Hmrc Payment Dates You need to pay the tax you owe by midnight 31 January 2025 There s usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on

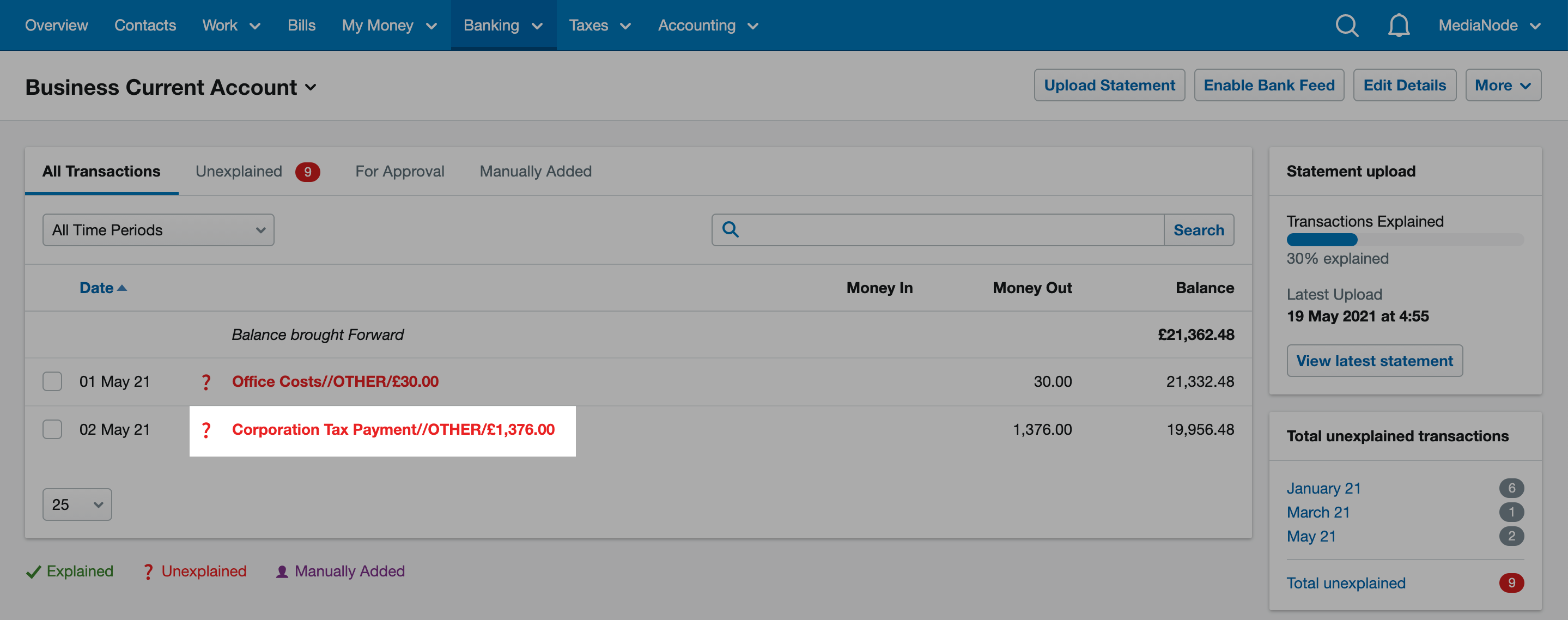

Regular payroll tasks record employee pay calculate deductions give payslips report to and pay HMRC view the balance of what you owe HMRC 31 January 2024 online tax returns and first payment on account due This is the deadline for online tax returns for the 2022 23 tax year HMRC must have received your tax return by midnight

Hmrc Payment Dates

Hmrc Payment Dates

http://www.payrollsolutionsltd.co.uk/blog/wp-content/uploads/2015/11/Payroll-Calendar-2016-2017.jpg

HMRC Uses Annual Report To Apologise For Service Levels AccountingWEB

https://www.accountingweb.co.uk/sites/default/files/hmrc_photot.jpg

How Do I To Hmrc Online Pay Your Self Assessment Tax Bill Make An

https://support.freeagent.com/hc/article_attachments/360026438819/Screenshot_2021-05-19_at_16.56.23.png

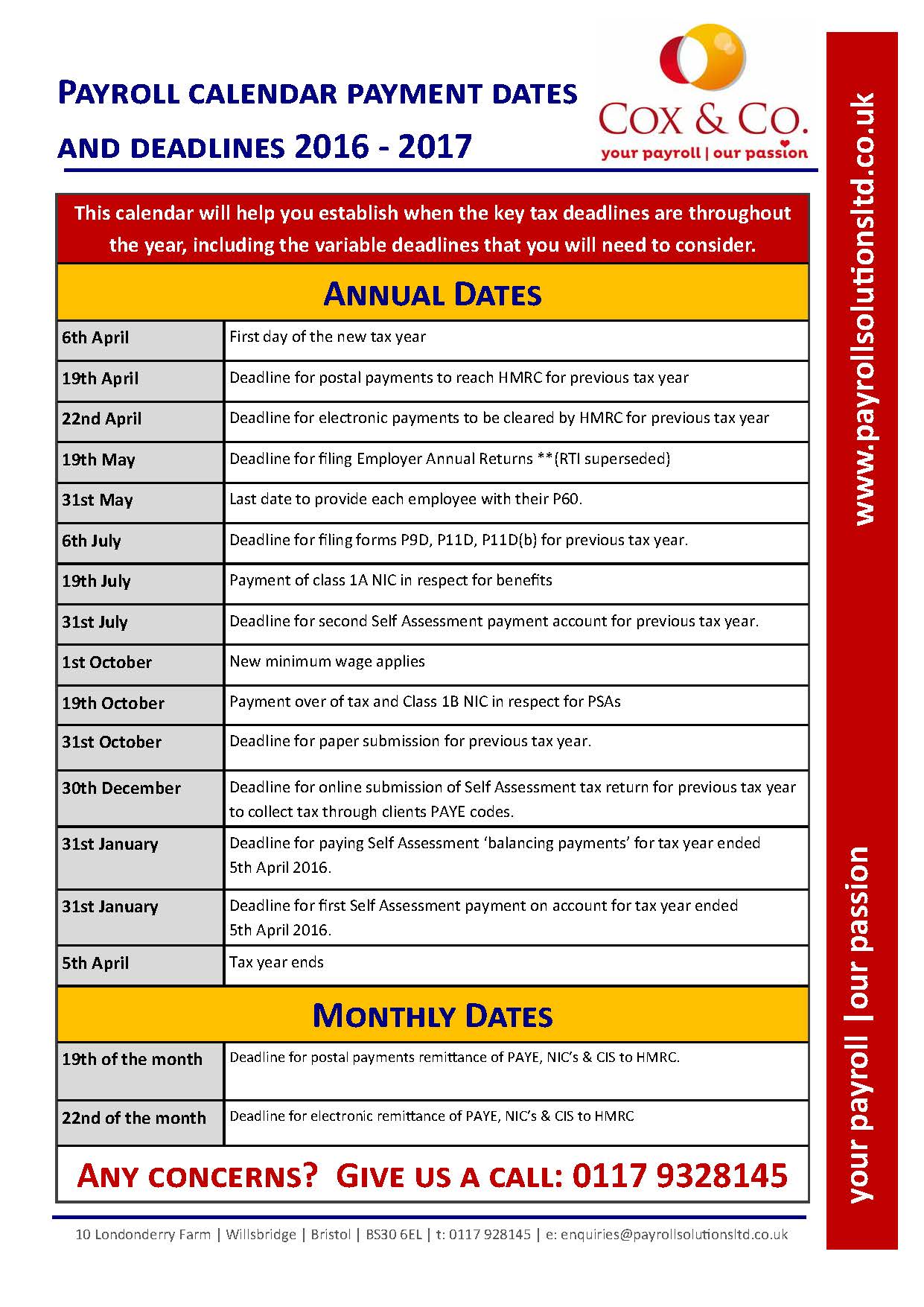

Like HMRC s tax months HMRC s quarters also begin from the 6 th of each month beginning the tax year from 6 th April PAYE deadlines for businesses that pay quarterly Quarter 1 22 nd June Quarter 2 22 nd September Quarter 3 22 nd December Quarter 4 22 nd March How do I pay quarterly 19th Deadline for employers final PAYE return Full Payment Submission to be submitted automatic interest is charged where PAYE Tax Student Loans Class 1 NI or CIS deductions are not paid by this day of the month Full Payment Submission FPS informs HMRC of employee s details pay and deductions for the previous

1 HMRC must receive your payment by 30 July While the payments on account deadline is 31 July as this falls on a Saturday this year it means you ll need to be even more organised than usual and get your payment to HMRC the last working day before which is 5 April End of tax year Individuals trusts and partnerships 6 April Start of tax year Individuals trusts and partnerships 31 July Second payment on account POA due Individuals trusts and partnerships 5 October Deadline for notifying HMRC of chargeability registering for self assessment Individuals trusts and partnerships

Download Hmrc Payment Dates

More picture related to Hmrc Payment Dates

150 000 Businesses Owe HMRC 2 7 Billion In Deferred VAT Payments

https://www.thompsonwright.co.uk/wp-content/uploads/2021/07/HMRC.jpg

How To Pay HMRC Self Assessment Income Tax Bill In The UK

https://www.gatwickaccountant.com/wp-content/uploads/2022/08/How-to-Pay-HMRC-Self-Assessment-Income-Tax-Bill-in-UK.jpg

Help With HMRC Pressure The Directors Helpline

https://www.thedirectorshelpline.org/media/nu4pdniz/logo-jpg.png

HMRC use the pay date contained in the submission to determine if you ve submitted late or not so it s important that you understand what this means to you and your employees What date to use when processing under Real Time Information RTI NOTE As 2024 is a leap year week 53 in the 2023 2024 tax year contains two days Benefit payment dates change depending on the type a person receives By Katie Elliott Personal finance reporter based in London 15 05 Tue May 21 2024 UPDATED 15 05 Tue May 21 2024

What tax period does my pay date fall into How does the HMRC tax calendar work Click here for a printable copy Resolution HMRC Her Majesty s Revenue and Customs use their tax calendar to break payroll dates into tax weeks months This calendar is fixed and does not change year on year DWP and HMRC payment dates for every benefit and tax credit in 2024 A guide on when benefits will be paid this year as well as how often they pay out News By William Morgan Senior

HMRC Menu And Delivery In Kuala Lumpur Foodpanda

https://images.deliveryhero.io/image/fd-my/LH/ma6n-hero.jpg

DWP And HMRC Cost Of Living Payment Dates Confirmed For 300 Cash Boost

https://i2-prod.coventrytelegraph.net/incoming/article27734977.ece/ALTERNATES/s810/0_DWP-and-HMRC-confirm-some-early-pension-and-benefit-payments-due-to-bank-holiday.jpg

https://www.gov.uk/self-assessment-tax-returns/deadlines

You need to pay the tax you owe by midnight 31 January 2025 There s usually a second payment deadline of 31 July if you make advance payments towards your bill known as payments on

https://www.gov.uk/running-payroll/paying-hmrc

Regular payroll tasks record employee pay calculate deductions give payslips report to and pay HMRC view the balance of what you owe HMRC

4 HMRC Foreign Commonwealth Development Office Blogs

HMRC Menu And Delivery In Kuala Lumpur Foodpanda

HMRC Release Employment Status Report Payroll Centre

What Is HMRC s Employment Allowance PayCaptain

HMRC Cost Of Living Payment Date For Tax Credits Claimants Confirmed

HMRC Is Demanding I Pay Tax In Advance For Its Error

HMRC Is Demanding I Pay Tax In Advance For Its Error

Staying On The Right Side Of HMRC Pace Properties

HMRC Dates Don t Miss Another Tax Date Again AIMS Accountants For

How To Pay HMRC NJB Taxback

Hmrc Payment Dates - Millions are set to see changes in their benefit payments over the coming days The May bank holiday weekend will disrupt the usual schedule and result in funds going into accounts on a different date The Spring Bank Holiday also known as the Late May Bank Holiday falls on Monday May 27 prompting the DWP and HMRC to adjust