Hmrc Emergency Tax Rate If you are paying emergency tax on your income it means you are being taxed at a temporary rate until HMRC has enough information about your income to work out what your correct rate should

If your tax code on your payslip contains W1 M1 or X that means you re on an emergency tax rate Why am I on emergency tax You might find you have been HMRC applies an emergency tax code when it doesn t know all your financial details Find out what to do if you are on an emergency BR tax code and how to make sure you don t pay too much tax

Hmrc Emergency Tax Rate

Hmrc Emergency Tax Rate

https://blog.paycheckplus.ie/hs-fs/hubfs/Imported_Blog_Media/EmergencyTax-1024x512.png?width=2560&height=1280&name=EmergencyTax-1024x512.png

Hmrc Emergency Tax Code Ot

https://i.pinimg.com/736x/ac/5b/66/ac5b66f79932be93248abaa543271f58.jpg

Emergency Tax Basis BrightPay Documentation

https://documentation.thesaurussoftware.com/images/691.png

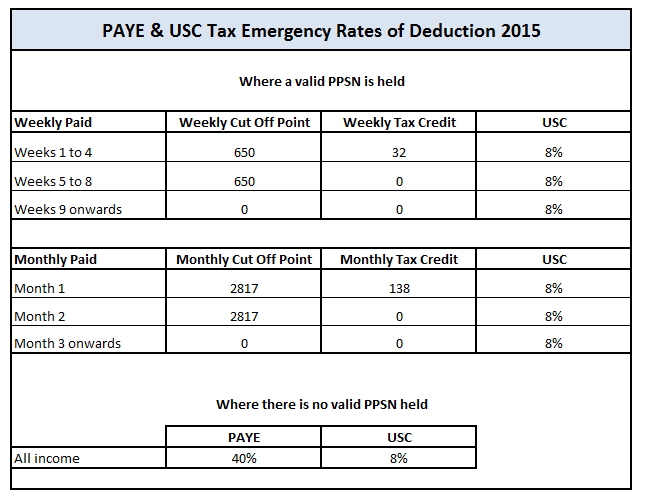

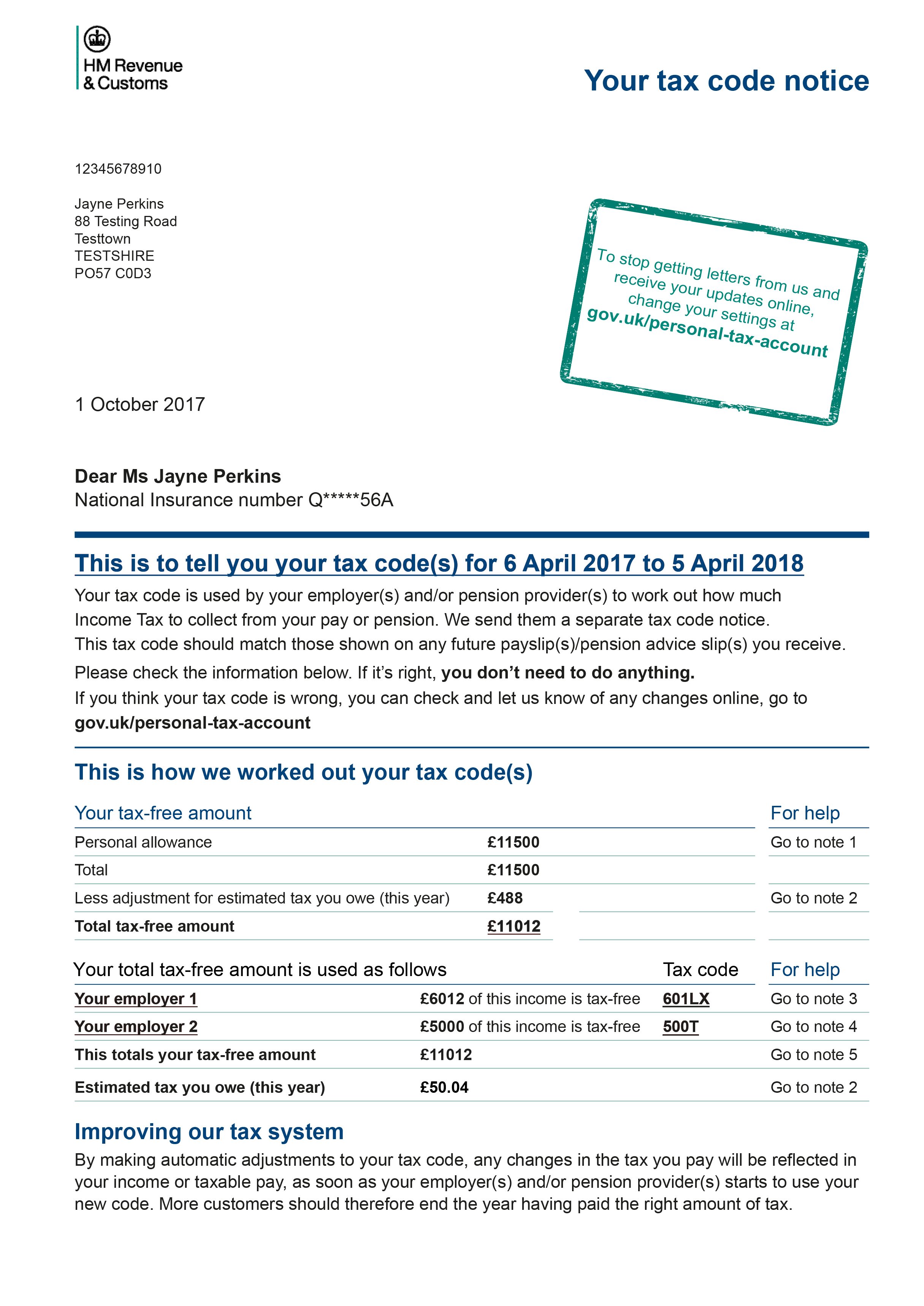

Important information This calculator provides you with an indication of the tax which might be deducted if an emergency tax code is used for a payment made in the 2024 25 tax The tax code issued in an emergency tax scenario is equivalent to the basic personal allowance for people under 65 or born after 5th April 1948 from 2013 This is to make sure you receive at least

Depending on the information available those on an emergency rate will be charged at the basic rate 20 or higher rate 40 of tax on all income that exceeds the personal Key Takeaways What Is the Emergency Tax Code An emergency tax code is a code applied by HMRC when it the lacks necessary information Without correct personal details you ll be

Download Hmrc Emergency Tax Rate

More picture related to Hmrc Emergency Tax Rate

Emergency Tax Help Emergency Tax Specialists Advice

https://vwtaxation.com/wp-content/uploads/2021/03/Emergency-Tax-Help.png

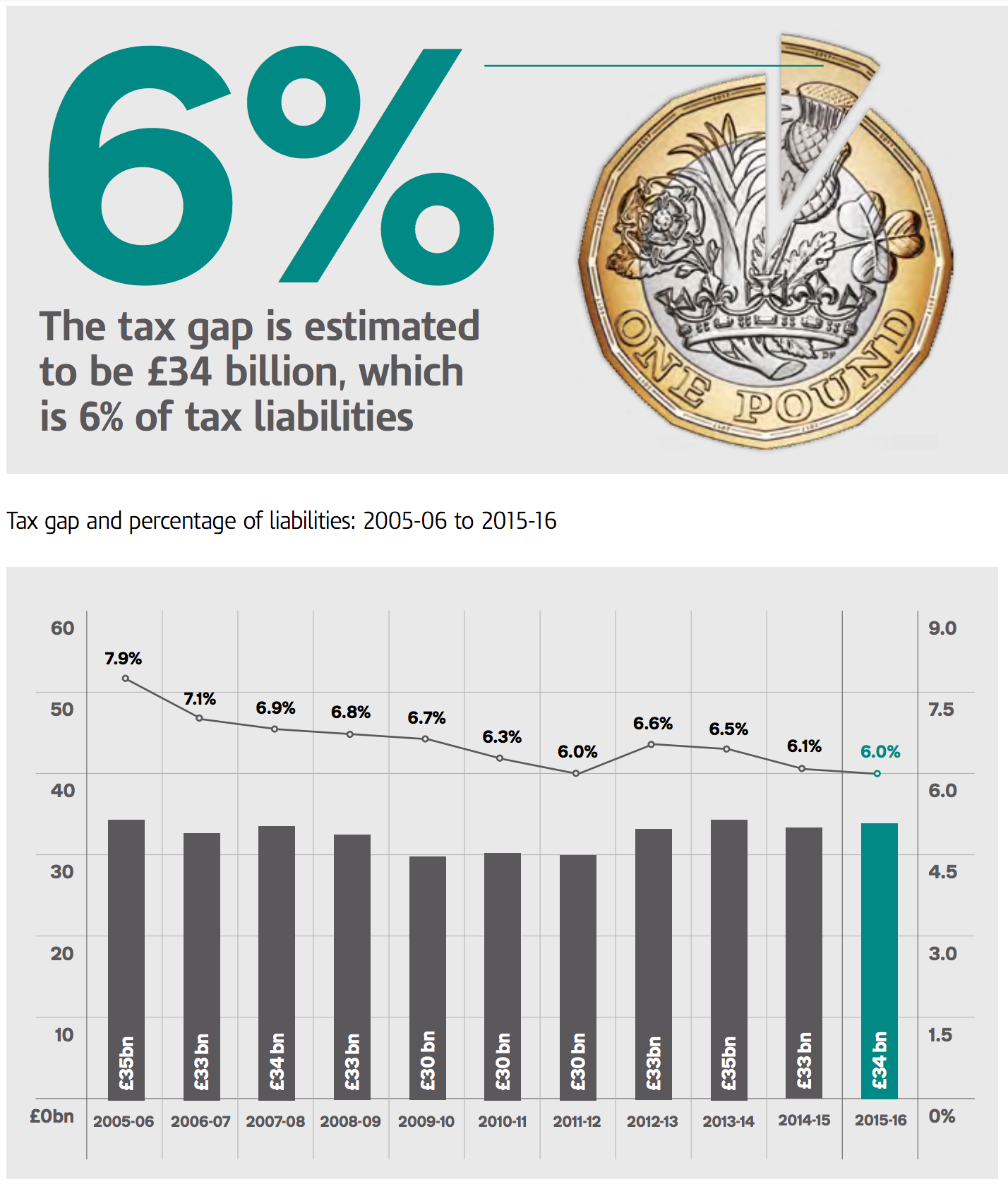

HMRC s New Tax Gap Data Too Predictable To Be Reliable

https://www.taxresearch.org.uk/Blog/wp-content/uploads/2017/10/Screen-Shot-2017-10-26-at-09.33.31.png

What Is A BR Emergency Tax Code Brian Alfred

https://brianalfred.co.uk/wp-content/uploads/2022/11/HMRC.png

Gill Laing 23 September 2022 IN THIS ARTICLE Ensuring that new employees are registered to pay tax forms an important part of an employer s role in fulfilling their The M1 tax code in the UK is known as an emergency tax code used temporarily until HM Revenue Customs HMRC has the necessary information

6 April 2024 Key points Single or ad hoc payments or initial payments of regular pension income are normally taxed on the Emergency month 1 basis The emergency tax Emergency tax is a tax code typically assigned to you if HMRC does not have the correct or sufficient information about you your income and your tax details Due to insufficient

How To Stop Emergency Tax

https://pearllemonaccountants.com/wp-content/uploads/2022/03/how-to-stop-emergency-tax.png

UK HMRC SC2 2023 Form Printable Blank PDF Online

https://www.pdffiller.com/preview/410/122/410122590/big.png

https://www.income-tax.co.uk/what-to-do-if-yo…

If you are paying emergency tax on your income it means you are being taxed at a temporary rate until HMRC has enough information about your income to work out what your correct rate should

https://www.unbiased.co.uk/discover/tax-business/...

If your tax code on your payslip contains W1 M1 or X that means you re on an emergency tax rate Why am I on emergency tax You might find you have been

How Do I Check My Coding Notice Low Incomes Tax Reform Group

How To Stop Emergency Tax

Reporting Expenses And Benefits For 2018 19 Accountwise

HMRC Overtaxing Pensioners At Record Rate This Is Money

The Chance Of Transfer Mispricing Occurring Is Much Higher Than HMRC

The UK Loses 20 Of Total Corporate Profits To Tax Havens But HMRC Are

The UK Loses 20 Of Total Corporate Profits To Tax Havens But HMRC Are

HMRC Tax Archives Huston And Co

HMRC Tax Code In 2020 Coding To Tell Bank Statement

HMRC Uses Annual Report To Apologise For Service Levels AccountingWEB

Hmrc Emergency Tax Rate - Depending on the information available those on an emergency rate will be charged at the basic rate 20 or higher rate 40 of tax on all income that exceeds the personal