point.com/guides/business/company-electric-car-tax

HM Treasury calculates how much benefit they receive based on a percentage BiK rate of the car s P11D value see below compared to just receiving

HMRC Releases Brief Explaining VAT Liability Of Charging Of Electric

Login Order Calculator Application

40 Electric Car Benefit In Kind 2020 21 Hmrc Kimber Automotive

Free Images Cash Science Calculator Ddr Office Supplies Office

Calculator

Calculator In Neumorphism Style Search By Muzli

Calculator In Neumorphism Style Search By Muzli

BIK

Companies Providing Electric Car Schemes Should Ensure Vehicles Are

HMRC Electric Car Mileage Rates 2024 Electric Car Guide

Hmrc Electric Car Benefit Calculator - Capital Allowance Aside from the above exceptions for road tax and congestion charges there are even more tax benefits to electric vehicles for