Hmrc Eu Vat Refund Contact Number If you re eligible to use the EU VAT refund system but cannot access the system you should contact HMRC or check the guidance for more information

You may have to pay VAT on goods and services bought for your business in an EU country You ll still be able to claim refunds of this VAT if your business is registered in the UK or Isle You must claim your VAT refund online via the authorities in the country where your business is based If you are eligible for a refund the authorities will pass on your claim to the authorities

Hmrc Eu Vat Refund Contact Number

Hmrc Eu Vat Refund Contact Number

https://www.francetraveltips.com/wp-content/uploads/2022/06/Tax-refund-area-at-Charles-de-Gaulle-airport-1-780x585.jpeg

Hecht Group How To Reclaim Value Added Tax VAT As A Commercial

https://img.hechtgroup.com/can_i_claim_vat_back_on_a_commercial_property.png

Qu est ce Qu une D claration De TVA Agent Gratuit I m Running

https://freeagent-res.cloudinary.com/image/upload/c_limit,w_1000/dpr_auto,f_auto/website-images/screenshots/screenshot_vat-return.png

Refunds of VAT from the UK made to traders established in another Member State Compliance Centres VAT Overseas Repayment Unit S1250 Benton Park View Newcastle Upon Tyne To enrol for the VAT EU Refunds service you will need information contained on your last VAT return and your VAT4 Certificate of Registration The information you enter will be verified

You will need to use 13 th Directive process for everything else such as VAT on purchase of services or where you are not eligible to use the EU VAT refund system See HMRC updated Retailers can either refund the VAT directly or use an intermediary One of these parties may charge a fee which may be withheld from the refunded VAT amount More on VAT refunds

Download Hmrc Eu Vat Refund Contact Number

More picture related to Hmrc Eu Vat Refund Contact Number

HMRC Sends UK Firms A Checklist Of Preparations For Trading With The EU

https://cdn.ymaws.com/export.site-ym.com/resource/resmgr/images/news_and_blog_images/international_trade_news_4/hmrc.jpeg

VAT Return Template

https://www.easybooksapp.com/hubfs/VAT-Return-LP_2x.png#keepProtocol

How To Claim VAT Refund An EU Guide

https://www.freshbooks.com/wp-content/uploads/2021/12/Vat-refund.jpg

The current EU VAT refund scheme is only available for expenses incurred prior to 1 January 2021 Claims need to be submitted before 11pm on 31 March 2021 through HMRC s VAT Claim VAT back for item purchased and delivered within the EU Posted Mon 12 Aug 2024 09 10 59 GMT by Jane We are a UK based company who have a supplier in Italy who we

HMRC has updated VAT notice 723A to reflect changes to the VAT refund process This relates to businesses located in the UK incurring EU VAT and businesses from outside the UK that Contact details webchat and helplines for enquiries with HMRC on tax Self Assessment Child Benefit or tax credits including Welsh language services

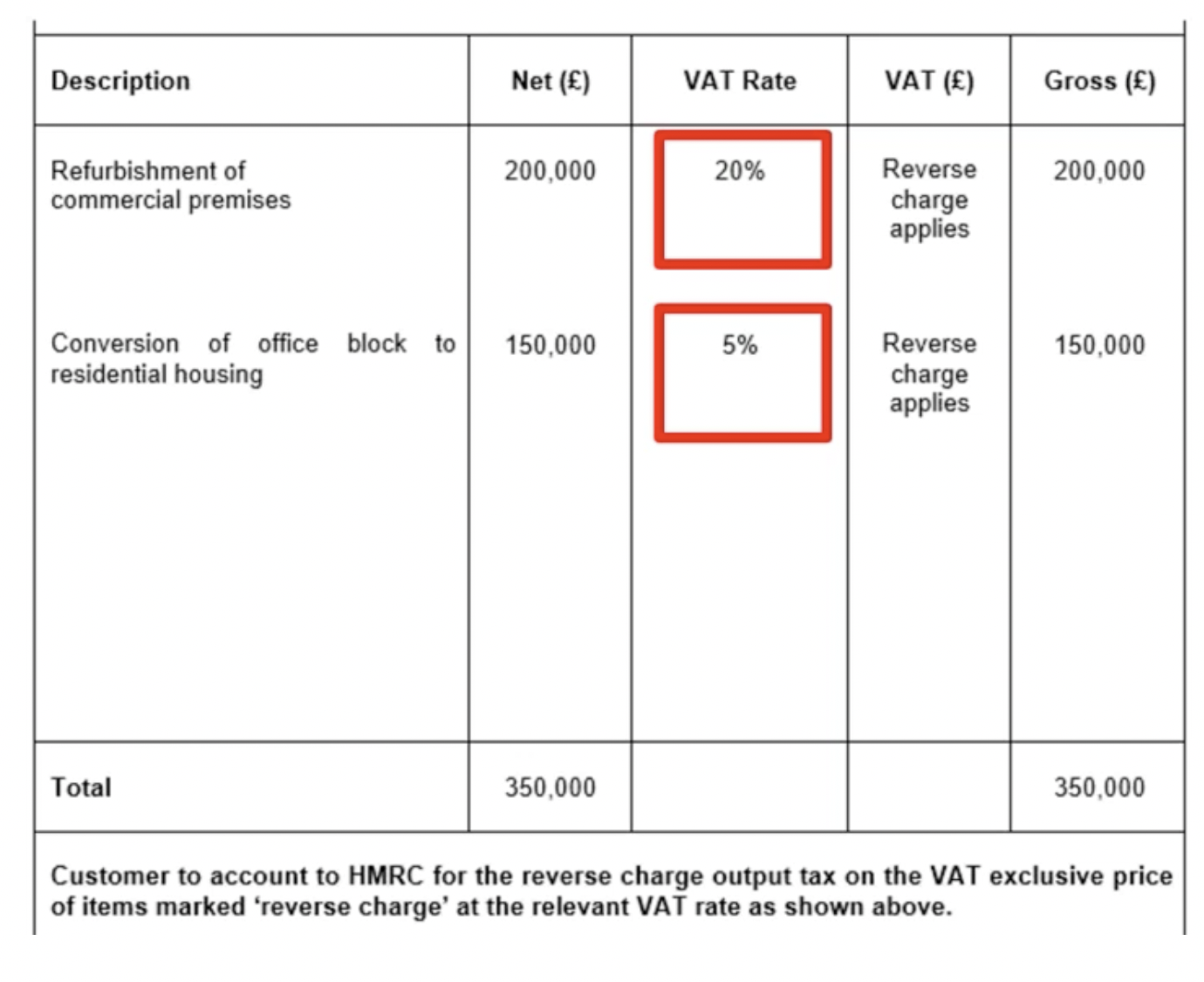

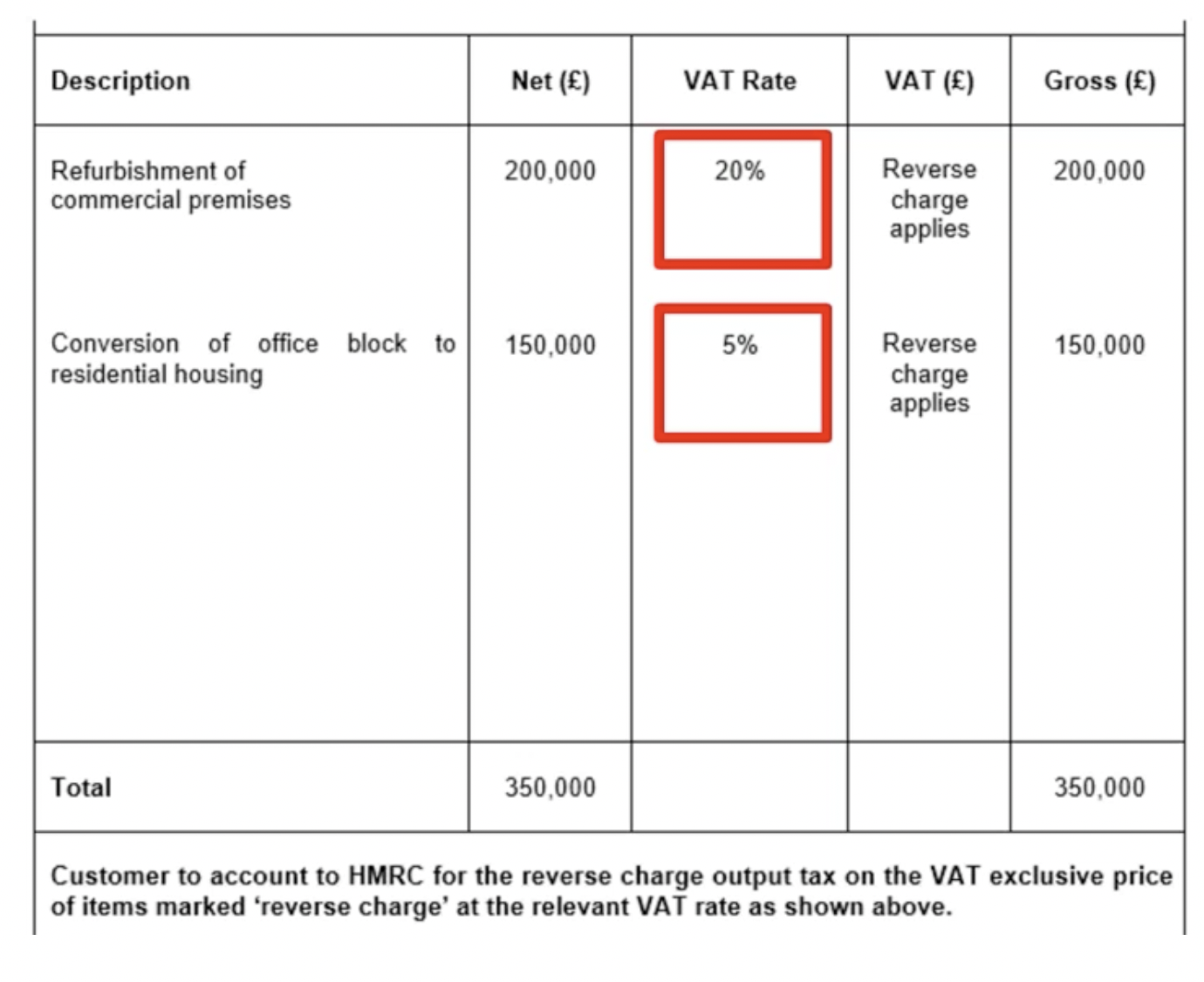

Cis And Vat Reversal Invoice Template SexiezPicz Web Porn

http://downloads.thesaurussoftware.com/images/CISVAT1.png

VAT Refund Made Easier Tourists Can Now Claim Value Added Tax At

https://i.pinimg.com/originals/a8/15/40/a815409d84ecd512ff3cea9276376ba9.jpg

https://www.gov.uk/government/publications/...

If you re eligible to use the EU VAT refund system but cannot access the system you should contact HMRC or check the guidance for more information

https://www.gov.uk/guidance/vat-refunds-for-uk...

You may have to pay VAT on goods and services bought for your business in an EU country You ll still be able to claim refunds of this VAT if your business is registered in the UK or Isle

HMRC s VAT Deferral Scheme To Close This Month Perrigo Consultants

Cis And Vat Reversal Invoice Template SexiezPicz Web Porn

VAT Returns Adkin Bookkeeping Consultants

Tax Free Form Uk All You Need To Know About Tax Free Form Uk This Or

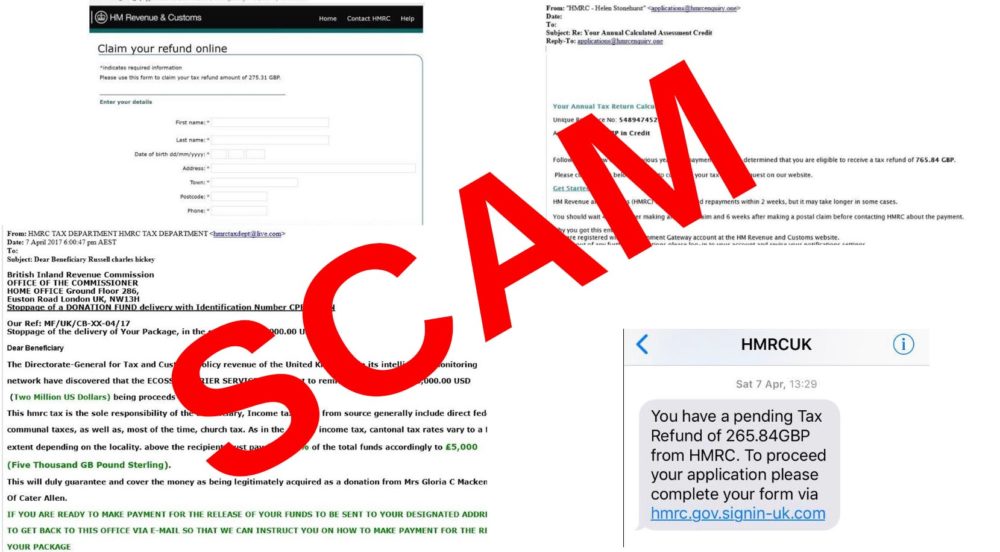

HMRC Refund Scams Must Read Guidelines And Reminder

VAT Refund Save Money In Europe Unseen Footprints

VAT Refund Save Money In Europe Unseen Footprints

VAT Refund FastVAT

Ah Accounting Services

VAT Return Deadlines Extended Financial Tribune

Hmrc Eu Vat Refund Contact Number - To enrol for the VAT EU Refunds service you will need information contained on your last VAT return and your VAT4 Certificate of Registration The information you enter will be verified