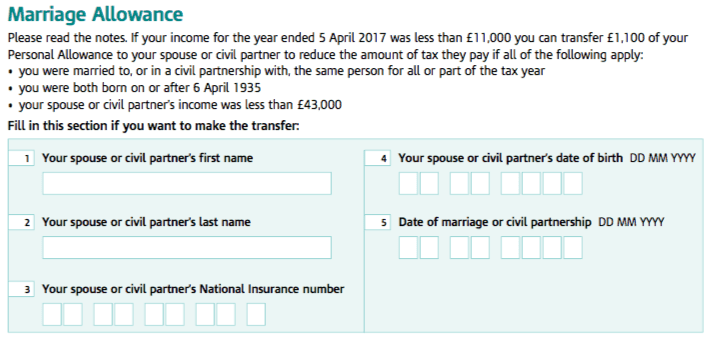

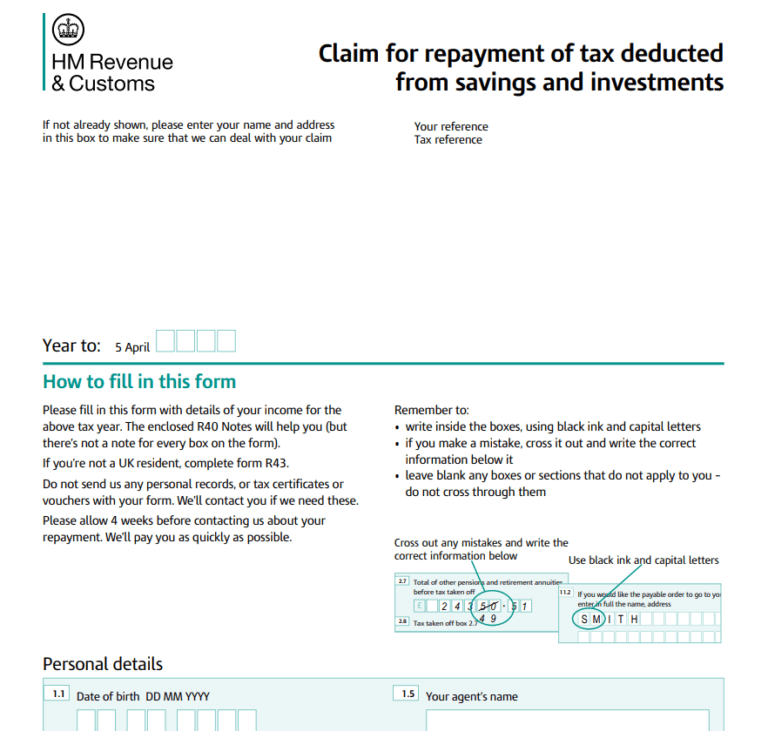

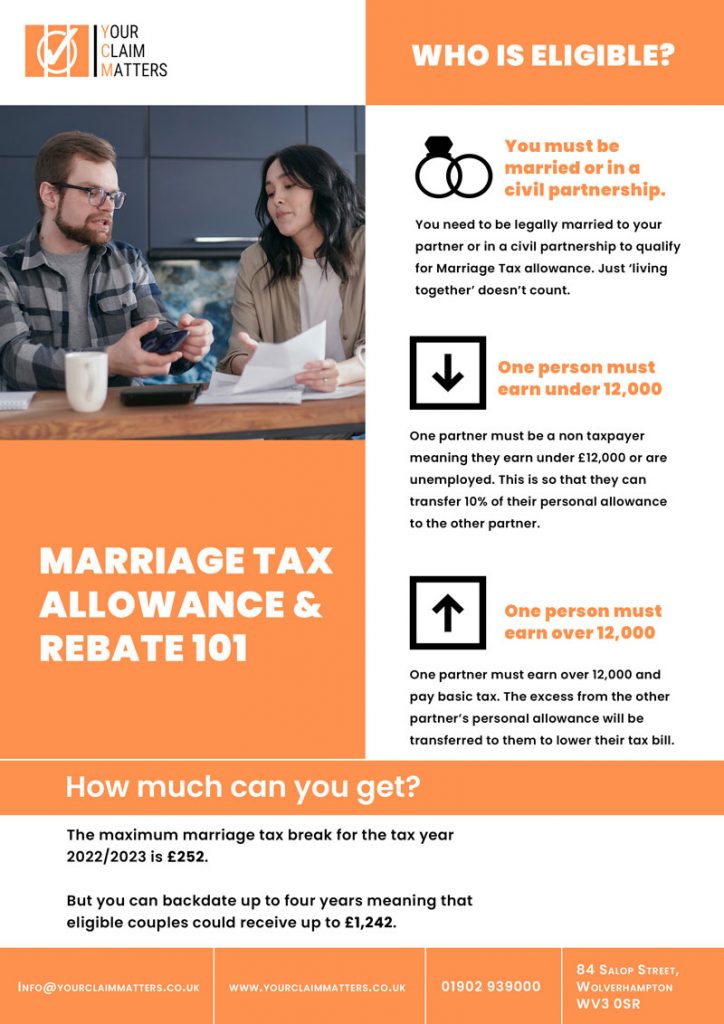

Hmrc Married Tax Allowance Rebate Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs Web HM Revenue and Customs HMRC will give your partner the allowance you have transferred to them either by changing their tax code this can take up to 2 months

Hmrc Married Tax Allowance Rebate

Hmrc Married Tax Allowance Rebate

https://images.contentstack.io/v3/assets/blt3de4d56151f717f2/blt9b9ec33cdf228db1/5e691216e3828b3e31a3345a/Table_1.png

Marriage Tax Allowance Explained Goselfemployed co

https://goselfemployed.co/wp-content/uploads/2018/07/marriage-allowance-self-employed.png

Get An Extra 212 By Using Govt s Marriage Allowance Scheme HotUKDeals

https://images.hotukdeals.com/threads/thread_full_screen/default/2318988_1.jpg

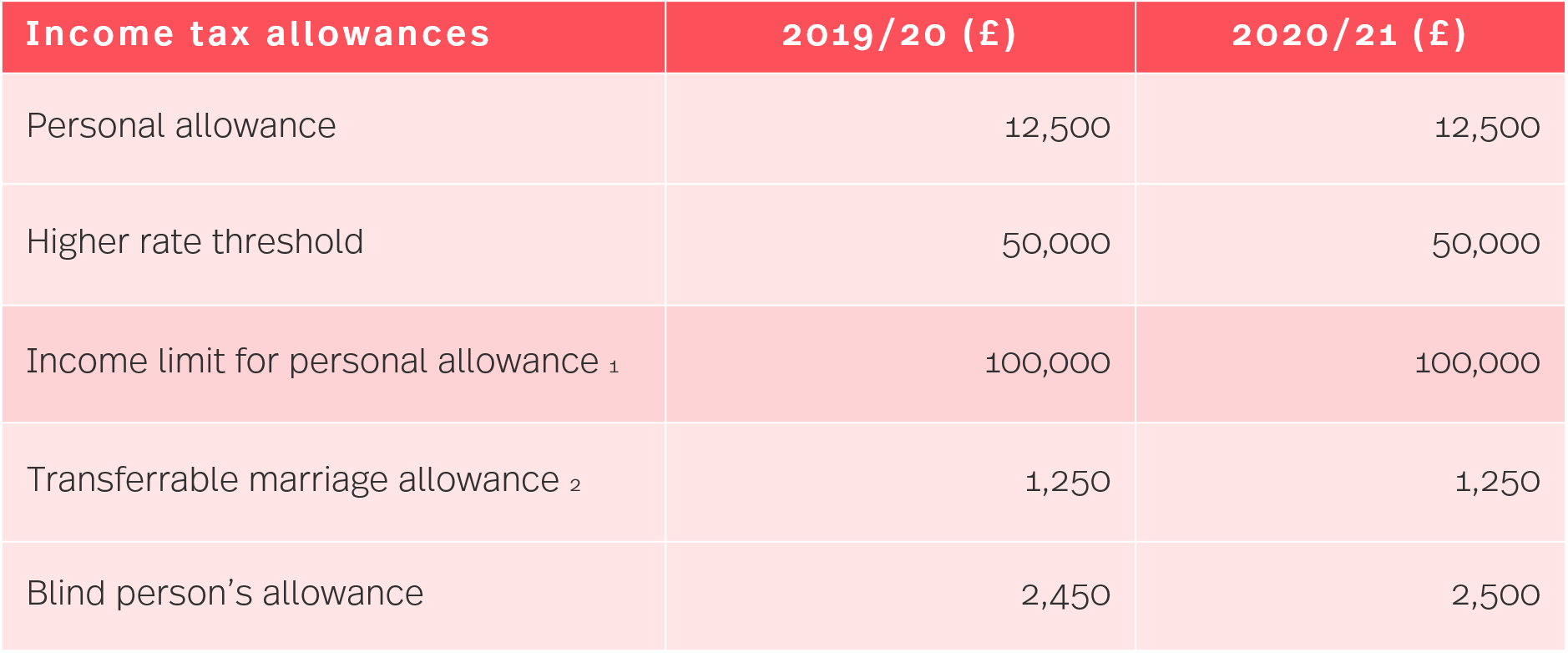

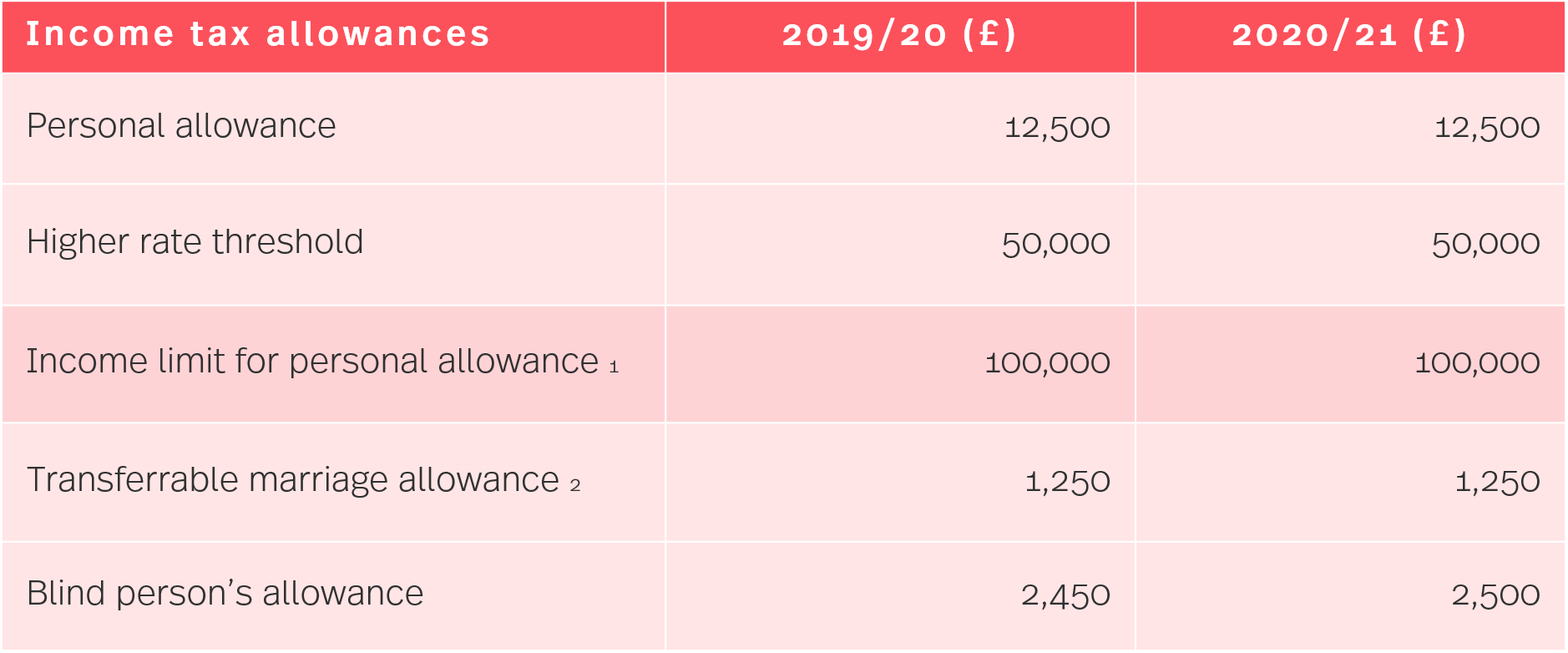

Web 11 f 233 vr 2022 nbsp 0183 32 Marriage Allowance is 10 of an individual s tax free Personal Allowance The maximum amount that can be transferred to their husband wife or civil partner is Web Married Couple s Allowance could reduce your tax bill each year if you re married or in a civil partnership For the 2023 to 2024 tax year it could cut your tax bill by between 163 401

Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you Web Marriage tax allowance for the 2023 24 tax year is worth up to 163 252 If you re eligible and apply successfully you ll also automatically get the tax break each year going forward so no need to keep reapplying

Download Hmrc Married Tax Allowance Rebate

More picture related to Hmrc Married Tax Allowance Rebate

HMRC Married Britons Could Get Tax Refund Worth Up To 252 Per Year

https://cdn.images.express.co.uk/img/dynamic/23/1200x712/4422940.jpg?r=1669386177194

PSA HMRC Will Not E mail Or Call You About Tax Rebates CasualUK

https://i.imgur.com/NPT0C0n.png

Hmrc Tool Tax Rebate Form Printable Rebate Form

https://printablerebateform.net/wp-content/uploads/2022/09/HMRC-Tax-Rebate-Form-768x731.png

Web 6 avr 2023 nbsp 0183 32 The marriage allowance allows an individual to give up 10 of their personal allowance 163 12 570 in 2023 24 so the amount is 163 1 260 to their spouse or civil partner 20 of this allowance is then given as a Web If your income changes and you re not sure if you should still claim call HMRC Marriage Allowance enquiries How to cancel Either of you can cancel if your relationship has

Web 2 janv 2022 nbsp 0183 32 HMRC has issued an update on marriage tax allowance rules as millions of couples may be eligible for tax back from the Government Couples in the UK could get Web 14 mars 2022 nbsp 0183 32 Martin Lewis Three must dos by 5 April 1 Tax code rebate 2 Marriage tax allowance 3 PPI tax back James Flanders News Reporter 14 March 2022 The tax

Draw Your Signature Marriage Tax Allowance Rebate

https://phillipsonhardwickadvisory.co.uk/wp-content/uploads/2022/08/Captured.png

Hm4 Form Fill Out Sign Online DocHub

https://www.pdffiller.com/preview/22/555/22555713/large.png

https://www.gov.uk/apply-marriage-allowance

Web Marriage Allowance lets you transfer 163 1 260 of your Personal Allowance to your husband wife or civil partner It s free to apply for Marriage Allowance This can reduce their tax

https://www.gov.uk/married-couples-allowance/how-to-claim

Web Claim by completing the Married Couple s Allowance section of the tax return If you do not fill in a Self Assessment tax return each year Contact HM Revenue amp Customs

HMRC Are Reminding Married Couples And Civil Partnerships To Sign Up

Draw Your Signature Marriage Tax Allowance Rebate

The 101 Marriage Tax Allowance Rebate And Claim Guide

Marriage Allowance Rebate HMRC Rebates Refunds Rebate Gateway

What Is Marriage Allowance HMRC s Message To Married Couples On

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Give Tax Relief Pre approval Save The Thorold Arms

HMRC Uses Form 17 To Confirm Where Civil Couples Or Married Own A Joint

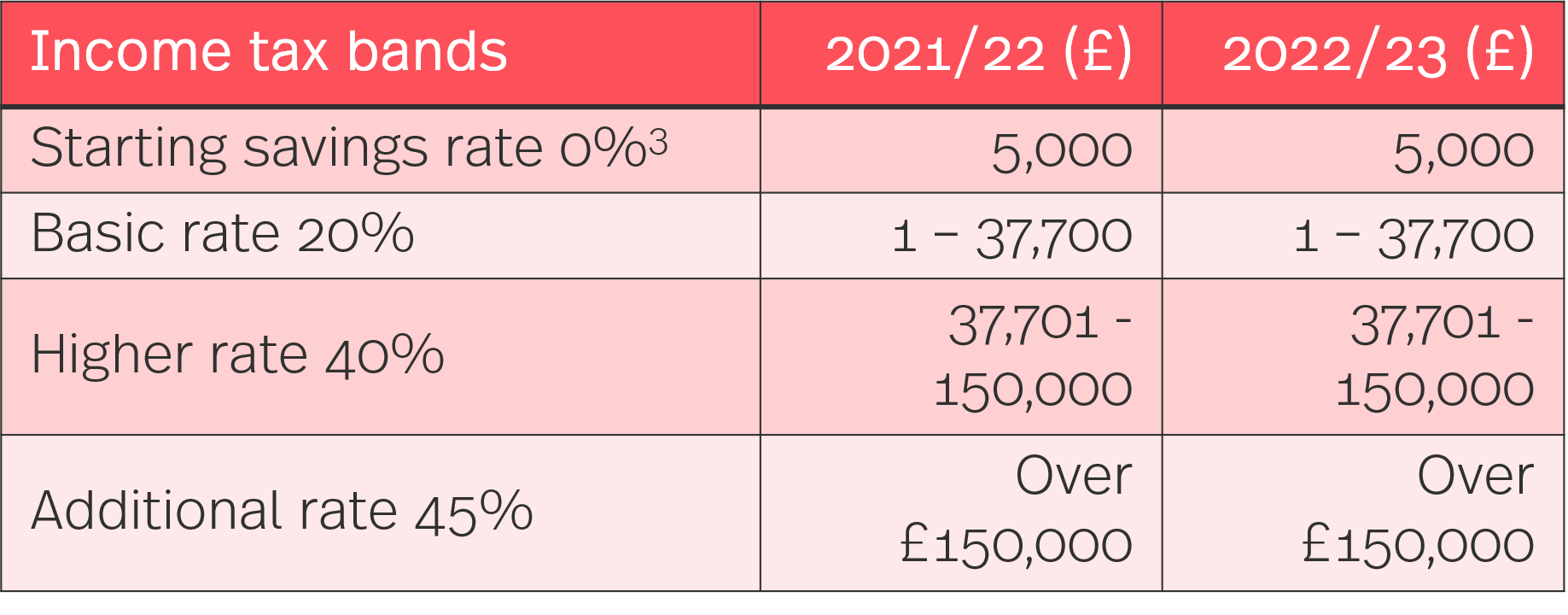

HMRC Tax Rates And Allowances For 2022 23 Simmons Simmons

UK HMRC P46 2005 Fill And Sign Printable Template Online US Legal Forms

Hmrc Married Tax Allowance Rebate - Web Eligibility You can claim Married Couple s Allowance if all the following apply you re married or in a civil partnership you re living with your spouse or civil partner one of you