Hmrc Electric Car Charging Benefit In Kind 9 rowsIf private use only the cost of electricity used is taxable as a benefit in kind If

HMRC accepts that no taxable benefit arises where an employer reimburses their employee for the cost of charging a company owned wholly electric car Following a campaign by the ICAEW HMRC has now conceded that the s239 exemption does apply to home charging company cars and vans as long as the

Hmrc Electric Car Charging Benefit In Kind

Hmrc Electric Car Charging Benefit In Kind

https://s3.eu-west-2.amazonaws.com/geads.co.uk/wp-content/uploads/2022/06/01135212/HMRC-criticized-as-mileage-rates-lag-behind-cost-of-charging-1536x1024.jpg

Buy SHELL Electric Vehicle Charger Level 2 40 Amp Fast Charging EV

https://m.media-amazon.com/images/I/61jxjqkE2HL.jpg

The Derby Conference Centre Now Boasts Largest Collection Of Electric

https://www.lovebusinesseastmidlands.com/clientfiles/images/news/original/Electric Car Charging.jpg

Electric cars with zero emissions fall into the lowest benefit in kind tax band resulting in lower tax liabilities for employees This makes electric vehicles very attractive for businesses and employees The current 2024 Benefit In Kind BIK rate in the UK is 2 for electric cars The 2 BIK rate is set to remain at 2 for the 2024 25 tax year after which it will increase by 1 a year each year to reach 5 in

Company car tax officially known as Benefit in Kind Tax BiK is calculated based on the P11D value of the vehicle its CO2 tailpipe emissions and the employee s HMRC have updated their Employment Income Manual to reflect a change in policy This impacts employers who reimburse employees for the cost of electricity used

Download Hmrc Electric Car Charging Benefit In Kind

More picture related to Hmrc Electric Car Charging Benefit In Kind

Electric Cars And Benefit In Kind Tax FAQs GreenCarGuide

https://www.greencarguide.co.uk/wp-content/uploads/2019/05/gcg-confused-faq-header-2640x1040.jpg

HMRC Releases Brief Explaining VAT Liability Of Charging Of Electric

https://www.pkb.co.uk/wp-content/uploads/2021/06/Electric-Car-charging-on-street-docking-station-in-UK-1070771894_1258x839.jpg

EV Charging

https://www.norwichconservatoryroofs.co.uk/wp-content/uploads/2022/08/bigstock-Electric-Car-Charging-In-Under-453237743-Converted.png

If your company car has CO2 emissions of 1 to 50g km the value of the car is based on its zero emission mileage figure or electric range This is the distance the car can go on From 6 April 2020 the benefit in kind for fully electric cars is being reduced to 0 for the tax year 2020 2021 increasing to 1 in 2021 2022 and 2 in 2022 2023 of an EV s taxable

HMRC guidance has recently been updated about the VAT treatment of electric vehicle charging points Here s a quick summary Liability relating to charging HMRC classes company cars as a benefit in kind BIK which is a term applied to most perks provided on top of your salary Tax bills vary enormously but the

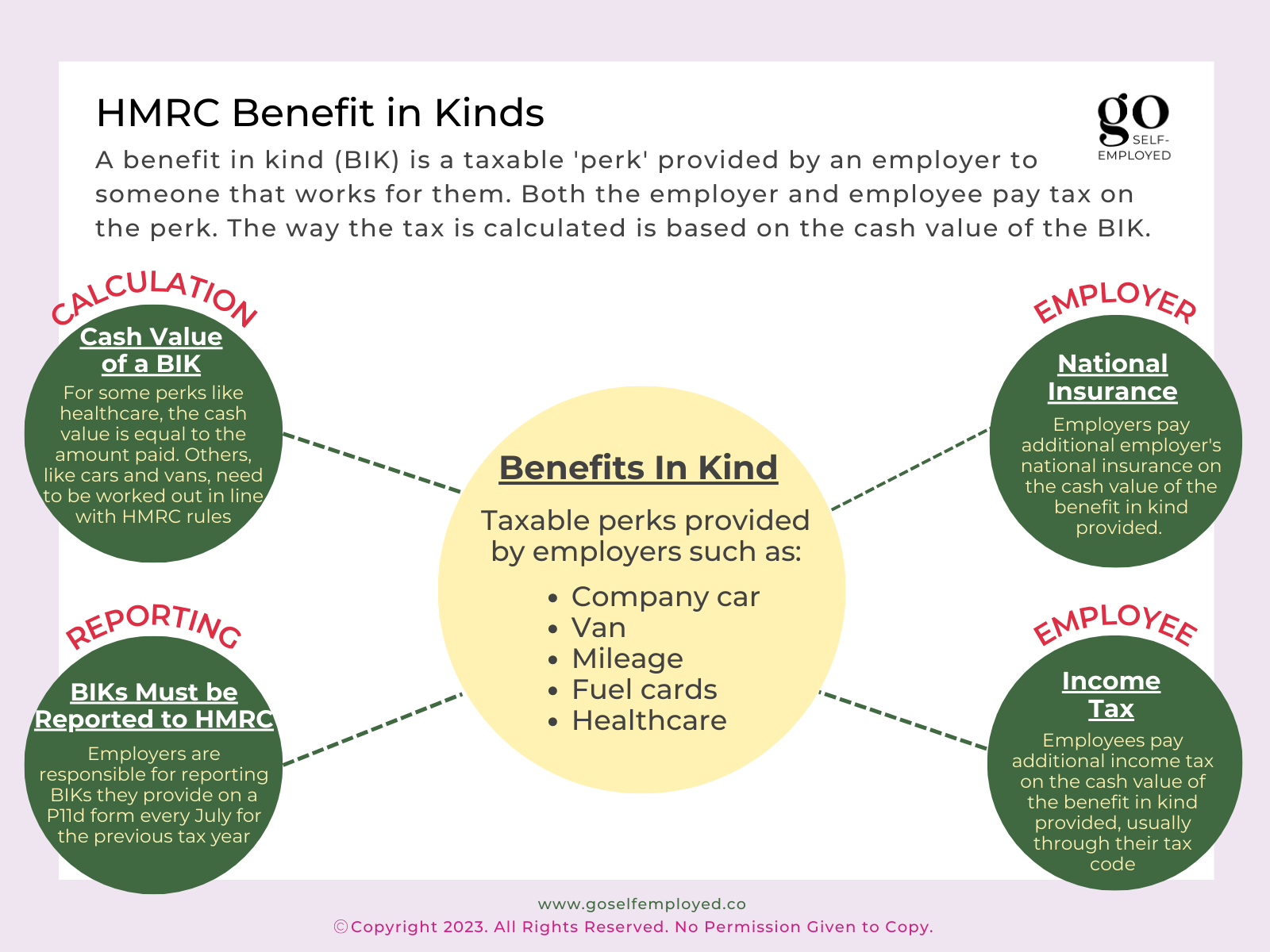

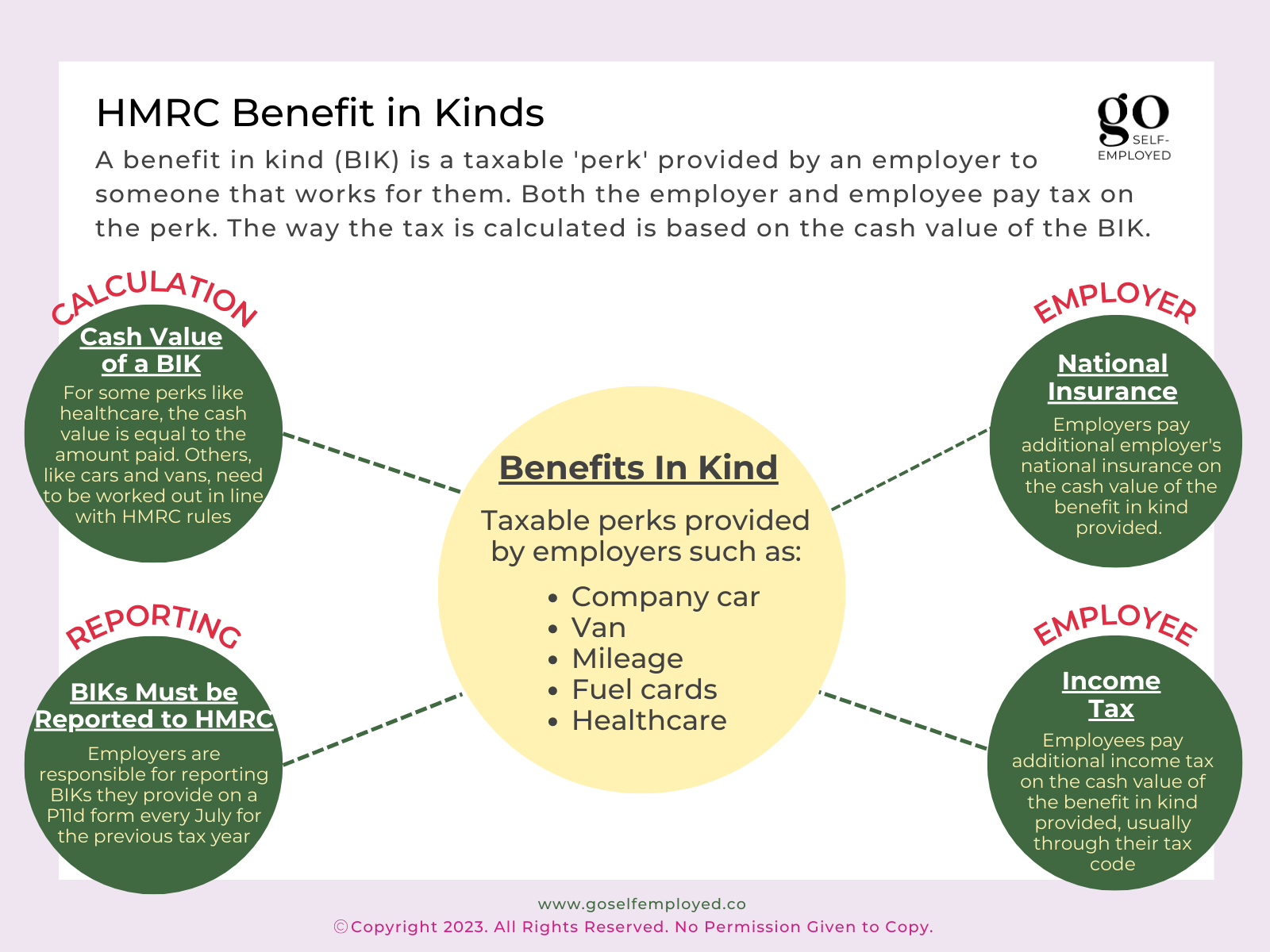

What Are HMRC Benefit In Kinds Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2023/01/benefit-in-kinds.png

Pioneers War At The Silicon Valley The Battle For The Electric

https://www.auto-data.net/images/f18/Electric-car-charging.jpg

https://www.gov.uk/hmrc-internal-manuals/...

9 rowsIf private use only the cost of electricity used is taxable as a benefit in kind If

https://www.icaew.com/insights/tax-news/2023/sep...

HMRC accepts that no taxable benefit arises where an employer reimburses their employee for the cost of charging a company owned wholly electric car

Instavolt Electric Car Charging Costs To Rise

What Are HMRC Benefit In Kinds Goselfemployed co

HMRC To Announce Advisory Fuel Rate For pure Electric Cars

Buy LEFANEV32 Amp EV Charger Level 2 NEMA 14 50 32A 25ft 7 68KW

BIK

HMRC To Review Rules For Claiming VAT On Charging Electric Vehicles

HMRC To Review Rules For Claiming VAT On Charging Electric Vehicles

Install Electric Car Charging Stations On Campus Tech Tribune France

HMRC Electric Car Mileage Rates 2024 Electric Car Guide

Demystifying Electric Car Charging

Hmrc Electric Car Charging Benefit In Kind - HMRC have updated their Employment Income Manual to reflect a change in policy This impacts employers who reimburse employees for the cost of electricity used